EX-1.01

Published on May 27, 2021

Advanced Micro Devices, Inc.

Conflict Minerals Report

For the Reporting Period from January 1 to December 31, 2020

This Conflict Minerals Report for Advanced Micro Devices, Inc. (“AMD”) covers the reporting period from January 1 to December 31, 2020 and has been prepared in accordance with Section 13(p) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Rule 13p-1 and Form SD thereunder (the “Conflict Minerals Rule” or “Rule”). The Conflict Minerals Rule requires disclosure of certain information by companies filing reports with the Securities Exchange Commission (“SEC”) that manufacture, or contract to manufacture, products for which certain minerals specified in Section 13(p) of the Exchange Act and the Rule as “conflict minerals” are necessary to the functionality or production of those products. The term “conflict minerals” is defined as columbite-tantalite (coltan), cassiterite, gold, wolframite and their derivatives, which are limited to tantalum, tin and tungsten. For the purposes of this report, tin, tungsten, tantalum and gold will collectively be referred to as the “3TGs”. The term “Covered Countries” for purposes of the Conflict Minerals Rule are the Democratic Republic of the Congo (“DRC”) and the following adjoining countries: the Republic of the Congo, the Central African Republic, South Sudan, Rwanda, Uganda, Zambia, Burundi, Tanzania and Angola.

AMD has determined that certain of its products contain 3TGs that are necessary to the functionality or production of such products. Accordingly, we are required under the Rule to conduct a good-faith, reasonable country of origin inquiry (“RCOI”) reasonably designed to determine whether any of the necessary 3TGs in our products either originated in the Covered Countries or came from recycled or scrap materials. The following is a brief description of the RCOI process and additional due diligence that AMD undertook in accordance with the Rule.

References in this Conflict Minerals Report to “AMD,” “we,” “us” or “our” mean Advanced Micro Devices, Inc. and our consolidated subsidiaries. The term “armed groups” means an armed group that is identified as a perpetrator of serious human rights abuses in annual Country Reports on Human Rights Practices under sections 116(d) and 502B(b) of the Foreign Assistance Act of 1961 relating to the DRC or an adjoining country.

Overview of our Conflict Minerals Program

AMD has actively engaged with its customers and suppliers for several years with respect to the issue of conflict minerals. Through our initiatives, we work to support responsible sourcing of minerals from Conflict-Affected and High-Risk Areas (“CAHRAs”). Our strategy is to support the enablement of ethical social and environmental sourcing through multi-stakeholder programs and dialogue.

We contributed to industry efforts to address conflict minerals as a member of the Responsible Business Alliance (“RBA”) and are an active member to the Responsible Minerals Initiative (“RMI”). Through RMI, we connect with industry members, governments, non-profits, and other stakeholders to contribute to mitigating the salient social and environmental impacts of extraction and processing of minerals in supply chains. We support the

1

RMI’s efforts to develop standards and tools that benefit all companies working to break the link between minerals trade and conflict. Specifically, AMD staff participate in RMI multi-stakeholder calls and due diligence meetings, as well as utilize RMI tools and resources for CM reporting and risk management.

Product and Supply Chain Description

We are a global semiconductor company primarily offering:

•x86 microprocessors, as standalone devices or as incorporated as an accelerated processing unit (“APU”), chipsets, discrete and integrated graphics processing units (“GPUs”), data center and professional GPUs and development services; and

•server and embedded processors, semi-custom System-on-Chip (“SoC”) products, development services and technology for game consoles.

From time to time, we may also sell or license portions of our intellectual property portfolio.

AMD does not directly purchase minerals; however, our suppliers do. AMD is considered a “downstream” purchaser. For a detailed description of our business and products, see “Part I, Item 1—Business” of our Annual Report on Form 10-K for the fiscal year ended December 26, 2020, filed with the SEC. All of our products may contain one or more of the 3TGs, therefore, all of our products are in scope for this report.

Due Diligence

Design of our Conflict Minerals Program

We designed our conflict minerals program to conform to the due diligence-related steps of the Organisation for Economic Co-operation and Development Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas, Third Edition, including the related supplements on gold, tantalum, tin and tungsten (the “OECD Guidance”). The SEC has recognized the OECD Guidance as an appropriate nationally and internationally recognized due diligence framework for conflict mineral reporting purposes.

Step 1: Establish Strong Company Management Systems

Conflict Minerals Sourcing Policy. We have established a conflict minerals sourcing policy that outlines our commitment, approach and expectations to achieving conflict-free certified sourcing of materials used in our products. Our conflict minerals policy is available at https://www.amd.com/system/files/documents/conflict-minerals-policy.pdf.

Internal Management Systems. We have established an internal AMD conflict minerals team that is responsible for the development and oversight of our conflict minerals policy, due diligence process and the internal management systems that implement our conflict minerals policy. Our conflict minerals team is headed by our Corporate Vice President of Global Procurement, and includes representatives from our supply chain operations, corporate responsibility, government relations, law, and finance departments. We also use a third-party service provider to assist with evaluating supply chain information regarding 3TGs, identifying potential risks, and in the

2

development and implementation of additional due diligence steps that we will undertake with suppliers in regard to conflict minerals.

