EX-99.2

Published on May 3, 2022

FIRST QUARTER 2022 FINANCIAL RESULTS MAY 3, 2022

2 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 CAUTIONARY STATEMENT This presentation contains forward-looking statements concerning Advanced Micro Devices, Inc. (AMD) such as the features, functionality, performance, availability, timing and expected benefits of AMD products; that AMD’s acquisition of Xilinx, Inc. will be non-GAAP EPS and free cash flow accretive in the first year; AMD’s expected product and revenue synergies from the acquisition of Xilinx, Inc.; and AMD’s expected second quarter 2022 and fiscal 2022 financial outlook, including revenue non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating expenses as a percentage of revenue, non-GAAP interest expense, taxes and other, non-GAAP tax rates and diluted share count, which are made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are commonly identified by words such as "would," "may," "expects," "believes," "plans," "intends," "projects" and other terms with similar meaning. Investors are cautioned that the forward-looking statements in this presentation are based on current beliefs, assumptions and expectations, speak only as of the date of this presentation and involve risks and uncertainties that could cause actual results to differ materially from current expectations. Such statements are subject to certain known and unknown risks and uncertainties, many of which are difficult to predict and generally beyond AMD's control, that could cause actual results and other future events to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. Material factors that could cause actual results to differ materially from current expectations include, without limitation, the following: Intel Corporation’s dominance of the microprocessor market and its aggressive business practices; global economic uncertainty; loss of a significant customer; impact of the COVID-19 pandemic on AMD’s business, financial condition and results of operations; competitive markets in which AMD’s products are sold; market conditions of the industries in which AMD products are sold; cyclical nature of the semiconductor industry; quarterly and seasonal sales patterns; AMD's ability to adequately protect its technology or other intellectual property; unfavorable currency exchange rate fluctuations; ability of third party manufacturers to manufacture AMD's products on a timely basis in sufficient quantities and using competitive technologies; availability of essential equipment, materials, substrates or manufacturing processes; ability to achieve expected manufacturing yields for AMD’s products; AMD's ability to introduce products on a timely basis with expected features and performance levels; AMD's ability to generate revenue from its semi-custom SoC products; potential security vulnerabilities; potential security incidents including IT outages, data loss, data breaches and cyber-attacks; uncertainties involving the ordering and shipment of AMD’s products; AMD’s reliance on third-party intellectual property to design and introduce new products in a timely manner; AMD's reliance on third-party companies for design, manufacture and supply of motherboards, software and other computer platform components; AMD's reliance on Microsoft and other software vendors' support to design and develop software to run on AMD’s products; AMD’s reliance on third-party distributors and add-in-board partners; impact of modification or interruption of AMD’s internal business processes and information systems; compatibility of AMD’s products with some or all industry-standard software and hardware; costs related to defective products; efficiency of AMD's supply chain; AMD's ability to rely on third party supply-chain logistics functions; AMD’s ability to effectively control sales of its products on the gray market; impact of government actions and regulations such as export administration regulations, tariffs and trade protection measures; AMD’s ability to realize its deferred tax assets; potential tax liabilities; current and future claims and litigation; impact of environmental laws, conflict minerals-related provisions and other laws or regulations; impact of acquisitions, joint ventures and/or investments on AMD's business and AMD’s ability to integrate acquired businesses, such as Xilinx; impact of any impairment of the combined company’s assets on the combined company’s financial position and results of operation; restrictions imposed by agreements governing AMD’s notes, the guarantees of Xilinx’s notes and the revolving credit facility; AMD's indebtedness; AMD's ability to generate sufficient cash to meet its working capital requirements or generate sufficient revenue and operating cash flow to make all of its planned R&D or strategic investments; political, legal, economic risks and natural disasters; future impairments of goodwill and technology license purchases; AMD’s ability to attract and retain qualified personnel; AMD’s stock price volatility; and worldwide political conditions. Investors are urged to review in detail the risks and uncertainties in AMD’s Securities and Exchange Commission filings, including but not limited to AMD’s most recent reports on Forms 10-K and 10-Q. NON-GAAP FINANCIAL MEASURES In this presentation, in addition to GAAP financial results, AMD has provided non-GAAP financial measures including non-GAAP gross profit, non-GAAP operating expenses, non-GAAP operating income, non-GAAP net income, non-GAAP earnings per share and free cash flow. AMD uses a normalized tax rate in its computation of the non-GAAP income tax provision to provide better consistency across the reporting periods. For full year 2022, AMD uses a projected non-GAAP tax rate of 13%, which excludes the tax impact of pre-tax non-GAAP adjustments, reflecting currently available information, and a projected non-GAAP cash tax rate of approximately 10% that includes the projected current income tax liability plus known foreign withholding tax obligations paid expressed as a percentage of non-GAAP profit before tax. In addition, AMD provided non- GAAP financial measures excluding Xilinx, including revenue, gross profit and operating income, and Xilinx pro forma revenue for the three months ended March 26, 2022 as supplemental information. AMD is providing these financial measures because it believes this non-GAAP presentation makes it easier for investors to compare its operating results for current and historical periods and also because AMD believes it assists investors in comparing AMD’s performance across reporting periods on a consistent basis by excluding items that it does not believe are indicative of its core operating performance. The non-GAAP financial measures disclosed in this presentation should be viewed in addition to and not as a substitute for or superior to AMD’s reported results prepared in accordance with GAAP and should be read only in conjunction with AMD’s Consolidated Financial Statements prepared in accordance with GAAP. These non-GAAP financial measures referenced are reconciled to their most directly comparable GAAP financial measures in the Appendices at the end of this presentation. This presentation also contains forward-looking non-GAAP measures concerning AMD’s financial outlook such as gross margin, operating expenses, interest expense, taxes and other. These forward- looking non-GAAP measures are based on current expectations as of May 3, 2022, and assumptions and beliefs that involve numerous risks and uncertainties. AMD undertakes no intent or obligation to publicly update or revise its forward-looking statements made in this presentation except as may be required by law.

3 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 OUR JOURNEY Outstanding Financial Performance Expanding Customer & Partner Ecosystem Best Product Portfolio in History Significant Business Acceleration

4 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 Diversified and Growing Markets Data Center Momentum Non-GAAP Margin Expansion Industry-Leading Products Non-GAAP EPS and Free Cash Flow Accretive for 2022 Xilinx Acquisition Creates Industry’s High-Performance and Adaptive Computing Leader

5 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 Open-source software co-designed with hardware, and optimized for performance across heterogenous solutions Driving leadership process technology and 3D chiplet packaging Executing leadership CPU, GPU, FPGA and Adaptive SoC products and roadmaps Driving innovation in cloud, enterprise, AI and accelerated computing OUR LEADERSHIP TECHNOLOGY SOFTWARE ENABLEMENTADVANCED TECHNOLOGYINDUSTRY LEADING IP DATA CENTER LEADERSHIP

6 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 CPUs, FPGAs and Adaptive SoCs for a broad set of markets Leadership processors for ultrathin, commercial and gaming notebooks and consumer, gaming and workstation desktop PCs Leadership AMD EPYC server processors for cloud, enterprise and HPC. Data center solutions with high-performance AMD Instinct accelerators, SmartNICs and adaptive SOC accelerators Top-to-bottom graphics cards and game consoles based on RDNA 2 Architecture OUR BEST EVER PRODUCT PORTFOLIO See endnotes R5K-002 and CZM-35 EMBEDDEDCLIENTDATA CENTER GAMING

