EX-99.2

Published on October 31, 2023

AMD FINANCIAL RESULTS Third Quarter 2023 October 31, 2023

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202322 CAUTIONARY STATEMENT This presentation contains forward-looking statements concerning Advanced Micro Devices, Inc. (AMD), such as the features, functionality, performance, availability, timing and expected benefits of AMD products; AMD’s expected fourth quarter 2023 financial outlook, including revenue, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP tax rate and diluted share count; AMD’s large and compelling TAM; AMD’s ability to expand Data Center and AI leadership; and AMD’s ability to drive long-term shareholder returns, which are made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are commonly identified by words such as "would," "may," "expects," "believes," "plans," "intends," "projects" and other terms with similar meaning. Investors are cautioned that the forward- looking statements in this presentation are based on current beliefs, assumptions and expectations, speak only as of the date of this presentation and involve risks and uncertainties that could cause actual results to differ materially from current expectations. Such statements are subject to certain known and unknown risks and uncertainties, many of which are difficult to predict and generally beyond AMD's control, that could cause actual results and other future events to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. Material factors that could cause actual results to differ materially from current expectations include, without limitation, the following: Intel Corporation’s dominance of the microprocessor market and its aggressive business practices; global economic uncertainty; cyclical nature of the semiconductor industry; market conditions of the industries in which AMD products are sold; loss of a significant customer; impact of the COVID-19 pandemic on AMD’s business, financial condition and results of operations; competitive markets in which AMD’s products are sold; quarterly and seasonal sales patterns; AMD's ability to adequately protect its technology or other intellectual property; unfavorable currency exchange rate fluctuations; ability of third party manufacturers to manufacture AMD's products on a timely basis in sufficient quantities and using competitive technologies; availability of essential equipment, materials, substrates or manufacturing processes; ability to achieve expected manufacturing yields for AMD’s products; AMD's ability to introduce products on a timely basis with expected features and performance levels; AMD's ability to generate revenue from its semi-custom SoC products; potential security vulnerabilities; potential security incidents including IT outages, data loss, data breaches and cyber-attacks; potential difficulties in upgrading and operating AMD’s new enterprise resource planning system; uncertainties involving the ordering and shipment of AMD’s products; AMD’s reliance on third-party intellectual property to design and introduce new products in a timely manner; AMD's reliance on third-party companies for design, manufacture and supply of motherboards, software and other computer platform components; AMD's reliance on Microsoft and other software vendors' support to design and develop software to run on AMD’s products; AMD’s reliance on third-party distributors and add-in-board partners; impact of modification or interruption of AMD’s internal business processes and information systems; compatibility of AMD’s products with some or all industry-standard software and hardware; costs related to defective products; efficiency of AMD's supply chain; AMD's ability to rely on third party supply-chain logistics functions; AMD’s ability to effectively control sales of its products on the gray market; impact of government actions and regulations such as export administration regulations, tariffs and trade protection measures; AMD’s ability to realize its deferred tax assets; potential tax liabilities; current and future claims and litigation; impact of environmental laws, conflict minerals-related provisions and other laws or regulations; impact of acquisitions, joint ventures and/or investments on AMD’s business and AMD’s ability to integrate acquired businesses; impact of any impairment of AMD’s tangible, definite-lived or indefinite-lived intangible assets, including goodwill, on AMD’s financial position and results of operation; restrictions imposed by agreements governing AMD’s notes, the guarantees of Xilinx’s notes and the revolving credit facility; AMD's indebtedness; AMD's ability to generate sufficient cash to meet its working capital requirements or generate sufficient revenue and operating cash flow to make all of its planned R&D or strategic investments, as well as the impact of financial institution failure on AMD’s cash and cash equivalents; political, legal, economic risks and natural disasters; future impairments of technology license purchases; AMD’s ability to attract and retain qualified personnel; AMD’s stock price volatility. Investors are urged to review in detail the risks and uncertainties in AMD’s Securities and Exchange Commission filings, including but not limited to AMD’s most recent reports on Forms 10-K and 10-Q. NON-GAAP FINANCIAL MEASURES In this presentation, in addition to GAAP financial results, AMD has provided non-GAAP financial measures including non-GAAP gross profit, non-GAAP operating expenses, non-GAAP operating income, non-GAAP net income and non-GAAP diluted earnings per share. AMD uses a normalized tax rate in its computation of the non-GAAP income tax provision to provide better consistency across the reporting periods. For fiscal year 2023, AMD uses a projected non-GAAP tax rate of 13%, which excludes the tax impact of pre-tax non-GAAP adjustments, reflecting currently available information. AMD is providing these financial measures because it believes this non-GAAP presentation makes it easier for investors to compare its operating results for current and historical periods and also because AMD believes it assists investors in comparing AMD’s performance across reporting periods on a consistent basis by excluding items that it does not believe are indicative of its core operating performance. The non-GAAP financial measures disclosed in this presentation should be viewed in addition to and not as a substitute for or superior to AMD’s reported results prepared in accordance with GAAP and should be read only in conjunction with AMD’s Consolidated Financial Statements prepared in accordance with GAAP. These non-GAAP financial measures referenced are reconciled to their most directly comparable GAAP financial measures in the Appendices at the end of this presentation. This presentation also contains forward-looking non-GAAP measures concerning AMD’s financial outlook such as gross margin and operating expenses. These forward-looking non-GAAP measures are based on current expectations as of October 31, 2023, and assumptions and beliefs that involve numerous risks and uncertainties. AMD undertakes no intent or obligation to publicly update or revise its forward-looking statements made in this presentation except as may be required by law.

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202333 Expanding Customer & Partner Ecosystem Data Center and AI Growth Strong Financial Foundation Leadership Product Portfolio OUR JOURNEY

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202344 OUR LEADERSHIP TECHNOLOGY Software Enablement Open-source software optimized for performance across heterogenous solutions Data Center Leadership Delivering innovation in cloud, enterprise, AI and accelerated computing Advanced Technology Driving leadership process technology and 3D chiplet packaging Broad IP Portfolio Executing leadership CPU, GPU, DPU, FPGA, Adaptive SoC and AI products

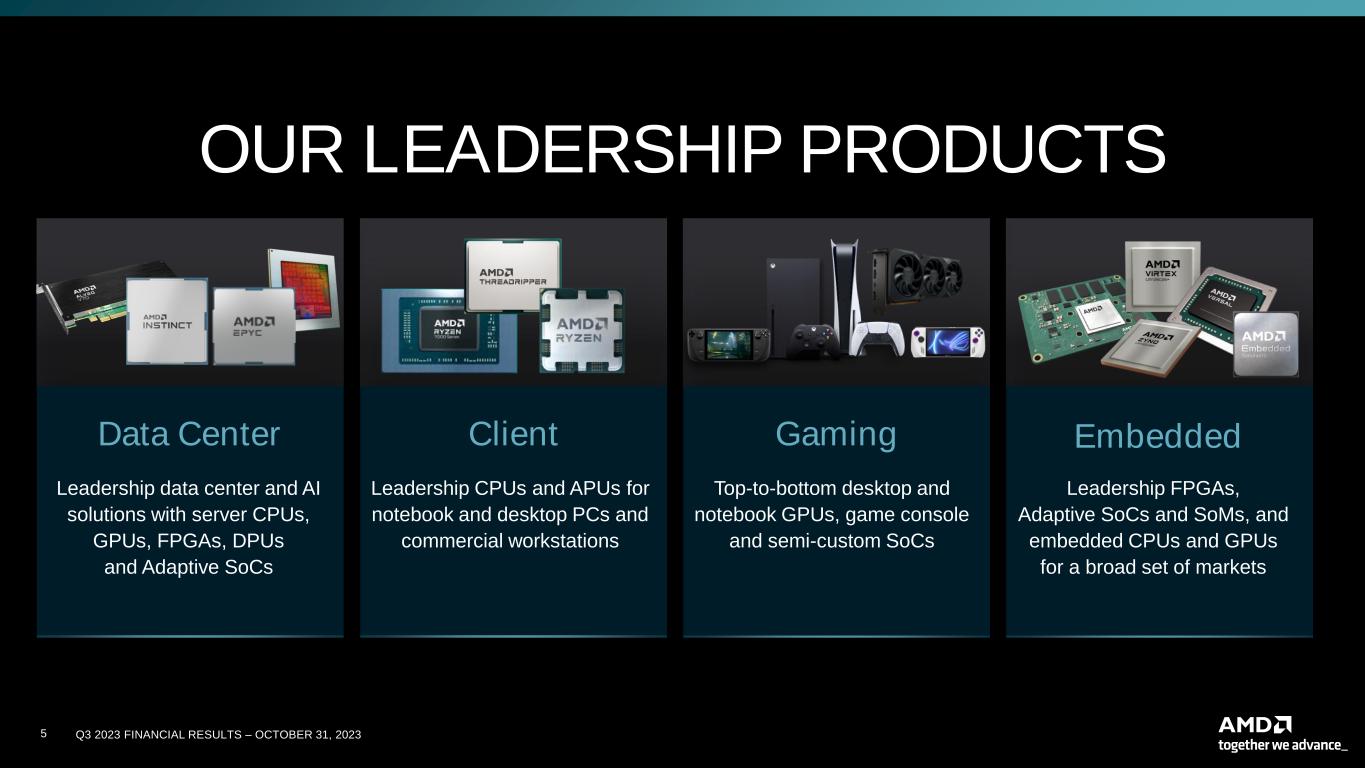

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202355 OUR LEADERSHIP PRODUCTS Embedded Leadership FPGAs, Adaptive SoCs and SoMs, and embedded CPUs and GPUs for a broad set of markets Gaming Top-to-bottom desktop and notebook GPUs, game console and semi-custom SoCs Client Leadership CPUs and APUs for notebook and desktop PCs and commercial workstations Data Center Leadership data center and AI solutions with server CPUs, GPUs, FPGAs, DPUs and Adaptive SoCs

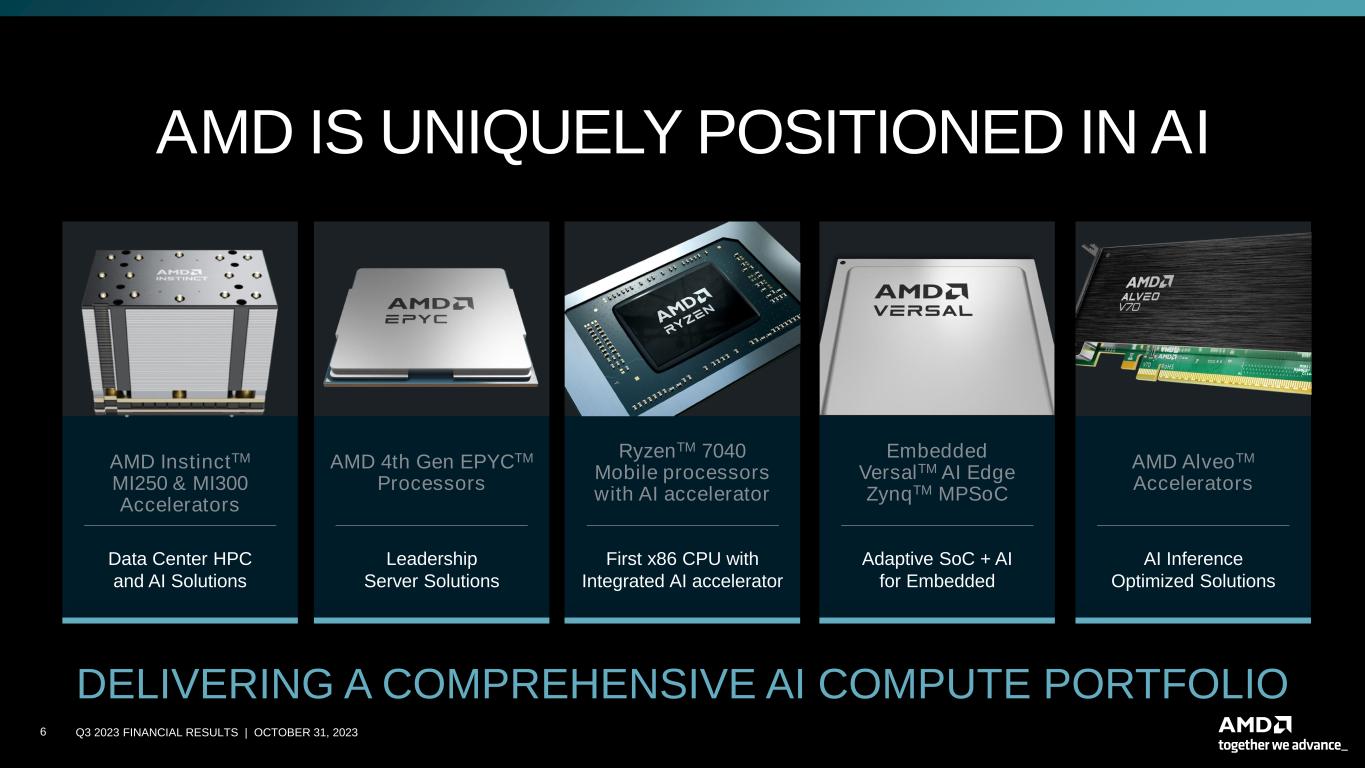

AMD IS UNIQUELY POSITIONED IN AI RyzenTM 7040 Mobile processors with AI accelerator First x86 CPU with Integrated AI accelerator Embedded VersalTM AI Edge ZynqTM MPSoC Adaptive SoC + AI for Embedded AMD AlveoTM Accelerators AI Inference Optimized Solutions DELIVERING A COMPREHENSIVE AI COMPUTE PORTFOLIO Q3 2023 FINANCIAL RESULTS | OCTOBER 31, 20236 AMD InstinctTM MI250 & MI300 Accelerators Data Center HPC and AI Solutions AMD 4th Gen EPYCTM Processors Leadership Server Solutions