Control Systems. The Conflict Mineral Reporting Template (“CMRTs”) obtained from our suppliers who contribute materials that directly impact and become a part of our products including wafers, outsourced assembly and test (“OSAT”), direct materials (substrates, lids, capacitors, memory), and boards inclusive of components (“Manufacturing Suppliers”) allowed us to gather information that was important for our due diligence efforts, including the 3TGs contained in the Manufacturing Suppliers’ products and the names of smelters or refiners in the Manufacturing Suppliers’ own supply chain. We elected to use the CMRT because it is an internationally recognized and commonly used tool that facilitated efficient data gathering and aggregation. We also provided our Manufacturing Suppliers with the RBA Code of Conduct and communicated with them our conflict mineral policy to source only from conformant RMAP or LBMA smelters and refiners.

Supplier Engagement. We communicate our Conflict Minerals Sourcing Policy annually. We also informed our suppliers of our process to track the submission of CMRTs from our supply base and escalate late or incomplete templates for follow-up action. Similar to last year, we utilized a third-party service provider’s online learning management system and provided all in-scope suppliers access to conflict minerals training courses. Our third-party service provider tracked and monitored completion of the courses and we will continue to prioritize education in our conflict minerals program.

Grievance Mechanisms. We established open lines of communication that serve as grievance mechanisms to provide employees, suppliers and others outside of AMD to report violations of our policies or other concerns. Suppliers and others outside of AMD may contact our conflict minerals team to communicate with us, including to report grievances, via a dedicated email address that is published in our conflict minerals policy and in other communications with our Manufacturing Suppliers. We have also actively participated in the RMI, which serves as an early warning system by sharing information with participants regarding supply chain risks relating to conflict minerals. In addition, our employees may anonymously report suspected violations using AMD Aware, available 24 hours a day, seven days a week. AMD Aware is staffed by non-AMD personnel, who share any information reported with our Corporate Compliance Committee.

Maintenance of Records. We maintain a company-wide document retention policy, which extends to the documents accumulated in performing our due diligence for this Report.

Step 2: Identifying and Assessing Risks in our Supply Chain. We identify Manufacturing Suppliers that may contribute necessary conflict minerals to our products. Manufacturing Suppliers are requested to complete an annual supply chain survey, using the CMRT template.

The primary risk that we identified with respect to conflict minerals were instances when our Manufacturing Suppliers identified smelters or refiners that were not listed on the RMI Responsible Minerals Assurance Process (“RMAP”) Standard Smelter List (the “RMAP List”). In accordance with OECD Guidelines, it is important to

3

understand risk levels associated with conflict minerals and the sourcing of those mineral in the supply chain. The basis of this understanding stems from smelter or refiner information provided by our Manufacturing Suppliers. Each facility that meets the RMI definition of a smelter or refiner of a 3TG mineral is assessed according to red flag indicators defined in the OECD Guidance. AMD uses the following factors to determine the risk level of each smelter and refiner:

•Geographic proximity to the DRC and covered countries;

•Known mineral source country of origin;

•Responsible Minerals Assurance Process (“RMAP”) audit status;

•Credible evidence of unethical or conflict sourcing;

•Peer Assessments conducted by credible third-party sources.

In addition, AMD also identified risk based on the accuracy and completeness of information contained in the CMRTs that we received from our Manufacturing Suppliers. In the past, we have received CMRTs with data entry errors, such as missing information and information that appeared inaccurate based on the RMAP Standard Smelter List and the London Bullion Metal Association’s (“LBMA”) Good Delivery List. To address these errors, our third-party service provider made further inquiries, conducted additional follow-up, tracked and consolidated the responses to ensure completeness of the responses from our Manufacturing Suppliers that we identified as having provided us a CMRT with errors. In addition to this, our third-party service provider’s process also included automated data validation on all submitted CMRTs, designed to increase the completeness and accuracy of submissions. While we work with our Manufacturing Suppliers to ensure error-free reporting, we rely on the representations made by them.

Additionally, we evaluated our Manufacturing Suppliers on the basis of four criteria, identified below, which further assisted us in identifying risk in the supply chain. By ensuring that the responses we received met the OECD Due Diligence Guidelines, we made key risk mitigation decisions to ensure compliance. The four criteria we used were based on the CMRT questions and included:

•Have you established a conflict minerals sourcing policy?

•Have you implemented due diligence measures in accordance with the OECD guidance?

•Do you review due diligence information received from your suppliers against your company’s expectations?

•Does your review process include mitigation actions and corrective action management?

When suppliers meet or exceed the above criteria (i.e. answering “Yes” to all four questions), they are deemed to have a strong program. When suppliers do not meet those criteria, they are deemed to have a weak program. Any suppliers that have been flagged as having a weak program were notified and provided guidance on how they can improve their internal conflict minerals policies and procedures.

