UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

Filed by the Registrant x |

Filed by a Party other than the Registrant ¨ |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under Rule 14a-12 |

ADVANCED MICRO DEVICES, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

ADVANCED MICRO DEVICES, INC.

ONE AMD PLACE

P.O. BOX 3453

SUNNYVALE, CALIFORNIA 94088-3453

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

You are cordially invited to attend our 2015 annual meeting of stockholders (our “Annual Meeting”) to be held on Wednesday, April 29, 2015 at 10:00 a.m. Eastern Time at the Andaz Wall Street Hotel, 75 Wall Street, New York, New York 10005. We are holding our Annual Meeting to:

| • | Elect the 11 director nominees named in this proxy statement; |

| • | Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current fiscal year; |

| • | Approve the amendment and restatement of the Advanced Micro Devices, Inc. 2004 Equity Incentive Plan (as amended and restated, the “2004 Plan”) to: (i) increase the number of authorized shares that can be awarded to our employees, consultants and directors under the 2004 Plan by 20 million shares; (ii) increase the limits on the number of authorized shares that may be awarded to a service provider in a calendar year or during his or her initial 12 months of service; and (iii) require a one-year minimum vesting period for awards granted under the 2004 Plan, subject to limited exceptions. |

| • | Approve on a non-binding, advisory basis the compensation of our named executive officers, as disclosed in this proxy statement pursuant to the compensation disclosure rules of the U.S. Securities and Exchange Commission (the “SEC”); and |

| • | Transact any other business that properly comes before our Annual Meeting or any adjournment or postponement thereof. |

We are pleased to provide access to our proxy materials over the Internet under the SEC’s “notice and access” rules. As a result, we are mailing to our stockholders (other than those who previously requested printed or emailed materials on an ongoing basis) a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of printed copies of our proxy materials. The Notice contains instructions on how to access our proxy materials on the Internet, how to vote on the Internet and how you can receive printed or emailed copies of our proxy materials. We believe that providing our proxy materials over the Internet will lower our Annual Meeting’s cost and environmental impact, while increasing the ability of our stockholders to access the information that they need.

Stockholders of record at the close of business on March 2, 2015 and holders of proxies for those stockholders may attend and vote at our Annual Meeting. To attend our Annual Meeting in person, you must present valid photo identification, and, if you hold shares through a broker, bank, trustee or nominee (i.e., in street name), you must also present a letter from your broker or other nominee showing that you were the beneficial owner of the shares on March 2, 2015.

This year, we are also pleased to offer a virtual annual meeting at which our stockholders can view our Annual Meeting at www.virtualshareholdermeeting.com/AMD15. Stockholders at the close of business on March 2, 2015 may also ask questions and vote at our Annual Meeting via the Internet. We hope this will allow our stockholders who are unable to attend our Annual Meeting in person to participate in our Annual Meeting.

Sincerely,

HARRY A. WOLIN

Senior Vice President, General Counsel & Secretary

This notice of annual meeting and proxy statement are dated March 12, 2015 and will first be distributed and made available to the stockholders of Advanced Micro Devices, Inc. on or about March 18, 2015.

YOUR VOTE IS IMPORTANT AND WE ENCOURAGE YOU TO VOTE PROMPTLY

Important notice regarding Internet availability of proxy materials: This proxy statement and our

Annual Report on Form 10-K for the fiscal year ended December 27, 2014 are available at

www.proxyvote.com and on the Investor Relations pages of our Web site at www.amd.com or ir.amd.com.

| Page | ||||

| 1 | ||||

| 7 | ||||

| 7 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 21 | ||||

| 26 | ||||

| 27 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 34 | ||||

| 38 | ||||

| Response to 2014 Stockholder Vote and Stockholder Engagement Process |

39 | |||

| Compensation Philosophy, Practices and Program Design Inputs |

39 | |||

| Change in Control Agreements and Other Change in Control Arrangements |

55 | |||

| 56 | ||||

| 56 | ||||

| 57 | ||||

| 58 | ||||

| 59 | ||||

| 60 | ||||

| 60 | ||||

| 62 | ||||

| 64 | ||||

| Page | ||||

| 67 | ||||

| 69 | ||||

| 69 | ||||

| 76 | ||||

| 78 | ||||

| ITEM 2—RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

79 | |||

| 79 | ||||

| 79 | ||||

| 80 | ||||

| 80 | ||||

| ITEM 3—APPROVAL OF THE AMENDMENT AND RESTATEMENT OF THE 2004 EQUITY INCENTIVE PLAN |

81 | |||

| Why the Board is Seeking Approval of the Amended and Restated 2004 Plan |

81 | |||

| 82 | ||||

| 82 | ||||

| 83 | ||||

| 84 | ||||

| 87 | ||||

| 88 | ||||

| 90 | ||||

| 90 | ||||

| 92 | ||||

| 92 | ||||

| 92 | ||||

| 93 | ||||

| 94 | ||||

| 94 | ||||

| 95 | ||||

| 95 | ||||

| EXHIBIT A—AMENDED AND RESTATED ADVANCED MICRO DEVICES, INC. 2004 EQUITY INCENTIVE PLAN |

||||

In this proxy statement, the words “AMD,” the “Company,” “we,” “ours,” “us” and similar terms refer to Advanced Micro Devices, Inc. and its consolidated subsidiaries, unless the context indicates otherwise.

