EX-99.2

Published on April 30, 2024

AMD FINANCIAL RESULTS First Quarter 2024 April 30, 2024

Q1 2024 FINANCIAL RESULTS – APRIL 30, 202422 CAUTIONARY STATEMENT This presentation contains forward-looking statements concerning Advanced Micro Devices, Inc. (AMD), such as the features, functionality, performance, availability, timing and expected benefits of AMD products; AMD’s expected second quarter 2024 financial outlook, including revenue, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP tax rate and diluted share count; AMD’s large and compelling TAM; AMD’s ability to expand Data Center and AI leadership; and AMD’s ability to drive long-term shareholder returns, which are made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are commonly identified by words such as "would," "may," "expects," "believes," "plans," "intends," "projects" and other terms with similar meaning. Investors are cautioned that the forward-looking statements in this presentation are based on current beliefs, assumptions and expectations, speak only as of the date of this presentation and involve risks and uncertainties that could cause actual results to differ materially from current expectations. Such statements are subject to certain known and unknown risks and uncertainties, many of which are difficult to predict and generally beyond AMD's control, that could cause actual results and other future events to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. Material factors that could cause actual results to differ materially from current expectations include, without limitation, the following: Intel Corporation’s dominance of the microprocessor market and its aggressive business practices; economic and market uncertainty; cyclical nature of the semiconductor industry; market conditions of the industries in which AMD products are sold; loss of a significant customer; public health crises, such as pandemics and epidemics; competitive markets in which AMD’s products are sold; quarterly and seasonal sales patterns; AMD's ability to adequately protect its technology or other intellectual property; unfavorable currency exchange rate fluctuations; ability of third party manufacturers to manufacture AMD's products on a timely basis in sufficient quantities and using competitive technologies; availability of essential equipment, materials, substrates or manufacturing processes; ability to achieve expected manufacturing yields for AMD’s products; AMD's ability to introduce products on a timely basis with expected features and performance levels; AMD's ability to generate revenue from its semi-custom SoC products; potential security vulnerabilities; potential security incidents including IT outages, data loss, data breaches and cyberattacks; potential difficulties in operating AMD’s newly upgraded enterprise resource planning system; uncertainties involving the ordering and shipment of AMD’s products; AMD’s reliance on third-party intellectual property to design and introduce new products in a timely manner; AMD's reliance on third-party companies for design, manufacture and supply of motherboards, software, memory and other computer platform components; AMD's reliance on Microsoft and other software vendors' support to design and develop software to run on AMD’s products; AMD’s reliance on third-party distributors and add-in-board partners; impact of modification or interruption of AMD’s internal business processes and information systems; compatibility of AMD’s products with some or all industry-standard software and hardware; costs related to defective products; efficiency of AMD's supply chain; AMD's ability to rely on third party supply-chain logistics functions; AMD’s ability to effectively control sales of its products on the gray market; long-term impact of climate change on AMD’s business; impact of government actions and regulations such as export regulations, tariffs and trade protection measures; AMD’s ability to realize its deferred tax assets; potential tax liabilities; current and future claims and litigation; impact of environmental laws, conflict minerals- related provisions and other laws or regulations; evolving expectations from governments, investors, customers and other stakeholders regarding corporate responsibility matters; issues related to the responsible use of AI; impact of acquisitions, joint ventures and/or investments on AMD’s business and AMD’s ability to integrate acquired businesses; impact of any impairment of the combined company’s assets; restrictions imposed by agreements governing AMD’s notes, the guarantees of Xilinx’s notes and the revolving credit facility; AMD's indebtedness; AMD's ability to generate sufficient cash to meet its working capital requirements or generate sufficient revenue and operating cash flow to make all of its planned R&D or strategic investments; political, legal and economic risks and natural disasters; future impairments of technology license purchases; AMD’s ability to attract and retain qualified personnel; and AMD’s stock price volatility. Investors are urged to review in detail the risks and uncertainties in AMD’s Securities and Exchange Commission filings, including but not limited to AMD’s most recent reports on Forms 10-K and 10-Q. NON-GAAP FINANCIAL MEASURE In this presentation, in addition to GAAP financial results, AMD has provided non-GAAP financial measures including non-GAAP gross profit and margin, non-GAAP operating expenses, non-GAAP operating income, non-GAAP net income and non-GAAP diluted earnings per share. AMD uses a normalized tax rate in its computation of the non-GAAP income tax provision to provide better consistency across the reporting periods. For fiscal 2024, AMD uses a projected non-GAAP tax rate of 13%, which excludes the tax impact of pre-tax non-GAAP adjustments. AMD is providing these financial measures because it believes this non-GAAP presentation makes it easier for investors to compare its operating results for current and historical periods and also because AMD believes it assists investors in comparing AMD’s performance across reporting periods on a consistent basis by excluding items that it does not believe are indicative of its core operating performance. The non-GAAP financial measures disclosed in this presentation should be viewed in addition to and not as a substitute for or superior to AMD’s reported results prepared in accordance with GAAP and should be read only in conjunction with AMD’s Consolidated Financial Statements prepared in accordance with GAAP. These non-GAAP financial measures referenced are reconciled to their most directly comparable GAAP financial measures in the Appendices at the end of this presentation. This presentation also contains forward- looking non-GAAP measures concerning AMD’s financial outlook such as gross margin, operating expenses and tax rate. These forward-looking non-GAAP measures are based on current expectations as of April 30, 2024, and assumptions and beliefs that involve numerous risks and uncertainties. AMD undertakes no intent or obligation to publicly update or revise its forward-looking statements made in this presentation except as may be required by law.

Q1 2024 FINANCIAL RESULTS – APRIL 30, 202433 Expanding Customer & Partner Ecosystem Data Center and AI Growth Strong Financial Foundation Leadership Product Portfolio OUR JOURNEY

Q1 2024 FINANCIAL RESULTS – APRIL 30, 202444 OUR LEADERSHIP TECHNOLOGY Software Enablement Open-source software optimized for performance across heterogenous solutions Data Center Leadership Delivering innovation in AI, cloud, enterprise and accelerated computing Advanced Technology Driving leadership process technology and 3D chiplet packaging Broad IP Portfolio Executing leadership CPU, GPU, DPU, FPGA, Adaptive SoC and AI products

Q1 2024 FINANCIAL RESULTS – APRIL 30, 202455 OUR LEADERSHIP PRODUCTS Embedded Leadership FPGAs, Adaptive SoCs and SoMs, and embedded CPUs and GPUs for a broad set of markets Gaming Top-to-bottom desktop and notebook GPUs, game console and semi-custom SoCs Client Powerful and efficient CPUs and APUs for notebook and desktop PCs and commercial workstations Data Center Broad portfolio of data center and AI solutions with server CPUs, GPUs, FPGAs, DPUs and Adaptive SoCs

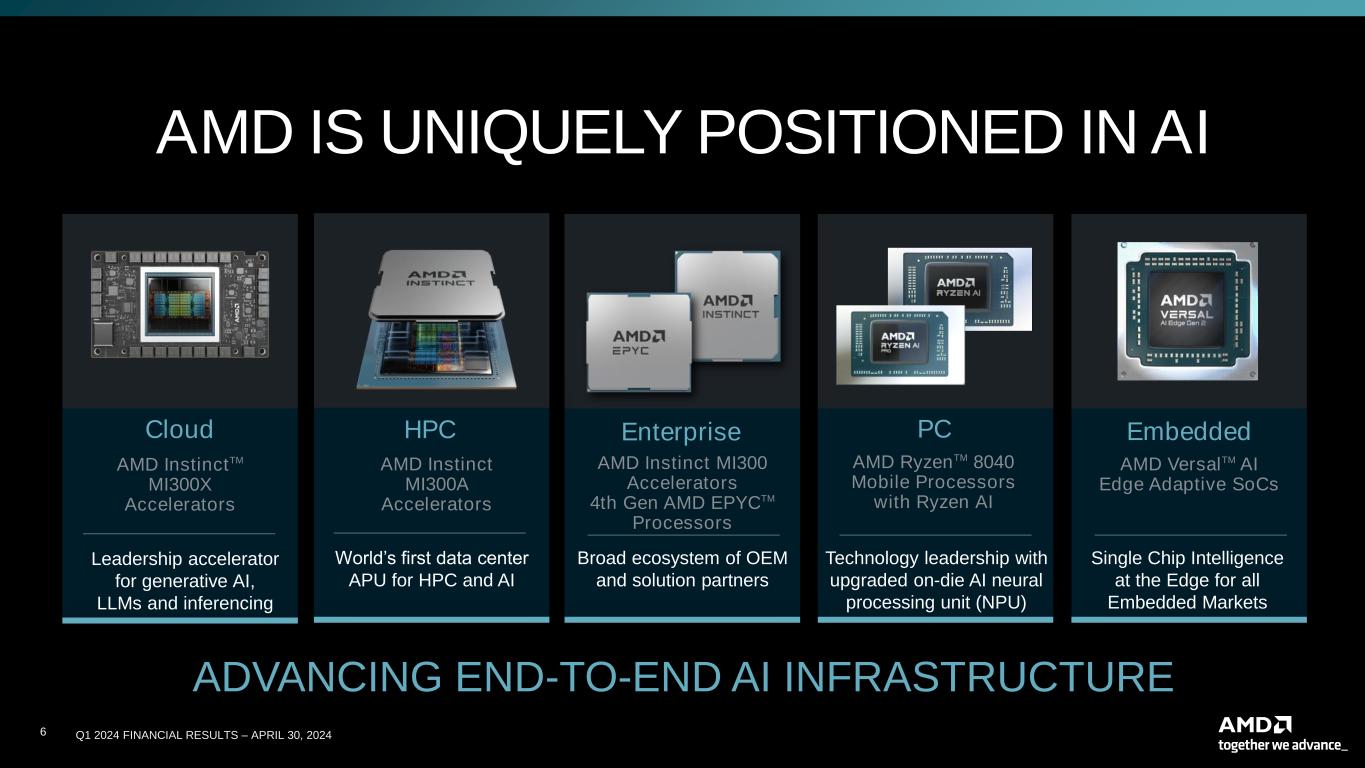

AMD IS UNIQUELY POSITIONED IN AI ADVANCING END-TO-END AI INFRASTRUCTURE 6 AMD InstinctTM MI300X Accelerators Leadership accelerator for generative AI, LLMs and inferencing AMD Instinct MI300 Accelerators 4th Gen AMD EPYCTM Processors Broad ecosystem of OEM and solution partners Cloud Enterprise AMD VersalTM AI Edge Adaptive SoCs Single Chip Intelligence at the Edge for all Embedded Markets Embedded AMD Instinct MI300A Accelerators World’s first data center APU for HPC and AI HPC AMD RyzenTM 8040 Mobile Processors with Ryzen AI Technology leadership with upgraded on-die AI neural processing unit (NPU) PC Q1 2024 FINANCIAL RESULTS – APRIL 30, 2024