4

To identify whether the smelters or refiners that potentially processed the 3TGs contained in our products have processes and systems that are aligned with the OECD Guidance, we compared the results of our compiled CMRT smelter list with the audit status of the list of smelters or refiners identified by our Manufacturing Suppliers to the RMAP Standard Smelter List. We also validated smelters through RMAP’s cross-recognition policy, which mutually recognizes the independent third-party gold refiner audit programs from the LBMA and the Responsible Jewelry Council (“RJC”). In addition, we identified smelters that are member companies of the Tungsten Industry – Conflict Minerals Council (“TI-CMC”) progressing toward RMAP validation.

Step 3: Designing and Implementing a Response to Identified Risks. Risk mitigation will depend on the supplier’s specific context. Manufacturing Suppliers are given clear performance objectives within reasonable timeframes with the ultimate goal of progressive mitigation of these risks. Furthermore, our third-party service provider provided our Manufacturing Suppliers with educational materials on mitigating the risk of smelters or refiners on the supply chain using our third-party service provider’s online learning management system.

We held meetings to review, among other things, our conflict minerals program, any potential or actual risks identified during due diligence and the status of CMRTs received from our Manufacturing Suppliers. If and when our expectations are not met and if certain identified risks are not resolved, the business relationship between AMD and that supplier will be evaluated.

We leverage our participation in RMI to encourage responsible parties to implement corrective actions and to take the necessary steps to comply with industry standards.

Step 4: Independent Third-Party Audits of Smelter’s and Refiner’s Due Diligence Practices. We supported the development and implementation of the RMAP through our RMI membership. Through the RMI, we encouraged smelters or refiners to participate in the RMAP. Any smelters or refiners that were reported by our Manufacturing Suppliers who were not part of the RMAP, were also contacted directly by our third-party service provider to encourage them to participate in the RMAP.

Step 5: Publicly Report our Supply Chain Due Diligence. We have published our conflict minerals policy and our annual corporate responsibility report on the Corporate Responsibility pages of our web site at https://www.amd.com/en/corporate-responsibility/supplier-conflict-minerals. Our Specialized Disclosure Report on Form SD for the reporting period from January 1 to December 31, 2020, which includes this Conflict Minerals Report, is also available at https://www.amd.com/en/corporate-responsibility/supplier-conflict-minerals.

Description of Reasonable Country of Origin Inquiry Efforts

For 2020, our reasonable country of origin inquiry (“RCOI”) efforts included conducting a supply chain survey of our Manufacturing Suppliers using the CMRT (see Identifying and Assessing Risks in our Supply Chain). To determine the country of origin of the conflict minerals in our products, we utilized the RMI RMAP’s Reasonable Country of Origin Inquiry Data (the “RMI RCOI Data”). The RMI RCOI Data provides country of origin information for the raw materials used by smelters or refiners that are reported by the RMAP as being

5

conformant with their assessment standards (i.e., demonstrated with reasonable confidence that the smelter or refiner’s due diligence processes are aligned with the expectations in the OECD). Available RMI RCOI Data provides traceability upstream to countries of origin at an aggregate level. Since the most detailed information is shown as groupings of countries, we are unable to determine with certainty the specific countries from which the 3TG in our products may be sourced.

Results of Efforts to Determine Country of Origin

Not all Manufacturing Suppliers completed the CMRT at the Product level for only those products that they provide to AMD. Therefore, those suppliers are unable to represent that the 3TGs from the smelters or refiners listed on their CMRT have been included in products or parts that they have supplied to us. Due to this, our list of smelters or refiners may contain more facilities than those that actually processed the 3TGs contained in our products.

Countries from which minerals in AMD’s products may have originated based on sourcing information disclosed during the RMAP’s third-party auditing process and RMI’s Reasonable Country of Origin Inquiry, report dated April 7, 2021, are believed to be the following:

| Argentina | Eritrea | Mexico | South Africa | ||||||||

| Australia | Ethiopia | Mongolia | Spain | ||||||||

| Austria | Germany | Mozambique | Swaziland | ||||||||

| Benin | Ghana | Myanmar | Tanzania | ||||||||

| Bolivia (Plurinational State of) | Guinea | Namibia | Thailand | ||||||||

| Brazil | Guyana | Niger | Uganda | ||||||||

| Burundi | India | Nigeria | United States of America | ||||||||

| Canada | Indonesia | Peru | Vietnam | ||||||||

| China | Japan | Portugal | Zimbabwe | ||||||||

| Colombia | Laos | Russian Federation | |||||||||

| Congo, Democratic Republic of the | Madagascar | Rwanda | |||||||||

| Ecuador | Malaysia | Sierra Leone | |||||||||

Description of Due Diligence Measures Performed

As a result of the above conclusion and pursuant to the Rule, we undertook due diligence on the source and chain of custody of the necessary conflict minerals used in our products, including:

•Confirmed receipt of CMRT reports from 100% of AMD manufacturing suppliers

•Compared the smelter lists from AMD suppliers to RMI RMAP conformant smelter list

•Clarified CMRT report anomalies for resubmission as needed and appropriate.

•Consolidated into AMD CMRT Report.