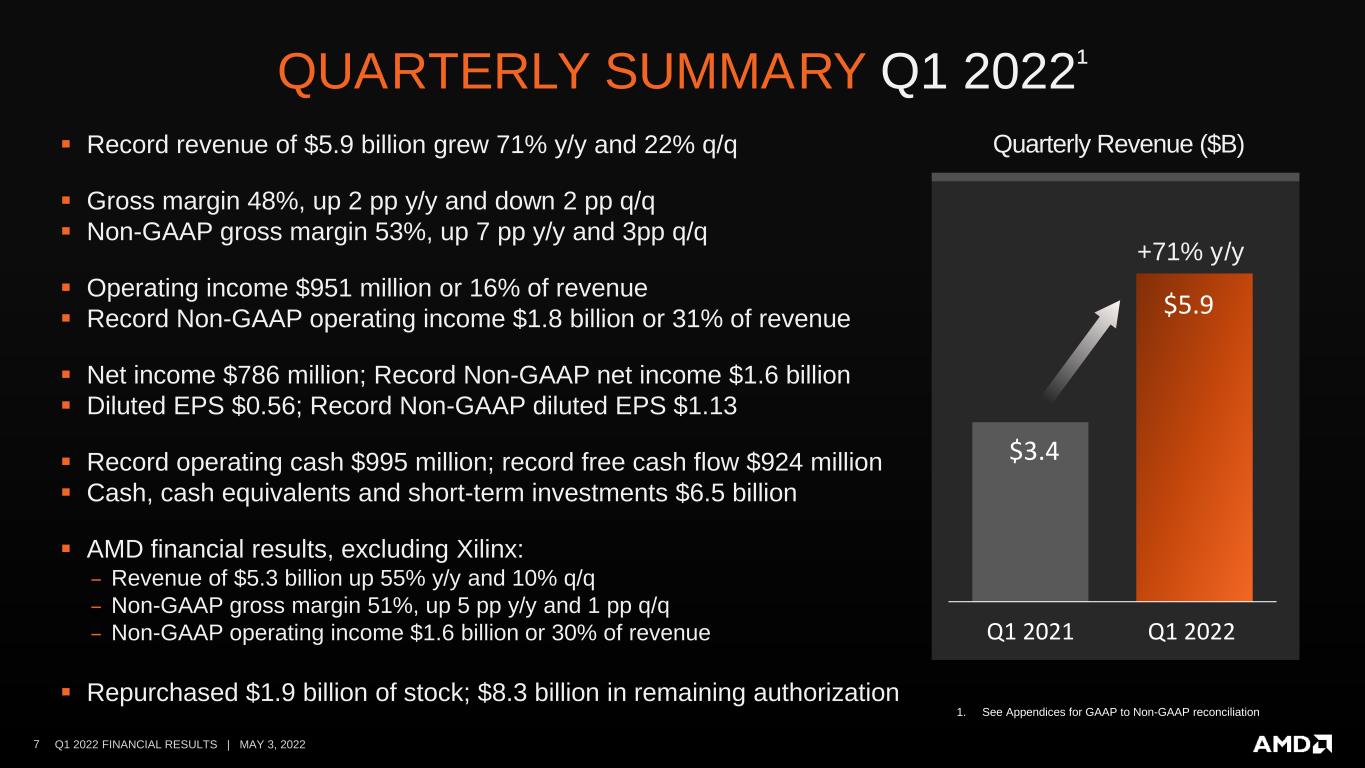

7 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 1. See Appendices for GAAP to Non-GAAP reconciliation QUARTERLY SUMMARY Q1 2022¹ $3.4 $5.9 Q1 2021 Q1 2022 +71% y/y Quarterly Revenue ($B) Record revenue of $5.9 billion grew 71% y/y and 22% q/q Gross margin 48%, up 2 pp y/y and down 2 pp q/q Non-GAAP gross margin 53%, up 7 pp y/y and 3pp q/q Operating income $951 million or 16% of revenue Record Non-GAAP operating income $1.8 billion or 31% of revenue Net income $786 million; Record Non-GAAP net income $1.6 billion Diluted EPS $0.56; Record Non-GAAP diluted EPS $1.13 Record operating cash $995 million; record free cash flow $924 million Cash, cash equivalents and short-term investments $6.5 billion AMD financial results, excluding Xilinx: ‒ Revenue of $5.3 billion up 55% y/y and 10% q/q ‒ Non-GAAP gross margin 51%, up 5 pp y/y and 1 pp q/q ‒ Non-GAAP operating income $1.6 billion or 30% of revenue Repurchased $1.9 billion of stock; $8.3 billion in remaining authorization

8 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 COMPUTING AND GRAPHICS SEGMENT Q1 2022 Record Revenue $2.8 billion • Up 33% y/y driven by RyzenTM and RadeonTM processor sales • Up 8% q/q driven by Ryzen processor sales Average Selling Prices (ASP) • Client processor ASP grew y/y and q/q driven by a richer mix of Ryzen processor sales • GPU ASP up y/y driven by high-end Radeon processor sales; down q/q due to lower mix of data center GPUs Record Operating Income $723 million or 26% of revenue Strategic • Announced Ryzen 7 5800X3D desktop CPU with AMD 3D V-Cache technology featuring 3D stacked chiplets • Launched Ryzen 6000 mobile processors and Ryzen 6000 PRO processors for the commercial market • Ryzen ThreadripperTM PRO WX-Series processors power Lenovo ThinkStation P620 workstations • Desktop GPU sales driven by Radeon 6000 series graphics cards; launched Radeon 6000 mobile GPUs • Launched ROCm 5 software suite targeting Exascale-class HPC and AI applications

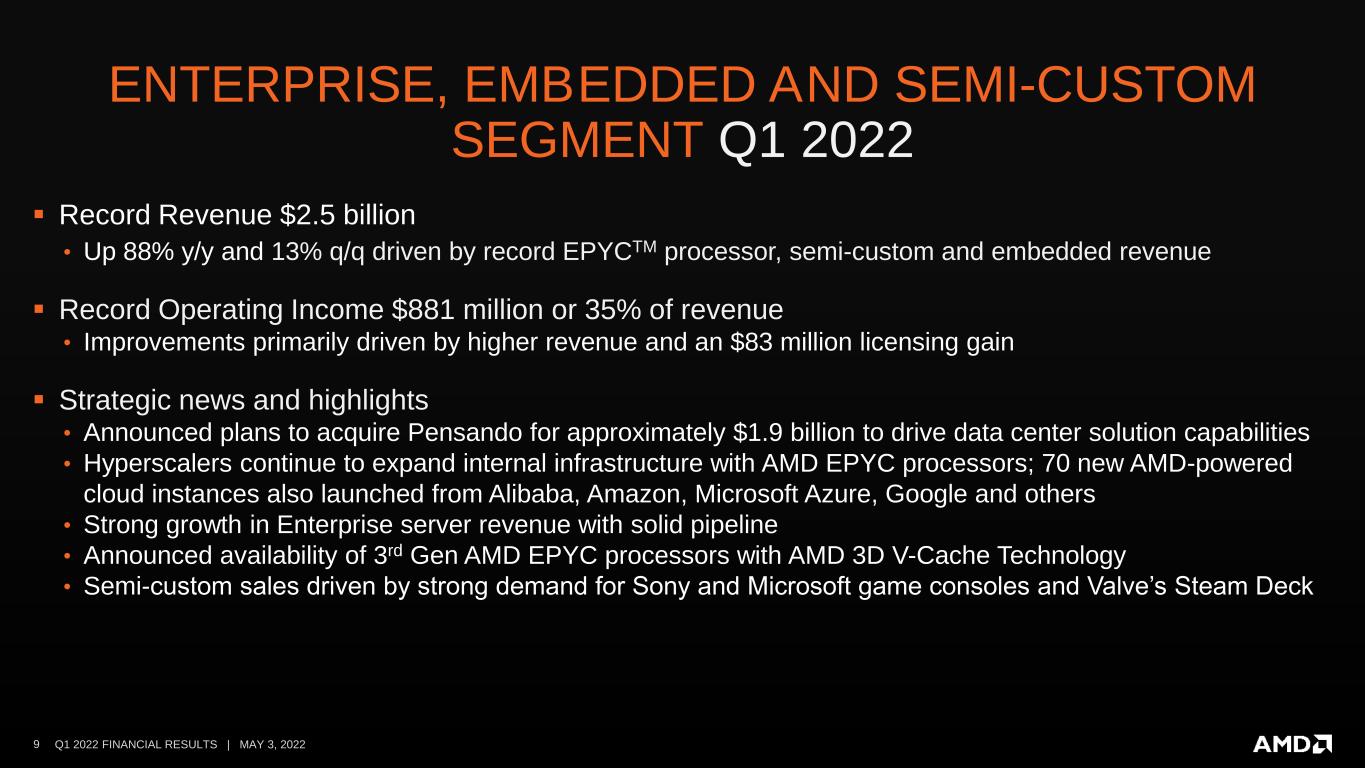

9 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 ENTERPRISE, EMBEDDED AND SEMI-CUSTOM SEGMENT Q1 2022 Record Revenue $2.5 billion • Up 88% y/y and 13% q/q driven by record EPYCTM processor, semi-custom and embedded revenue Record Operating Income $881 million or 35% of revenue • Improvements primarily driven by higher revenue and an $83 million licensing gain Strategic news and highlights • Announced plans to acquire Pensando for approximately $1.9 billion to drive data center solution capabilities • Hyperscalers continue to expand internal infrastructure with AMD EPYC processors; 70 new AMD-powered cloud instances also launched from Alibaba, Amazon, Microsoft Azure, Google and others • Strong growth in Enterprise server revenue with solid pipeline • Announced availability of 3rd Gen AMD EPYC processors with AMD 3D V-Cache Technology • Semi-custom sales driven by strong demand for Sony and Microsoft game consoles and Valve’s Steam Deck

10 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 XILINX Q1 2022 AMD’s acquisition of Xilinx closed on February 14, 2022 Xilinx adds multiple high-margin, long-term revenue streams spanning a new set of markets for AMD Xilinx generated $559 million of revenue for the six weeks of Q1’22 after the transaction closed Operating income of $233 million for the six weeks of Q1’22 after the transaction closed On a pro-forma basis for the full quarter, Xilinx generated $1.04 billion of revenue, up 22% y/y Strategic news and highlights • Strong demand across all the Xilinx end markets • Expanded Versal product lineup with the first customer shipments of Versal HBM adaptive SOCs • Expanded FPGA-as-a-Service and SmartNIC deployments at Tier-1 hyperscalers • Record revenue from auto, industrial, vision and healthcare, and consumer customers

11 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 $1,932 $2,801 $3,244 $3,445 $3,850 $4,313 $4,826 $5,887 1000 2000 3000 4000 5000 6000 7000 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 +71% y/y REVENUE TREND ($ IN MILLIONS) SIGNIFICANT REVENUE GROWTH