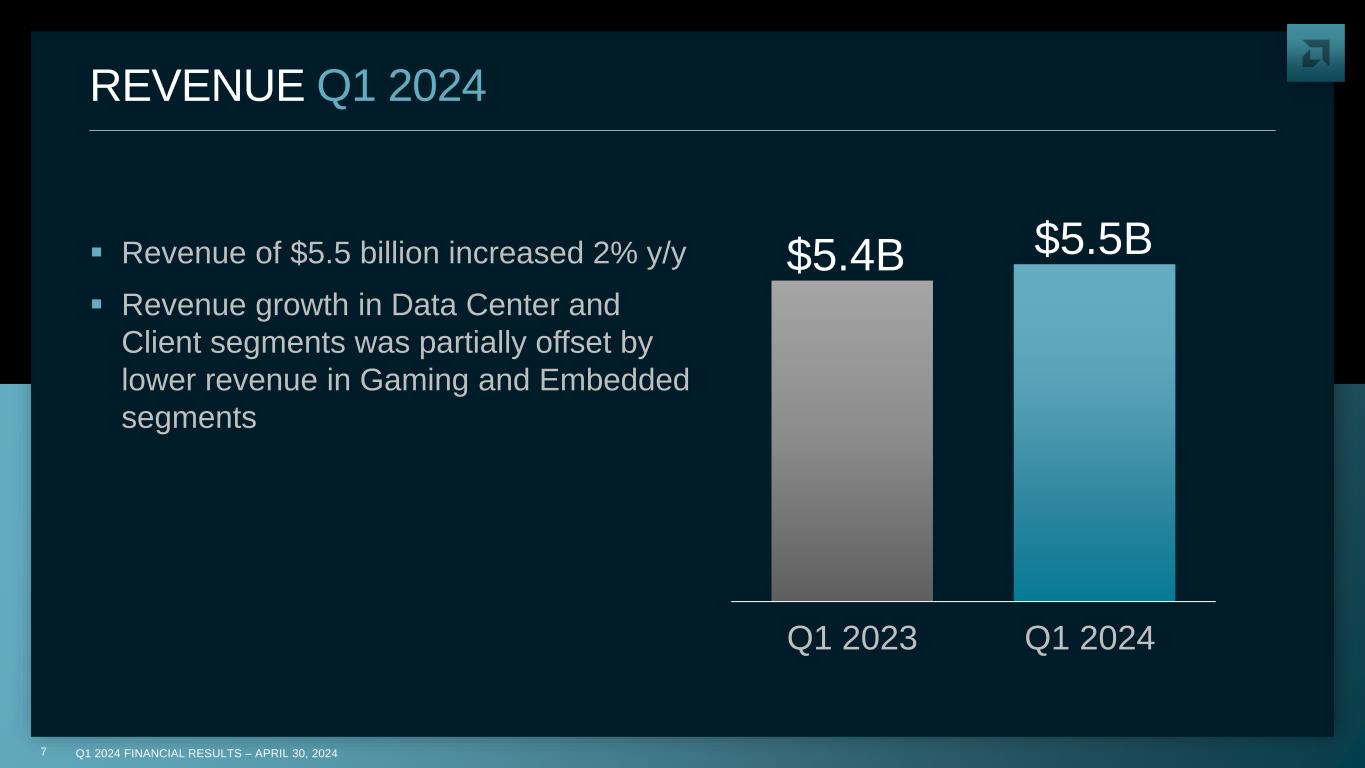

Q1 2024 FINANCIAL RESULTS – APRIL 30, 20247 REVENUE Q1 2024 ▪ Revenue of $5.5 billion increased 2% y/y ▪ Revenue growth in Data Center and Client segments was partially offset by lower revenue in Gaming and Embedded segments $5.4B $5.5B Q1 2023 Q1 2024

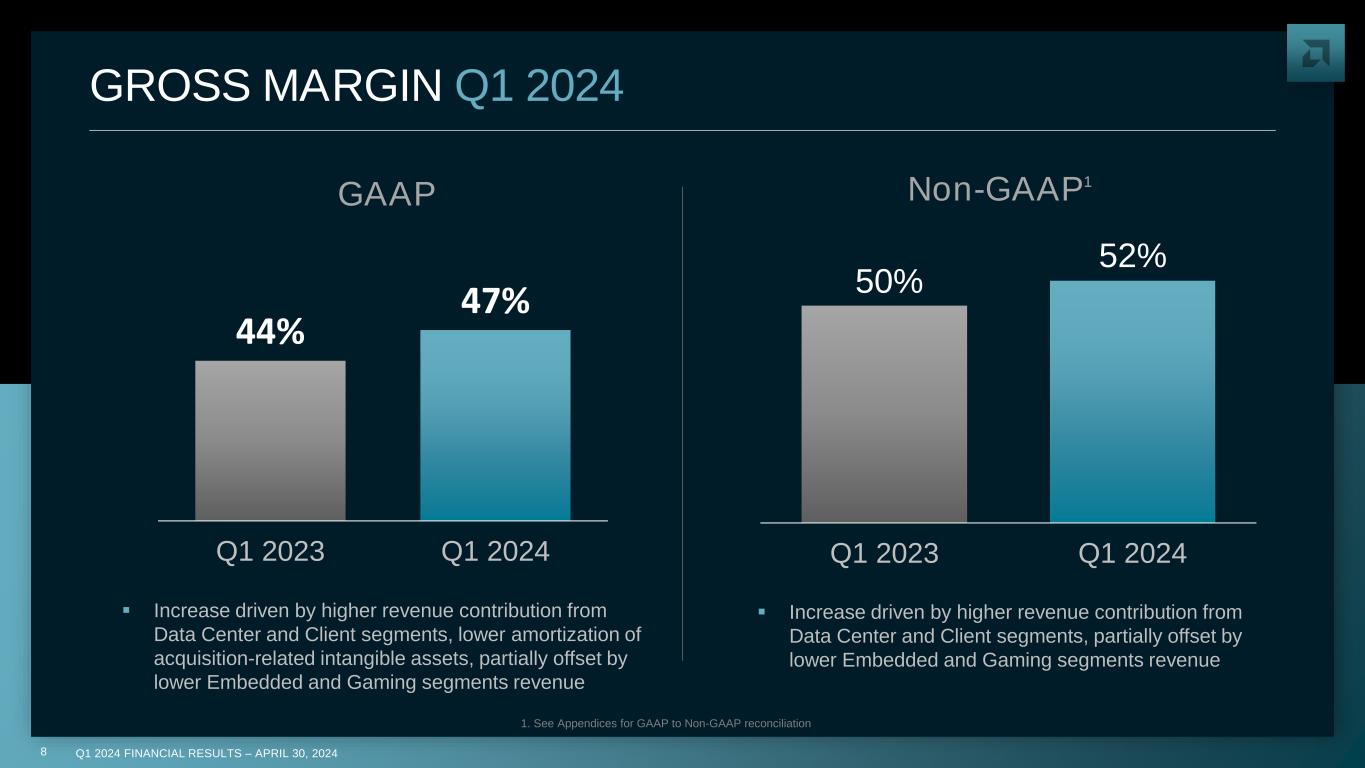

Q1 2024 FINANCIAL RESULTS – APRIL 30, 20248 GROSS MARGIN Q1 2024 1. See Appendices for GAAP to Non-GAAP reconciliation ▪ Increase driven by higher revenue contribution from Data Center and Client segments, partially offset by lower Embedded and Gaming segments revenue Non-GAAP1 44% 47% Q1 2023 Q1 2024 GAAP ▪ Increase driven by higher revenue contribution from Data Center and Client segments, lower amortization of acquisition-related intangible assets, partially offset by lower Embedded and Gaming segments revenue 50% 52% Q1 2023 Q1 2024

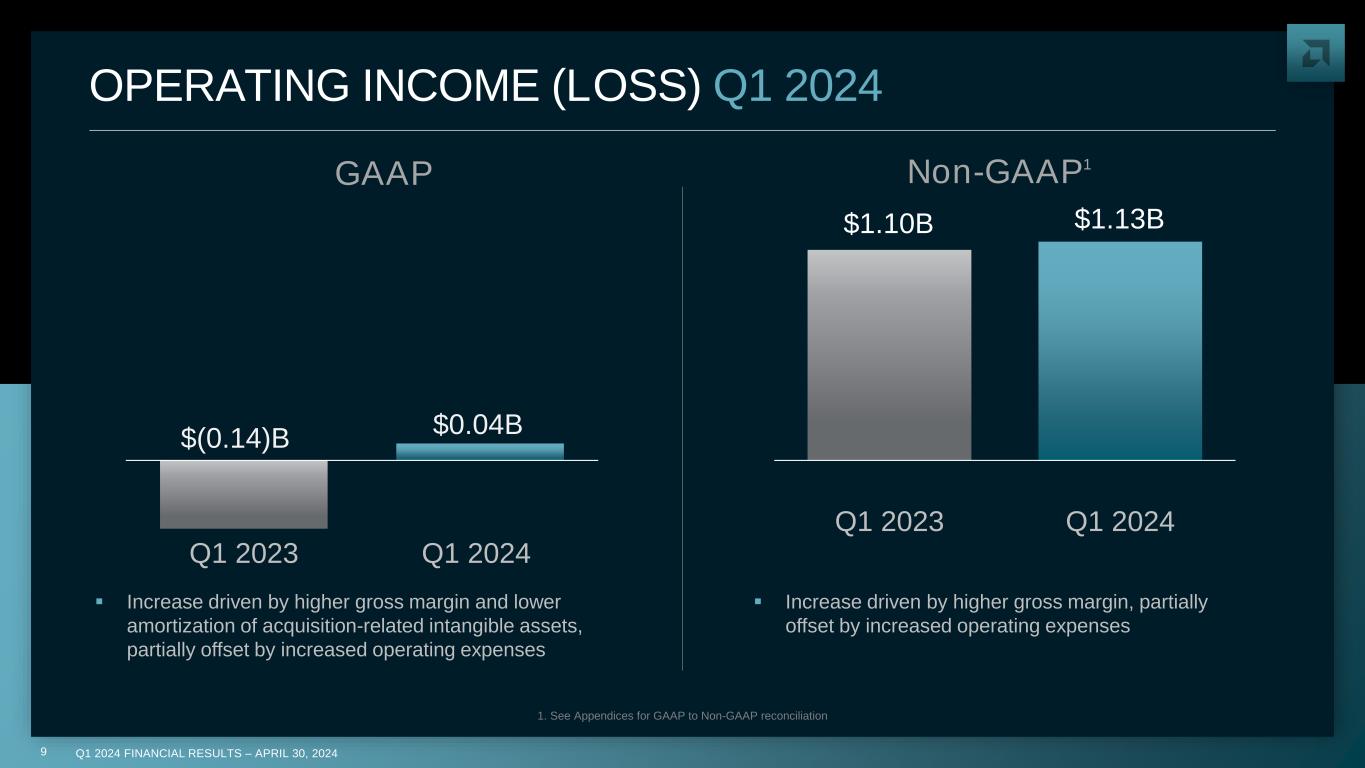

Q1 2024 FINANCIAL RESULTS – APRIL 30, 20249 Q1 2023 Q1 2024 $(0.14)B $0.04B OPERATING INCOME (LOSS) Q1 2024 1. See Appendices for GAAP to Non-GAAP reconciliation GAAP Non-GAAP1 $1.10B $1.13B Q1 2023 Q1 2024 ▪ Increase driven by higher gross margin and lower amortization of acquisition-related intangible assets, partially offset by increased operating expenses ▪ Increase driven by higher gross margin, partially offset by increased operating expenses