ADVANCED MICRO DEVICES, INC.

PROXY STATEMENT

2015 ANNUAL MEETING OF STOCKHOLDERS

| 1. | Q: | WHY DID I RECEIVE A NOTICE IN THE MAIL REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS INSTEAD OF A FULL SET OF PROXY MATERIALS? | ||||

| A: | In accordance with rules adopted by the SEC, commonly referred to as “Notice and Access,” we may furnish proxy materials by providing access to the documents on the Internet, instead of mailing printed copies. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice was mailed on or about March 18, 2015 to stockholders of record on March 2, 2015 who have not previously requested to receive printed or emailed materials on an ongoing basis. The Notice instructs you as to how you may access our proxy materials on the Internet and how to vote on the Internet. | |||||

| You may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis by following the instructions in the Notice. Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you and will reduce the environmental impact of our annual meetings. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

| ||||||

| 2. | Q: | WHY AM I RECEIVING THESE MATERIALS? | ||||

| A: | Our board of directors (the “Board”) is providing these materials to you in connection with the Board’s solicitation of proxies for use at our Annual Meeting, which will take place on Wednesday, April 29, 2015 at 10:00 a.m. Eastern Time at the Andaz Wall Street Hotel, 75 Wall Street, New York, New York 10005. Our stockholders as of the close of business on March 2, 2015, the record date for our Annual Meeting, are invited to attend our Annual Meeting and are requested to vote on the items described in this proxy statement. This proxy statement includes information that we are required to provide you under SEC rules and is designed to assist you in voting your shares.

| |||||

| 3. | Q: | WHAT IS INCLUDED IN THE PROXY MATERIALS? | ||||

| A: | The proxy materials for our Annual Meeting include the Notice, this proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 27, 2014 (our “Annual Report”). If you received a printed copy of these materials, the proxy materials also include a proxy card or voting instruction form.

| |||||

| 4. | Q: | WHO IS SOLICITING MY VOTE? | ||||

| A: | This proxy solicitation is being made by the Board of Advanced Micro Devices, Inc. We have retained MacKenzie Partners, Inc., professional proxy solicitors, to assist us with this proxy solicitation. We will pay the entire cost of this solicitation, including MacKenzie’s fees and expenses, which we expect to be approximately $30,000. | |||||

1

| 5. | Q: | HOW CAN I ACCESS THE PROXY MATERIALS OVER THE INTERNET? | ||||

| A: | The Notice, proxy card and voting instruction form contain instructions on how you may access our proxy materials on the Internet and how to vote on the Internet. Our proxy materials are also available at www.proxyvote.com and the Investor Relations pages of our Web site at www.amd.com or ir.amd.com.

| |||||

| 6. | Q: | WHAT AM I BEING ASKED TO VOTE ON? | ||||

| A: | You may vote on: | |||||

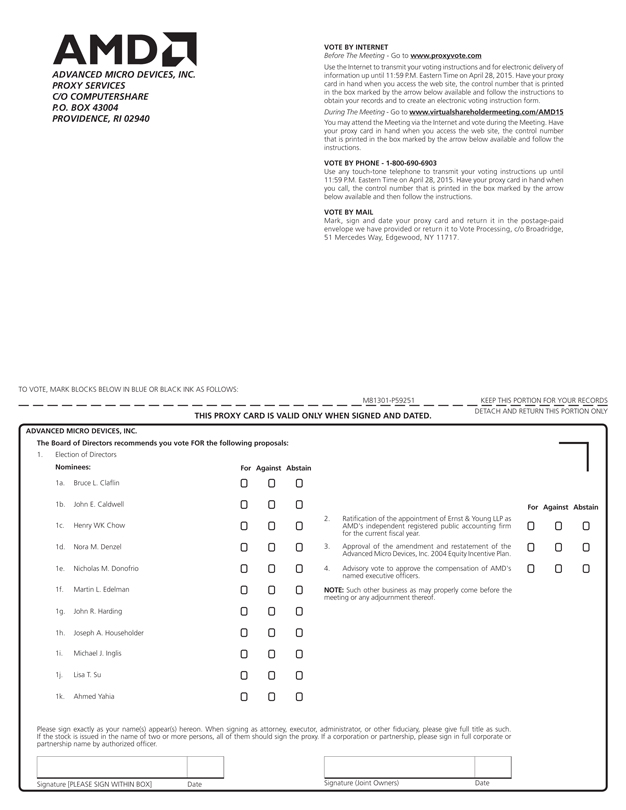

| • | Proposal 1: Election of the 11 director nominees named in this proxy statement. | |||||