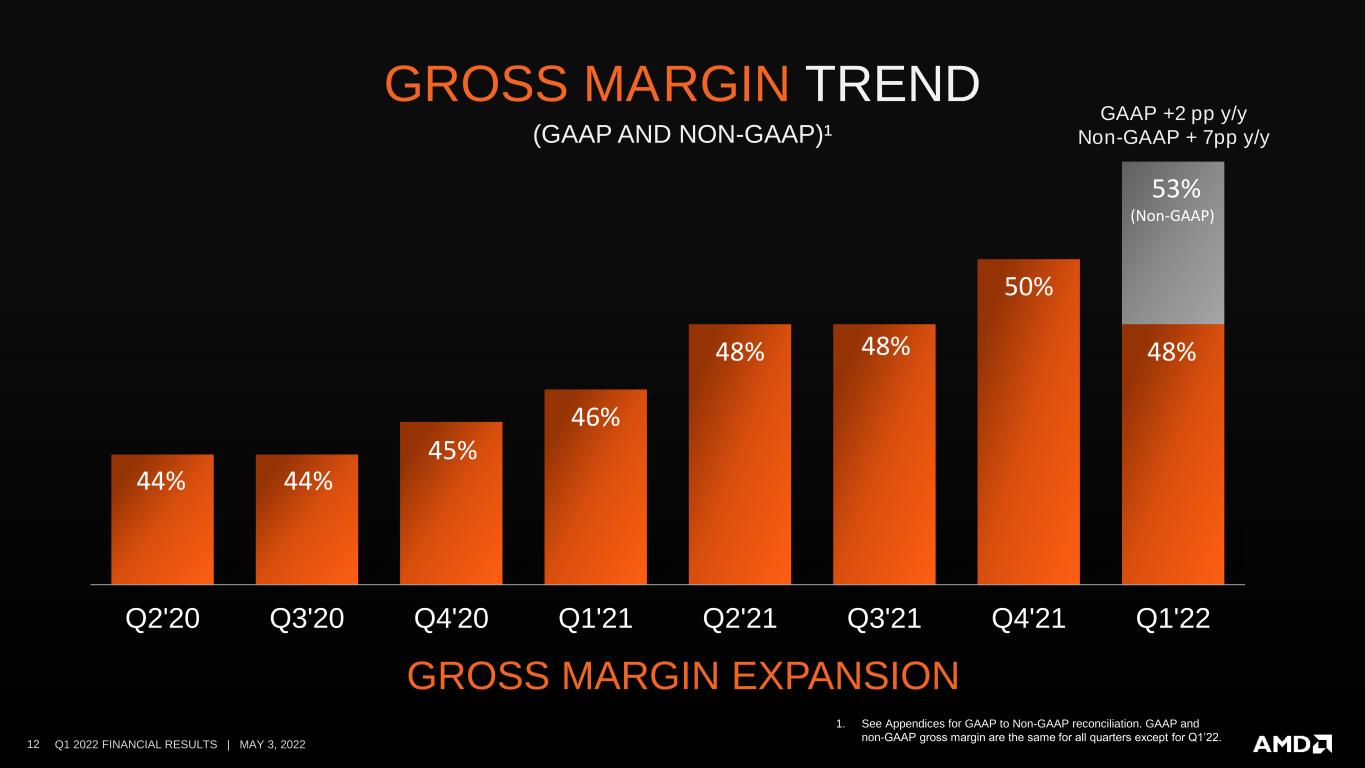

12 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 44% 44% 45% 46% 48% 48% 50% 48% Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 53% (Non-GAAP) GAAP +2 pp y/y Non-GAAP + 7pp y/y GROSS MARGIN TREND (GAAP AND NON-GAAP)¹ 1. See Appendices for GAAP to Non-GAAP reconciliation. GAAP and non-GAAP gross margin are the same for all quarters except for Q1’22. GROSS MARGIN EXPANSION

13 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 EARNINGS PER SHARE TREND $0.13 $0.32 $0.39 $0.45 $0.58 $0.75 $0.80 $0.56 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 A x is T it le +24% y/y (GAAP) $1.45 1 1. In Q4 2020, AMD released $1.3 billion of its $2.9 billion income tax valuation allowance. The valuation allowance release had a $1.06 benefit to Q4 2020 earnings per share. Y/Y GROWTH IN PROFITABILITY $1.06 Valuation Allowance Release

14 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 $0.18 $0.41 $0.52 $0.52 $0.63 $0.73 $0.92 $1.13 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 +117% y/y EARNINGS PER SHARE TREND (NON-GAAP)1 1. 1. See Appendices for GAAP to Non-GAAP reconciliation STRONG EPS TRAJECTORY

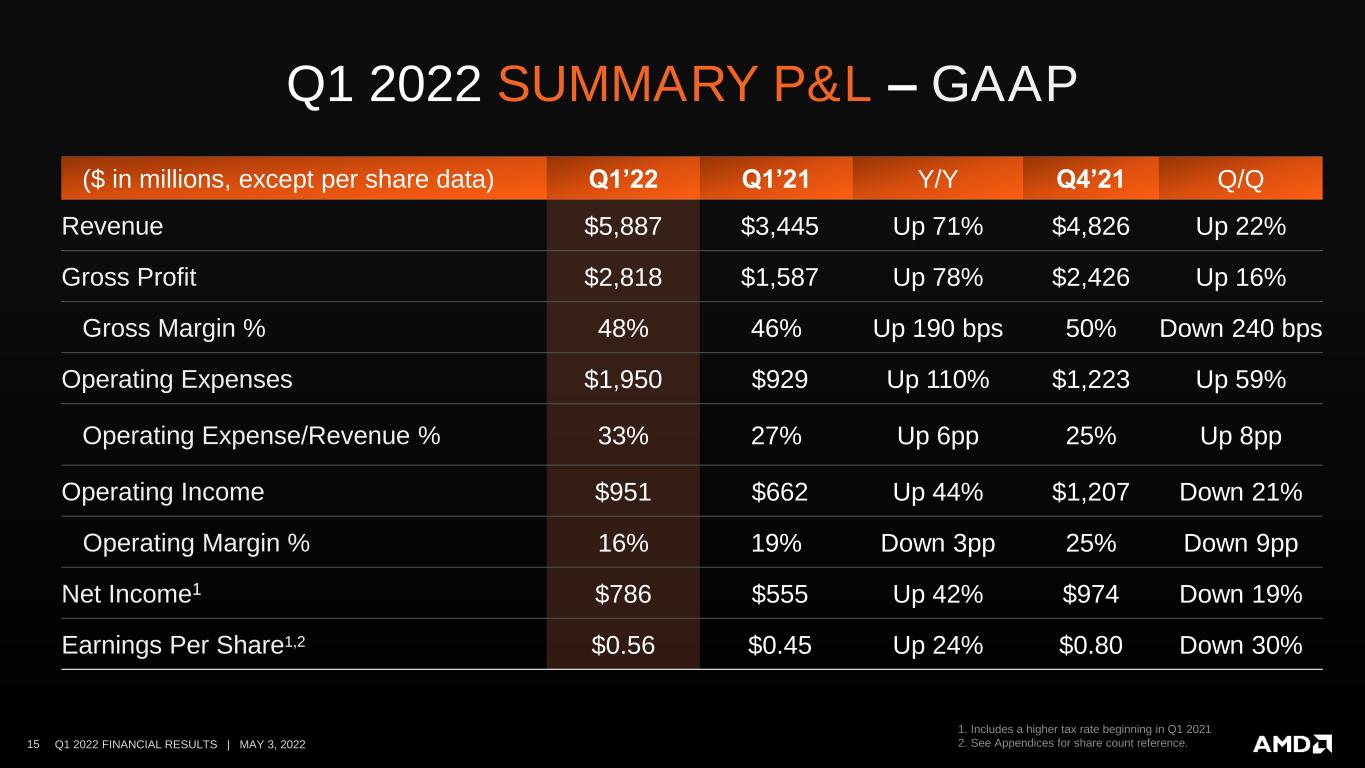

15 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 ($ in millions, except per share data) Q1’22 Q1’21 Y/Y Q4’21 Q/Q Revenue $5,887 $3,445 Up 71% $4,826 Up 22% Gross Profit $2,818 $1,587 Up 78% $2,426 Up 16% Gross Margin % 48% 46% Up 190 bps 50% Down 240 bps Operating Expenses $1,950 $929 Up 110% $1,223 Up 59% Operating Expense/Revenue % 33% 27% Up 6pp 25% Up 8pp Operating Income $951 $662 Up 44% $1,207 Down 21% Operating Margin % 16% 19% Down 3pp 25% Down 9pp Net Income1 $786 $555 Up 42% $974 Down 19% Earnings Per Share1,2 $0.56 $0.45 Up 24% $0.80 Down 30% Q1 2022 SUMMARY P&L – GAAP 1. Includes a higher tax rate beginning in Q1 2021 2. See Appendices for share count reference.