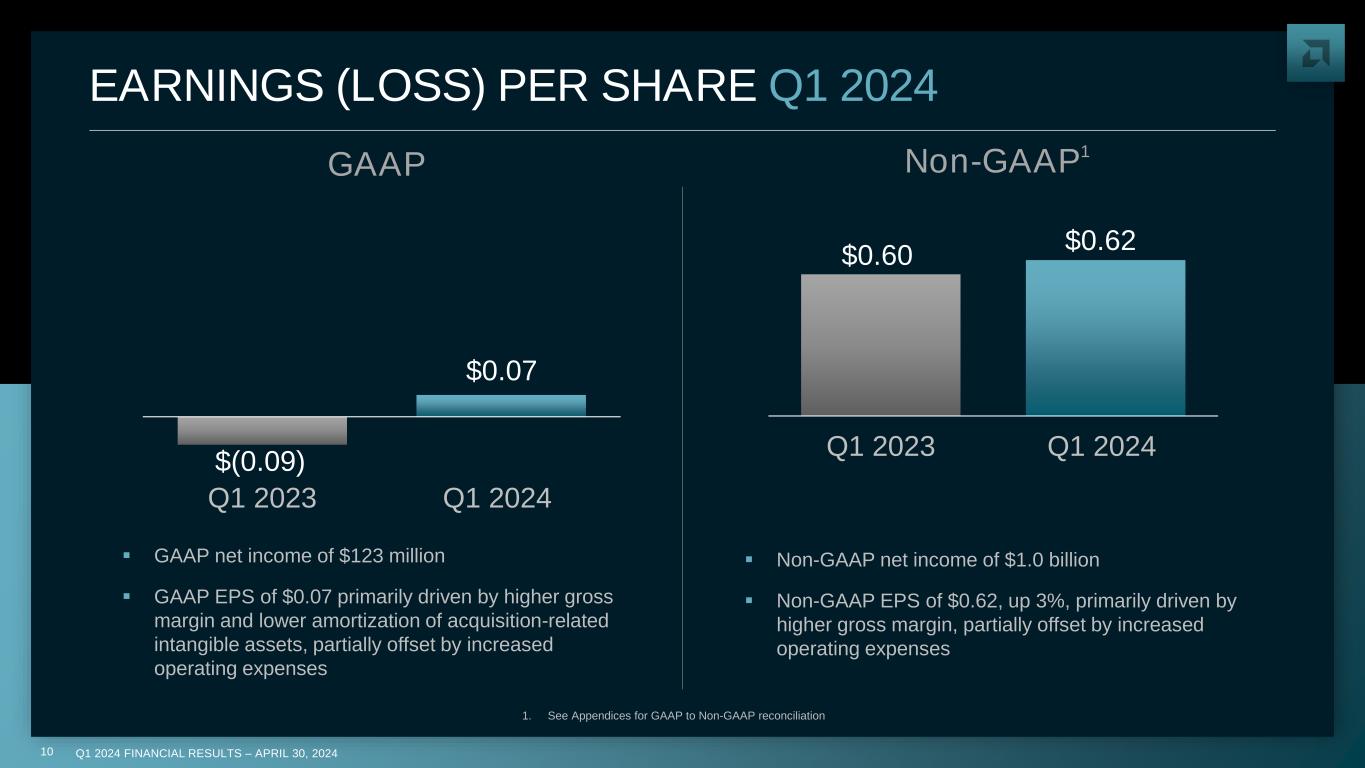

Q1 2024 FINANCIAL RESULTS – APRIL 30, 202410 $0.60 $0.62 Q1 2023 Q1 2024 EARNINGS (LOSS) PER SHARE Q1 2024 1. See Appendices for GAAP to Non-GAAP reconciliation GAAP Non-GAAP1 ▪ GAAP net income of $123 million ▪ GAAP EPS of $0.07 primarily driven by higher gross margin and lower amortization of acquisition-related intangible assets, partially offset by increased operating expenses $(0.09) $0.07 Q1 2023 Q1 2024 ▪ Non-GAAP net income of $1.0 billion ▪ Non-GAAP EPS of $0.62, up 3%, primarily driven by higher gross margin, partially offset by increased operating expenses

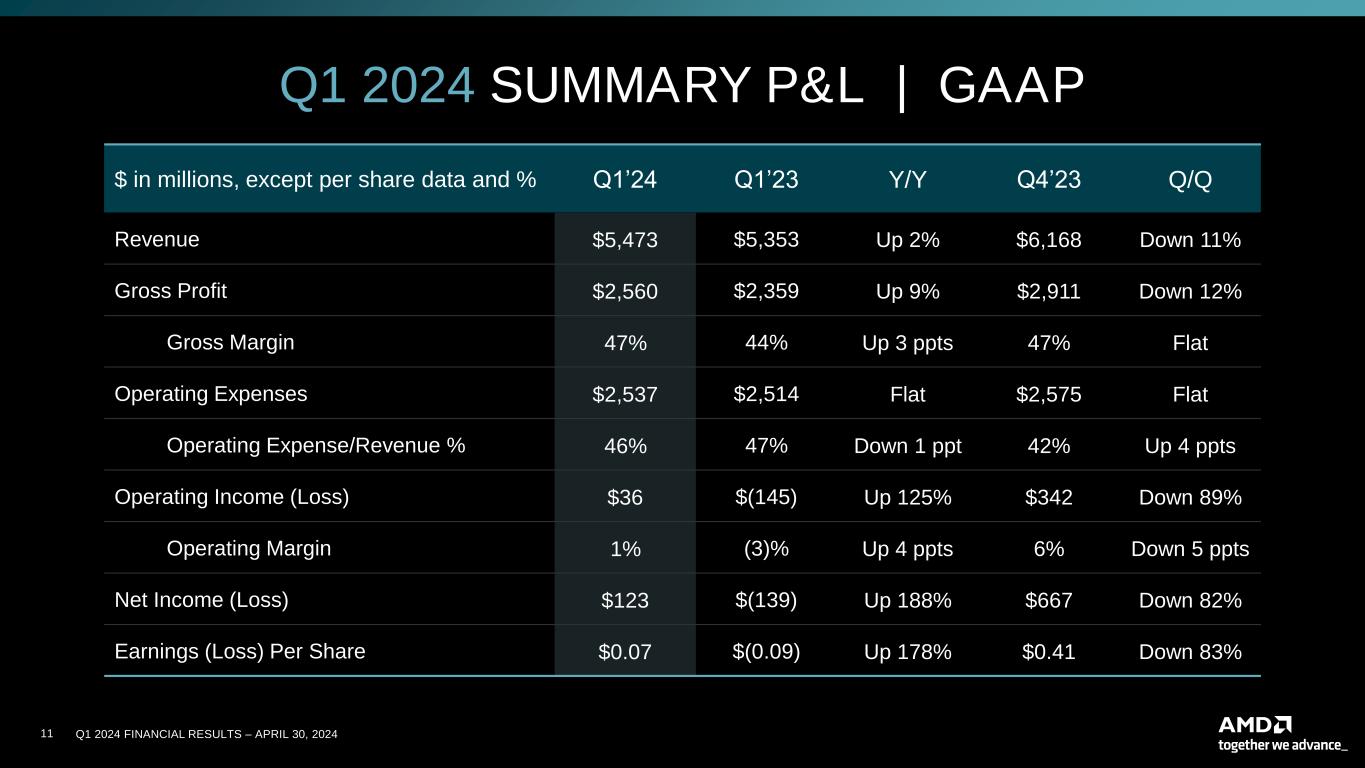

Q1 2024 FINANCIAL RESULTS – APRIL 30, 202411 $ in millions, except per share data and % Q1’24 Q1’23 Y/Y Q4’23 Q/Q Revenue $5,473 $5,353 Up 2% $6,168 Down 11% Gross Profit $2,560 $2,359 Up 9% $2,911 Down 12% Gross Margin 47% 44% Up 3 ppts 47% Flat Operating Expenses $2,537 $2,514 Flat $2,575 Flat Operating Expense/Revenue % 46% 47% Down 1 ppt 42% Up 4 ppts Operating Income (Loss) $36 $(145) Up 125% $342 Down 89% Operating Margin 1% (3)% Up 4 ppts 6% Down 5 ppts Net Income (Loss) $123 $(139) Up 188% $667 Down 82% Earnings (Loss) Per Share $0.07 $(0.09) Up 178% $0.41 Down 83% Q1 2024 SUMMARY P&L | GAAP