To identify whether the smelters or refiners that potentially processed the 3TGs contained in our products have processes and systems that are aligned with the OECD Guidance, we compared the results of our compiled CMRT

6

smelter list with the audit status of the list of smelters or refiners identified by our Manufacturing Suppliers to the RMAP Standard Smelter Conformant report.

Results of Due Diligence

For the 2020 Reporting Year, we received CMRT responses from 100% of our in-scope Manufacturing Suppliers. All final CMRT submissions were reviewed and validated to ensure no inaccuracies or gaps in data were found. These CMRT submissions were then used to review smelter and refiner data in order to determine mine or location of origin relying on RMI RCOI tables.

Table 1 lists the facilities which, to the extent known, process the necessary minerals in our products based on the responses from the CMRT.

7

Table 1: RMI and/or LBMA Responsible Gold Programme Smelters and Refiners

Metal(1)

|

Standard Smelter Name | Smelter Facility Location | ||||||

| Gold | 8853 S.p.A. | ITALY | ||||||

| Gold | Advanced Chemical Company | UNITED STATES OF AMERICA | ||||||

| Gold | Aida Chemical Industries Co., Ltd. | JAPAN | ||||||

| Gold | Al Etihad Gold Refinery DMCC | UNITED ARAB EMIRATES | ||||||

| Gold | Allgemeine Gold-und Silberscheideanstalt A.G. | GERMANY | ||||||

| Gold | Almalyk Mining and Metallurgical Complex (AMMC) | UZBEKISTAN | ||||||

| Gold | AngloGold Ashanti Corrego do Sitio Mineracao | BRAZIL | ||||||

| Gold | Argor-Heraeus S.A. | SWITZERLAND | ||||||

| Gold | Asahi Pretec Corp. | JAPAN | ||||||

| Gold | Asahi Refining Canada Ltd. | CANADA | ||||||

| Gold | Asahi Refining USA Inc. | UNITED STATES OF AMERICA | ||||||

| Gold | Asaka Riken Co., Ltd. | JAPAN | ||||||

| Gold | AU Traders and Refiners | SOUTH AFRICA | ||||||

| Gold | Aurubis AG | GERMANY | ||||||

| Gold | Bangalore Refinery | INDIA | ||||||

| Gold | Bangko Sentral ng Pilipinas (Central Bank of the Philippines) | PHILIPPINES | ||||||