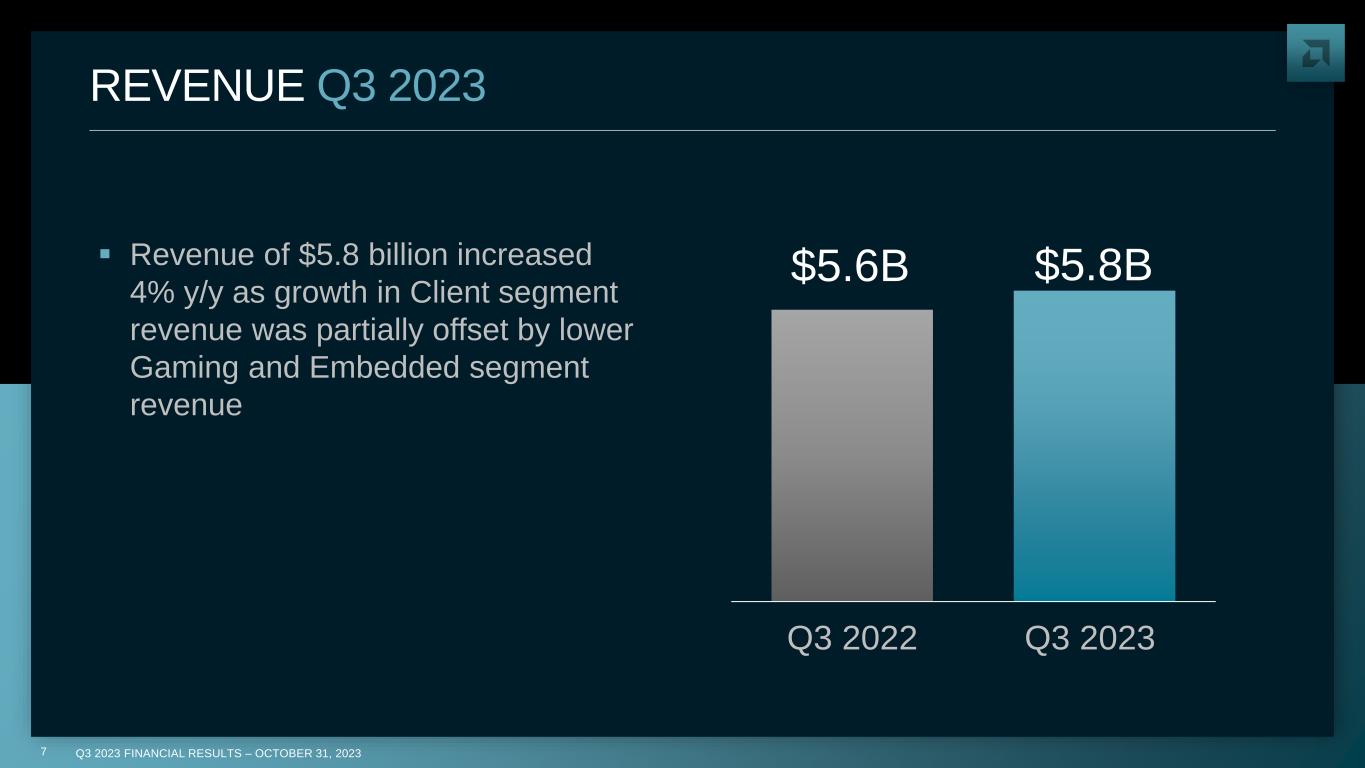

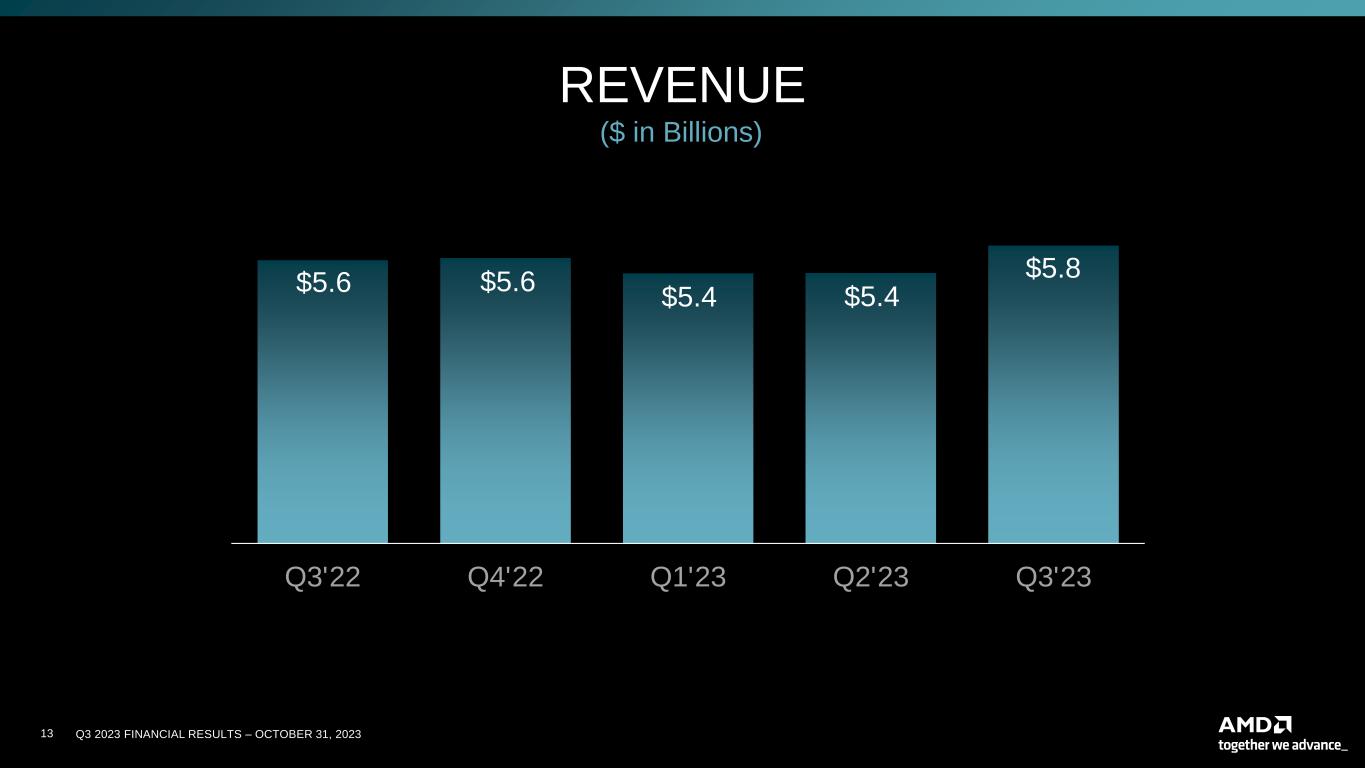

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 20237 REVENUE Q3 2023 ▪ Revenue of $5.8 billion increased 4% y/y as growth in Client segment revenue was partially offset by lower Gaming and Embedded segment revenue $5.6B $5.8B Q3 2022 Q3 2023