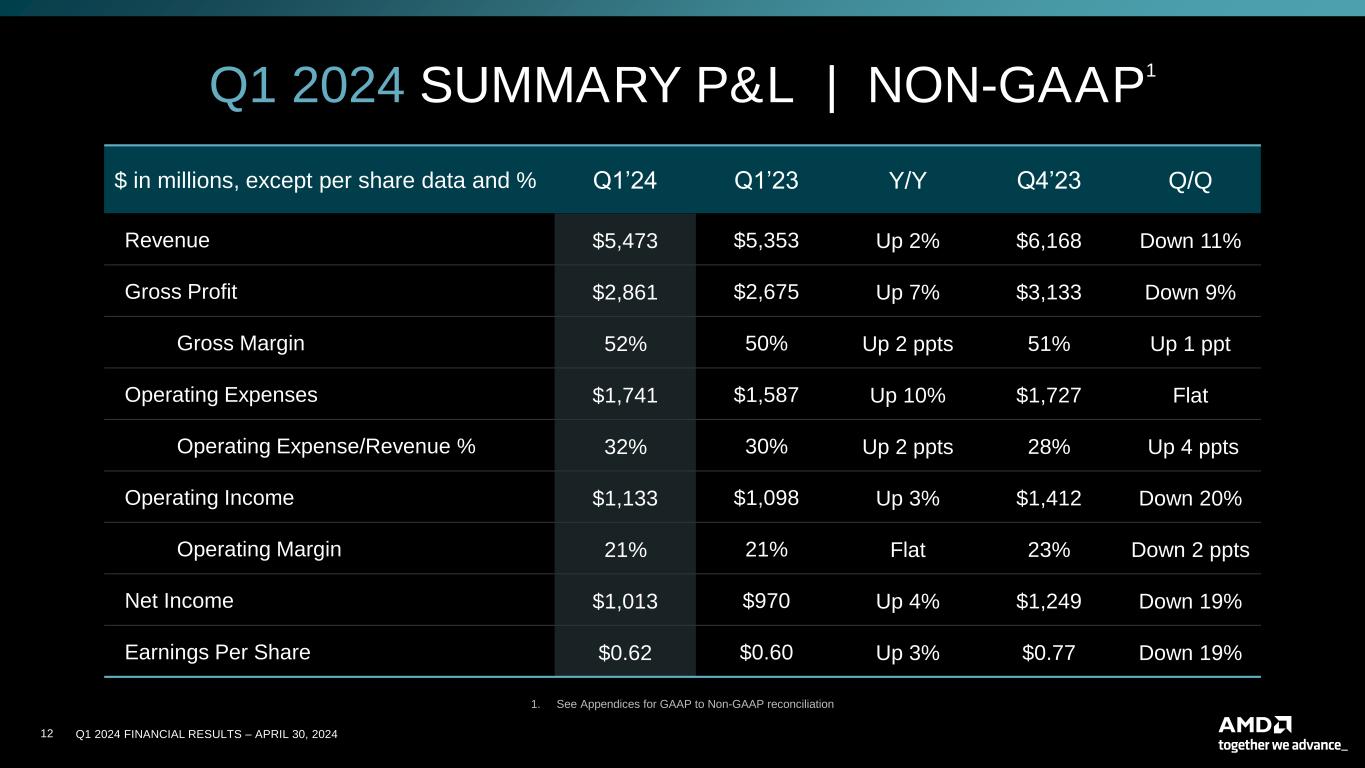

Q1 2024 FINANCIAL RESULTS – APRIL 30, 202412 $ in millions, except per share data and % Q1’24 Q1’23 Y/Y Q4’23 Q/Q Revenue $5,473 $5,353 Up 2% $6,168 Down 11% Gross Profit $2,861 $2,675 Up 7% $3,133 Down 9% Gross Margin 52% 50% Up 2 ppts 51% Up 1 ppt Operating Expenses $1,741 $1,587 Up 10% $1,727 Flat Operating Expense/Revenue % 32% 30% Up 2 ppts 28% Up 4 ppts Operating Income $1,133 $1,098 Up 3% $1,412 Down 20% Operating Margin 21% 21% Flat 23% Down 2 ppts Net Income $1,013 $970 Up 4% $1,249 Down 19% Earnings Per Share $0.62 $0.60 Up 3% $0.77 Down 19% Q1 2024 SUMMARY P&L | NON-GAAP 1 1. See Appendices for GAAP to Non-GAAP reconciliation

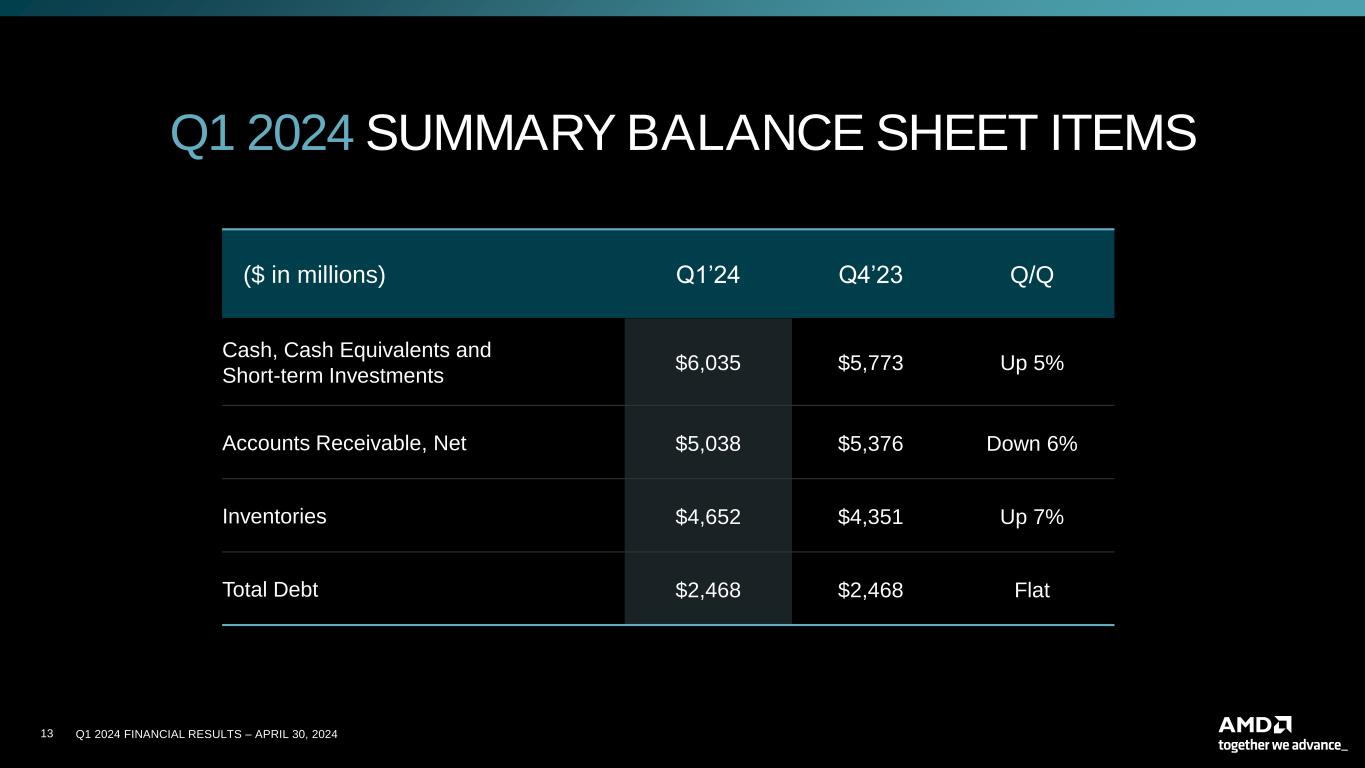

Q1 2024 FINANCIAL RESULTS – APRIL 30, 202413 Q1 2024 SUMMARY BALANCE SHEET ITEMS ($ in millions) Q1’24 Q4’23 Q/Q Cash, Cash Equivalents and Short-term Investments $6,035 $5,773 Up 5% Accounts Receivable, Net $5,038 $5,376 Down 6% Inventories $4,652 $4,351 Up 7% Total Debt $2,468 $2,468 Flat