| • | Proposal 2: Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current fiscal year. | |||||

| • | Proposal 3: Approval of the amendment and restatement of the 2004 Plan to: (i) increase the number of authorized shares that can be awarded to our employees, consultants and directors under the 2004 Plan by 20 million shares; (ii) increase the limits on the number of authorized shares that may be awarded to a service provider in a calendar year or during his or her initial 12 months of service; and (iii) require a one-year minimum vesting period for awards granted under the 2004 Plan, subject to limited exceptions. | |||||

| • | Proposal 4: Approval on a non-binding, advisory basis of the compensation of our named executive officers, as disclosed in this proxy statement pursuant to the compensation disclosure rules of the SEC (Proposal 4 is referred to in this proxy statement as the “Say-On-Pay” proposal). | |||||

| • | Such other business as may properly come before our Annual Meeting or any adjournment or postponement of our Annual Meeting.

| |||||

| 7. | Q: | HOW DOES THE BOARD RECOMMEND I VOTE ON THE PROPOSALS? | ||||

| A: | The Board recommends that you vote: | |||||

| • | FOR each of the 11 director nominees named in this proxy statement. | |||||

| • | FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current fiscal year. | |||||

| • | FOR the approval of the amendment and restatement of the 2004 Plan. | |||||

| • | FOR the Say-On-Pay proposal.

| |||||

| 8. | Q: | WHO IS ENTITLED TO VOTE? | ||||

| A: | Stockholders as of the close of business on March 2, 2015, the record date for our Annual Meeting, are entitled to vote on all items properly presented at our Annual Meeting. On the record date, 777,735,008 shares of our common stock were outstanding. Every stockholder is entitled to one vote for each share of common stock held on the record date. A list of these stockholders will be available during regular business hours at our headquarters, located at One AMD Place, Sunnyvale, California 94088, from our Secretary at least ten days before our Annual Meeting. The list of stockholders will also be available at the time and place of our Annual Meeting.

| |||||

| 9. | Q: | WHAT IS THE DIFFERENCE BETWEEN HOLDING SHARES AS A STOCKHOLDER OF RECORD AND AS A BENEFICIAL OWNER? | ||||

| A: | Most of our stockholders hold their shares as a beneficial owner through a broker or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially. | |||||

2

| Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered, with respect to those shares, the stockholder of record, and the Notice was sent directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to AMD or to vote at our Annual Meeting. If you requested to receive printed proxy materials, we have enclosed a proxy card for you to use, as described in the Notice and under Question 10 below. You may also vote on the Internet, as described in the Notice and under Question 10 below. You are also invited to attend our Annual Meeting in person or via the Internet.

Beneficial Owner. If your shares are held in an account at a brokerage firm, bank, broker-dealer, trust or other similar organization (i.e., in street name), like the vast majority of our stockholders, you are considered the beneficial owner of shares held in street name, and the Notice should be forwarded to you by that organization. As the beneficial owner, you have the right to direct your broker or other nominee how to vote your shares, and you are also invited to attend our Annual Meeting in person or via the Internet, as described in the Notice and under Question 12 below. You may not vote your shares in person at our Annual Meeting unless you obtain a “legal proxy” from the broker or other nominee that holds your shares giving you the right to vote the shares at our Annual Meeting and a letter from your broker or other nominee showing that you were the beneficial owner of your shares on March 2, 2015.

| ||||||

| 10. | Q: | WHO CAN ATTEND THE ANNUAL MEETING? CAN I VOTE AT THE ANNUAL MEETING? CAN I ATTEND THE ANNUAL MEETING VIA THE INTERNET? | ||||

| A: | You can attend our Annual Meeting in person or you can attend and participate via the Internet. | |||||

| Attending in Person. Only stockholders as of the close of business on March 2, 2015 (the record date for our Annual Meeting), holders of valid proxies for those stockholders and other persons invited by us can attend our Annual Meeting in person. To attend our Annual Meeting in person, you must present valid photo identification, such as a driver’s license or passport, and, if you were a beneficial owner you must also present a letter from your broker or other nominee showing that you were the beneficial owner of the shares on March 2, 2015. If you were a stockholder of record on March 2, 2015, you may vote your shares in person at our Annual Meeting. If you were a beneficial owner on March 2, 2015, you must also bring a legal proxy from your broker or other nominee to vote your shares in person at our Annual Meeting. | ||||||

| Attending and Participating via the Internet. Stockholders may also attend our Annual Meeting via the Internet at www.virtualshareholdermeeting.com/AMD15. Stockholders of record and beneficial owners as of the close of business on March 2, 2015 may also submit questions and vote while attending the meeting via the Internet. Instructions on how to attend and participate at our Annual Meeting via the Internet are posted at www.virtualshareholdermeeting.com/AMD15. To demonstrate proof of stock ownership, you will need to enter the 12-digit control number received with your Notice or proxy materials to submit questions and vote at our Annual Meeting via the Internet. We have retained Broadridge Financial Solutions to host our virtual annual meeting and to distribute, receive, count and tabulate proxies. On the day of our Annual Meeting, Broadridge may be contacted at 1-955-449-0991, and will be available to answer your questions regarding how to attend and participate at our Annual Meeting via the Internet.