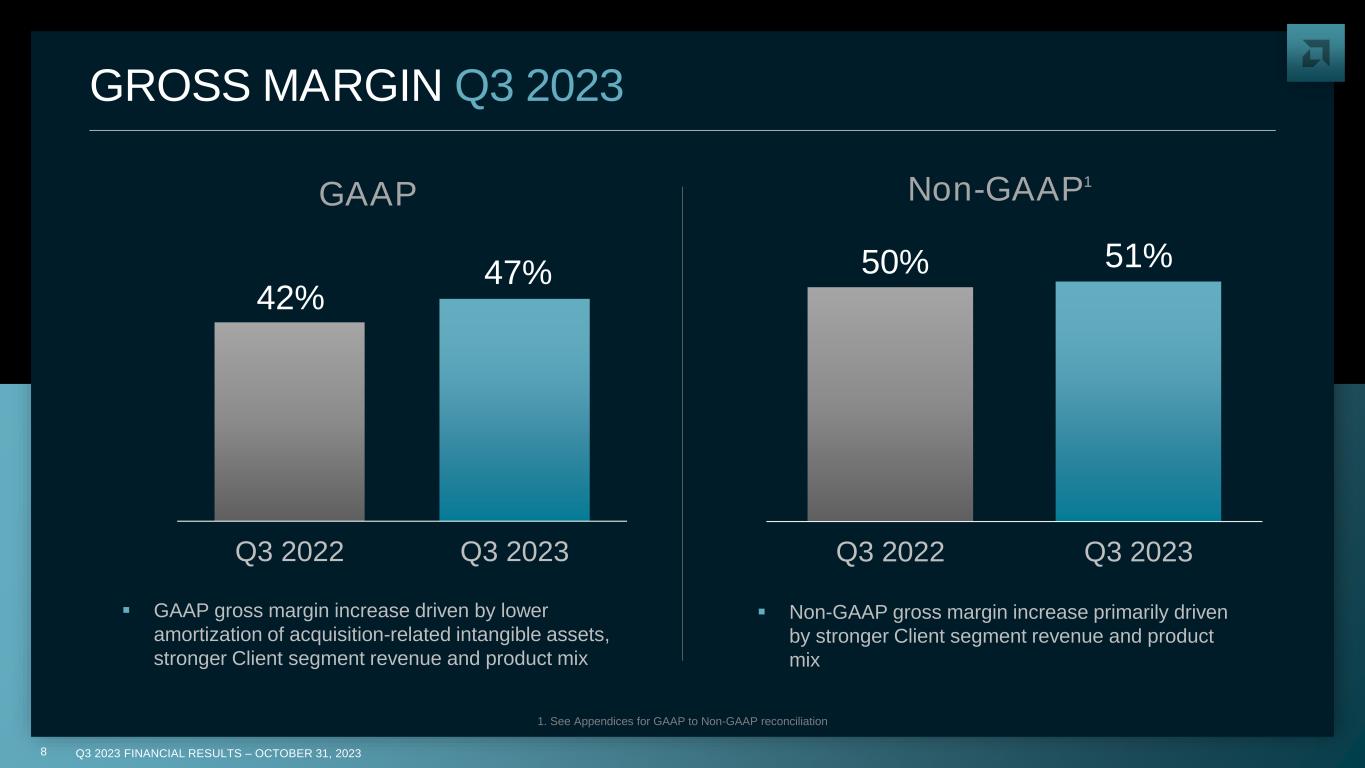

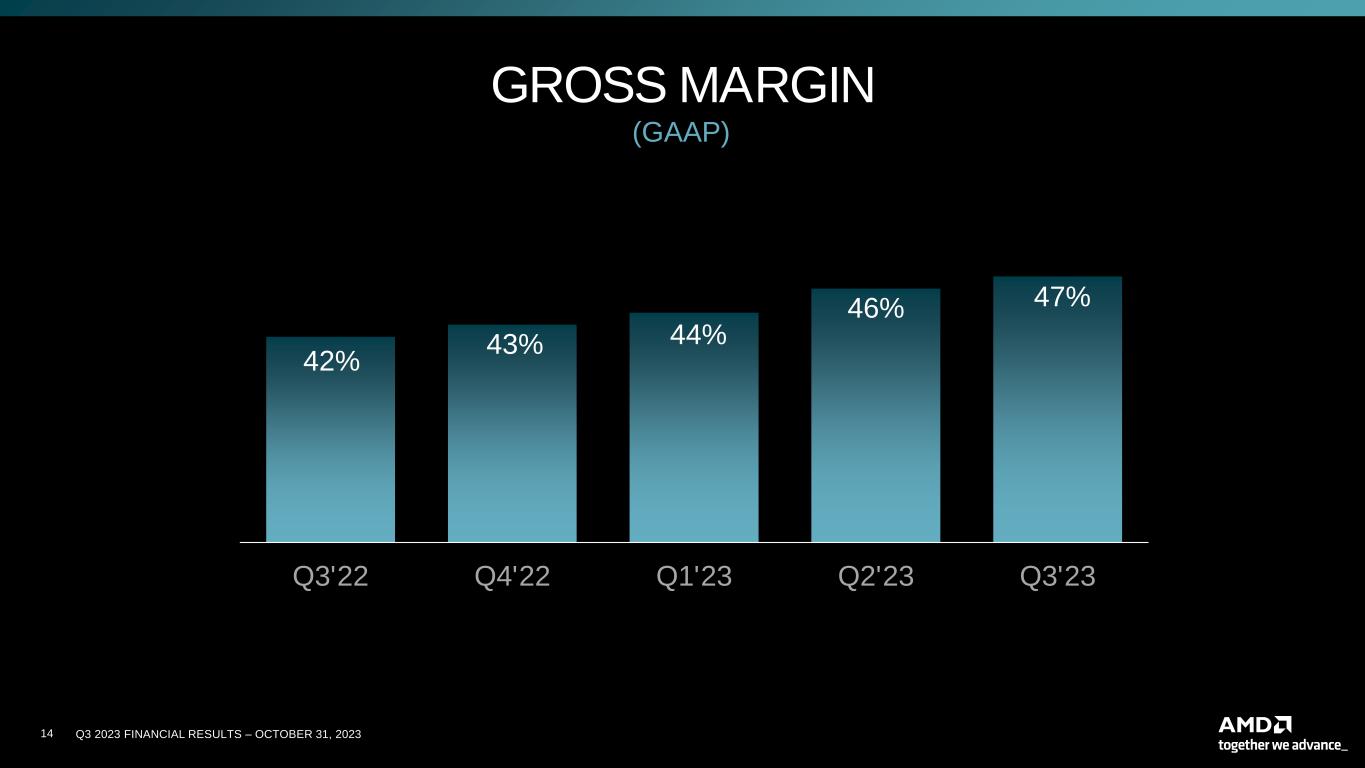

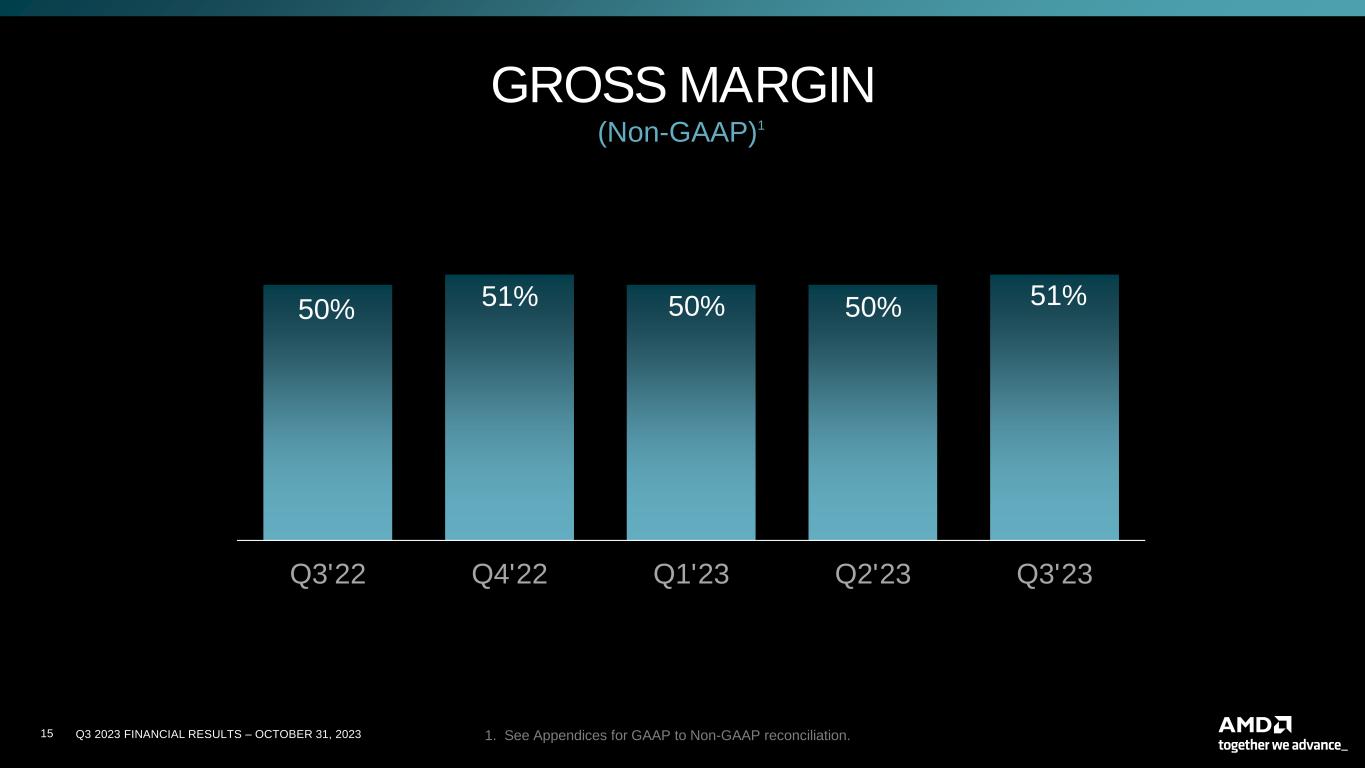

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 20238 GROSS MARGIN Q3 2023 1. See Appendices for GAAP to Non-GAAP reconciliation ▪ Non-GAAP gross margin increase primarily driven by stronger Client segment revenue and product mix Non-GAAP1 42% 47% Q3 2022 Q3 2023 GAAP ▪ GAAP gross margin increase driven by lower amortization of acquisition-related intangible assets, stronger Client segment revenue and product mix 50% 51% Q3 2022 Q3 2023

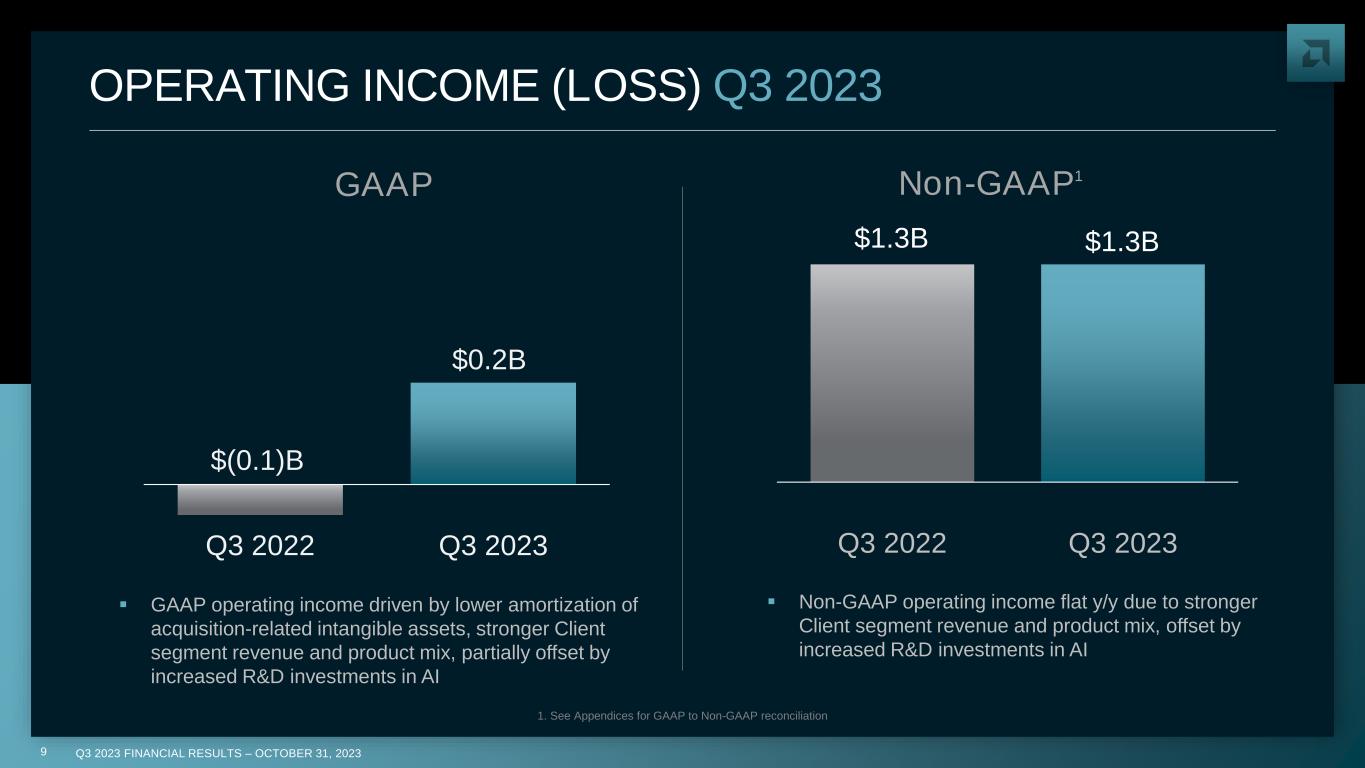

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 20239 Q3 2022 Q3 2023 $(0.1)B $0.2B OPERATING INCOME (LOSS) Q3 2023 1. See Appendices for GAAP to Non-GAAP reconciliation GAAP Non-GAAP1 $1.3B $1.3B Q3 2022 Q3 2023 ▪ GAAP operating income driven by lower amortization of acquisition-related intangible assets, stronger Client segment revenue and product mix, partially offset by increased R&D investments in AI ▪ Non-GAAP operating income flat y/y due to stronger Client segment revenue and product mix, offset by increased R&D investments in AI

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202310 $0.67 $0.70 Q3 2022 Q3 2023 EARNINGS PER SHARE 1 Q3 2023 1. Earnings Per Share (EPS) = Diluted earnings per share; see Appendices for GAAP to Non-GAAP reconciliation GAAP Non-GAAP ▪ GAAP net income of $299 million, up 353% y/y ▪ GAAP EPS of $0.18, up 350% y/y, primarily driven by lower amortization of acquisition-related intangible assets and stronger Client segment revenue $0.04 $0.18 Q3 2022 Q3 2023 ▪ Non-GAAP net income of $1.1 billion, up 4% y/y ▪ Non-GAAP EPS of $0.70, up 4% y/y, primarily driven by stronger Client segment revenue