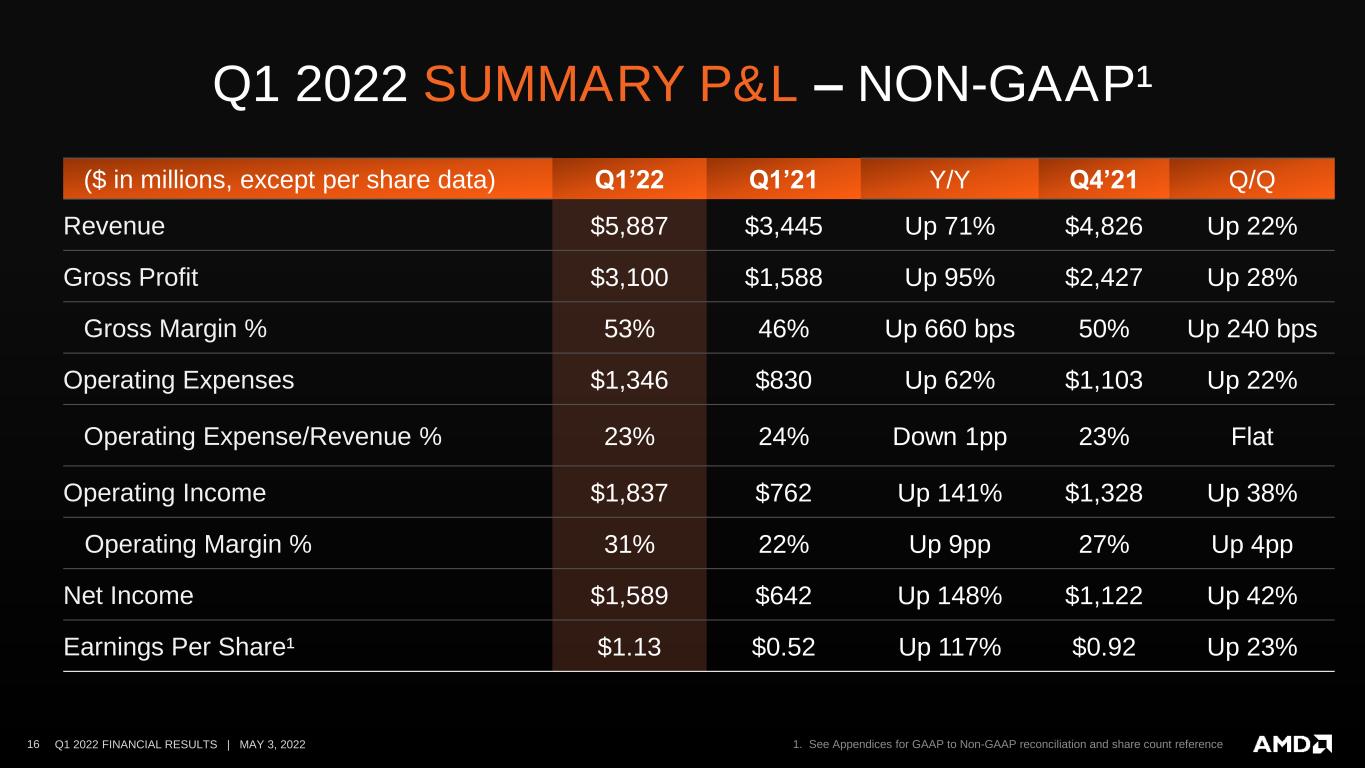

16 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 ($ in millions, except per share data) Q1’22 Q1’21 Y/Y Q4’21 Q/Q Revenue $5,887 $3,445 Up 71% $4,826 Up 22% Gross Profit $3,100 $1,588 Up 95% $2,427 Up 28% Gross Margin % 53% 46% Up 660 bps 50% Up 240 bps Operating Expenses $1,346 $830 Up 62% $1,103 Up 22% Operating Expense/Revenue % 23% 24% Down 1pp 23% Flat Operating Income $1,837 $762 Up 141% $1,328 Up 38% Operating Margin % 31% 22% Up 9pp 27% Up 4pp Net Income $1,589 $642 Up 148% $1,122 Up 42% Earnings Per Share¹ $1.13 $0.52 Up 117% $0.92 Up 23% Q1 2022 SUMMARY P&L – NON-GAAP¹ 1. See Appendices for GAAP to Non-GAAP reconciliation and share count reference

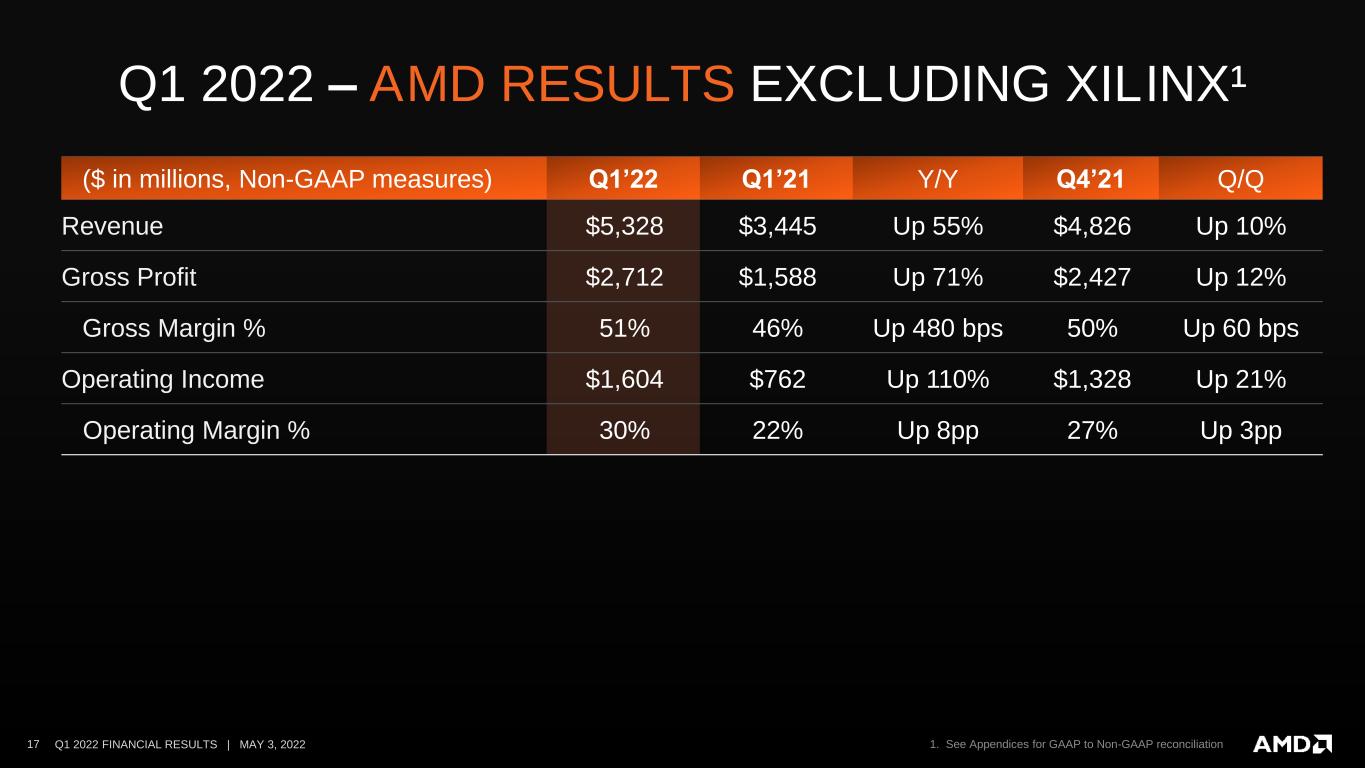

17 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 Q1 2022 – AMD RESULTS EXCLUDING XILINX¹ ($ in millions, Non-GAAP measures) Q1’22 Q1’21 Y/Y Q4’21 Q/Q Revenue $5,328 $3,445 Up 55% $4,826 Up 10% Gross Profit $2,712 $1,588 Up 71% $2,427 Up 12% Gross Margin % 51% 46% Up 480 bps 50% Up 60 bps Operating Income $1,604 $762 Up 110% $1,328 Up 21% Operating Margin % 30% 22% Up 8pp 27% Up 3pp 1. See Appendices for GAAP to Non-GAAP reconciliation