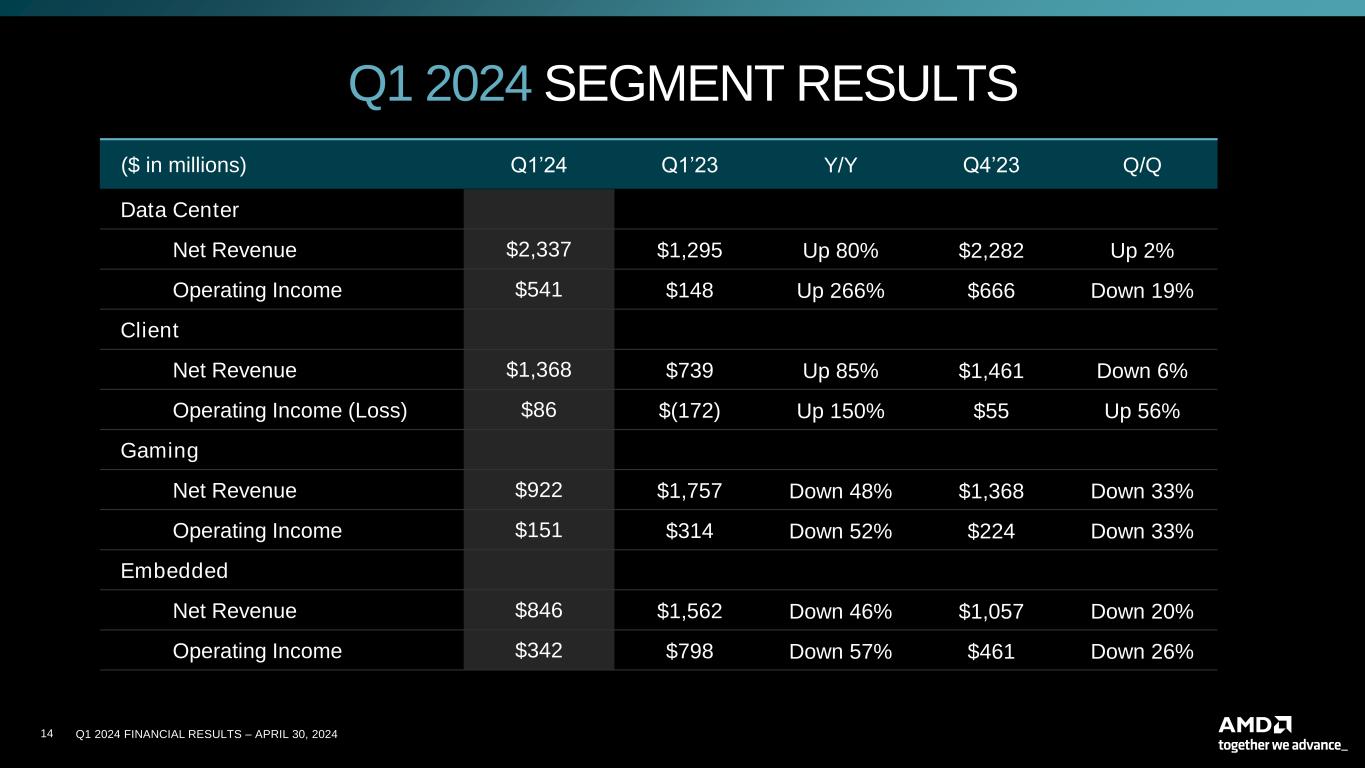

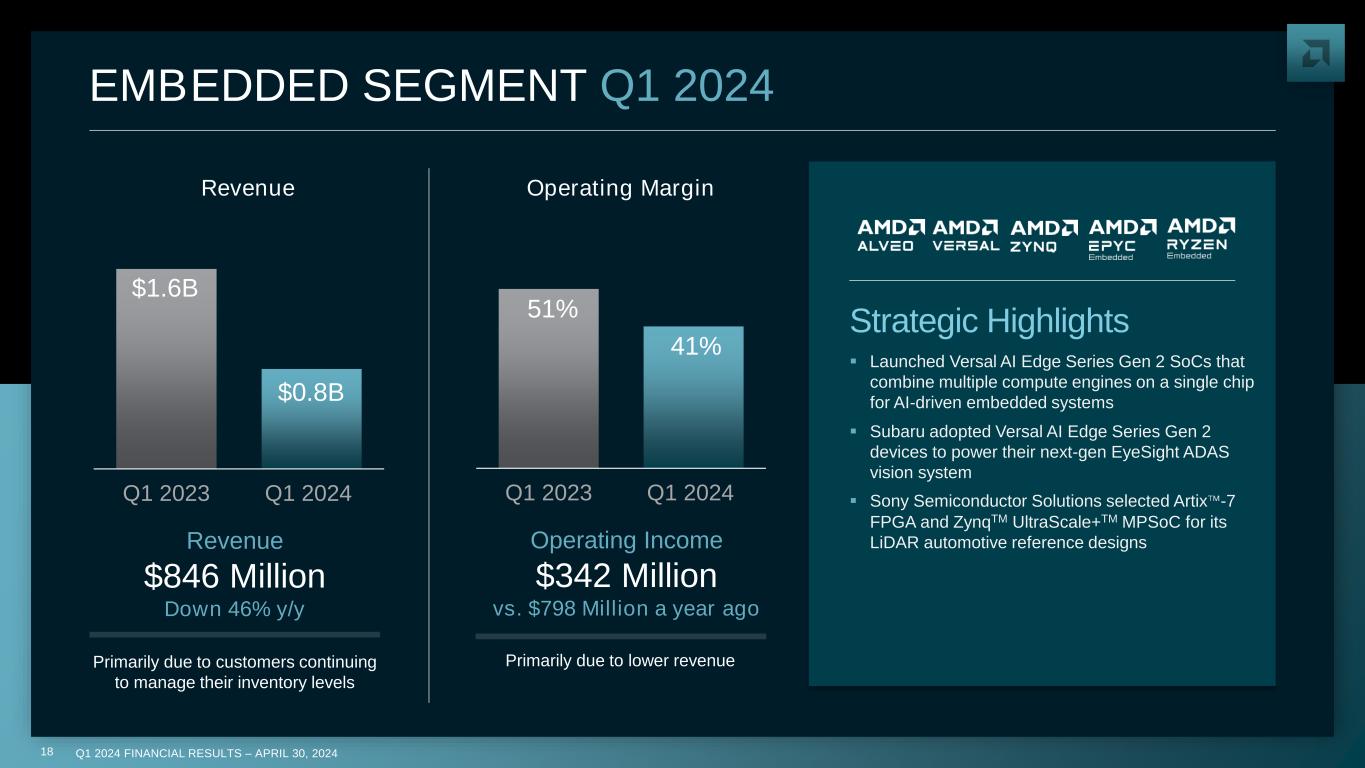

Q1 2024 FINANCIAL RESULTS – APRIL 30, 202414 Q1 2024 SEGMENT RESULTS ($ in millions) Q1’24 Q1’23 Y/Y Q4’23 Q/Q Data Center Net Revenue $2,337 $1,295 Up 80% $2,282 Up 2% Operating Income $541 $148 Up 266% $666 Down 19% Client Net Revenue $1,368 $739 Up 85% $1,461 Down 6% Operating Income (Loss) $86 $(172) Up 150% $55 Up 56% Gaming Net Revenue $922 $1,757 Down 48% $1,368 Down 33% Operating Income $151 $314 Down 52% $224 Down 33% Embedded Net Revenue $846 $1,562 Down 46% $1,057 Down 20% Operating Income $342 $798 Down 57% $461 Down 26%

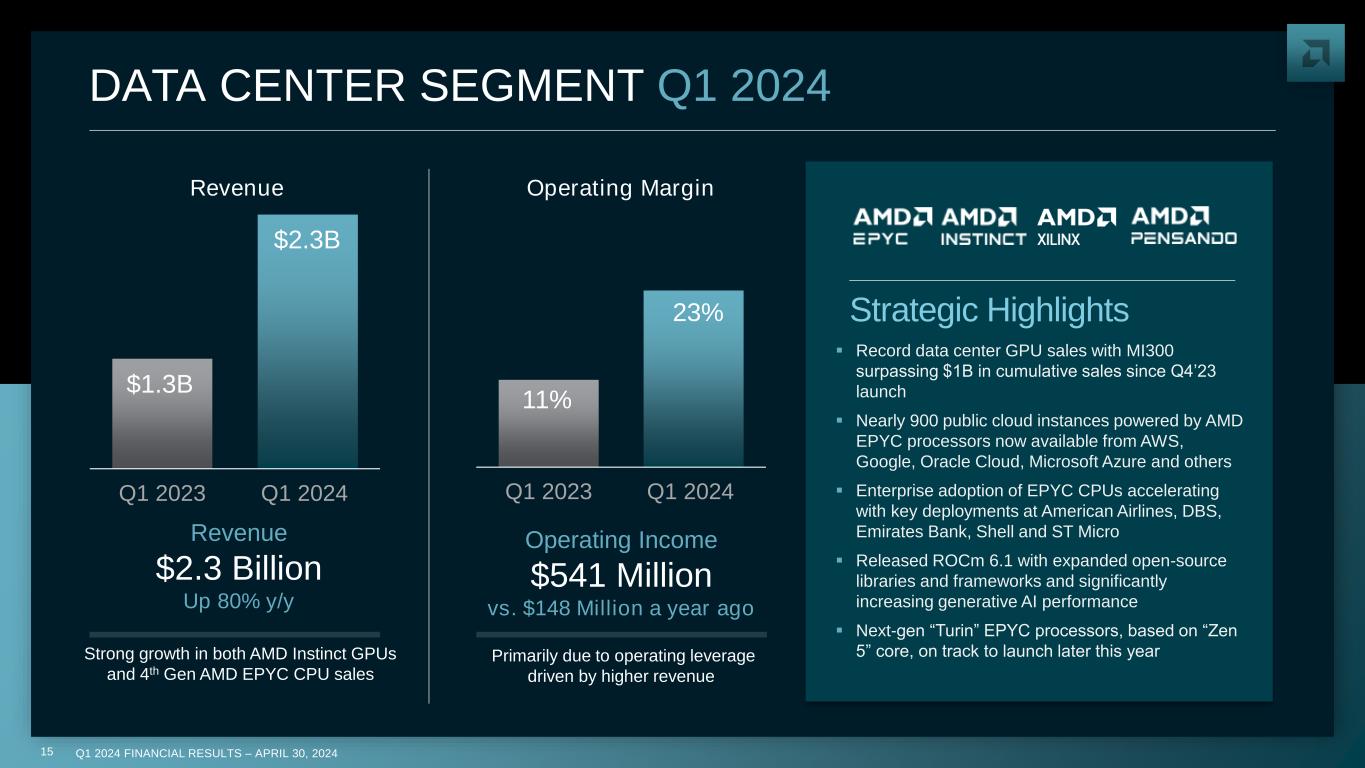

Q1 2024 FINANCIAL RESULTS – APRIL 30, 202415 DATA CENTER SEGMENT Q1 2024 ▪ Record data center GPU sales with MI300 surpassing $1B in cumulative sales since Q4’23 launch ▪ Nearly 900 public cloud instances powered by AMD EPYC processors now available from AWS, Google, Oracle Cloud, Microsoft Azure and others ▪ Enterprise adoption of EPYC CPUs accelerating with key deployments at American Airlines, DBS, Emirates Bank, Shell and ST Micro ▪ Released ROCm 6.1 with expanded open-source libraries and frameworks and significantly increasing generative AI performance ▪ Next-gen “Turin” EPYC processors, based on “Zen 5” core, on track to launch later this year Strategic Highlights $1.3B $2.3B Q1 2023 Q1 2024 11% 23% Q1 2023 Q1 2024 Revenue Operating Margin Revenue $2.3 Billion Up 80% y/y Operating Income $541 Million vs. $148 Million a year ago Primarily due to operating leverage driven by higher revenue Strong growth in both AMD Instinct GPUs and 4th Gen AMD EPYC CPU sales

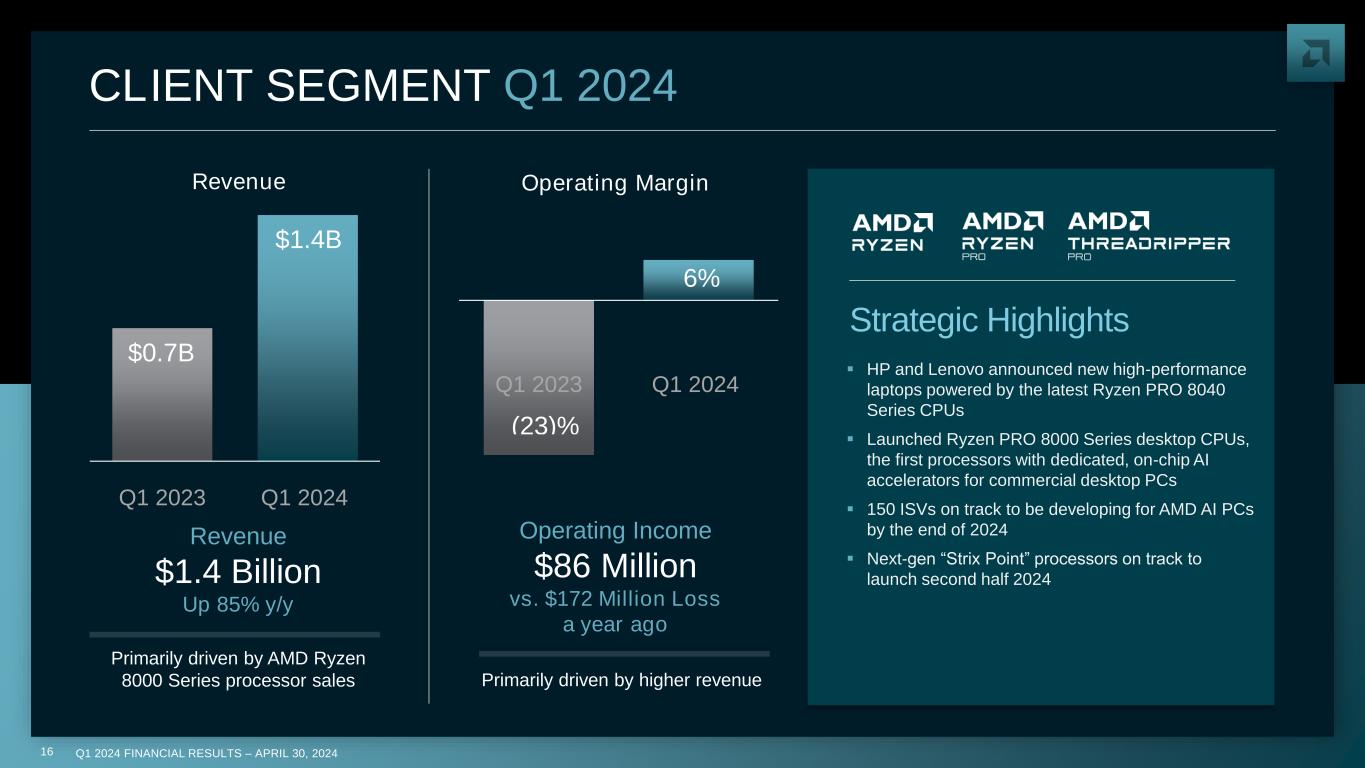

Q1 2024 FINANCIAL RESULTS – APRIL 30, 202416 CLIENT SEGMENT Q1 2024 ▪ HP and Lenovo announced new high-performance laptops powered by the latest Ryzen PRO 8040 Series CPUs ▪ Launched Ryzen PRO 8000 Series desktop CPUs, the first processors with dedicated, on-chip AI accelerators for commercial desktop PCs ▪ 150 ISVs on track to be developing for AMD AI PCs by the end of 2024 ▪ Next-gen “Strix Point” processors on track to launch second half 2024 Strategic Highlights $0.7B $1.4B Q1 2023 Q1 2024 (23)% 6% Q1 2023 Q1 2024 Revenue Operating Margin Revenue $1.4 Billion Up 85% y/y Primarily driven by AMD Ryzen 8000 Series processor sales Operating Income $86 Million vs. $172 Million Loss a year ago Primarily driven by higher revenue