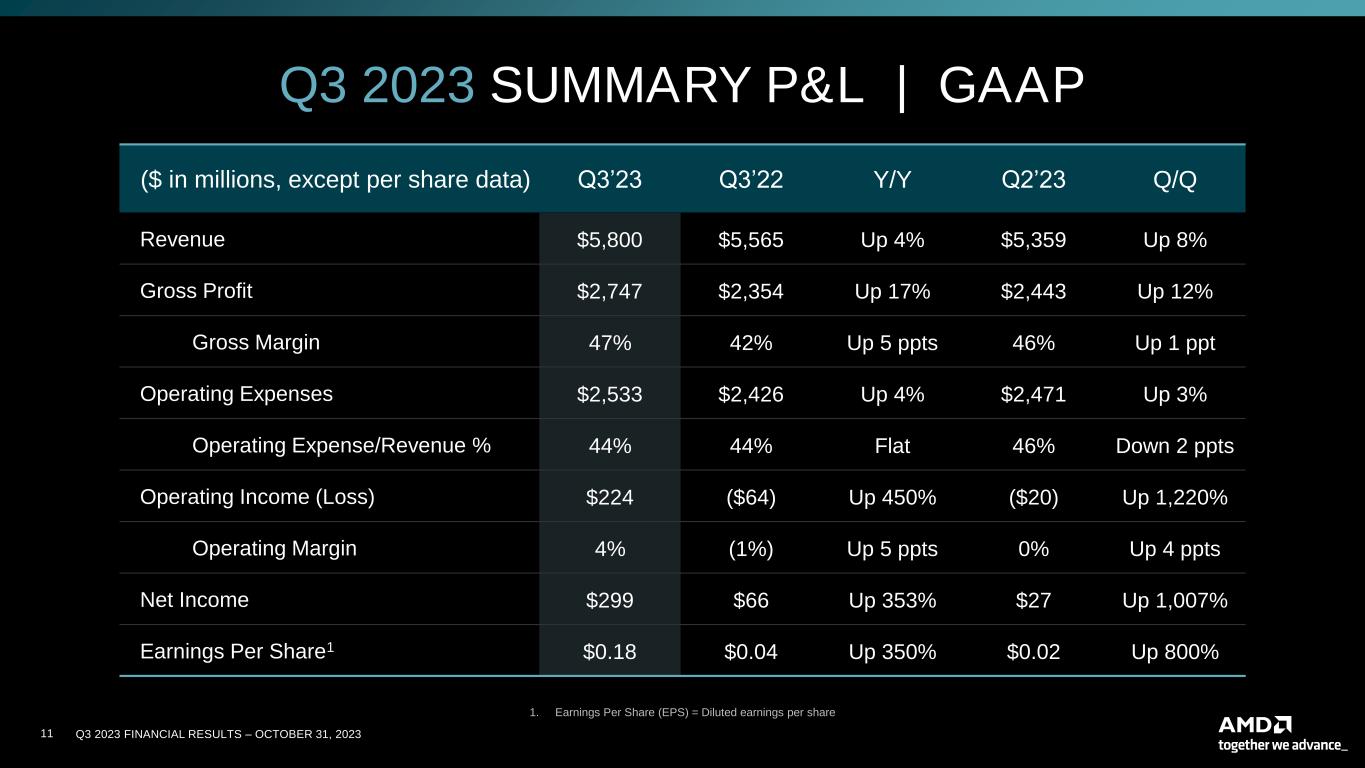

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202311 ($ in millions, except per share data) Q3’23 Q3’22 Y/Y Q2’23 Q/Q Revenue $5,800 $5,565 Up 4% $5,359 Up 8% Gross Profit $2,747 $2,354 Up 17% $2,443 Up 12% Gross Margin 47% 42% Up 5 ppts 46% Up 1 ppt Operating Expenses $2,533 $2,426 Up 4% $2,471 Up 3% Operating Expense/Revenue % 44% 44% Flat 46% Down 2 ppts Operating Income (Loss) $224 ($64) Up 450% ($20) Up 1,220% Operating Margin 4% (1%) Up 5 ppts 0% Up 4 ppts Net Income $299 $66 Up 353% $27 Up 1,007% Earnings Per Share1 $0.18 $0.04 Up 350% $0.02 Up 800% Q3 2023 SUMMARY P&L | GAAP 1. Earnings Per Share (EPS) = Diluted earnings per share

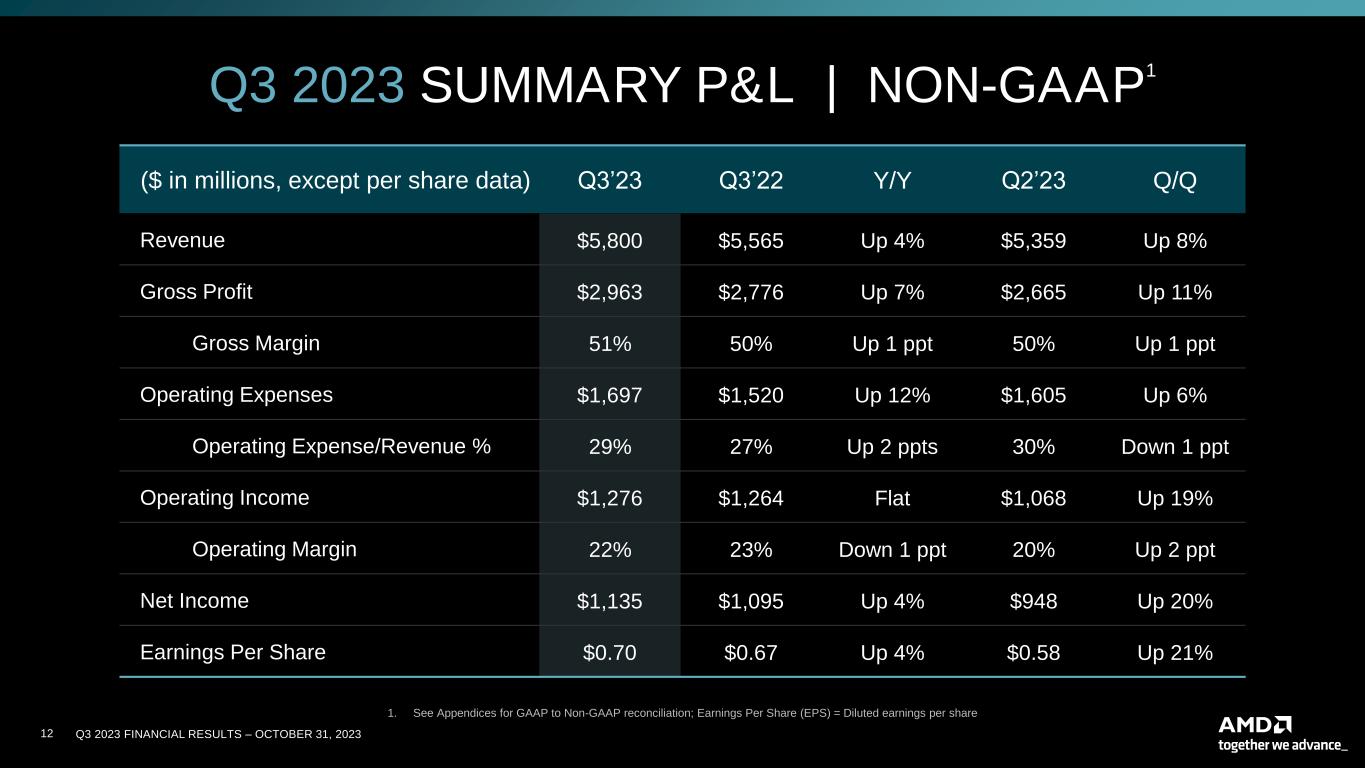

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202312 ($ in millions, except per share data) Q3’23 Q3’22 Y/Y Q2’23 Q/Q Revenue $5,800 $5,565 Up 4% $5,359 Up 8% Gross Profit $2,963 $2,776 Up 7% $2,665 Up 11% Gross Margin 51% 50% Up 1 ppt 50% Up 1 ppt Operating Expenses $1,697 $1,520 Up 12% $1,605 Up 6% Operating Expense/Revenue % 29% 27% Up 2 ppts 30% Down 1 ppt Operating Income $1,276 $1,264 Flat $1,068 Up 19% Operating Margin 22% 23% Down 1 ppt 20% Up 2 ppt Net Income $1,135 $1,095 Up 4% $948 Up 20% Earnings Per Share $0.70 $0.67 Up 4% $0.58 Up 21% Q3 2023 SUMMARY P&L | NON-GAAP 1 1. See Appendices for GAAP to Non-GAAP reconciliation; Earnings Per Share (EPS) = Diluted earnings per share

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202313 $5.6 $5.6 $5.4 $5.4 $5.8 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 REVENUE ($ in Billions)

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202314 42% 43% 44% 46% 47% Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 GROSS MARGIN (GAAP)

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202315 50% 51% 50% 50% 51% Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 GROSS MARGIN (Non-GAAP)1 1. See Appendices for GAAP to Non-GAAP reconciliation.

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202316 $0.04 $0.01 $(0.09) $0.02 $0.18 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 EARNINGS (LOSS) PER SHARE 1 (GAAP) 1. Earnings Per Share (EPS) = Diluted earnings per share except for Q1’23 for which basic shares were used

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202317 $0.67 $0.69 $0.60 $0.58 $0.70 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 EARNINGS PER SHARE (Non-GAAP)1 1. See Appendices for GAAP to Non-GAAP reconciliation; Earnings Per Share (EPS) = Diluted earnings per share

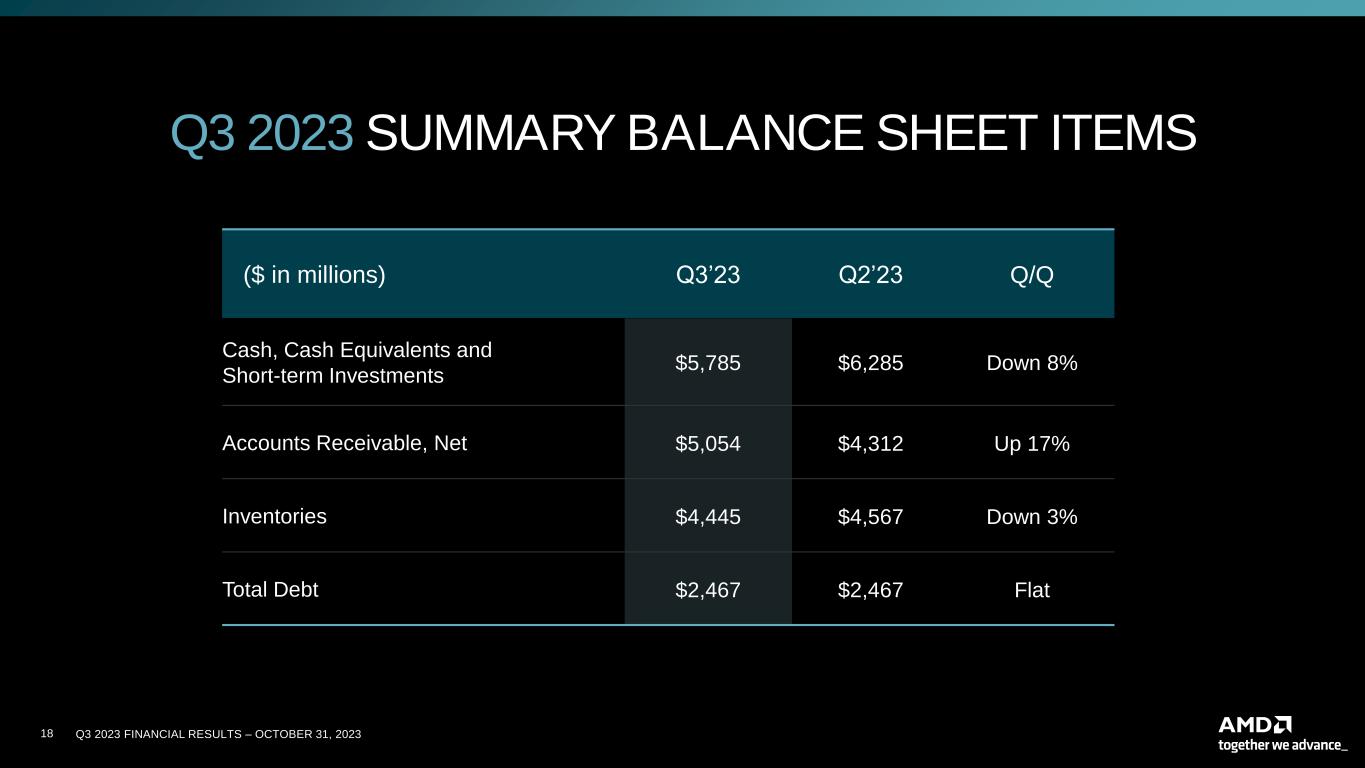

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202318 Q3 2023 SUMMARY BALANCE SHEET ITEMS ($ in millions) Q3’23 Q2’23 Q/Q Cash, Cash Equivalents and Short-term Investments $5,785 $6,285 Down 8% Accounts Receivable, Net $5,054 $4,312 Up 17% Inventories $4,445 $4,567 Down 3% Total Debt $2,467 $2,467 Flat