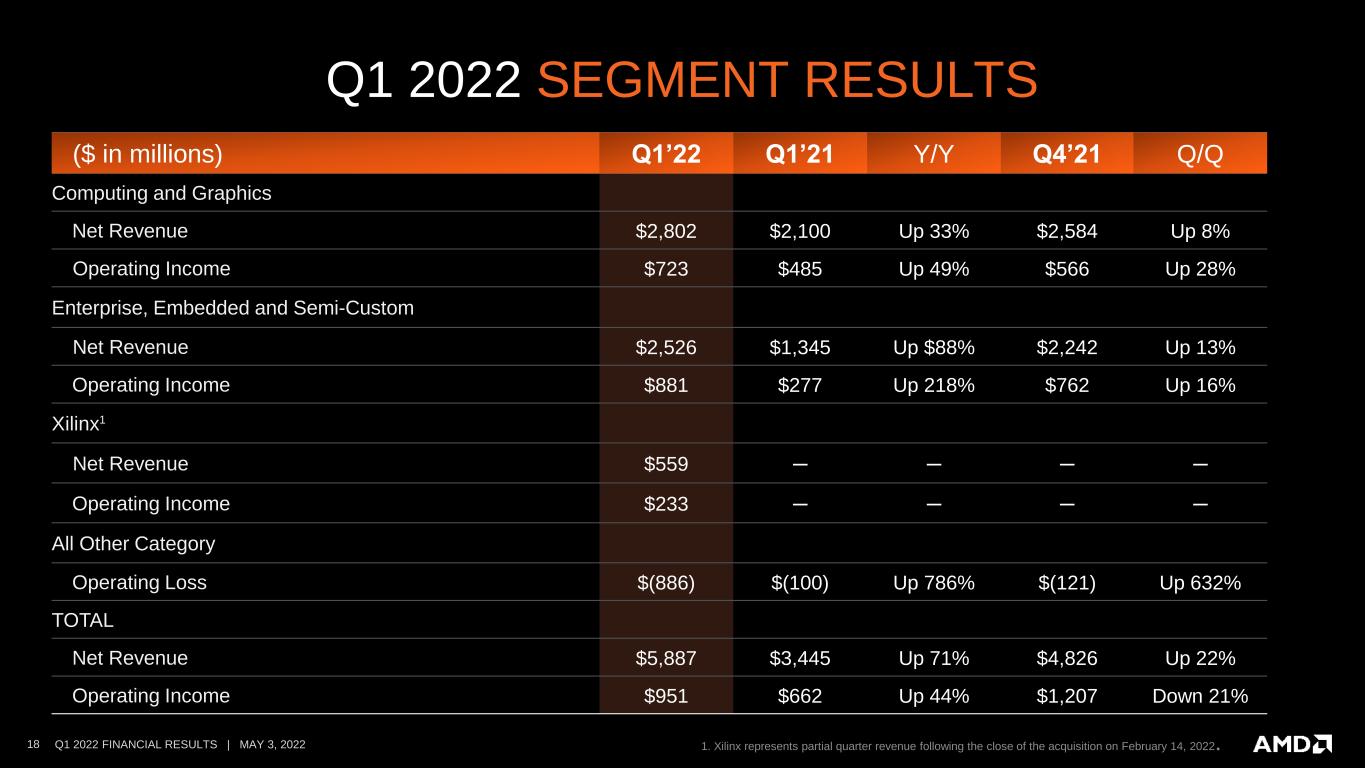

18 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 Q1 2022 SEGMENT RESULTS ($ in millions) Q1’22 Q1’21 Y/Y Q4’21 Q/Q Computing and Graphics Net Revenue $2,802 $2,100 Up 33% $2,584 Up 8% Operating Income $723 $485 Up 49% $566 Up 28% Enterprise, Embedded and Semi-Custom Net Revenue $2,526 $1,345 Up $88% $2,242 Up 13% Operating Income $881 $277 Up 218% $762 Up 16% Xilinx1 Net Revenue $559 ─ ─ ─ ─ Operating Income $233 ─ ─ ─ ─ All Other Category Operating Loss $(886) $(100) Up 786% $(121) Up 632% TOTAL Net Revenue $5,887 $3,445 Up 71% $4,826 Up 22% Operating Income $951 $662 Up 44% $1,207 Down 21% 1. Xilinx represents partial quarter revenue following the close of the acquisition on February 14, 2022.

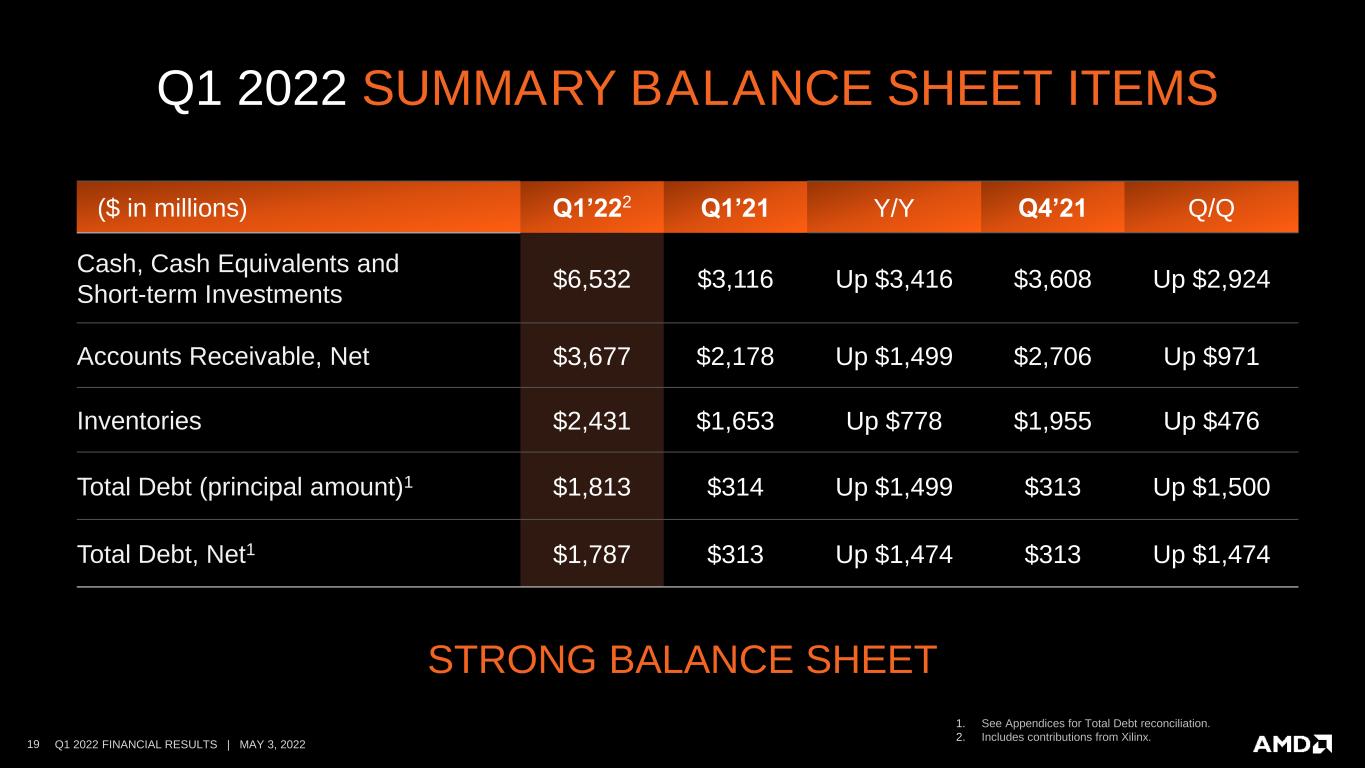

19 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 Q1 2022 SUMMARY BALANCE SHEET ITEMS ($ in millions) Q1’222 Q1’21 Y/Y Q4’21 Q/Q Cash, Cash Equivalents and Short-term Investments $6,532 $3,116 Up $3,416 $3,608 Up $2,924 Accounts Receivable, Net $3,677 $2,178 Up $1,499 $2,706 Up $971 Inventories $2,431 $1,653 Up $778 $1,955 Up $476 Total Debt (principal amount)1 $1,813 $314 Up $1,499 $313 Up $1,500 Total Debt, Net1 $1,787 $313 Up $1,474 $313 Up $1,474 1. See Appendices for Total Debt reconciliation. 2. Includes contributions from Xilinx. STRONG BALANCE SHEET