| ||||||

| 11. | Q: | IF I AM A STOCKHOLDER OF RECORD, HOW DO I VOTE? | ||||

| A: | If you are a stockholder of record you may vote by proxy. You can vote by proxy over the Internet by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can vote by mail, telephone (from the United States and Canada) or the Internet pursuant to instructions provided on the proxy card provided to you with your printed proxy materials. | |||||

3

| You may also vote in person at our Annual Meeting. A ballot will be given to you upon request when you arrive at our Annual Meeting. You may also vote while attending our Annual Meeting via the Internet, as described in Question 10 above. Even if you plan to attend our Annual Meeting, we recommend that you also submit your proxy as described above so that your vote will be counted if you later decide not to attend our Annual Meeting.

| ||||||

| 12. | Q: | IF I AM A BENEFICIAL OWNER, HOW DO I VOTE? | ||||

| A: | If you are a beneficial owner, you may submit your voting instructions over the Internet by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can submit your voting instructions by following the instructions in the voting instruction form provided to you by your broker or other nominee. We urge you to instruct your broker or other nominee how to vote on your behalf. As described more fully under Question 14, your broker or other nominee cannot vote on certain items without your instructions. | |||||

| Alternatively, you can vote in person at our Annual Meeting, but you must bring to our Annual Meeting a legal proxy from your broker or other nominee as the record holder and a letter from your broker or other nominee showing that you were the beneficial owner of your shares on March 2, 2015. You may also vote while attending our Annual Meeting via the Internet, as described in Question 10 above. Even if you plan to attend our Annual Meeting, we recommend that you also submit your voting instructions as described above so that your vote will be counted if you later decide not to attend our Annual Meeting.

| ||||||

| 13. | Q: | WHAT IF I AM A STOCKHOLDER OF RECORD AND DO NOT SPECIFY A CHOICE FOR A MATTER WHEN RETURNING A PROXY CARD OR VOTING BY TELEPHONE OR THE INTERNET? | ||||

| A: | If you are a stockholder of record and you return a properly executed proxy card or vote by proxy over the Internet but do not mark the boxes showing how you wish to vote, your shares will be voted in accordance with the recommendations of the Board, as specified in Question 7 above. With respect to any other matter that properly comes before our Annual Meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, at their own discretion.

| |||||

| 14. | Q: | WHAT IF I AM A BENEFICIAL OWNER AND DO NOT GIVE VOTING INSTRUCTIONS TO MY BROKER OR OTHER NOMINEE? WHAT IS A BROKER NON-VOTE? | ||||

| A: | As a beneficial owner, in order to ensure your shares are voted, you must provide voting instructions to your broker or other nominee by the deadline provided in the materials you receive from your broker or other nominee. If you do not provide voting instructions to your broker or other nominee, whether your shares can be voted by such person depends on the type of item being considered for vote. | |||||

| Non-Discretionary Items. The election of directors, the amendment and restatement of the 2004 Plan and the Say-on-Pay proposal are non-discretionary items and may not be voted on by brokers or other nominees who have not received specific voting instructions from beneficial owners. A broker non-vote occurs when your broker or other nominee has not received instructions from you as to how to vote your shares on a proposal and does not have discretionary authority to vote your shares on that proposal. | ||||||

| Discretionary Items. The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current fiscal year is a discretionary item. Generally, brokers and other nominees that do not receive voting instructions from beneficial owners may vote on this proposal in their discretion. | ||||||

4

| 15. | Q: | CAN I CHANGE MY VOTE AFTER I HAVE VOTED? | ||||

| A: | Yes. You may change your vote at any time before the voting concludes at our Annual Meeting. You may vote by proxy again on the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to our Annual Meeting will be counted), by signing and returning a new proxy card with a later date or by attending our Annual Meeting and voting in person or via the Internet. However, your attendance at our Annual Meeting in person or via the Internet will not automatically revoke your proxy unless you vote again at our Annual Meeting or specifically request in writing that your prior proxy be revoked.

| |||||

| 16. | Q: | WHAT IS A “QUORUM”? | ||||

| A: | For the purposes of our Annual Meeting, a “quorum” is the presence, in person or by proxy, by the holders of a majority of the voting power of the outstanding shares entitled to vote at our Annual Meeting. There must be a quorum for our Annual Meeting to be held. Both abstentions and broker non-votes are counted for the purpose of determining the presence of a quorum.