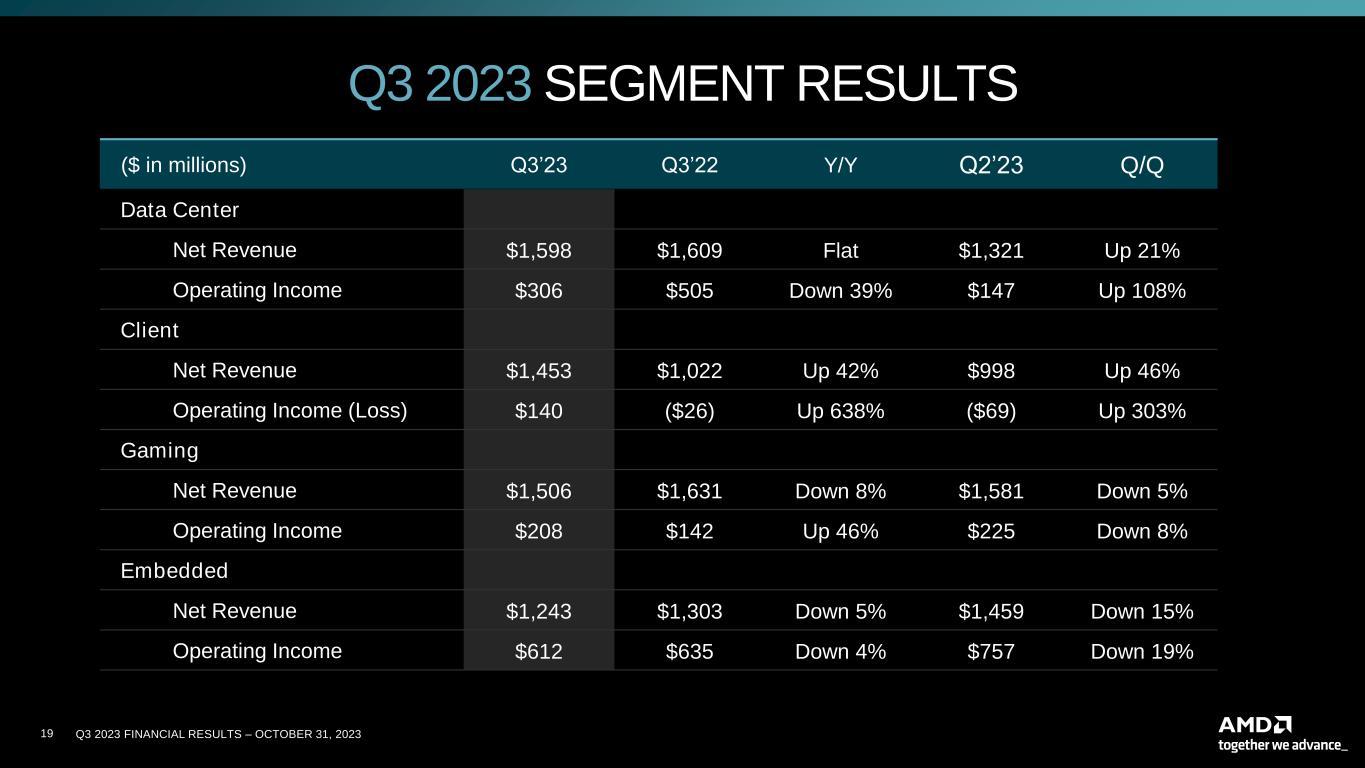

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202319 Q3 2023 SEGMENT RESULTS ($ in millions) Q3’23 Q3’22 Y/Y Q2’23 Q/Q Data Center Net Revenue $1,598 $1,609 Flat $1,321 Up 21% Operating Income $306 $505 Down 39% $147 Up 108% Client Net Revenue $1,453 $1,022 Up 42% $998 Up 46% Operating Income (Loss) $140 ($26) Up 638% ($69) Up 303% Gaming Net Revenue $1,506 $1,631 Down 8% $1,581 Down 5% Operating Income $208 $142 Up 46% $225 Down 8% Embedded Net Revenue $1,243 $1,303 Down 5% $1,459 Down 15% Operating Income $612 $635 Down 4% $757 Down 19%

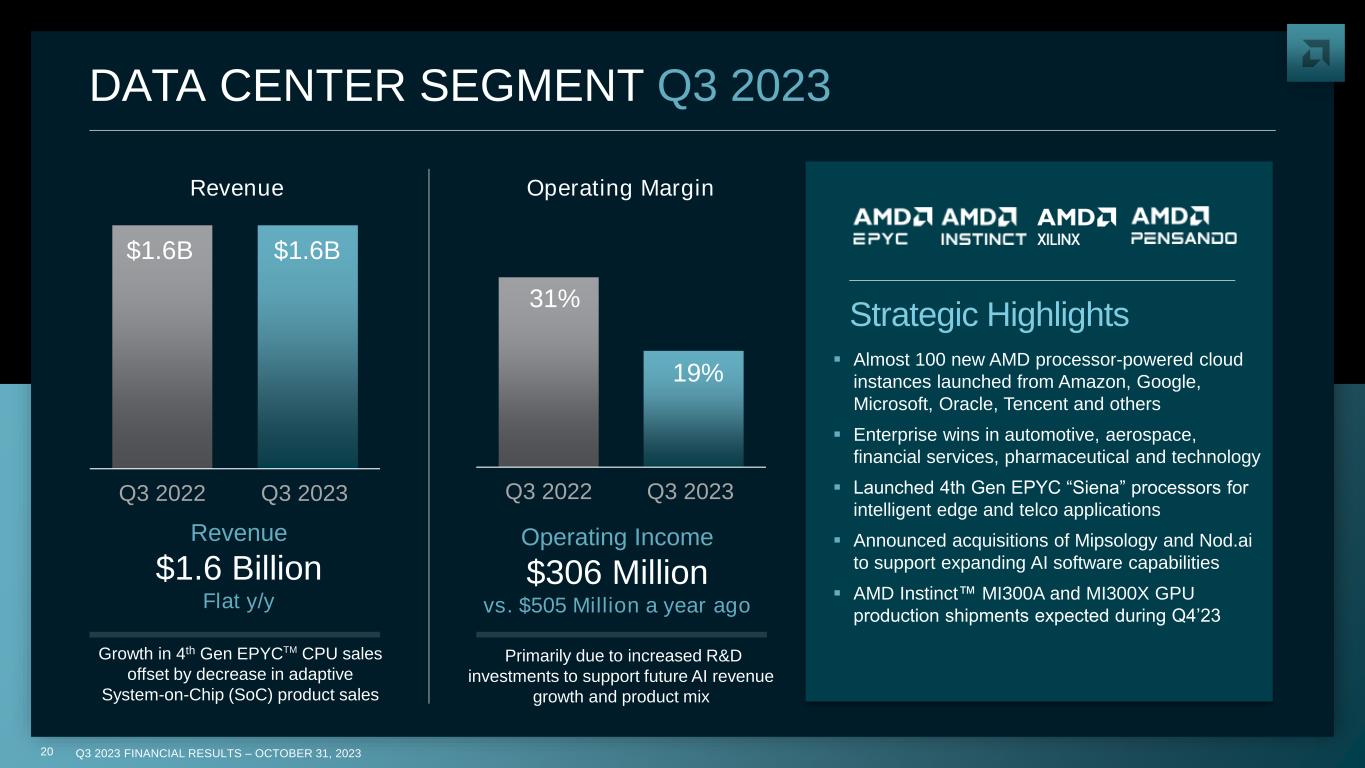

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202320 DATA CENTER SEGMENT Q3 2023 ▪ Almost 100 new AMD processor-powered cloud instances launched from Amazon, Google, Microsoft, Oracle, Tencent and others ▪ Enterprise wins in automotive, aerospace, financial services, pharmaceutical and technology ▪ Launched 4th Gen EPYC “Siena” processors for intelligent edge and telco applications ▪ Announced acquisitions of Mipsology and Nod.ai to support expanding AI software capabilities ▪ AMD Instinct™ MI300A and MI300X GPU production shipments expected during Q4’23 Strategic Highlights $1.6B $1.6B Q3 2022 Q3 2023 31% 19% Q3 2022 Q3 2023 Revenue Operating Margin Revenue $1.6 Billion Flat y/y Operating Income $306 Million vs. $505 Million a year ago Primarily due to increased R&D investments to support future AI revenue growth and product mix Growth in 4th Gen EPYCTM CPU sales offset by decrease in adaptive System-on-Chip (SoC) product sales

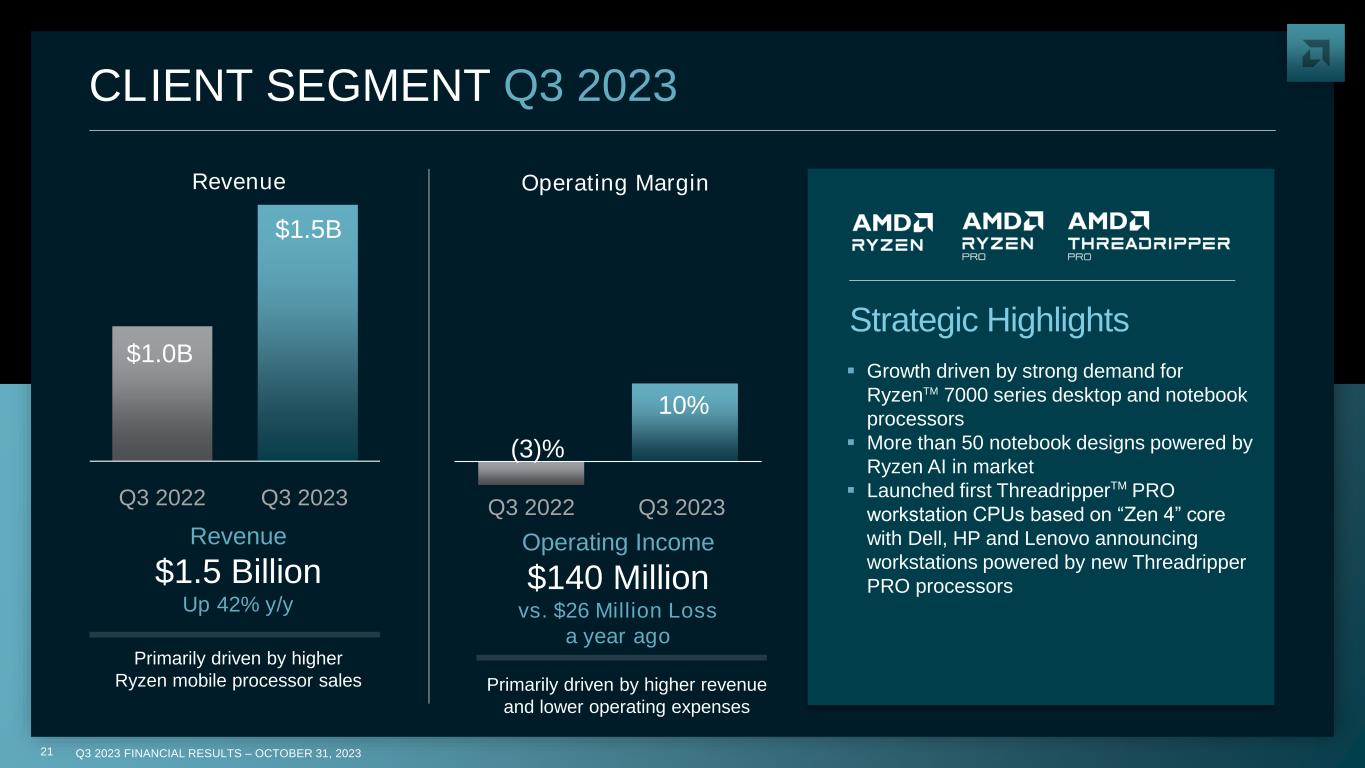

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202321 CLIENT SEGMENT Q3 2023 ▪ Growth driven by strong demand for RyzenTM 7000 series desktop and notebook processors ▪ More than 50 notebook designs powered by Ryzen AI in market ▪ Launched first ThreadripperTM PRO workstation CPUs based on “Zen 4” core with Dell, HP and Lenovo announcing workstations powered by new Threadripper PRO processors Strategic Highlights $1.0B $1.5B Q3 2022 Q3 2023 (3)% 10% Q3 2022 Q3 2023 Revenue Operating Margin Revenue $1.5 Billion Up 42% y/y Primarily driven by higher Ryzen mobile processor sales Operating Income $140 Million vs. $26 Million Loss a year ago Primarily driven by higher revenue and lower operating expenses