| Gold | Boliden AB | SWEDEN | ||||||

| Gold | C. Hafner GmbH + Co. KG | GERMANY | ||||||

| Gold | CCR Refinery - Glencore Canada Corporation | CANADA | ||||||

| Gold | Cendres + Metaux S.A. | SWITZERLAND | ||||||

| Gold | Chimet S.p.A. | ITALY | ||||||

| Gold | Chugai Mining | JAPAN | ||||||

| Gold | DODUCO Contacts and Refining GmbH | GERMANY | ||||||

| Gold | Dowa | JAPAN | ||||||

| Gold | DSC (Do Sung Corporation) | KOREA, REPUBLIC OF | ||||||

| Gold | Eco-System Recycling Co., Ltd. East Plant | JAPAN | ||||||

| Gold | Eco-System Recycling Co., Ltd. North Plant | JAPAN | ||||||

| Gold | Eco-System Recycling Co., Ltd. West Plant | JAPAN | ||||||

| Gold | Emirates Gold DMCC | UNITED ARAB EMIRATES | ||||||

| Gold | Geib Refining Corporation | UNITED STATES OF AMERICA | ||||||

| Gold | Gold Refinery of Zijin Mining Group Co., Ltd. | CHINA | ||||||

| Gold | Heimerle + Meule GmbH | GERMANY | ||||||

| Gold | Heraeus Metals Hong Kong Ltd. | CHINA | ||||||

| Gold | Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd. | CHINA | ||||||

| Gold | Ishifuku Metal Industry Co., Ltd. | JAPAN | ||||||

| Gold | Istanbul Gold Refinery | TURKEY | ||||||

| Gold | Italpreziosi | ITALY | ||||||

| Gold | Japan Mint | JAPAN | ||||||

| Gold | Jiangxi Copper Co., Ltd. | CHINA | ||||||

| Gold | JSC Novosibirsk Refinery | RUSSIAN FEDERATION | ||||||

8

| Gold | JSC Uralelectromed | RUSSIAN FEDERATION | ||||||

| Gold | JX Nippon Mining & Metals Co., Ltd. | JAPAN | ||||||

| Gold | Kazzinc | KAZAKHSTAN | ||||||

| Gold | Kennecott Utah Copper LLC | UNITED STATES OF AMERICA | ||||||

| Gold | KGHM Polska Miedz Spolka Akcyjna | POLAND | ||||||

| Gold | Kojima Chemicals Co., Ltd. | JAPAN | ||||||

| Gold | Korea Zinc Co., Ltd. | KOREA, REPUBLIC OF | ||||||

| Gold | Kyrgyzaltyn JSC | KYRGYZSTAN | ||||||

| Gold | L'Orfebre S.A. | ANDORRA | ||||||

| Gold | LS-NIKKO Copper Inc. | KOREA, REPUBLIC OF | ||||||

| Gold | LT Metal Ltd. | KOREA, REPUBLIC OF | ||||||

| Gold | Marsam Metals | BRAZIL | ||||||

| Gold | Materion | UNITED STATES OF AMERICA | ||||||

| Gold | Matsuda Sangyo Co., Ltd. | JAPAN | ||||||

| Gold | Metal Concentrators SA (Pty) Ltd. | SOUTH AFRICA | ||||||

| Gold | Metalor Technologies (Hong Kong) Ltd. | CHINA | ||||||

| Gold | Metalor Technologies (Singapore) Pte., Ltd. | SINGAPORE | ||||||

| Gold | Metalor Technologies (Suzhou) Ltd. | CHINA | ||||||

| Gold | Metalor Technologies S.A. | SWITZERLAND | ||||||

| Gold | Metalor USA Refining Corporation | UNITED STATES OF AMERICA | ||||||

| Gold | Metalurgica Met-Mex Penoles S.A. De C.V. | MEXICO | ||||||

| Gold | Mitsubishi Materials Corporation | JAPAN | ||||||

| Gold | Mitsui Mining and Smelting Co., Ltd. | JAPAN | ||||||

| Gold | MMTC-PAMP India Pvt., Ltd. | INDIA | ||||||

| Gold | Moscow Special Alloys Processing Plant | RUSSIAN FEDERATION | ||||||

| Gold | Nadir Metal Rafineri San. Ve Tic. A.S. | TURKEY | ||||||

| Gold | Navoi Mining and Metallurgical Combinat | UZBEKISTAN | ||||||

| Gold | Nihon Material Co., Ltd. | JAPAN | ||||||

| Gold | Ogussa Osterreichische Gold- und Silber-Scheideanstalt GmbH | AUSTRIA | ||||||

| Gold | Ohura Precious Metal Industry Co., Ltd. | JAPAN | ||||||

| Gold | OJSC "The Gulidov Krasnoyarsk Non-Ferrous Metals Plant" (OJSC Krastsvetmet) | RUSSIAN FEDERATION | ||||||

| Gold | PAMP S.A. | SWITZERLAND | ||||||

| Gold | Planta Recuperadora de Metales SpA | CHILE | ||||||

| Gold | Prioksky Plant of Non-Ferrous Metals | RUSSIAN FEDERATION | ||||||

| Gold | PT Aneka Tambang (Persero) Tbk | INDONESIA | ||||||

| Gold | PX Precinox S.A. | SWITZERLAND | ||||||

| Gold | Rand Refinery (Pty) Ltd. | SOUTH AFRICA | ||||||

| Gold | REMONDIS PMR B.V. | NETHERLANDS | ||||||

| Gold | Royal Canadian Mint | CANADA | ||||||

| Gold | SAAMP | FRANCE | ||||||

| Gold | Safimet S.p.A | ITALY | ||||||

| Gold | SAFINA A.S. | CZECHIA | ||||||

9

| Gold | Samduck Precious Metals | KOREA, REPUBLIC OF | ||||||

| Gold | SAXONIA Edelmetalle GmbH | GERMANY | ||||||

| Gold | SEMPSA Joyeria Plateria S.A. | SPAIN | ||||||

| Gold | Shandong Gold Smelting Co., Ltd. | CHINA | ||||||

| Gold | Shandong Zhaojin Gold & Silver Refinery Co., Ltd. | CHINA | ||||||

| Gold | Sichuan Tianze Precious Metals Co., Ltd. | CHINA | ||||||

| Gold | Singway Technology Co., Ltd. | TAIWAN, PROVINCE OF CHINA | ||||||

| Gold | SOE Shyolkovsky Factory of Secondary Precious Metals | RUSSIAN FEDERATION | ||||||

| Gold | Solar Applied Materials Technology Corp. | TAIWAN, PROVINCE OF CHINA | ||||||

| Gold | Sumitomo Metal Mining Co., Ltd. | JAPAN | ||||||

| Gold | SungEel HiMetal Co., Ltd. | KOREA, REPUBLIC OF | ||||||

| Gold | T.C.A S.p.A | ITALY | ||||||

| Gold | Tanaka Kikinzoku Kogyo K.K. | JAPAN | ||||||

| Gold | Tokuriki Honten Co., Ltd. | JAPAN | ||||||

| Gold | TOO Tau-Ken-Altyn | KAZAKHSTAN | ||||||

| Gold | Torecom | KOREA, REPUBLIC OF | ||||||

| Gold | TSK Pretech | KOREA, REPUBLIC OF | ||||||

| Gold | Umicore Precious Metals Thailand | THAILAND | ||||||

| Gold | Umicore S.A. Business Unit Precious Metals Refining | BELGIUM | ||||||

| Gold | United Precious Metal Refining, Inc. | UNITED STATES OF AMERICA | ||||||

