Human

Resources| June 29 – July 27, 2009 Confidential AMD Stock Option Exchange Program Eligible Employee Overview EXHIBIT (a)(1)(xv) Employee Presentation Materials |

Human

Resources| June 29 – July 27, 2009 Confidential AMD Stock Option Exchange Program Eligible Employee Overview EXHIBIT (a)(1)(xv) Employee Presentation Materials |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 2 By the end of our session you should be familiar with… Basic Terminology Stock option exchange program objective Plan design elements Stock option exchange election process Timeline, including deadline Where to go with questions |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 3 Basic Terminology Stock Option – A right, but not the obligation, to buy stock at an agreed-upon price on or after a specific date. Stock Appreciation Right (SAR) – A right to receive a bonus equal to the appreciation in the company’s stock over a specified period (can be settled in cash or shares). Restricted Stock Unit (RSU) - An unsecured promise by the employer to grant a set number of shares of stock to the employee upon the completion of the vesting schedule. RSUs can also be settled in cash. Exercise Price – The price at which an underlying security is purchased. The exercise price is set in advance. The difference between the exercise price and the market price at the time the option is exercised is what gives it value. |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 4 Basic Terminology Underwater – A condition when the exercise price of a stock option is higher than the market price of the stock. Vesting - The process by which employees accrue non- forfeitable rights based on a number of years of service, or possibly meeting performance criteria. Expiration Date – The day on which an option contract is no longer valid, and, therefore, ceases to exist. Exchange ratio – The relationship between the number of options exchanged and the number of replacement options . If the exchange ratio is 5 to 1, you will need to give up (exchange) five options to receive one new option. |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 5 Program Objective |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 6 Program Objective Allow eligible employees the opportunity to exchange eligible underwater stock options for fewer replacement stock options The replacement options will provide renewed incentives that are better aligned with the current stock price and AMD’s shareholders |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 7 Plan Design Elements |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 8 Overview of Plan Design Elements Employee Eligibility – Excluded from participation are AMD’s executive officers, members of the board of directors and employees in Russia. The remaining current employees, who hold eligible options, are eligible to participate. Eligible Options are determine by exercise price, grant date and expiration date Exchange Ratios - Employee can elect to exchange underwater options for fewer new options that carry an equivalent value Terms of replacement options – all replacement options will have a new vesting schedule and expiration dates are maintained Grant-by-grant flexibility - Eligible employees can elect to exchange all or none of a particular grant. Employees can exchange one grant and not another. |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 9 Employee eligibility Exclude Executive Officers (Meyer, Rivet, McCoy and Ghilardi), members of the Board of Directors and employees in Russia Include all other current employees who hold stock options that meet the eligibility criteria • To be eligible, must be an employee on the date of the replacement grant (July 27, 2009) • Employees terminating prior to the close of the Tender Offer will be ineligible • Approximately 3,800 employees are eligible to participate in the offer |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 10 Options eligible for exchange must meet all three criteria – exercise price, grant date and expiration Exercise price must be greater than the 52-week high - >$6.34 Grant Date must be more than 12 months prior to exchange - granted