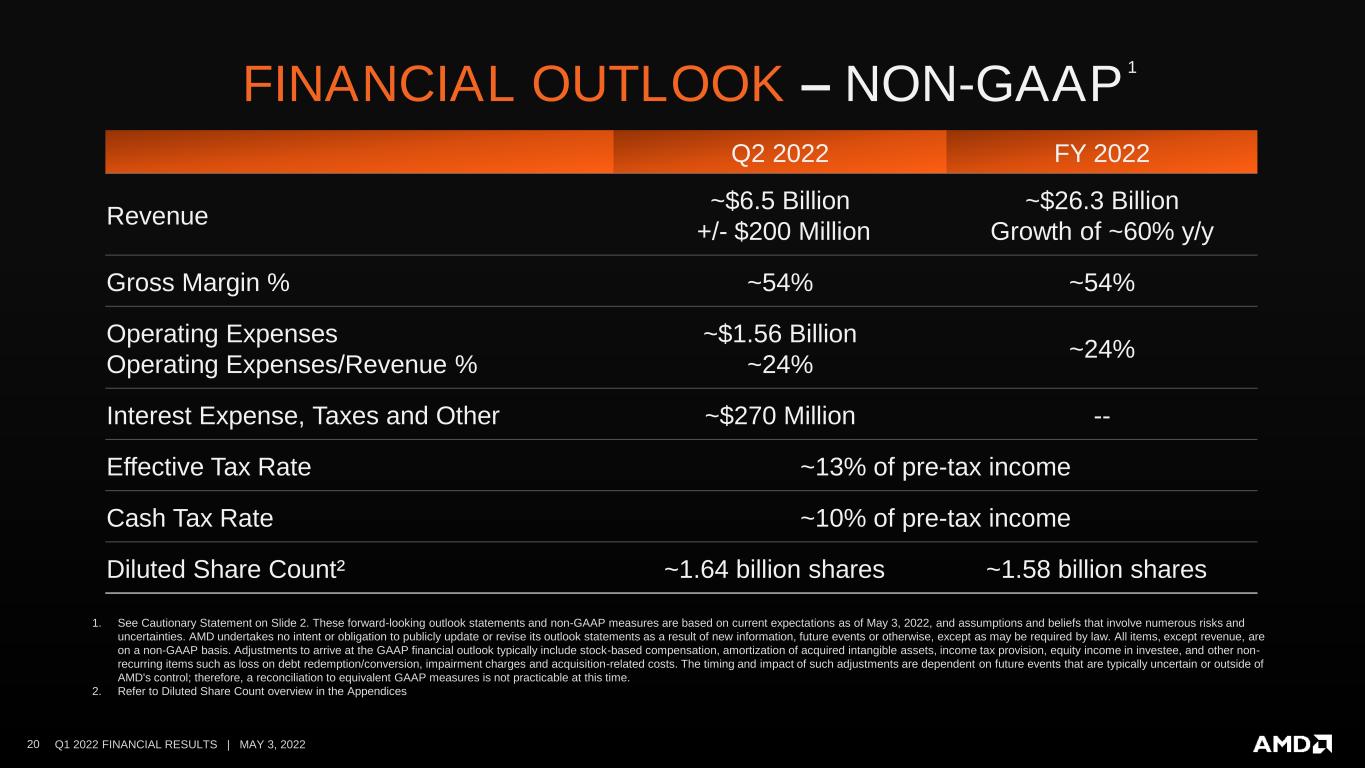

20 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 1. See Cautionary Statement on Slide 2. These forward-looking outlook statements and non-GAAP measures are based on current expectations as of May 3, 2022, and assumptions and beliefs that involve numerous risks and uncertainties. AMD undertakes no intent or obligation to publicly update or revise its outlook statements as a result of new information, future events or otherwise, except as may be required by law. All items, except revenue, are on a non-GAAP basis. Adjustments to arrive at the GAAP financial outlook typically include stock-based compensation, amortization of acquired intangible assets, income tax provision, equity income in investee, and other non- recurring items such as loss on debt redemption/conversion, impairment charges and acquisition-related costs. The timing and impact of such adjustments are dependent on future events that are typically uncertain or outside of AMD's control; therefore, a reconciliation to equivalent GAAP measures is not practicable at this time. 2. Refer to Diluted Share Count overview in the Appendices Q2 2022 FY 2022 Revenue ~$6.5 Billion +/- $200 Million ~$26.3 Billion Growth of ~60% y/y Gross Margin % ~54% ~54% Operating Expenses Operating Expenses/Revenue % ~$1.56 Billion ~24% ~24% Interest Expense, Taxes and Other ~$270 Million -- Effective Tax Rate ~13% of pre-tax income Cash Tax Rate ~10% of pre-tax income Diluted Share Count² ~1.64 billion shares ~1.58 billion shares FINANCIAL OUTLOOK – NON-GAAP 1

21 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 Q1 2022 SUMMARY Record Non-GAAP Profitability Gross Margin of 48% Non-GAAP GM of 53% Record revenue $5.9B Up 71% Y/Y, 22% Q/Q Repurchased $1.9B Common Stock COMPLETED ACQUISITION OF XILINX

22 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 AMD’S COMMITMENT TO ESG CORPORATE RESPONSIBILITY REPORT ON AMD.COM ENVIRONMENTAL Steadfast commitment to environmental stewardship and contributing to our local communities SOCIAL Creating a culture that drives innovation by fostering diversity, inclusion and belonging GOVERNANCE Delivering industry leading products with integrity, innovation and quality in order to help solve global challenges

23 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 BUILDING THE BEST Outstanding Financial Performance Execution Excellence Leadership Roadmaps Increasing Market Share

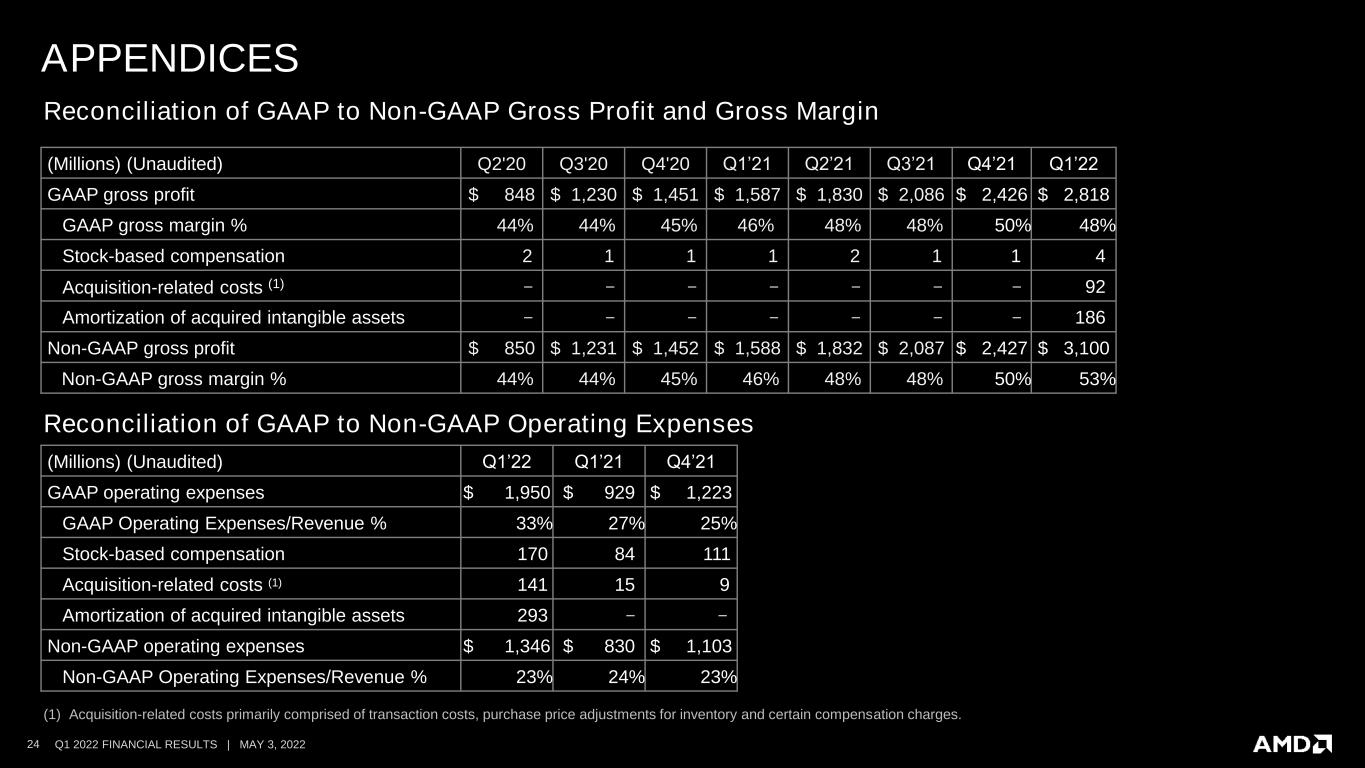

24 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 APPENDICES Reconciliation of GAAP to Non-GAAP Gross Profit and Gross Margin (Millions) (Unaudited) Q2'20 Q3'20 Q4'20 Q1’21 Q2’21 Q3’21 Q4’21 Q1’22 GAAP gross profit $ 848 $ 1,230 $ 1,451 $ 1,587 $ 1,830 $ 2,086 $ 2,426 $ 2,818 GAAP gross margin % 44% 44% 45% 46% 48% 48% 50% 48% Stock-based compensation 2 1 1 1 2 1 1 4 Acquisition-related costs (1) – – – – – – – 92 Amortization of acquired intangible assets – – – – – – – 186 Non-GAAP gross profit $ 850 $ 1,231 $ 1,452 $ 1,588 $ 1,832 $ 2,087 $ 2,427 $ 3,100 Non-GAAP gross margin % 44% 44% 45% 46% 48% 48% 50% 53% Reconciliation of GAAP to Non-GAAP Operating Expenses (Millions) (Unaudited) Q1’22 Q1’21 Q4’21 GAAP operating expenses $ 1,950 $ 929 $ 1,223 GAAP Operating Expenses/Revenue % 33% 27% 25% Stock-based compensation 170 84 111 Acquisition-related costs (1) 141 15 9 Amortization of acquired intangible assets 293 – – Non-GAAP operating expenses $ 1,346 $ 830 $ 1,103 Non-GAAP Operating Expenses/Revenue % 23% 24% 23% (1) Acquisition-related costs primarily comprised of transaction costs, purchase price adjustments for inventory and certain compensation charges.

25 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 APPENDICES Reconciliation of GAAP Operating Income to Non-GAAP Operating Income (Millions) (Unaudited) Q1’22 Q1’21 Q4’21 GAAP operating income $ 951 $ 662 $ 1,207 GAAP operating margin % 16% 19% 25% Stock-based compensation 174 85 112 Acquisition-related costs (1) 233 15 9 Amortization of acquired intangible assets 479 – – Non-GAAP operating income $ 1,837 $ 762 $ 1,328 Non-GAAP operating margin % 31% 22% 27% (1) Acquisition-related costs primarily comprised of transaction costs, purchase price adjustments for inventory and certain compensation charges.