| Gold | Valcambi S.A. | SWITZERLAND | ||||||

| Gold | Western Australian Mint (T/a The Perth Mint) | AUSTRALIA | ||||||

| Gold | WIELAND Edelmetalle GmbH | GERMANY | ||||||

| Gold | Yamakin Co., Ltd. | JAPAN | ||||||

| Gold | Yokohama Metal Co., Ltd. | JAPAN | ||||||

| Gold | Zhongyuan Gold Smelter of Zhongjin Gold Corporation | CHINA | ||||||

| Tantalum | AMG Brasil | BRAZIL | ||||||

| Tantalum | Asaka Riken Co., Ltd. | JAPAN | ||||||

| Tantalum | Changsha South Tantalum Niobium Co., Ltd. | CHINA | ||||||

| Tantalum | D Block Metals, LLC | UNITED STATES OF AMERICA | ||||||

| Tantalum | Exotech Inc. | UNITED STATES OF AMERICA | ||||||

| Tantalum | F&X Electro-Materials Ltd. | CHINA | ||||||

| Tantalum | FIR Metals & Resource Ltd. | CHINA | ||||||

| Tantalum | Global Advanced Metals Aizu | JAPAN | ||||||

| Tantalum | Global Advanced Metals Boyertown | UNITED STATES OF AMERICA | ||||||