before June 29, 2008 Expiration date must be later than the first replacement vesting date – expires after July 27, 2010 Original Grant Date Expiration Date Option Number Exercise Price Per Share Shares Subject to Eligible Options Shares Vested Shares Unvested Exchange Ratio 4/8/2004 4/8/2014 23456 $17.60 1000 1000 0 11 to 1 5/2/2005 5/2/2015 78912 $16.07 5000 4500 500 11 to 1 4/10/2006 4/10/2016 34567 $17.87 8000 7250 750 11 to 1 11/15/2007 11/15/2014 89123 $12.70 4000 2500 1500 5 to 1 2/15/2008 2/15/2015 45678 $ 6.45 6000 1999 4001 1.5 to 1 5/15/2008 5/15/2015 91234 $ 7.41 4375 1458 2917 1.5 to 1 |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 11 Exchange ratios vary by exercise price Exercise Price Ranges Exchange Ratios $6.35 - $9.99 1.5 to 1 $10.00 - $15.99 5 to 1 $16.00 and up 11 to 1 Original Grant Date Expiration Date Option Number Exercise Price Per Share Shares Subject to Eligible Options Shares Vested Shares Unvested Exchange Ratio Replacement Options 4/8/2004 4/8/2014 23456 $17.60 1000 1000 0 11 to 1 90 5/2/2005 5/2/2015 78912 $16.07 5000 4500 500 11 to 1 454 4/10/2006 4/10/2016 34567 $17.87 8000 7250 750 11 to 1 727 11/15/2007 11/15/2014 89123 $12.70 4000 2500 1500 5 to 1 800 2/15/2008 2/15/2015 45678 $ 6.45 6000 1999 4001 1.5 to 1 4000 5/15/2008 5/15/2015 91234 $ 7.41 4375 1458 2917 1.5 to 1 2916 |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 12 Replacement options will have new vesting schedules Options replacing vested shares subject to the old options vest 100% after one year (July 27, 2010) Options replacing unvested shares subject to the old options - vest 50% after one year and 50% after two years (July 27, 2010 and July 27, 2011) Original Grant Date Expiration Date Exercise Price Per Share Shares Subject to Eligible Options Shares Vested Shares Unvested Exchange Ratio Replacement Options Total Vesting in One Year Vesting in Two Years 4/8/2004 4/8/2014 $17.60 1000 1000 0 11 to 1 90 90 0 5/2/2005 5/2/2015 $16.07 5000 4500 500 11 to 1 454 431 23 4/10/2006 4/10/2016 $17.87 8000 7250 750 11 to 1 727 693 34 11/15/2007 11/15/2014 $12.70 4000 2500 1500 5 to 1 800 650 150 2/15/2008 2/15/2015 $ 6.45 6000 1999 4001 1.5 to 1 4000 2667 1333 5/15/2008 5/15/2015 $ 7.41 4375 1458 2917 1.5 to 1 2916 1944 972 |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 13 Expiration Dates will not change Replacement options maintain the same expiration dates as the exchanged options Options expiring before the first replacement option vesting date (July 27, 2010) will not be eligible for exchange Original Grant Date Expiration Date Exercise Price Per Share Shares Subject to Eligible Options Shares Vested Shares Unvested Exchange Ratio Replacement Options Total Vesting in One Year Vesting in Two Years 4/8/2004 4/8/2014 $17.60 1000 1000 0 11 to 1 90 90 0 5/2/2005 5/2/2015 $16.07 5000 4500 500 11 to 1 454 431 23 4/10/2006 4/10/2016 $17.87 8000 7250 750 11 to 1 727 693 34 11/15/2007 11/15/2014 $12.70 4000 2500 1500 5 to 1 800 650 150 2/15/2008 2/15/2015 $ 6.45 6000 1999 4001 1.5 to 1 4000 2667 1333 5/15/2008 5/15/2015 $ 7.41 4375 1458 2917 1.5 to 1 2916 1944 972 |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 14 Grant-by-grant flexibility Employees can elect to exchange some eligible grants and not others, all eligible grants, or none at all Employees cannot elect to split a grant, exchanging some and retaining the other portion Original Grant Date Expiration Date Exercise Price Per Share Shares Subject to Eligible Options Shares Vested Shares Unvested Exchange Ratio Replacement Options Total Vesting in One Year Vesting in Two Years 4/8/2004 4/8/2014 $17.60 1000 1000 0 11 to 1 90 90 0 5/2/2005 5/2/2015 $16.07 5000 4500 500 11 to 1 454 431 23 4/10/2006 4/10/2016 $17.87 8000 7250 750 11 to 1 727 693 34 11/15/2007 11/15/2014 $12.70 4000 2500 1500 5 to 1 800 650 150 2/15/2008 2/15/2015 $ 6.45 6000 1999 4001 1.5 to 1 4000 2667 1333 5/15/2008 5/15/2015 $ 7.41 4375 1458 2917 1.5 to 1 2916 1944 972 |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 15 Participation is voluntary Nobody is required to participate in the stock option exchange |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 16 Process Overview |