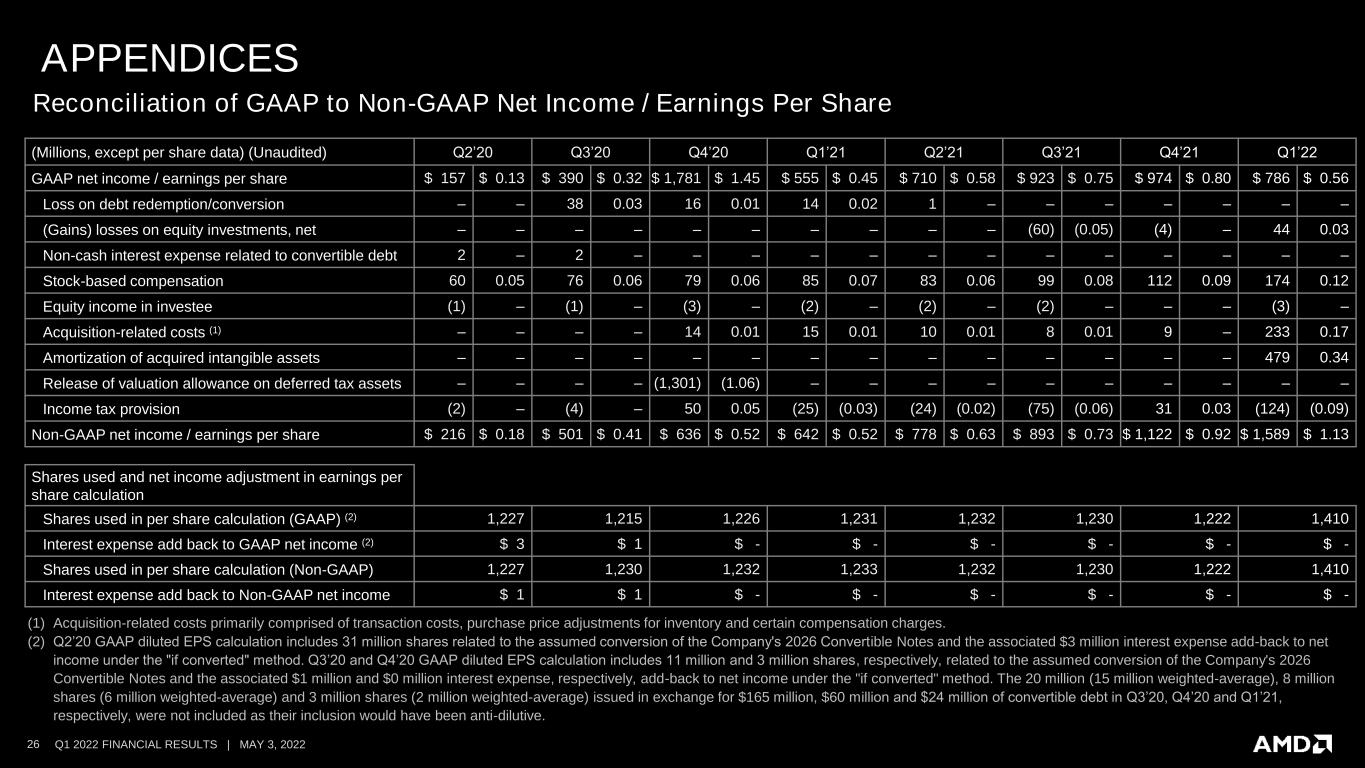

26 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 APPENDICES (1) Acquisition-related costs primarily comprised of transaction costs, purchase price adjustments for inventory and certain compensation charges. (2) Q2’20 GAAP diluted EPS calculation includes 31 million shares related to the assumed conversion of the Company's 2026 Convertible Notes and the associated $3 million interest expense add-back to net income under the "if converted" method. Q3’20 and Q4’20 GAAP diluted EPS calculation includes 11 million and 3 million shares, respectively, related to the assumed conversion of the Company's 2026 Convertible Notes and the associated $1 million and $0 million interest expense, respectively, add-back to net income under the "if converted" method. The 20 million (15 million weighted-average), 8 million shares (6 million weighted-average) and 3 million shares (2 million weighted-average) issued in exchange for $165 million, $60 million and $24 million of convertible debt in Q3’20, Q4’20 and Q1’21, respectively, were not included as their inclusion would have been anti-dilutive. (Millions, except per share data) (Unaudited) Q2’20 Q3’20 Q4’20 Q1’21 Q2’21 Q3’21 Q4’21 Q1’22 GAAP net income / earnings per share $ 157 $ 0.13 $ 390 $ 0.32 $ 1,781 $ 1.45 $ 555 $ 0.45 $ 710 $ 0.58 $ 923 $ 0.75 $ 974 $ 0.80 $ 786 $ 0.56 Loss on debt redemption/conversion – – 38 0.03 16 0.01 14 0.02 1 – – – – – – – (Gains) losses on equity investments, net – – – – – – – – – – (60) (0.05) (4) – 44 0.03 Non-cash interest expense related to convertible debt 2 – 2 – – – – – – – – – – – – – Stock-based compensation 60 0.05 76 0.06 79 0.06 85 0.07 83 0.06 99 0.08 112 0.09 174 0.12 Equity income in investee (1) – (1) – (3) – (2) – (2) – (2) – – – (3) – Acquisition-related costs (1) – – – – 14 0.01 15 0.01 10 0.01 8 0.01 9 – 233 0.17 Amortization of acquired intangible assets – – – – – – – – – – – – – – 479 0.34 Release of valuation allowance on deferred tax assets – – – – (1,301) (1.06) – – – – – – – – – – Income tax provision (2) – (4) – 50 0.05 (25) (0.03) (24) (0.02) (75) (0.06) 31 0.03 (124) (0.09) Non-GAAP net income / earnings per share $ 216 $ 0.18 $ 501 $ 0.41 $ 636 $ 0.52 $ 642 $ 0.52 $ 778 $ 0.63 $ 893 $ 0.73 $ 1,122 $ 0.92 $ 1,589 $ 1.13 Shares used and net income adjustment in earnings per share calculation Shares used in per share calculation (GAAP) (2) 1,227 1,215 1,226 1,231 1,232 1,230 1,222 1,410 Interest expense add back to GAAP net income (2) $ 3 $ 1 $ - $ - $ - $ - $ - $ - Shares used in per share calculation (Non-GAAP) 1,227 1,230 1,232 1,233 1,232 1,230 1,222 1,410 Interest expense add back to Non-GAAP net income $ 1 $ 1 $ - $ - $ - $ - $ - $ - Reconciliation of GAAP to Non-GAAP Net Income / Earnings Per Share

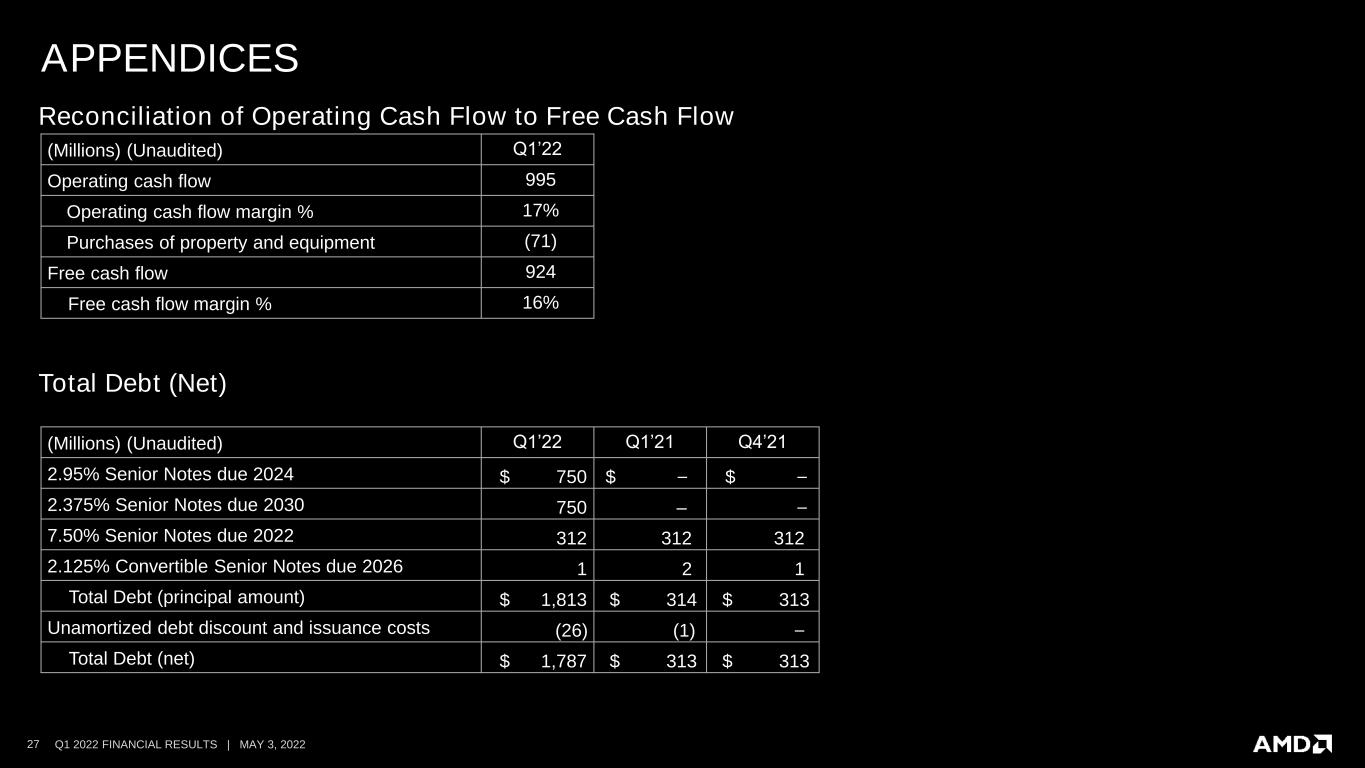

27 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 APPENDICES Total Debt (Net) (Millions) (Unaudited) Q1’22 Q1’21 Q4’21 2.95% Senior Notes due 2024 $ 750 $ – $ – 2.375% Senior Notes due 2030 750 – – 7.50% Senior Notes due 2022 312 312 312 2.125% Convertible Senior Notes due 2026 1 2 1 Total Debt (principal amount) $ 1,813 $ 314 $ 313 Unamortized debt discount and issuance costs (26) (1) – Total Debt (net) $ 1,787 $ 313 $ 313 Reconciliation of Operating Cash Flow to Free Cash Flow (Millions) (Unaudited) Q1’22 Operating cash flow 995 Operating cash flow margin % 17% Purchases of property and equipment (71) Free cash flow 924 Free cash flow margin % 16%