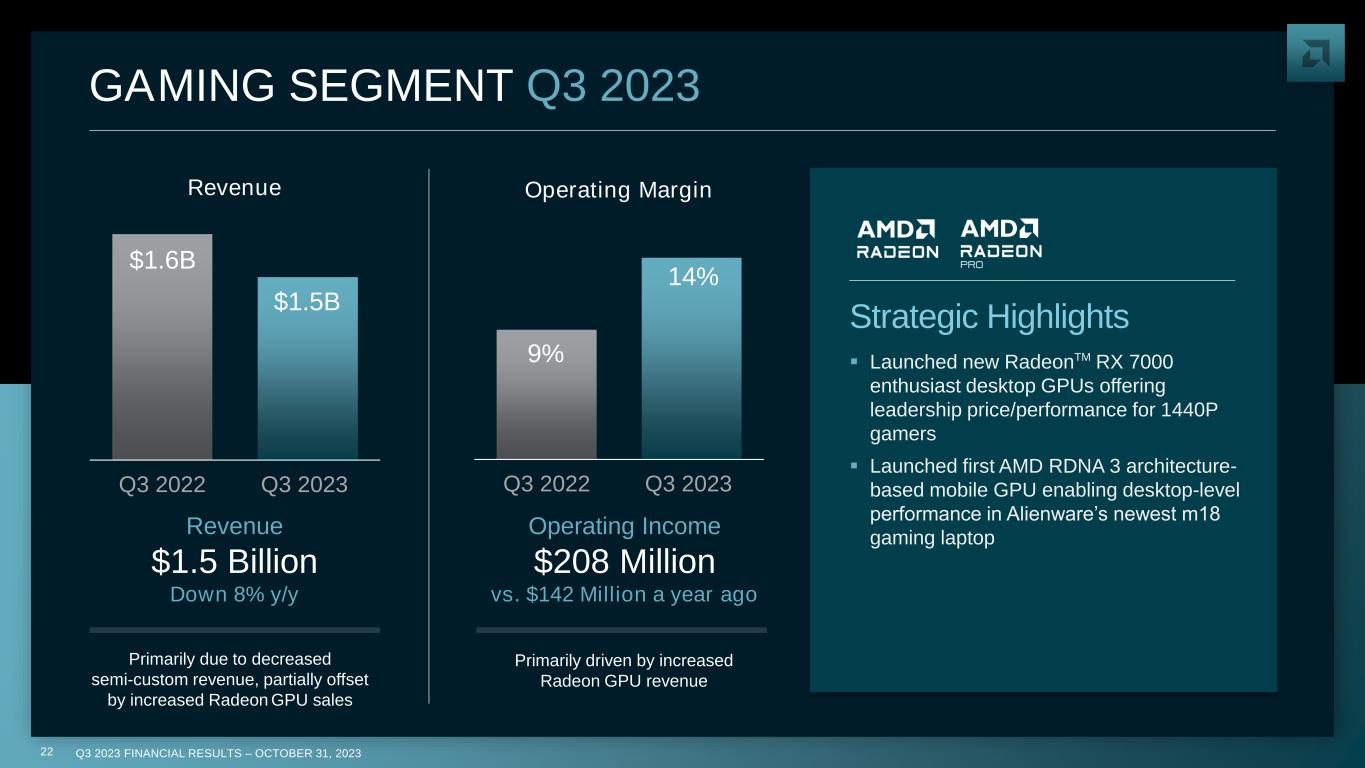

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202322 9% 14% Q3 2022 Q3 2023 GAMING SEGMENT Q3 2023 ▪ Launched new RadeonTM RX 7000 enthusiast desktop GPUs offering leadership price/performance for 1440P gamers ▪ Launched first AMD RDNA 3 architecture- based mobile GPU enabling desktop-level performance in Alienware’s newest m18 gaming laptop Strategic Highlights $1.6B $1.5B Q3 2022 Q3 2023 Revenue Operating Margin Revenue $1.5 Billion Down 8% y/y Operating Income $208 Million vs. $142 Million a year ago Primarily driven by increased Radeon GPU revenue Primarily due to decreased semi-custom revenue, partially offset by increased Radeon GPU sales

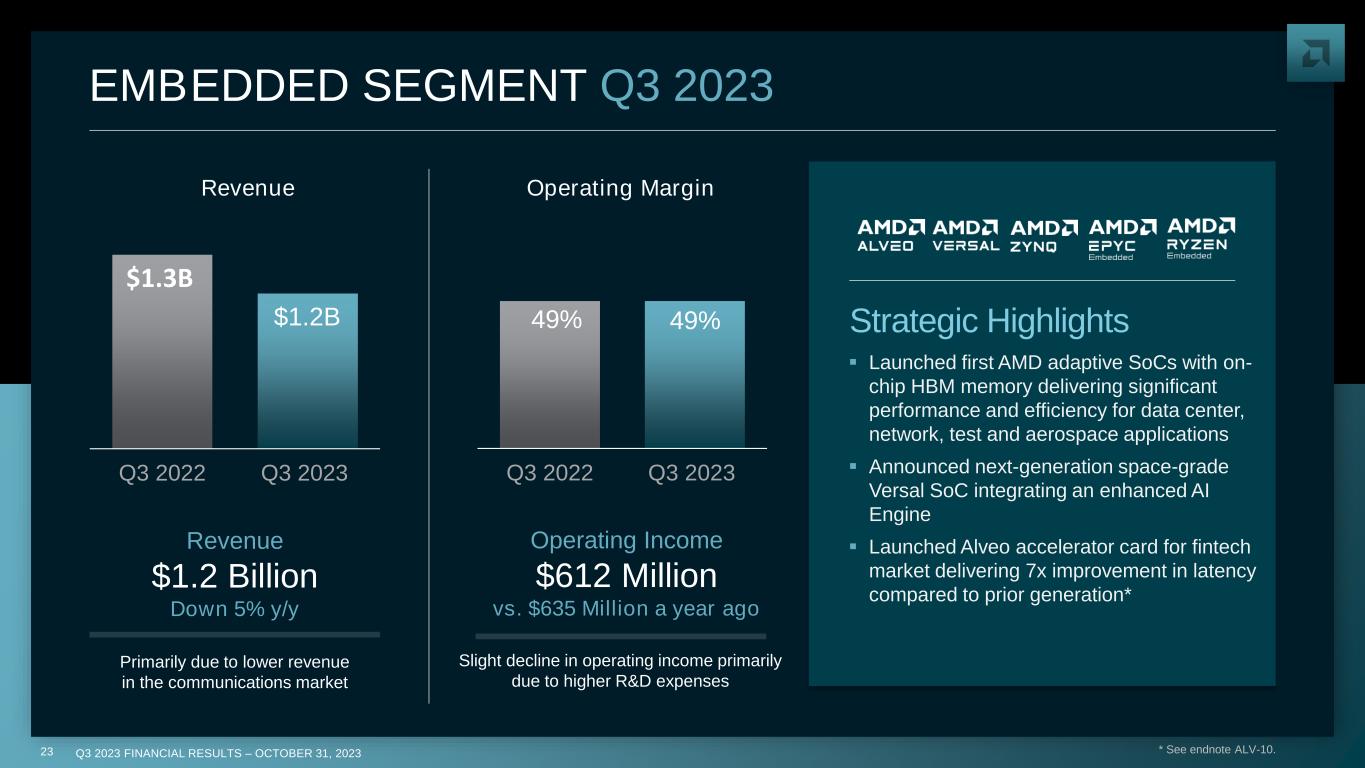

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202323 EMBEDDED SEGMENT Q3 2023 ▪ Launched first AMD adaptive SoCs with on- chip HBM memory delivering significant performance and efficiency for data center, network, test and aerospace applications ▪ Announced next-generation space-grade Versal SoC integrating an enhanced AI Engine ▪ Launched Alveo accelerator card for fintech market delivering 7x improvement in latency compared to prior generation* Strategic Highlights$1.2B Q3 2022 Q3 2023 49% 49% Q3 2022 Q3 2023 Revenue Operating Margin Revenue $1.2 Billion Down 5% y/y Primarily due to lower revenue in the communications market Operating Income $612 Million vs. $635 Million a year ago $1.3B Slight decline in operating income primarily due to higher R&D expenses * See endnote ALV-10.

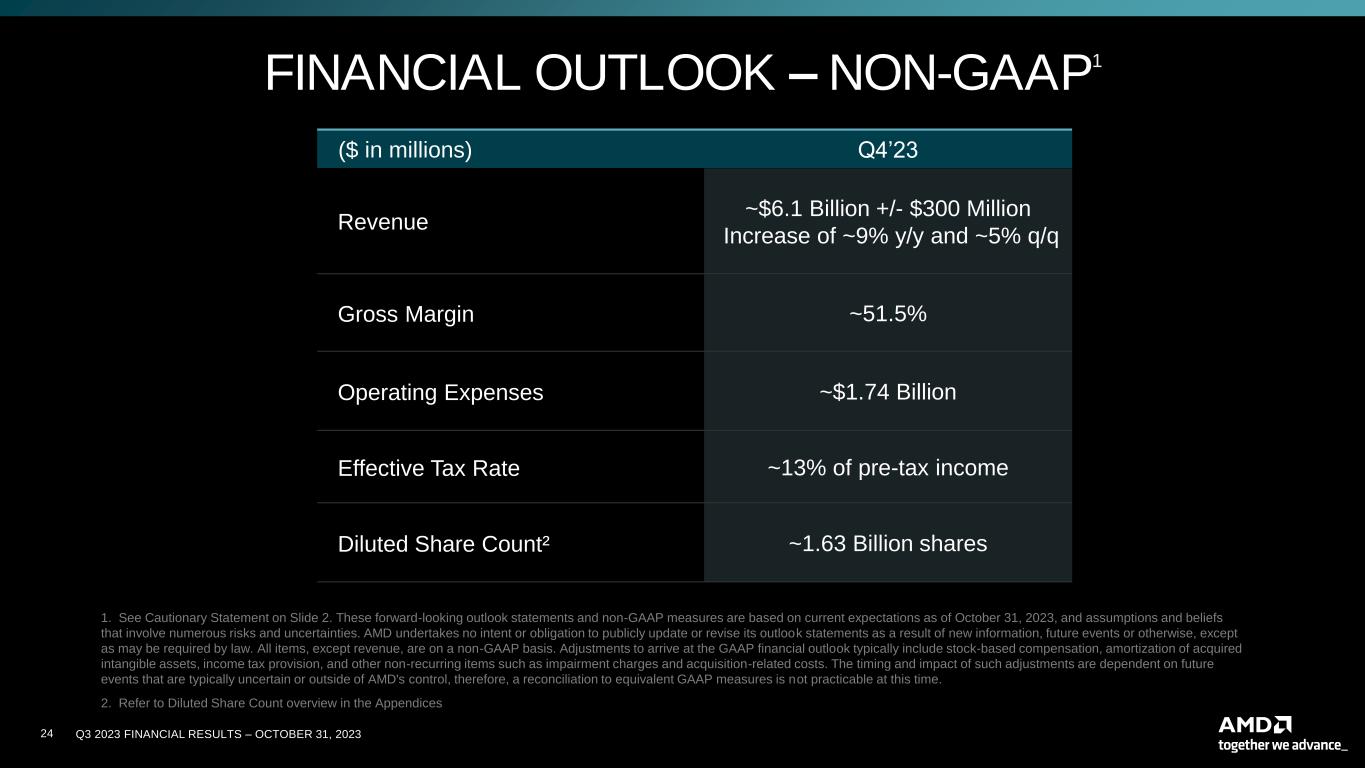

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202324 ($ in millions) Q4’23 Revenue ~$6.1 Billion +/- $300 Million Increase of ~9% y/y and ~5% q/q Gross Margin ~51.5% Operating Expenses ~$1.74 Billion Effective Tax Rate ~13% of pre-tax income Diluted Share Count² ~1.63 Billion shares FINANCIAL OUTLOOK – NON-GAAP1 1. 1. See Cautionary Statement on Slide 2. These forward-looking outlook statements and non-GAAP measures are based on current expectations as of October 31, 2023, and assumptions and beliefs that involve numerous risks and uncertainties. AMD undertakes no intent or obligation to publicly update or revise its outlook statements as a result of new information, future events or otherwise, except as may be required by law. All items, except revenue, are on a non-GAAP basis. Adjustments to arrive at the GAAP financial outlook typically include stock-based compensation, amortization of acquired intangible assets, income tax provision, and other non-recurring items such as impairment charges and acquisition-related costs. The timing and impact of such adjustments are dependent on future events that are typically uncertain or outside of AMD's control, therefore, a reconciliation to equivalent GAAP measures is not practicable at this time. 2. 2. Refer to Diluted Share Count overview in the Appendices