| Stock

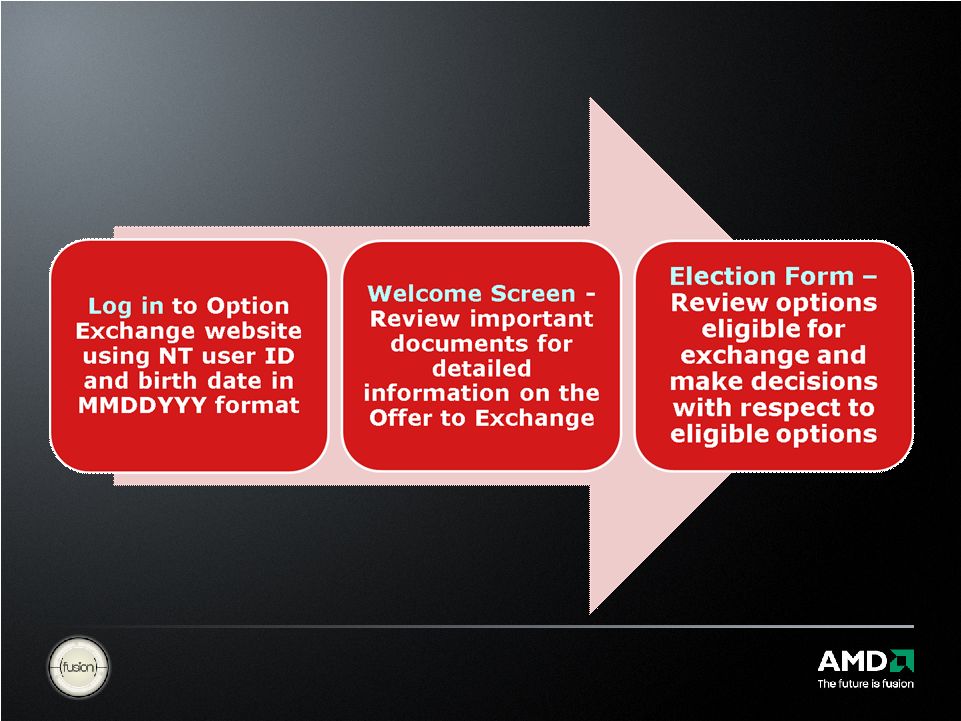

Option Exchange | June 29 – July 27, 2009 | Confidential 17 Process Overview– June 29 – July 27, 2009, 11:00 pm Central |