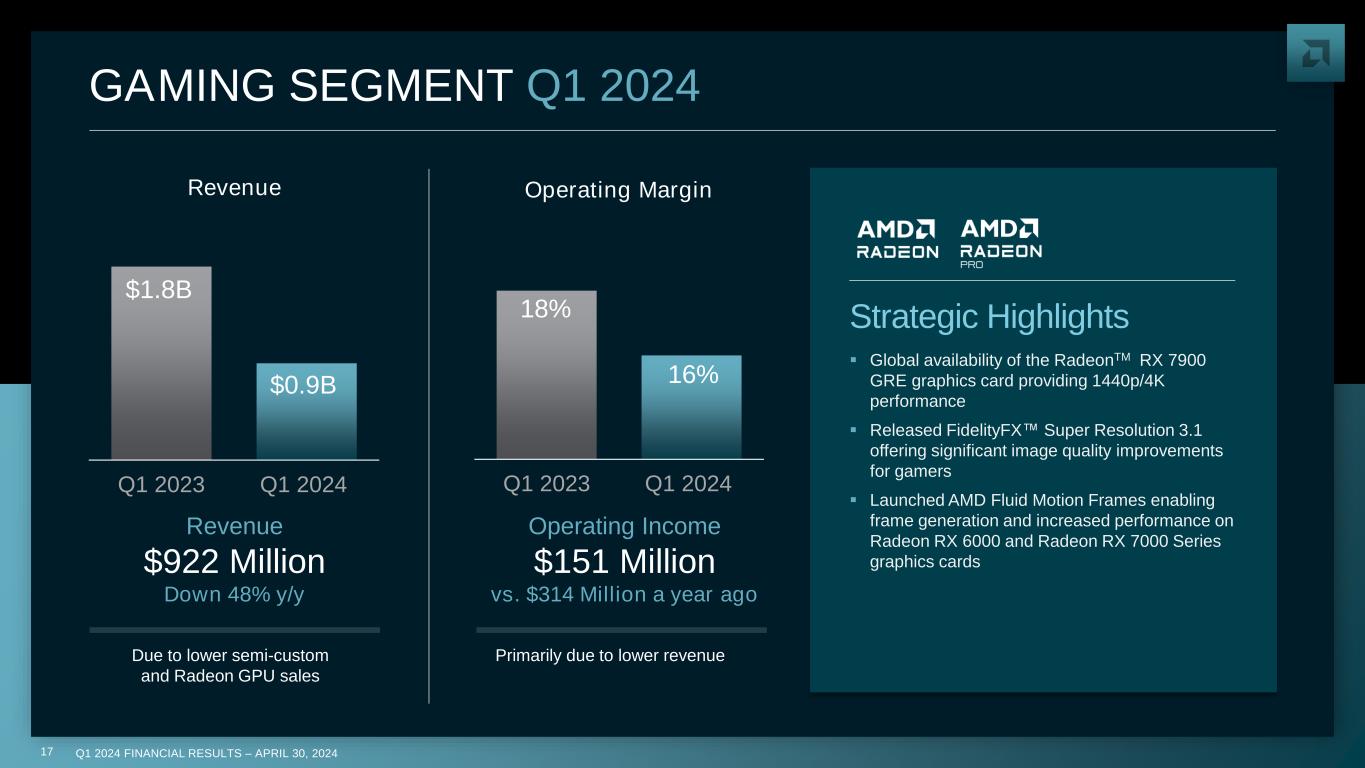

Q1 2024 FINANCIAL RESULTS – APRIL 30, 202417 18% 16% Q1 2023 Q1 2024 GAMING SEGMENT Q1 2024 ▪ Global availability of the RadeonTM RX 7900 GRE graphics card providing 1440p/4K performance ▪ Released FidelityFX Super Resolution 3.1 offering significant image quality improvements for gamers ▪ Launched AMD Fluid Motion Frames enabling frame generation and increased performance on Radeon RX 6000 and Radeon RX 7000 Series graphics cards Strategic Highlights $1.8B $0.9B Q1 2023 Q1 2024 Revenue Operating Margin Revenue $922 Million Down 48% y/y Operating Income $151 Million vs. $314 Million a year ago Primarily due to lower revenueDue to lower semi-custom and Radeon GPU sales

Q1 2024 FINANCIAL RESULTS – APRIL 30, 202418 EMBEDDED SEGMENT Q1 2024 ▪ Launched Versal AI Edge Series Gen 2 SoCs that combine multiple compute engines on a single chip for AI-driven embedded systems ▪ Subaru adopted Versal AI Edge Series Gen 2 devices to power their next-gen EyeSight ADAS vision system ▪ Sony Semiconductor Solutions selected Artix -7 FPGA and ZynqTM UltraScale+TM MPSoC for its LiDAR automotive reference designs Strategic Highlights $0.8B Q1 2023 Q1 2024 51% 41% Q1 2023 Q1 2024 Revenue Operating Margin Revenue $846 Million Down 46% y/y Primarily due to customers continuing to manage their inventory levels Operating Income $342 Million vs. $798 Million a year ago $1.6B Primarily due to lower revenue

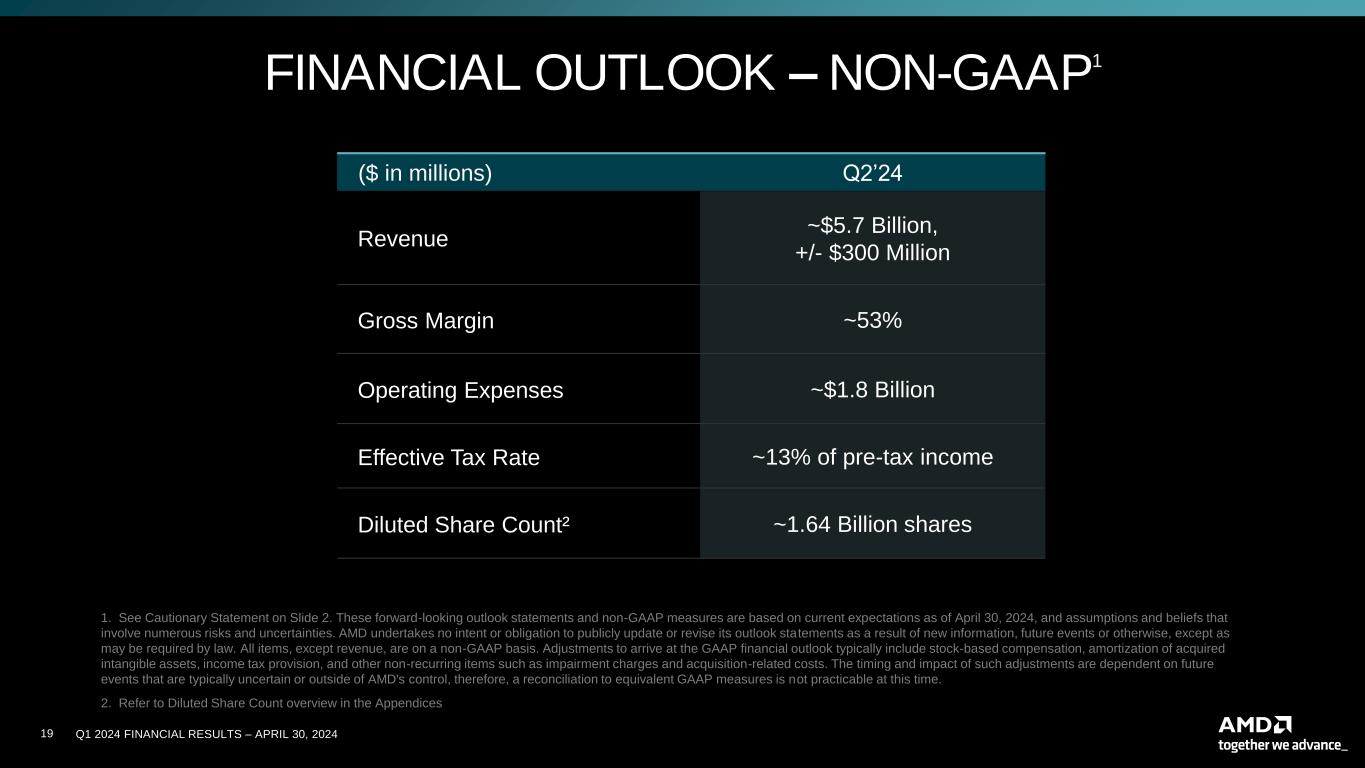

Q1 2024 FINANCIAL RESULTS – APRIL 30, 202419 ($ in millions) Q2’24 Revenue ~$5.7 Billion, +/- $300 Million Gross Margin ~53% Operating Expenses ~$1.8 Billion Effective Tax Rate ~13% of pre-tax income Diluted Share Count² ~1.64 Billion shares FINANCIAL OUTLOOK – NON-GAAP1 1. 1. See Cautionary Statement on Slide 2. These forward-looking outlook statements and non-GAAP measures are based on current expectations as of April 30, 2024, and assumptions and beliefs that involve numerous risks and uncertainties. AMD undertakes no intent or obligation to publicly update or revise its outlook statements as a result of new information, future events or otherwise, except as may be required by law. All items, except revenue, are on a non-GAAP basis. Adjustments to arrive at the GAAP financial outlook typically include stock-based compensation, amortization of acquired intangible assets, income tax provision, and other non-recurring items such as impairment charges and acquisition-related costs. The timing and impact of such adjustments are dependent on future events that are typically uncertain or outside of AMD's control, therefore, a reconciliation to equivalent GAAP measures is not practicable at this time. 2. 2. Refer to Diluted Share Count overview in the Appendices