| |||||

| 17. | Q: | WHAT IS THE REQUIRED VOTE FOR EACH PROPOSAL? | ||||

| A: | Election of Directors. Each of the 11 director nominees will be elected if each of them receives the affirmative vote of a majority of the votes cast. A majority of the votes cast means that the number of votes cast “for” a director must exceed the number of votes cast “against” that director. Abstentions and broker non-votes will have no effect on the outcome of these elections. Each director nominee has submitted a written resignation that will be effective if he or she does not receive a majority of the votes cast for such director and the resignation is accepted by the Nominating and Corporate Governance Committee, another authorized committee of the Board or the Board. | |||||

| Ratification of the Appointment of our Independent Registered Public Accounting Firm. Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm requires the affirmative vote of a majority of the shares of our common stock entitled to vote and present in person or represented by proxy at the Annual Meeting. Abstentions have the same effect as a vote against this proposal. Because brokers and other nominees have discretionary authority to vote on the ratification, we do not expect any broker non-votes in connection with this item. | ||||||

| Amendment and Restatement of the 2004 Plan. The proposal to amend and restate the 2004 Plan requires the affirmative vote of a majority of the shares of our common stock entitled to vote and present in person or represented by proxy at the Annual Meeting. Abstentions have the same effect as a vote against this proposal. Broker non-votes will have no effect on the outcome of this proposal. | ||||||

| Say-On-Pay Proposal. Approval, on an advisory basis, of the compensation of our named executive officers as disclosed in this proxy statement pursuant to the compensation disclosure rules of the SEC, requires the affirmative vote of a majority of the shares of our common stock entitled to vote and present in person or represented by proxy at the Annual Meeting. Because your vote is advisory, it will not be binding on the Board, the Compensation Committee or us. However, the Board and the Compensation Committee will review the voting results and take them into consideration when making future decisions about our executive compensation program. Abstentions have the same effect as a vote against this proposal. Broker non-votes will have no effect on the outcome of this proposal.

| ||||||

| 18. | Q: | WHERE CAN I FIND THE VOTING RESULTS OF THE ANNUAL MEETING? | ||||

| A: | We will announce preliminary voting results at our Annual Meeting and publish voting results in a Current Report on Form 8-K, which will be filed with the SEC within four business days after our Annual Meeting. If the official results are not available at that time, we will provide preliminary voting results in the Form 8-K and the final voting results in an amendment to the Form 8-K as soon as they become available. | |||||

5

| 19. | Q: | IS MY VOTE CONFIDENTIAL? | ||||

| A: | Proxy cards, ballots and voting tabulations that identify individual stockholders are mailed or returned directly to Broadridge and handled in a manner that protects your voting privacy. Your vote will not be disclosed except as needed to permit Broadridge to tabulate and certify the vote and as required by law. However, comments written on the proxy card may be forwarded to management. In that case, your identity may not be kept confidential.

| |||||

| 20. | Q: | HOW WILL VOTING ON ANY BUSINESS NOT DESCRIBED IN THIS PROXY STATEMENT BE CONDUCTED? | ||||

| A: | We do not know of any business to be considered at our Annual Meeting other than the items described in this proxy statement. If any other business is presented at our Annual Meeting, your proxy gives authority to each of Dr. Lisa T. Su, our President and Chief Executive Officer, and Harry A. Wolin, our Senior Vice President, General Counsel and Secretary, to vote on such matters at his or her discretion.

| |||||

| 21. | Q: | WHEN ARE THE STOCKHOLDER PROPOSALS FOR THE 2016 ANNUAL MEETING DUE? | ||||

| A: | For stockholder proposals to be considered for inclusion in the proxy statement for our 2016 annual meeting of stockholders, they must be submitted in writing to Advanced Micro Devices, Inc., One AMD Place, Sunnyvale, California 94088, Attention: Secretary and received by us on or before November 19, 2015. In addition, for directors to be nominated or other stockholder proposals to be properly presented at our 2016 annual meeting of stockholders (but not included in our proxy materials), a separate notice of any nomination or proposal must be received by us between December 31, 2015 and January 30, 2016. If our 2016 annual meeting of stockholders is not held within 30 days of April 29, 2016, to be timely, the stockholder’s notice must be received by us no later than the close of business on the tenth day following the earlier of the day on which the first public announcement of the date of 2015 annual meeting of stockholders was made or the notice of our 2015 annual meeting of stockholders is mailed. The public announcement of an adjournment or postponement of our 2015 annual meeting of stockholders will not trigger a new time period (or extend any time period) for the giving of a stockholder’s notice as described in this proxy statement. More information about the notice period and information required to be included in a stockholder’s notice of a nomination is included under “Consideration of Stockholder Nominees for Director” below.