| Stock

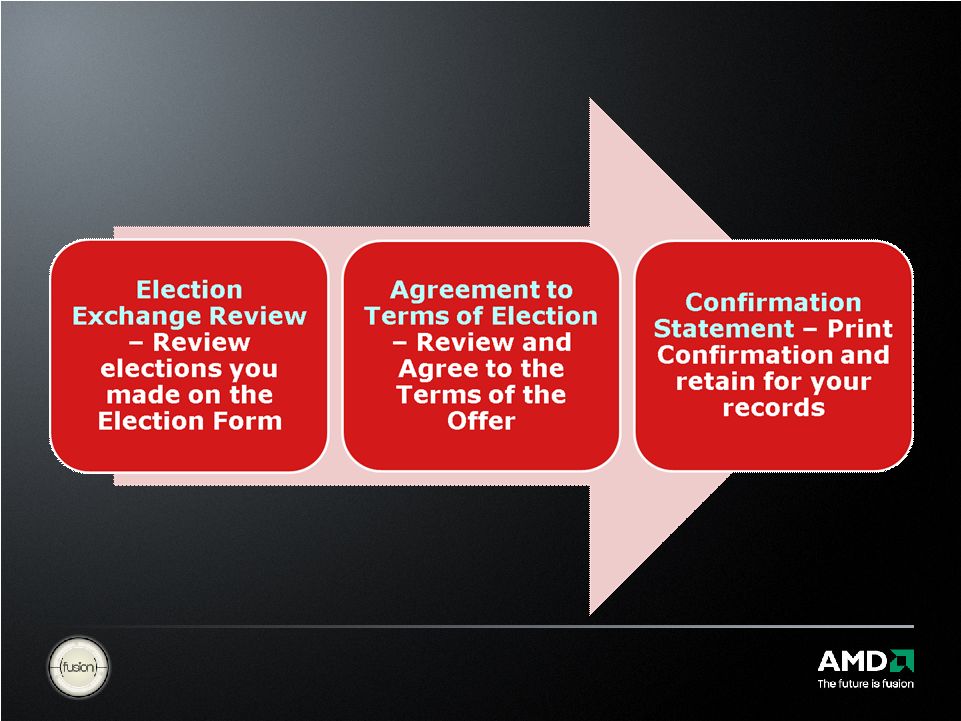

Option Exchange | June 29 – July 27, 2009 | Confidential 18 Process Overview, Continued |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 19 Tender Offer Tool Hints Navigation • Do not use your browser Back and Forward buttons – Use the navigation buttons built into the application Supported Browsers • Internet Explorer is the only “supported” browser. However, tests have shown that Firefox also works. Timeout • Your session will end with ten (10) minutes of inactivity – nothing is saved unless you complete the election process through to confirmation |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 20 Timeline |