| Tantalum | Guangdong Rising Rare Metals-EO Materials Ltd. | CHINA | ||||||

| Tantalum | H.C. Starck Hermsdorf GmbH | GERMANY | ||||||

| Tantalum | H.C. Starck Inc. | UNITED STATES OF AMERICA | ||||||

| Tantalum | Hengyang King Xing Lifeng New Materials Co., Ltd. | CHINA | ||||||

| Tantalum | Jiangxi Dinghai Tantalum & Niobium Co., Ltd. | CHINA | ||||||

| Tantalum | Jiangxi Tuohong New Raw Material | CHINA | ||||||

| Tantalum | JiuJiang JinXin Nonferrous Metals Co., Ltd. | CHINA | ||||||

| Tantalum | Jiujiang Tanbre Co., Ltd. | CHINA | ||||||

| Tantalum | Jiujiang Zhongao Tantalum & Niobium Co., Ltd. | CHINA | ||||||

| Tantalum | KEMET de Mexico | MEXICO | ||||||

10

| Tantalum | Meta Materials | NORTH MACEDONIA, REPUBLIC OF | ||||||

| Tantalum | Metallurgical Products India Pvt., Ltd. | INDIA | ||||||

| Tantalum | Mineracao Taboca S.A. | BRAZIL | ||||||

| Tantalum | Mitsui Mining and Smelting Co., Ltd. | JAPAN | ||||||

| Tantalum | Ningxia Orient Tantalum Industry Co., Ltd. | CHINA | ||||||

| Tantalum | NPM Silmet AS | ESTONIA | ||||||

| Tantalum | QuantumClean | UNITED STATES OF AMERICA | ||||||

| Tantalum | Resind Industria e Comercio Ltda. | BRAZIL | ||||||

| Tantalum | Solikamsk Magnesium Works OAO | RUSSIAN FEDERATION | ||||||

| Tantalum | Taki Chemical Co., Ltd. | JAPAN | ||||||

| Tantalum | TANIOBIS Co., Ltd. | THAILAND | ||||||

| Tantalum | TANIOBIS GmbH | GERMANY | ||||||

| Tantalum | TANIOBIS Japan Co., Ltd. | JAPAN | ||||||

| Tantalum | TANIOBIS Smelting GmbH & Co. KG | GERMANY | ||||||

| Tantalum | Telex Metals | UNITED STATES OF AMERICA | ||||||

| Tantalum | Ulba Metallurgical Plant JSC | KAZAKHSTAN | ||||||

| Tantalum | XIMEI RESOURCES (GUANGDONG) LIMITED | CHINA | ||||||

| Tantalum | XinXing HaoRong Electronic Material Co., Ltd. | CHINA | ||||||

| Tantalum | Yanling Jincheng Tantalum & Niobium Co., Ltd. | CHINA | ||||||

| Tin | Alpha | UNITED STATES OF AMERICA | ||||||

| Tin | Chenzhou Yunxiang Mining and Metallurgy Co., Ltd. | CHINA | ||||||

| Tin | Chifeng Dajingzi Tin Industry Co., Ltd. | CHINA | ||||||

| Tin | China Tin Group Co., Ltd. | CHINA | ||||||

| Tin | Dowa | JAPAN | ||||||

| Tin | EM Vinto | BOLIVIA (PLURINATIONAL STATE OF) | ||||||

| Tin | Fenix Metals | POLAND | ||||||

| Tin | Gejiu Fengming Metallurgy Chemical Plant | CHINA | ||||||

| Tin | Gejiu Kai Meng Industry and Trade LLC | CHINA | ||||||

| Tin | Gejiu Non-Ferrous Metal Processing Co., Ltd. | CHINA | ||||||

| Tin | Gejiu Yunxin Nonferrous Electrolysis Co., Ltd. | CHINA | ||||||

| Tin | Gejiu Zili Mining And Metallurgy Co., Ltd. | CHINA | ||||||

| Tin | Guangdong Hanhe Non-Ferrous Metal Co., Ltd. | CHINA | ||||||

| Tin | Guanyang Guida Nonferrous Metal Smelting Plant | CHINA | ||||||

| Tin | HuiChang Hill Tin Industry Co., Ltd. | CHINA | ||||||

| Tin | Huichang Jinshunda Tin Co., Ltd. | CHINA | ||||||

| Tin | Jiangxi New Nanshan Technology Ltd. | CHINA | ||||||

| Tin | Luna Smelter, Ltd. | RWANDA | ||||||

| Tin | Ma'anshan Weitai Tin Co., Ltd. | CHINA | ||||||

| Tin | Magnu's Minerais Metais e Ligas Ltda. | BRAZIL | ||||||

| Tin | Malaysia Smelting Corporation (MSC) | MALAYSIA | ||||||

| Tin | Melt Metais e Ligas S.A. | BRAZIL | ||||||

| Tin | Metallic Resources, Inc. | UNITED STATES OF AMERICA | ||||||

| Tin | Metallo Belgium N.V. | BELGIUM | ||||||

11

| Tin | Metallo Spain S.L.U. | SPAIN | ||||||

| Tin | Mineracao Taboca S.A. | BRAZIL | ||||||

| Tin | Minsur | PERU | ||||||

| Tin | Mitsubishi Materials Corporation | JAPAN | ||||||

| Tin | O.M. Manufacturing (Thailand) Co., Ltd. | THAILAND | ||||||

| Tin | O.M. Manufacturing Philippines, Inc. | PHILIPPINES | ||||||

| Tin | Operaciones Metalurgicas S.A. | BOLIVIA (PLURINATIONAL STATE OF) | ||||||