| |||||

| 22. | Q: | WHAT IS HOUSEHOLDING AND HOW DO I OBTAIN A SEPARATE SET OF PROXY MATERIALS IF I SHARE AN ADDRESS WITH OTHER STOCKHOLDERS? | ||||

| A: | We have adopted a procedure called “householding,” which has been approved by the SEC. Under this procedure, we will deliver only one copy of the Notice and, if applicable, our printed proxy materials to stockholders of record who share the same address (if they appear to be members of the same family) unless we have received contrary instructions from an affected stockholder. A separate proxy card for each stockholder of record will be included in the printed materials. This procedure reduces our printing costs, mailing costs and fees. Upon written or oral request, we will promptly deliver a separate copy of the Notice or, if applicable, the printed proxy materials to any stockholder at a shared address to which a single copy of any of those documents was delivered. To receive a separate copy of the Notice or Annual Report or, if applicable, the printed proxy materials, contact us at (408) 749-4000 or at Advanced Micro Devices, Inc., One AMD Place, Sunnyvale, California 94088, Attention: Secretary, or by email to Corporate.Secretary@amd.com. If you would like to revoke your householding consent or you are a stockholder eligible for householding and would like to participate in householding, please contact Broadridge at 1-800-542-1061. | |||||

| A number of brokerage firms have instituted householding. If you are a beneficial owner, please contact your broker or other nominee to request information about householding. | ||||||

6

Our Board currently consists of 12 members: Mr. Bruce L. Claflin, Dr. W. Michael Barnes, Mr. John E. Caldwell, Mr. Henry WK Chow, Ms. Nora Denzel, Mr. Nicholas M. Donofrio, Mr. Martin L Edelman, Mr. John R. Harding, Mr. Joseph A. Householder, Mr. Michael J. Inglis, Dr. Lisa T. Su and Mr. Ahmed Yahia. Dr. Barnes will retire at the end of his current term and will not stand for re-election at our Annual Meeting. We expect the Board to reduce the size of the Board to 11 members following the Annual meeting. Proxies cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement.

The Nominating and Corporate Governance Committee of the Board selected, and the Board approved, the remaining 11 current members of our Board as nominees for election to the Board at the Annual Meeting. All directors are elected annually and serve a one-year term until our next annual meeting or until such director’s success.

Mr. Edelman was first appointed to the Board on February 22, 2013, pursuant to our agreement with Mubadala Technology Investments LLC, formerly known as Advanced Technology Investment Corporation (“Mubadala Tech”), and West Coast Hitech L.P. (“WCH”), which provides that until such time as WCH and its permitted transferees beneficially own, in the aggregate, less than 10% of the outstanding shares of our common stock, WCH has the right to designate a representative to our Board. Mr. Householder was first appointed to the Board on September 15, 2014 and was recommended as a potential candidate for the Board by a third-party search firm. On October 8, 2014, Dr. Su was appointed to the Board in connection with her appointment as our President and Chief Executive Officer, succeeding Mr. Rory P. Read, our former President and Chief Executive Officer and member of the Board.

The Board expects all nominees named below to be available for election. If a nominee declines or is unable to act as a director, your proxy may vote for any substitute nominee proposed by the Board. Your proxy will vote for the election of these nominees, unless you instruct otherwise.

Directors are strongly encouraged to attend annual meetings of our stockholders. All of the director nominees were present at our 2014 annual meeting of stockholders except Dr. Su and Mr. Householder, who were appointed to the Board after the 2014 annual meeting, and Mr. Edelman.

Director Experience, Skills and Qualifications

Our goal is to assemble a Board that operates cohesively and works with management in a constructive way to deliver long-term value to our stockholders. We believe that the nominees set forth below, all of whom are currently directors of AMD, possess valuable experience necessary to guide us in the best interests of our stockholders. Our current Board consists of individuals with proven records of success in their chosen professions. They possess the highest integrity and a keen intellect. They are collegial, yet independent in their thinking, and are committed to the hard work necessary to be informed about the semiconductor industry, us and our key constituents, including our customers, stockholders and management. Most of our directors have broad technology sector experience, including expertise in semiconductor technology, innovation and strategy. Several members of the Board are current or former chief executive officers, thereby providing the Board with practical understanding of how large organizations operate, including the importance of employee development and retention. They also understand strategy and risk management and how these factors impact our operations.

Certain information regarding each of the nominees is set forth below, including his or her experience, qualifications, attributes and skills that led the Nominating and Corporate Governance Committee and the Board to conclude that the individual should serve as a director on the Board, as well as his or her principal occupation and directorships during the past five years. The age of each director is as of our Annual Meeting.

7

| Bruce L. Claflin Director since August 2003 and Chairman of the Board since March 2009 Age: 63 Board Committee: Nominating and Corporate Governance Committee (Chair)

|

Mr. Claflin served as President, Chief Executive Officer and a member of the board of directors of 3Com Corporation (a voice and data networking products and services provider) from January 2001 until his retirement in 2006. He joined 3Com as President and Chief Operating Officer in August 1998. Prior to 3Com, Mr. Claflin worked at Digital Equipment Corporation (a computer systems vendor) as Executive Vice President, Sales and as General Manager of the PC Business Unit. Mr. Claflin also worked at International Business Machines Corporation (“IBM”) for 22 years, where he held various senior management positions of increasing responsibility and was responsible for almost every operation of the global, high tech company, including sales, marketing, research and development and manufacturing. Also, while employed by IBM, Mr. Claflin lived and worked in Hong Kong and Tokyo and was responsible for IBM’s Asia/South Pacific Area, and, while employed by 3Com, Mr. Claflin established a joint venture in China in partnership with a leading Chinese global telecom solutions provider. Mr. Claflin was first appointed as our Chairman of the Board in March 2009 and was appointed as our non-employee Executive Chairman of the Board in January 2011. He held that position until August 2011, when he resumed acting as our Chairman of the Board. He has been a member of the board of directors of Ciena Corporation since 2006. He is also founder, director and President of Kids First! (a U.S. Virgin Islands non-profit corporation). Mr. Claflin holds a bachelor of arts degree in political science from Pennsylvania State University.