28 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 APPENDICES Reconciliation of AMD GAAP to AMD Non-GAAP Excluding Xilinx Q1’22 (Millions) (Unaudited) Revenue Gross Profit Gross Margin % Operating Income Operating Margin % AMD GAAP $ 5,887 $ 2,818 48% $ 951 16% Stock-based compensation — 4 174 Acquisition-related costs (1) — 92 233 Amortization of acquired intangible assets — 186 479 AMD Non-GAAP 5,887 3,100 53% 1,837 31% Xilinx segment 559 388 233 AMD Non-GAAP Excluding Xilinx $ 5,328 $ 2,712 51% $ 1,604 30% (1) Acquisition-related costs primarily comprised of transaction costs, purchase price adjustments for inventory and certain compensation charges.

29 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 APPENDICES Reconciliation of Xilinx Segment Revenue to Xilinx Pro Forma Revenue Q1’22 (Millions) (Unaudited) Revenue Xilinx Segment (1) $ 559 Xilinx Pre-Acquisition (2) 477 Xilinx Pro Forma (3) $ 1,036 (1) Represents unaudited Xilinx revenue from the date of acquisition, February 14, 2022, through March 26, 2022. (2) Represents unaudited Xilinx revenue from January 2, 2022 to February 13, 2022. (3) The unaudited Xilinx pro forma revenue represents the three-month period beginning January 2, 2022 through March 26, 2022. The pro forma revenue is presented for informational purposes only.

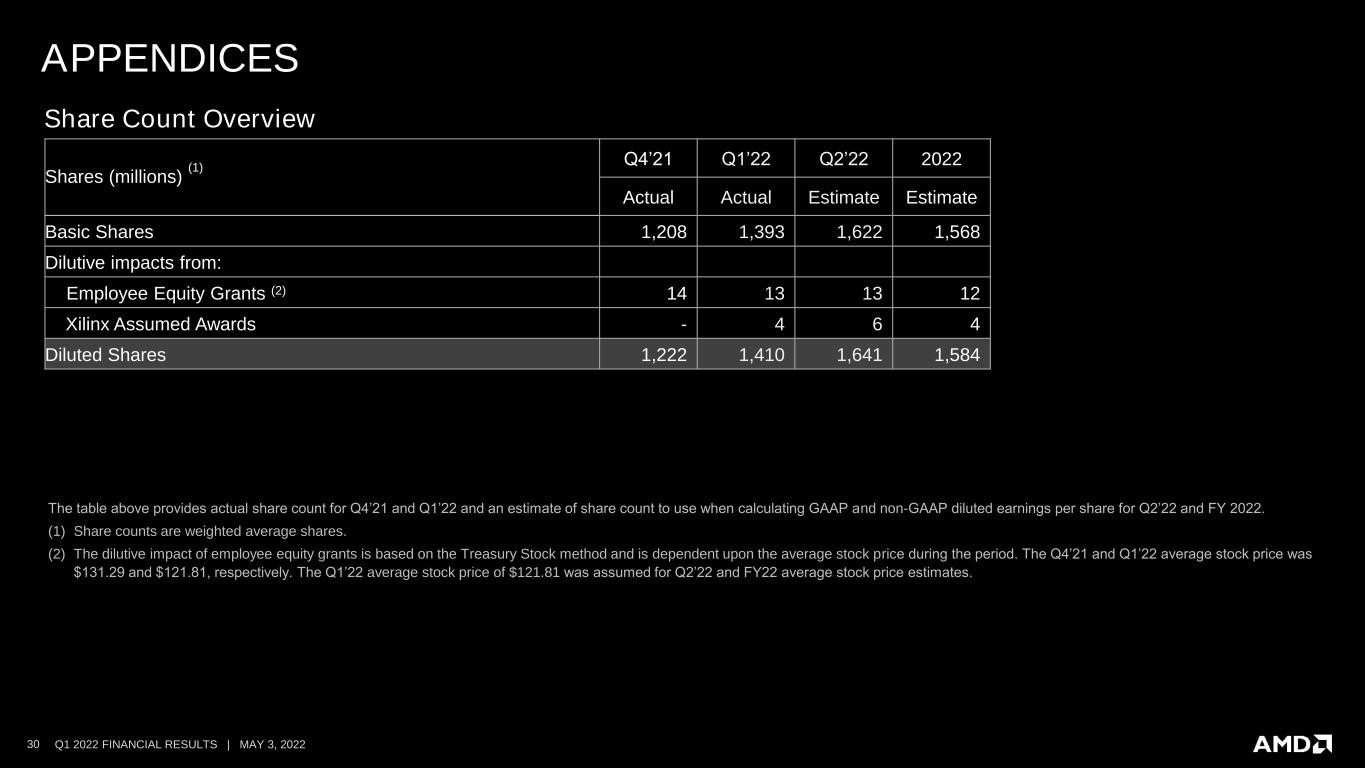

30 Q1 2022 FINANCIAL RESULTS | MAY 3, 2022 APPENDICES Share Count Overview Shares (millions) (1) Q4’21 Q1’22 Q2’22 2022 Actual Actual Estimate Estimate Basic Shares 1,208 1,393 1,622 1,568 Dilutive impacts from: Employee Equity Grants (2) 14 13 13 12 Xilinx Assumed Awards - 4 6 4 Diluted Shares 1,222 1,410 1,641 1,584 The table above provides actual share count for Q4’21 and Q1’22 and an estimate of share count to use when calculating GAAP and non-GAAP diluted earnings per share for Q2’22 and FY 2022. (1) Share counts are weighted average shares. (2) The dilutive impact of employee equity grants is based on the Treasury Stock method and is dependent upon the average stock price during the period. The Q4’21 and Q1’22 average stock price was $131.29 and $121.81, respectively. The Q1’22 average stock price of $121.81 was assumed for Q2’22 and FY22 average stock price estimates.

31 FIRST QUARTER 2022 FINANCIAL RESULTS | MAY 3, 2022 [AMD Official Use Only] ENDNOTES R5K-002: Testing by AMD Performance labs as of 5/28/2021 based on the average FPS of 20 PC games at 1920x1080 with the High image quality preset using an AMD Ryzen™ 9 5900X processor vs. Core i9-11900K. For Ryzen 5000 G-Series processors testing as of 5/5/2021 based on the average FPS of 11 PC games at 1920x1080 with the low image quality preset using an AMD Ryzen™ 7 5700G vs Core i7-11700, both configured with integrated graphics. Results may vary. R5K-002.R5K-050: Testing by AMD Performance Labs as of December 11, 2020 using an AMD Ryzen 9 5900 and Intel Core i9-10900, each similarly configured and tested with an NVIDIA GeForce RTX 2080 Ti graphics card. Results may vary. R5K-002. CZM-35:Tested by AMD Labs in December 2020. The Ryzen 5000 series mobile processors are the fastest mobile processors with the highest-performing single-thread and multi-thread performance available on an x86 mobile processor, measured with Cinebench R.20 1T and Cinebench R20 nT respectively, using similarly configured systems with Ryzen 9 4900H, Ryzen 9 5980HX and Ryzen 5980HS processors vs i9-10980HK, Core i7-1185G7 processors. Performance may vary. CZM-35. DISCLAIMERS AND ATTRIBUTIONS The information contained herein is for informational purposes only and is subject to change without notice. Timelines, roadmaps, and/or product release dates shown in these slides are plans only and subject to change. While every precaution has been taken in the preparation of this document, it may contain technical inaccuracies, omissions and typographical errors, and AMD is under no obligation to update or otherwise correct this information. Advanced Micro Devices, Inc. makes no representations or warranties with respect to the accuracy or completeness of the contents of this document, and assumes no liability of any kind, including the implied warranties of non-infringement, merchantability or fitness for particular purposes, with respect to the operation or use of AMD hardware, software or other products described herein. No license, including implied or arising by estoppel, to any intellectual property rights is granted by this document. Terms and limitations applicable to the purchase or use of AMD’s products are as set forth in a signed agreement between the parties or in AMD's Standard Terms and Conditions of Sale. ©2022 Advanced Micro Devices, Inc. All rights reserved. AMD, the AMD Arrow logo, AMD CDNA, AMD Instinct, AMD RDNA, Radeon, Ryzen, EPYC and combinations thereof are trademarks of Advanced Micro Devices, Inc. Other product names used in this presentation are for identification purposes only and may be trademarks of their respective companies.