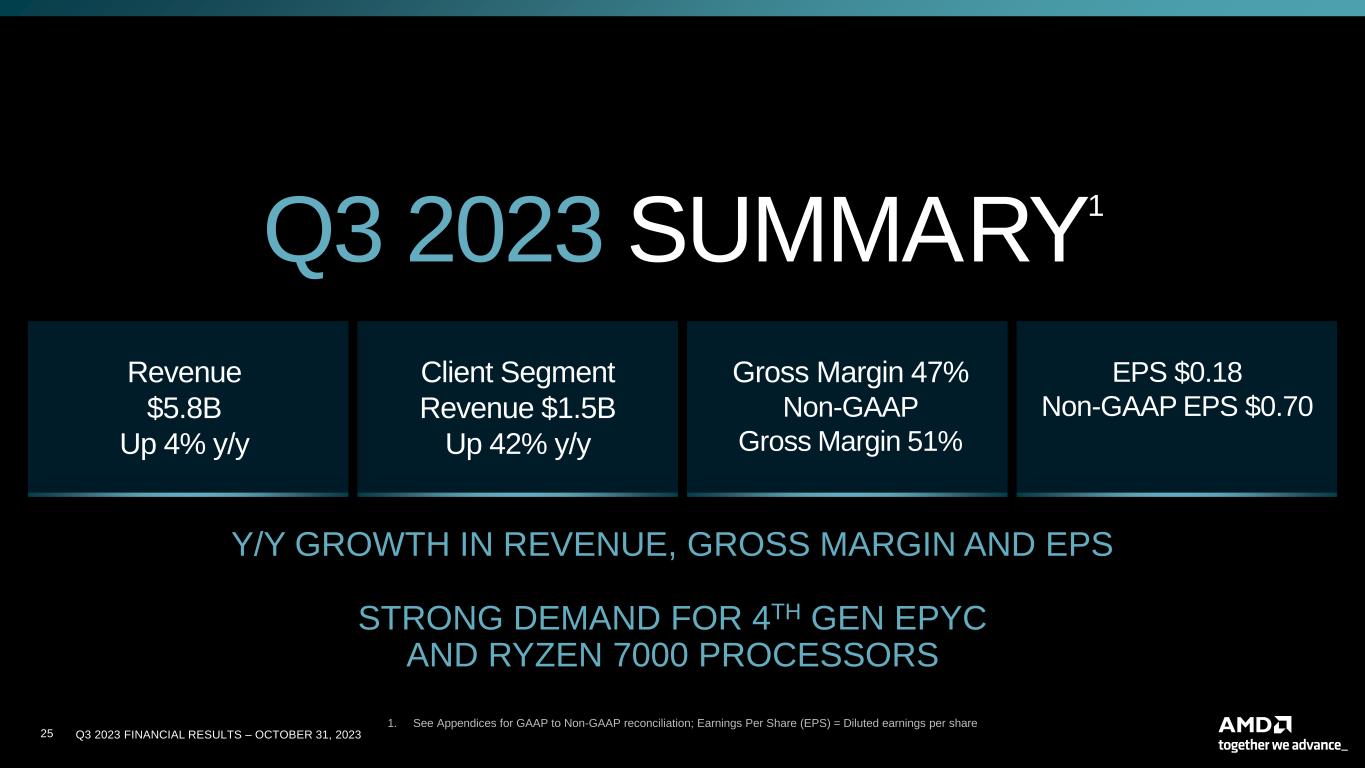

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 20232525 Client Segment Revenue $1.5B Up 42% y/y Gross Margin 47% Non-GAAP Gross Margin 51% EPS $0.18 Non-GAAP EPS $0.70 Revenue $5.8B Up 4% y/y Q3 2023 SUMMARY 1 Y/Y GROWTH IN REVENUE, GROSS MARGIN AND EPS STRONG DEMAND FOR 4TH GEN EPYC AND RYZEN 7000 PROCESSORS 1. See Appendices for GAAP to Non-GAAP reconciliation; Earnings Per Share (EPS) = Diluted earnings per share

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 20232626 AMD COMMITMENT TO ESG Governance Integrating corporate responsibility and governance across product design, supply chain, operations and external engagement Social Fostering a culture of diversity, belonging and inclusion, partnering with suppliers and positively impacting our communities Environmental Advancing environmental solutions in our products, supply chain and operations, while accelerating energy efficiency for IT users TOGETHER WE ADVANCE_CORPORATE RESPONSIBILITY

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 20232727 Large and Compelling TAM World-Class Execution and Focus Technology Leadership Expanding Data Center and AI Leadership Strong Balance Sheet OUR MOMENTUM DRIVING LONG-TERM SHAREHOLDER RETURNS

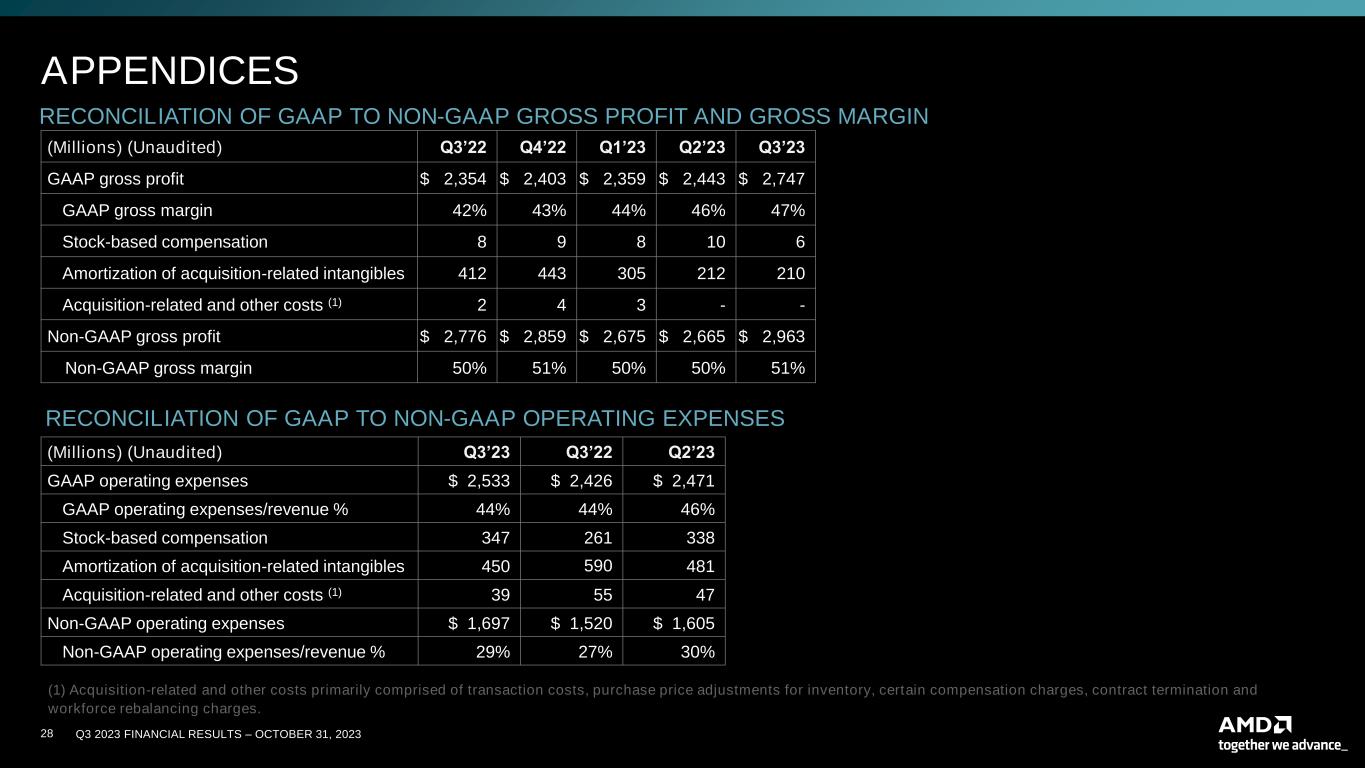

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202328 RECONCILIATION OF GAAP TO NON-GAAP GROSS PROFIT AND GROSS MARGIN (Millions) (Unaudited) Q3’22 Q4’22 Q1’23 Q2’23 Q3’23 GAAP gross profit $ 2,354 $ 2,403 $ 2,359 $ 2,443 $ 2,747 GAAP gross margin 42% 43% 44% 46% 47% Stock-based compensation 8 9 8 10 6 Amortization of acquisition-related intangibles 412 443 305 212 210 Acquisition-related and other costs (1) 2 4 3 - - Non-GAAP gross profit $ 2,776 $ 2,859 $ 2,675 $ 2,665 $ 2,963 Non-GAAP gross margin 50% 51% 50% 50% 51% RECONCILIATION OF GAAP TO NON-GAAP OPERATING EXPENSES (Millions) (Unaudited) Q3’23 Q3’22 Q2’23 GAAP operating expenses $ 2,533 $ 2,426 $ 2,471 GAAP operating expenses/revenue % 44% 44% 46% Stock-based compensation 347 261 338 Amortization of acquisition-related intangibles 450 590 481 Acquisition-related and other costs (1) 39 55 47 Non-GAAP operating expenses $ 1,697 $ 1,520 $ 1,605 Non-GAAP operating expenses/revenue % 29% 27% 30% APPENDICES (1) Acquisition-related and other costs primarily comprised of transaction costs, purchase price adjustments for inventory, certain compensation charges, contract termination and workforce rebalancing charges.

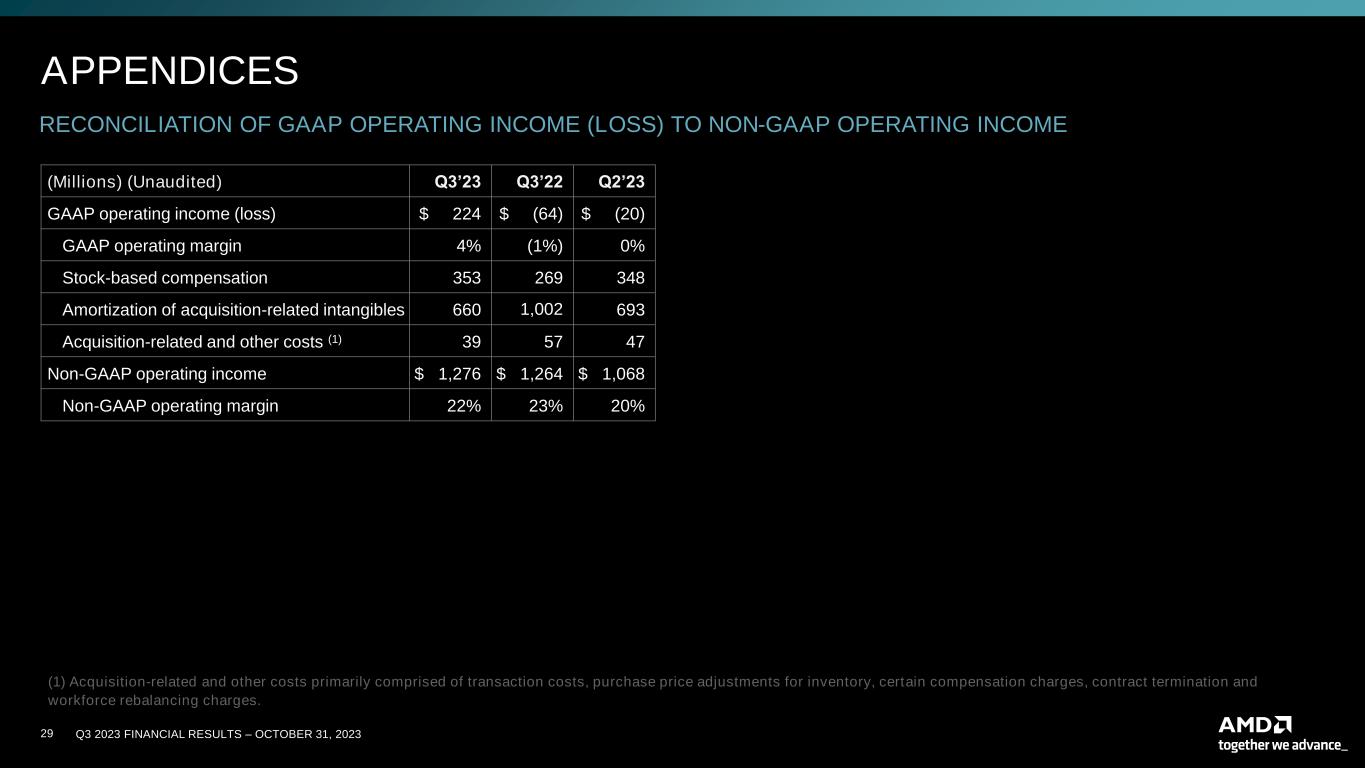

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202329 APPENDICES RECONCILIATION OF GAAP OPERATING INCOME (LOSS) TO NON-GAAP OPERATING INCOME (Millions) (Unaudited) Q3’23 Q3’22 Q2’23 GAAP operating income (loss) $ 224 $ (64) $ (20) GAAP operating margin 4% (1%) 0% Stock-based compensation 353 269 348 Amortization of acquisition-related intangibles 660 1,002 693 Acquisition-related and other costs (1) 39 57 47 Non-GAAP operating income $ 1,276 $ 1,264 $ 1,068 Non-GAAP operating margin 22% 23% 20% (1) Acquisition-related and other costs primarily comprised of transaction costs, purchase price adjustments for inventory, certain compensation charges, contract termination and workforce rebalancing charges.