Director Qualifications: Mr. Claflin brings to the Board extensive experience in the IT industry, having held a wide range of senior operating and executive positions at large IT providers. Mr. Claflin has run large PC operations and has extensive global experience, particularly in China, which is our largest single market. As a former chief executive, he is familiar with the challenges faced by our senior management, and as a director of a major telecommunications company, he has insights into a segment of the IT industry that strongly influences how technology is used.

| John E. Caldwell Director since October 2006 Age: 65 Board Committees: Compensation Committee (Chair) and Nominating and Corporate Governance Committee

|

Mr. Caldwell served as President and Chief Executive Officer of SMTC Corporation (an electronics manufacturing services company) from March 2003 until he retired in March 2011. Before joining SMTC, Mr. Caldwell served as chair of the restructuring committee of the board of directors of The Mosaic Group (a marketing services provider) from October 2002 to September 2003, as President and Chief Executive Officer of GEAC Computer Corporation, Ltd. (a computer software company) from October 2000 to December 2001 and as President and Chief Executive Officer of CAE Inc. (a simulation technologies and integrated training solutions provider for the civil aviation and defense industries) from June 1993 to October 1999. In addition, Mr. Caldwell has served in a variety of senior executive positions in finance, including Senior Vice President of Finance and Corporate Affairs of CAE and Executive Vice President of Finance and Administration of Carling O’Keefe Breweries of Canada. Over the course of his career, Mr. Caldwell has served on the audit committees of ten public companies. Mr. Caldwell has been a director of Faro Technologies, Inc. since 2002 and of IAMGOLD Corporation since 2006. Mr. Caldwell also served on the board of directors of SMTC from 2003 to March 2011. Mr. Caldwell holds a bachelor of commerce degree from Carleton University, Ontario, and is a chartered professional accountant with the Chartered Professional Accountants of Ontario. Mr. Caldwell is an author and lecturer on the subject of board oversight of enterprise risk.

Director Qualifications: Mr. Caldwell brings to the Board extensive and diversified general management, financial management and risk assessment experience as a result of his experience at SMTC, his other executive management experience and his service as a director on the boards of directors of other public companies.

8

| Henry WK Chow Director since February 2011 Age: 69 Board Committees: Audit and Finance Committee and Nominating and Corporate Governance Committee

|

Mr. Chow acted as a corporate business advisor to IBM from July 2009 through August 2011. Prior to this role, during his 41-year career at IBM, Mr. Chow held a variety of management positions in the services, systems engineering, sales and marketing and human resources divisions across IBM’s Asia Pacific operations, including as Chairman of IBM’s Greater China Group from January 2007 until June 2009 and as General Manager of IBM’s Greater China Group from 1995 until January 2008, where he was responsible for IBM’s operations in China, Hong Kong and Taiwan. Prior to serving in these positions, Mr. Chow served in a variety of general management positions, including General Manager of IBM China Company Limited and General Manager of IBM PC Company, Asia Pacific South. From 2005 until 2009, Mr. Chow served as an observer for IBM at meetings of the board of directors of Lenovo Group Limited, which acquired IBM’s PC business in 2005. Mr. Chow has been a member of the board of directors of Trina Solar Limited since July 2012. In addition, Mr. Chow has been Vice Chairman of the Advisory Board for Guangtong International Clinical Research Center (a government-owned research center) since September 2011 and a member of the European Advisory Committee for Bridgepoint (a private equity firm) since October 2011. Mr. Chow completed a one-year fellowship in Advanced Leadership Initiative at Harvard University and holds a bachelor of science degree in electrical engineering from the University of Hong Kong.

Director Qualifications: Mr. Chow brings to the Board his extensive experience and insight in operating a technology business in the Asia Pacific region, a strategic market for us, as well as his significant expertise in general management and operations.