| Tin | PT Artha Cipta Langgeng | INDONESIA | ||||||

| Tin | PT ATD Makmur Mandiri Jaya | INDONESIA | ||||||

| Tin | PT Babel Inti Perkasa | INDONESIA | ||||||

| Tin | PT Babel Surya Alam Lestari | INDONESIA | ||||||

| Tin | PT Bangka Serumpun | INDONESIA | ||||||

| Tin | PT Menara Cipta Mulia | INDONESIA | ||||||

| Tin | PT Mitra Stania Prima | INDONESIA | ||||||

| Tin | PT Prima Timah Utama | INDONESIA | ||||||

| Tin | PT Rajawali Rimba Perkasa | INDONESIA | ||||||

| Tin | PT Rajehan Ariq | INDONESIA | ||||||

| Tin | PT Refined Bangka Tin | INDONESIA | ||||||

| Tin | PT Stanindo Inti Perkasa | INDONESIA | ||||||

| Tin | PT Timah Tbk Kundur | INDONESIA | ||||||

| Tin | PT Timah Tbk Mentok | INDONESIA | ||||||

| Tin | PT Tinindo Inter Nusa | INDONESIA | ||||||

| Tin | Resind Industria e Comercio Ltda. | BRAZIL | ||||||

| Tin | Rui Da Hung | TAIWAN, PROVINCE OF CHINA | ||||||

| Tin | Soft Metais Ltda. | BRAZIL | ||||||

| Tin | Thai Nguyen Mining and Metallurgy Co., Ltd. | VIET NAM | ||||||

| Tin | Thaisarco | THAILAND | ||||||

| Tin | Tin Technology & Refining | UNITED STATES OF AMERICA | ||||||

| Tin | White Solder Metalurgia e Mineracao Ltda. | BRAZIL | ||||||

| Tin | Yunnan Chengfeng Non-ferrous Metals Co., Ltd. | CHINA | ||||||

| Tin | Yunnan Tin Company Limited | CHINA | ||||||

| Tin | Yunnan Yunfan Non-ferrous Metals Co., Ltd. | CHINA | ||||||

| Tungsten | A.L.M.T. Corp. | JAPAN | ||||||

| Tungsten | ACL Metais Eireli | BRAZIL | ||||||

| Tungsten | Asia Tungsten Products Vietnam Ltd. | VIET NAM | ||||||

| Tungsten | Chenzhou Diamond Tungsten Products Co., Ltd. | CHINA | ||||||

| Tungsten | China Molybdenum Tungsten Co., Ltd. | CHINA | ||||||

| Tungsten | Chongyi Zhangyuan Tungsten Co., Ltd. | CHINA | ||||||

| Tungsten | Fujian Ganmin RareMetal Co., Ltd. | CHINA | ||||||

| Tungsten | Ganzhou Haichuang Tungsten Co., Ltd. | CHINA | ||||||

| Tungsten | Ganzhou Huaxing Tungsten Products Co., Ltd. | CHINA | ||||||

| Tungsten | Ganzhou Jiangwu Ferrotungsten Co., Ltd. | CHINA | ||||||

12

| Tungsten | Ganzhou Seadragon W & Mo Co., Ltd. | CHINA | ||||||

| Tungsten | Global Tungsten & Powders Corp. | UNITED STATES OF AMERICA | ||||||

| Tungsten | Guangdong Xianglu Tungsten Co., Ltd. | CHINA | ||||||

| Tungsten | H.C. Starck Tungsten GmbH | GERMANY | ||||||

| Tungsten | Hunan Chenzhou Mining Co., Ltd. | CHINA | ||||||

| Tungsten | Hunan Chuangda Vanadium Tungsten Co., Ltd. Wuji | CHINA | ||||||

| Tungsten | Hunan Chunchang Nonferrous Metals Co., Ltd. | CHINA | ||||||

| Tungsten | Hunan Litian Tungsten Industry Co., Ltd. | CHINA | ||||||

| Tungsten | Hydrometallurg, JSC | RUSSIAN FEDERATION | ||||||

| Tungsten | Japan New Metals Co., Ltd. | JAPAN | ||||||

| Tungsten | Jiangwu H.C. Starck Tungsten Products Co., Ltd. | CHINA | ||||||

| Tungsten | Jiangxi Gan Bei Tungsten Co., Ltd. | CHINA | ||||||

| Tungsten | Jiangxi Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd. | CHINA | ||||||

| Tungsten | Jiangxi Xinsheng Tungsten Industry Co., Ltd. | CHINA | ||||||

| Tungsten | Jiangxi Yaosheng Tungsten Co., Ltd. | CHINA | ||||||

| Tungsten | Kennametal Fallon | UNITED STATES OF AMERICA | ||||||

| Tungsten | Kennametal Huntsville | UNITED STATES OF AMERICA | ||||||

| Tungsten | KGETS Co., Ltd. | KOREA, REPUBLIC OF | ||||||

| Tungsten | Lianyou Metals Co., Ltd. | TAIWAN, PROVINCE OF CHINA | ||||||

| Tungsten | Malipo Haiyu Tungsten Co., Ltd. | CHINA | ||||||

| Tungsten | Masan High-Tech Materials | VIET NAM | ||||||

| Tungsten | Moliren Ltd. | RUSSIAN FEDERATION | ||||||

| Tungsten | Niagara Refining LLC | UNITED STATES OF AMERICA | ||||||

| Tungsten | Philippine Chuangxin Industrial Co., Inc. | PHILIPPINES | ||||||

| Tungsten | TANIOBIS Smelting GmbH & Co. KG | GERMANY | ||||||

| Tungsten | Tejing (Vietnam) Tungsten Co., Ltd. | VIET NAM | ||||||

| Tungsten | Unecha Refractory metals plant | RUSSIAN FEDERATION | ||||||

| Tungsten | Wolfram Bergbau und Hutten AG | AUSTRIA | ||||||

| Tungsten | Woltech Korea Co., Ltd. | KOREA, REPUBLIC OF | ||||||

| Tungsten | Xiamen Tungsten (H.C.) Co., Ltd. | CHINA | ||||||

| Tungsten | Xiamen Tungsten Co., Ltd. | CHINA | ||||||

| Tungsten | Xinfeng Huarui Tungsten & Molybdenum New Material Co., Ltd. | CHINA | ||||||

(1) |

Information is based on the CMRTs received from our Manufacturing Suppliers. See “Due Diligence,” above, for more information. |

||||

13

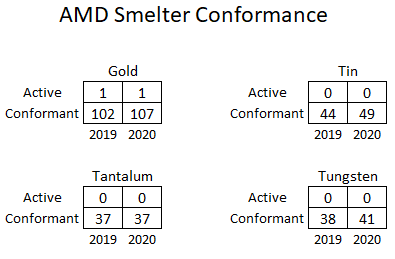

Table 2 lists the number of operational smelters and refiner facilities, identified by our surveyed suppliers, that as of April 8, 2021 are:

•RMAP Conformant

•RMAP Active

•RMAP Eligible

Steps to Further Mitigate Risk and Improve Due Diligence in 2020

Since December 31, 2020, we have taken, or intend to take, the following steps to improve the due diligence conducted to further mitigate any risk that the necessary 3TGs in our products could benefit armed groups in the DRC or adjoining countries:

•Continue to evaluate upstream sources through a broader set of tools to evaluate risk. These include, but are not limited to:

◦Using a comprehensive smelter and refiner library with detailed status and notes for each listing.

◦Scanning for credible media on each smelter and refiner to flag risk issues.

◦Comparing the list of smelters and refiners against government watch and denied parties lists.

•Engage with suppliers more closely and provide more information and training resources regarding responsible sourcing of 3TGs.

•Encourage suppliers to have due diligence procedures in place for their supply chains to improve the content of the responses from such suppliers.

•Continue to include a conflict minerals flow-down clause in new or renewed supplier contracts, as well as included in the terms and conditions of each purchase order issued.

•Following the OECD Guidance process, increase the emphasis on clean and validated smelter and refiner information from the supply chain through feedback and detailed smelter analysis.

14

No Incorporation By Reference

Information contained on AMD’s Web site is not incorporated by reference in, or considered to be a part of, this Conflict Minerals Report, the Form SD accompanying this Conflict Minerals Report or any other SEC filings made by us.

15