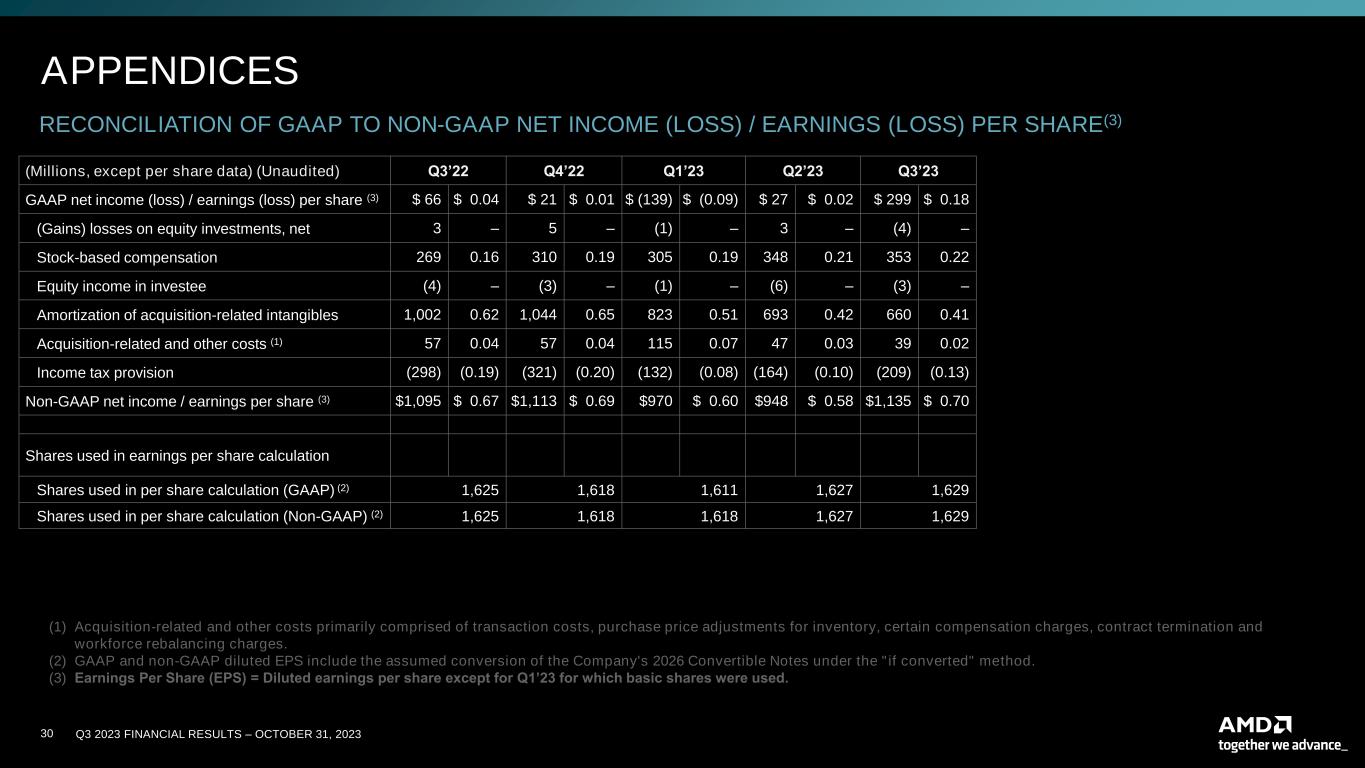

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202330 RECONCILIATION OF GAAP TO NON-GAAP NET INCOME (LOSS) / EARNINGS (LOSS) PER SHARE(3) (1) Acquisition-related and other costs primarily comprised of transaction costs, purchase price adjustments for inventory, certain compensation charges, contract termination and workforce rebalancing charges. (2) GAAP and non-GAAP diluted EPS include the assumed conversion of the Company's 2026 Convertible Notes under the "if converted" method. (3) Earnings Per Share (EPS) = Diluted earnings per share except for Q1’23 for which basic shares were used. APPENDICES (Millions, except per share data) (Unaudited) Q3’22 Q4’22 Q1’23 Q2’23 Q3’23 GAAP net income (loss) / earnings (loss) per share (3) $ 66 $ 0.04 $ 21 $ 0.01 $ (139) $ (0.09) $ 27 $ 0.02 $ 299 $ 0.18 (Gains) losses on equity investments, net 3 – 5 – (1) – 3 – (4) – Stock-based compensation 269 0.16 310 0.19 305 0.19 348 0.21 353 0.22 Equity income in investee (4) – (3) – (1) – (6) – (3) – Amortization of acquisition-related intangibles 1,002 0.62 1,044 0.65 823 0.51 693 0.42 660 0.41 Acquisition-related and other costs (1) 57 0.04 57 0.04 115 0.07 47 0.03 39 0.02 Income tax provision (298) (0.19) (321) (0.20) (132) (0.08) (164) (0.10) (209) (0.13) Non-GAAP net income / earnings per share (3) $1,095 $ 0.67 $1,113 $ 0.69 $970 $ 0.60 $948 $ 0.58 $1,135 $ 0.70 Shares used in earnings per share calculation Shares used in per share calculation (GAAP) (2) 1,625 1,618 1,611 1,627 1,629 Shares used in per share calculation (Non-GAAP) (2) 1,625 1,618 1,618 1,627 1,629

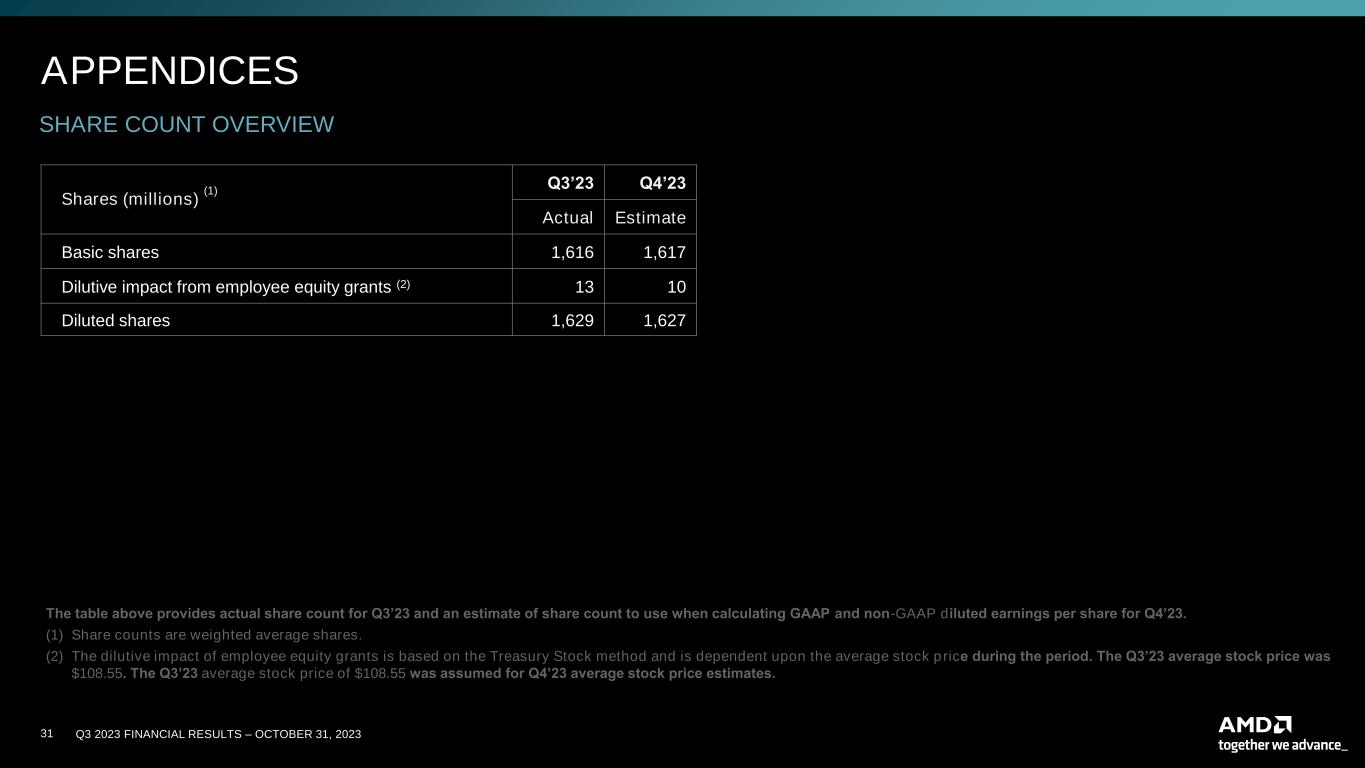

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202331 Shares (millions) (1) Q3’23 Q4’23 Actual Estimate Basic shares 1,616 1,617 Dilutive impact from employee equity grants (2) 13 10 Diluted shares 1,629 1,627 APPENDICES SHARE COUNT OVERVIEW The table above provides actual share count for Q3’23 and an estimate of share count to use when calculating GAAP and non-GAAP diluted earnings per share for Q4’23. (1) Share counts are weighted average shares. (2) The dilutive impact of employee equity grants is based on the Treasury Stock method and is dependent upon the average stock price during the period. The Q3’23 average stock price was $108.55. The Q3’23 average stock price of $108.55 was assumed for Q4’23 average stock price estimates.

Q3 2023 FINANCIAL RESULTS – OCTOBER 31, 202332 ENDNOTES ALV-10: Testing conducted by AMD Performance Labs as of 8/16/23 on the Alveo UL3524 accelerator card, using Vivado™ Design Suite 2023.1 and running on Vivado Lab (Hardware Manager) 2023.1. Based on the GTF Latency Benchmark Design configured to enable GTF transceivers in internal near-end loopback mode. GTF TX and RX clocks operate at same frequency of ~644MHz with a 180 degrees phase shift. GTF Latency Benchmark Design measures latency in hardware by latching value of a single free running counter. Latency is measured as the difference between when TX data is latched at the GTF transceiver and when TX data is latched at the GTF receiver prior to routing back into the FPGA fabric. Latency measurement does not include protocol overhead, protocol framing, programmable logic (PL) latency, TX PL interface setup time, RX PL interface clock-to-out, package flight time, and other sources of latency. Benchmark test was run 1,000 times with 250 frames per test. Cited measurement result is based on GTF transceiver “RAW Mode”, where PCS (physical medium attachment) of the transceiver passes data ‘as-is’ to FPGA fabric. Latency measurement is consistent across all test runs for this configuration. System manufacturers may vary configurations, yielding different results. ALV-10