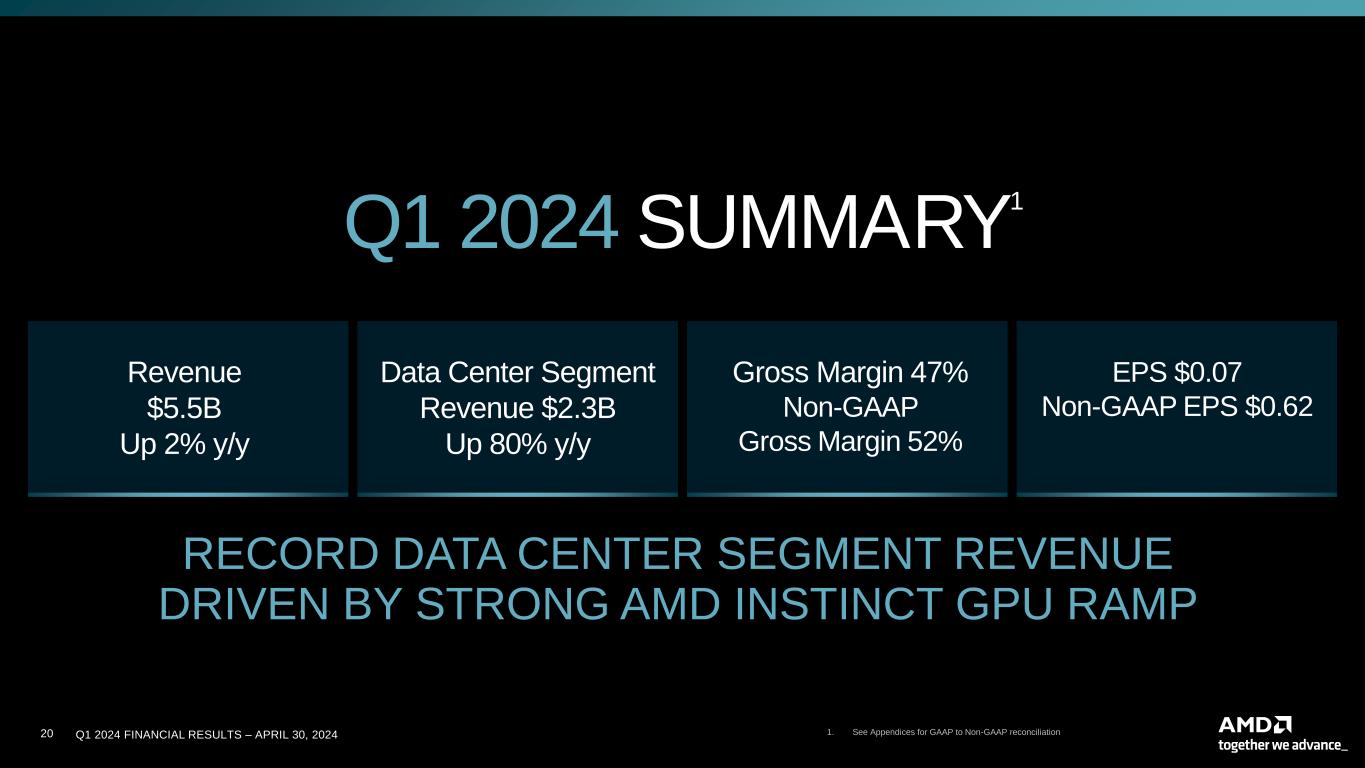

Q1 2024 FINANCIAL RESULTS – APRIL 30, 20242020 Data Center Segment Revenue $2.3B Up 80% y/y Gross Margin 47% Non-GAAP Gross Margin 52% EPS $0.07 Non-GAAP EPS $0.62 Revenue $5.5B Up 2% y/y Q1 2024 SUMMARY 1 RECORD DATA CENTER SEGMENT REVENUE DRIVEN BY STRONG AMD INSTINCT GPU RAMP 1. See Appendices for GAAP to Non-GAAP reconciliation

Q1 2024 FINANCIAL RESULTS – APRIL 30, 20242121 CORPORATE RESPONSIBILITY AT AMD Governance Integrating corporate responsibility and governance across product design, supply chain, operations and external engagement Social Fostering a culture of diversity, belonging and inclusion, partnering with suppliers and positively impacting our communities Environmental Advancing environmental solutions in our products, supply chain and operations, while accelerating energy efficiency for IT users

Q1 2024 FINANCIAL RESULTS – APRIL 30, 2024222 Large and Compelling TAM World-Class Execution and Focus Technology Leadership Expanding Data Center and AI Leadership Strong Balance Sheet OUR MOMENTUM DRIVING LONG-TERM SHAREHOLDER RETURNS

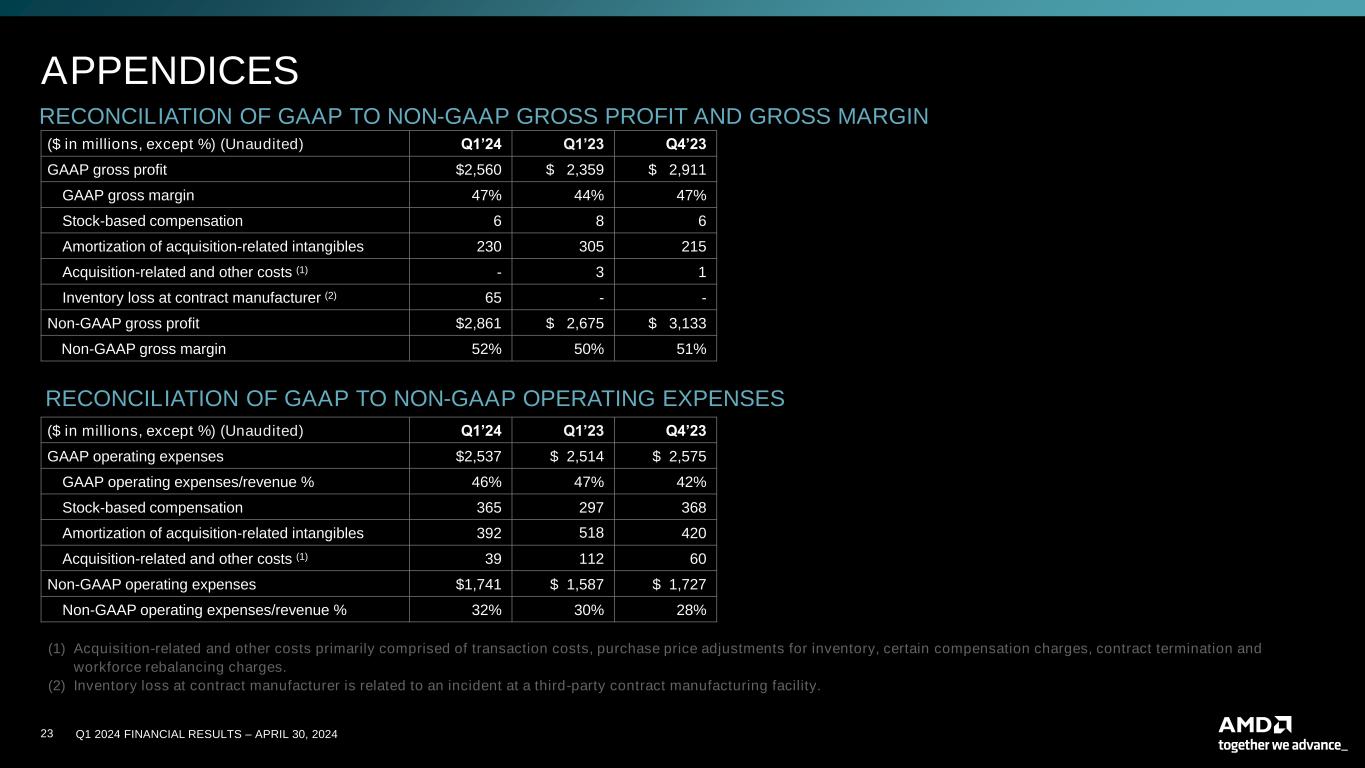

Q1 2024 FINANCIAL RESULTS – APRIL 30, 202423 RECONCILIATION OF GAAP TO NON-GAAP GROSS PROFIT AND GROSS MARGIN ($ in millions, except %) (Unaudited) Q1’24 Q1’23 Q4’23 GAAP gross profit $2,560 $ 2,359 $ 2,911 GAAP gross margin 47% 44% 47% Stock-based compensation 6 8 6 Amortization of acquisition-related intangibles 230 305 215 Acquisition-related and other costs (1) - 3 1 Inventory loss at contract manufacturer (2) 65 - - Non-GAAP gross profit $2,861 $ 2,675 $ 3,133 Non-GAAP gross margin 52% 50% 51% RECONCILIATION OF GAAP TO NON-GAAP OPERATING EXPENSES ($ in millions, except %) (Unaudited) Q1’24 Q1’23 Q4’23 GAAP operating expenses $2,537 $ 2,514 $ 2,575 GAAP operating expenses/revenue % 46% 47% 42% Stock-based compensation 365 297 368 Amortization of acquisition-related intangibles 392 518 420 Acquisition-related and other costs (1) 39 112 60 Non-GAAP operating expenses $1,741 $ 1,587 $ 1,727 Non-GAAP operating expenses/revenue % 32% 30% 28% APPENDICES (1) Acquisition-related and other costs primarily comprised of transaction costs, purchase price adjustments for inventory, certain compensation charges, contract termination and workforce rebalancing charges. (2) Inventory loss at contract manufacturer is related to an incident at a third-party contract manufacturing facility.