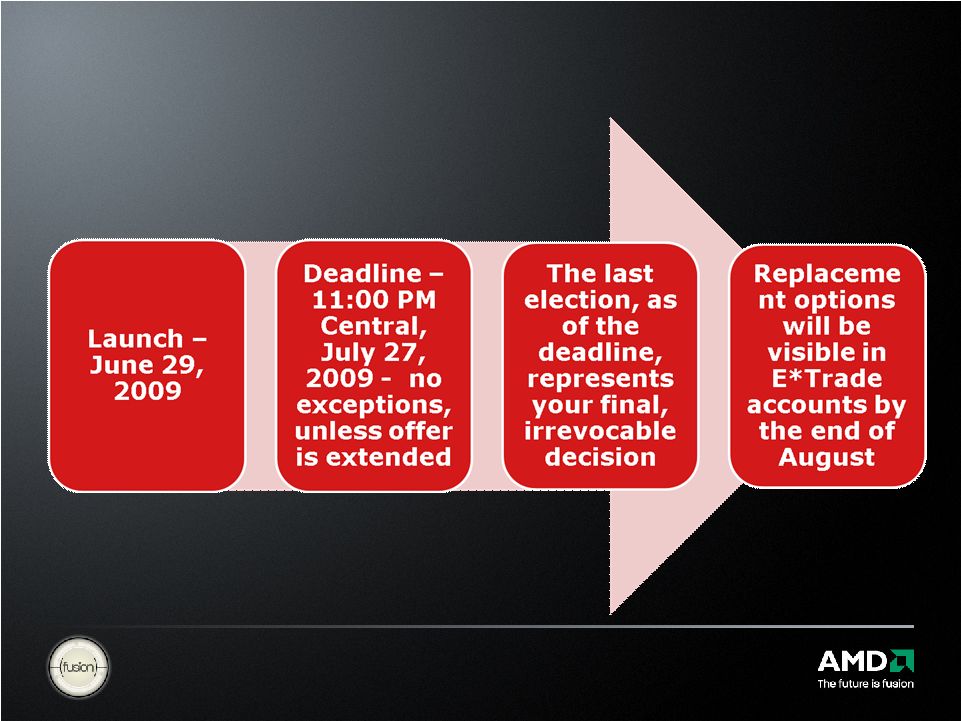

| Stock

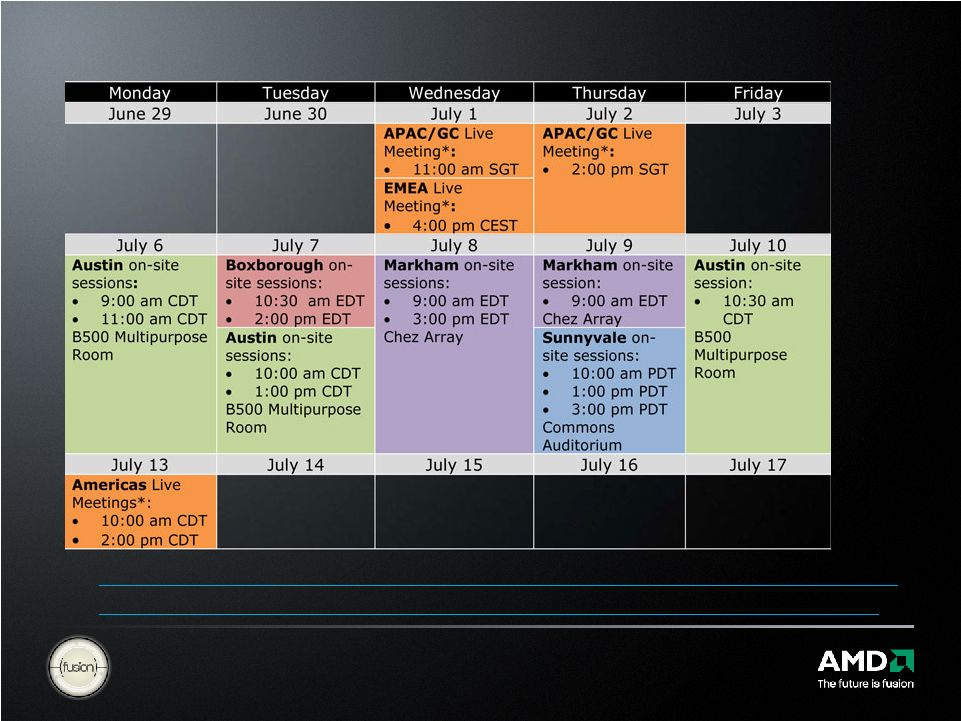

Option Exchange | June 29 – July 27, 2009 | Confidential 21 Timeline June 29, 2009 through July 27, 2009 at 11:00 pm Central |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 22 Where to go with questions |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 23 Questions Advice • AMD and/or any independent firms hired by AMD with respect to the offer cannot give legal, tax or investment advice with respect to the offer. You are being advised to consult with your own legal, tax and investment advisors as to the consequences of participating or not participating in the offer. Q&A • Please review the Q&A document accessible from the option exchange tool for common questions |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 24 Questions, continued Tender Offer (TO) Statement • Access the formal Schedule TO, filed with the SEC, from launch email Ask the Stock Administration Team – • Preferred approach - hrsc.stockadministration@amd.com • Alternative approach – leave a message on the Option Exchange Helpline – x51174 • We’re targeting a response time of within 24 hours. Depending on volume, the response may differ, especially the first and last weeks of the offer. |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 25 Employee Sessions http://amdcentral.amd.com/AboutAMD/NewsandEvents/InternalN ews/internalcorporatenews/Pages/StockOptionExchangeQA.aspx |

| Stock

Option Exchange | June 29 – July 27, 2009 | Confidential 26 Trademark Attribution AMD, the AMD Arrow logo and combinations thereof are trademarks of Advanced Micro Devices, Inc. in

the United States and/or other jurisdictions. Other names used in this presentation are

for identification purposes only and may be trademarks of their respective owners.

©2008 Advanced Micro Devices, Inc. All rights reserved.

|