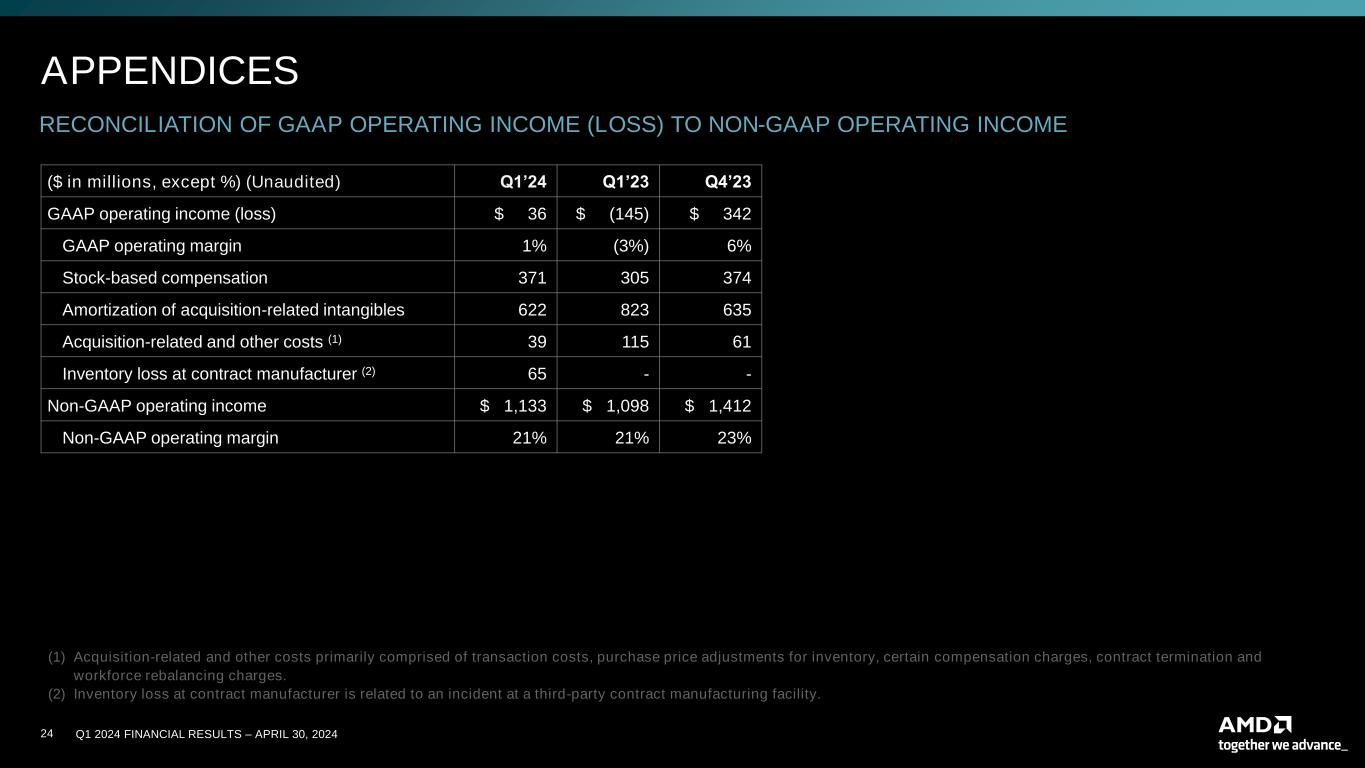

Q1 2024 FINANCIAL RESULTS – APRIL 30, 202424 APPENDICES RECONCILIATION OF GAAP OPERATING INCOME (LOSS) TO NON-GAAP OPERATING INCOME ($ in millions, except %) (Unaudited) Q1’24 Q1’23 Q4’23 GAAP operating income (loss) $ 36 $ (145) $ 342 GAAP operating margin 1% (3%) 6% Stock-based compensation 371 305 374 Amortization of acquisition-related intangibles 622 823 635 Acquisition-related and other costs (1) 39 115 61 Inventory loss at contract manufacturer (2) 65 - - Non-GAAP operating income $ 1,133 $ 1,098 $ 1,412 Non-GAAP operating margin 21% 21% 23% (1) Acquisition-related and other costs primarily comprised of transaction costs, purchase price adjustments for inventory, certain compensation charges, contract termination and workforce rebalancing charges. (2) Inventory loss at contract manufacturer is related to an incident at a third-party contract manufacturing facility.

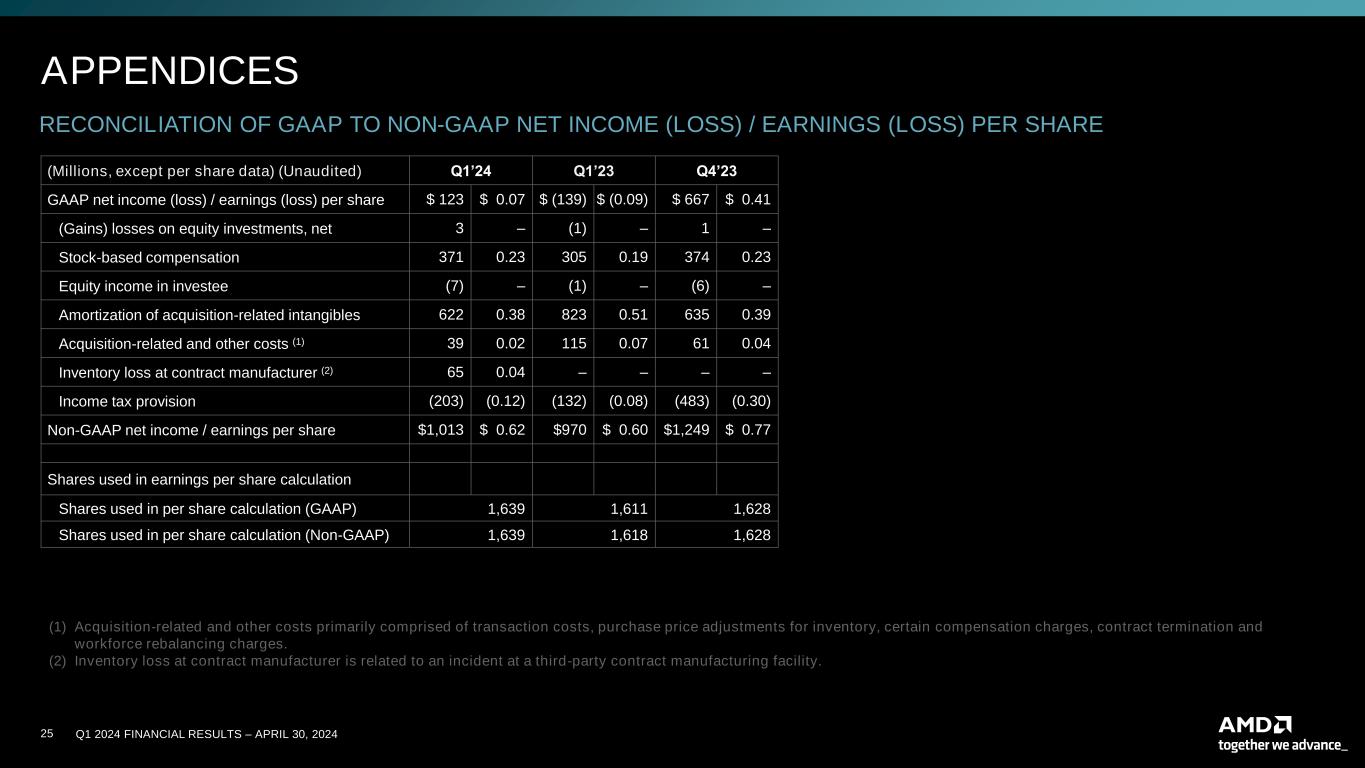

Q1 2024 FINANCIAL RESULTS – APRIL 30, 202425 RECONCILIATION OF GAAP TO NON-GAAP NET INCOME (LOSS) / EARNINGS (LOSS) PER SHARE (1) Acquisition-related and other costs primarily comprised of transaction costs, purchase price adjustments for inventory, certain compensation charges, contract termination and workforce rebalancing charges. (2) Inventory loss at contract manufacturer is related to an incident at a third-party contract manufacturing facility. APPENDICES (Millions, except per share data) (Unaudited) Q1’24 Q1’23 Q4’23 GAAP net income (loss) / earnings (loss) per share $ 123 $ 0.07 $ (139) $ (0.09) $ 667 $ 0.41 (Gains) losses on equity investments, net 3 – (1) – 1 – Stock-based compensation 371 0.23 305 0.19 374 0.23 Equity income in investee (7) – (1) – (6) – Amortization of acquisition-related intangibles 622 0.38 823 0.51 635 0.39 Acquisition-related and other costs (1) 39 0.02 115 0.07 61 0.04 Inventory loss at contract manufacturer (2) 65 0.04 – – – – Income tax provision (203) (0.12) (132) (0.08) (483) (0.30) Non-GAAP net income / earnings per share $1,013 $ 0.62 $970 $ 0.60 $1,249 $ 0.77 Shares used in earnings per share calculation Shares used in per share calculation (GAAP) 1,639 1,611 1,628 Shares used in per share calculation (Non-GAAP) 1,639 1,618 1,628

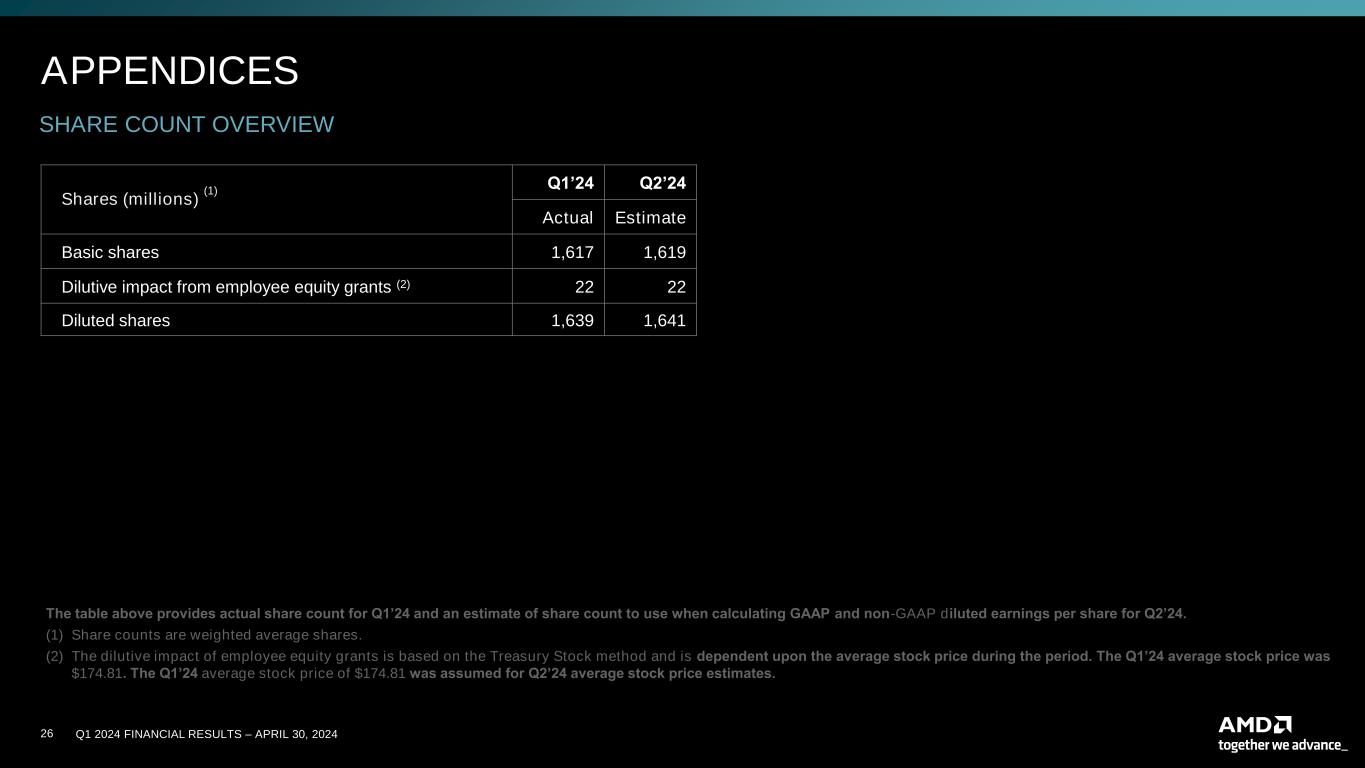

Q1 2024 FINANCIAL RESULTS – APRIL 30, 202426 Shares (millions) (1) Q1’24 Q2’24 Actual Estimate Basic shares 1,617 1,619 Dilutive impact from employee equity grants (2) 22 22 Diluted shares 1,639 1,641 APPENDICES SHARE COUNT OVERVIEW The table above provides actual share count for Q1’24 and an estimate of share count to use when calculating GAAP and non-GAAP diluted earnings per share for Q2’24. (1) Share counts are weighted average shares. (2) The dilutive impact of employee equity grants is based on the Treasury Stock method and is dependent upon the average stock price during the period. The Q1’24 average stock price was $174.81. The Q1’24 average stock price of $174.81 was assumed for Q2’24 average stock price estimates.