| Nora M. Denzel Director since March 2014 Age: 52 Board Committees: Compensation Committee and Nominating and Corporate Governance Committee

|

Ms. Denzel has served as the interim Chief Executive Officer of Outerwall Inc. (an automated retail solutions provider) since January 2015. Ms. Denzel held various executive management positions from February 2008 through August 2012 at Intuit Inc. (a cloud financial management software company), including Senior Vice President of Big Data, Social Design and Marketing and Senior Vice President and General Manager of the QuickBooks Employee Management business unit. From 2000 to 2006, Ms. Denzel held several executive level positions at Hewlett-Packard Company (a technology software, services and hardware provider), including Senior Vice President and General Manager Software Global Business Unit from May 2002 to February 2006 and Vice President of Storage Organization from August 2000 to May 2002. Prior to Hewlett-Packard, Ms. Denzel held executive positions at Legato Systems Inc. (a data storage management software company purchased by EMC) and IBM. Ms. Denzel has served as a member of the board of directors of Saba Software, Inc. since November 2011, Ericsson since March 2013 and Outerwall Inc. since March 2013. Ms. Denzel also served on the board of directors of Overland Storage Inc. from 2008 until February 2013. Ms. Denzel also serves on the board of directors of FirstRain (a private company). She holds a master of business administration degree from Santa Clara University and a bachelor of science degree in computer science from the State University of New York.

Director Qualifications: Ms. Denzel brings to the Board more than 25 years of technology, software and leadership experience as a result of her experience at Intuit, Hewlett-Packard and IBM and her experience on the boards of directors of other public companies.

9

| Nicholas M. Donofrio Director since November 2009 Age: 69 Board Committees: Compensation Committee, Innovation and Technology Committee (Chair) and Nominating and Corporate Governance Committee

|

Mr. Donofrio held a variety of executive and technical management positions during his 44-year career at IBM in its server, advanced workstations, personal computing, manufacturing and semiconductor development divisions, including as Senior Vice President, Technology and Manufacturing from 1997 to 2005 and as Executive Vice President, Innovation and Technology from 2005 until his retirement in September 2008. Mr. Donofrio holds seven technology patents and is a member of numerous technical and science honor societies. He is a fellow of the Institute for Electrical and Electronics Engineers, the UK-based Royal Academy of Engineering and the American Academy of Arts and Sciences. He also serves as chairman of the New York Youth Hall of Science, Syracuse University and The MITRE Corporation (a non-profit organization), and serves on the advisory boards of the Secretary of Energy, Pennsylvania State University’s School of International Affairs and the Workforce Opportunity Services Academic Advisory Board. Mr. Donofrio is also a member of the U.S.-based National Academy of Engineering. Mr. Donofrio is the recipient of numerous awards. For example, in 2006, he was named among Business Week magazine’s 25 Top Innovation Champions, and in 2008 was awarded the Renaissance Engineer Award by the Society of Hispanic Professional Engineers for his commitment and promotion of Science, Technology, Engineering and Mathematics for the U.S. Hispanic Community. In 2003, he received the Rodney D. Chipp Memorial Award by the Society of Women Engineers for his contributions to the advancement of women in the engineering field. In addition to being on the board of several private companies, including Liberty Mutual Holding Company Inc. and Sproxil, Inc., Mr. Donofrio has been a director of The Bank of New York Mellon Corporation since 1998 and a director of Delphi Automotive PLC since 2009. Mr. Donofrio has a bachelor of science degree in electrical engineering from Rensselaer Polytechnic Institute and a master of science in the same discipline from Syracuse University.

Director Qualifications: Mr. Donofrio brings to the Board significant expertise in the areas of semiconductor technology and manufacturing, system design and integration, and is able to provide us with valuable insight and guidance regarding technological and innovation strategies as well as the development and retention of our technical employee population.

| Martin L. Edelman Director since February 2013 Age: 73

|

Mr. Edelman has served as Of Counsel to Paul, Hastings, Janofsky & Walker LLP (a law firm) since 2000. Mr. Edelman was a partner with Battle Fowler LLP (a law firm), which merged with Paul, Hastings, Janofsky & Walker, LLP, from 1972 to 1993 and was Of Counsel to Battle Fowler LLP from 1994 to 2000. In addition, Mr. Edelman is a senior advisor to Mubadala Development Company PJSC (a strategic investment and development company headquartered in the Emirate of Abu Dhabi, “Mubadala”). In addition to serving on the boards of several private corporations and charitable entities, Mr. Edelman served as a member of the board of directors of Ashford Hospitality Trust Inc. from 2003 until 2014 and Blackstone Mortgage Trust, Inc. since 1997. He also served on the board of directors of Avis Budget Group, Inc. from 1997 until March 2013 and is currently on the board of Morgans Hotel Group and Equity Commonwealth EQC. Mr. Edelman also serves as a member of the board of directors of Aldar Property Group (publicly traded in Abu Dhabi). Mr. Edelman holds a bachelor of law degree from Columbia Law School and a bachelor of arts degree from Princeton University.

Director Qualifications: Mr. Edelman brings to the Board an extensive legal background as a result of over 40 years of experience in the legal profession and his considerable experience in structuring and negotiating complex transactions.

10

| John R. Harding Director since August 2012 Age: 60 Board Committee: Innovation and Technology Committee

|

Mr. Harding co-founded and is President and Chief Executive Officer of eSilicon Corporation (a privately held company that designs and manufactures complex, custom chips). Before starting eSilicon in 2000, Mr. Harding served as President, Chief Executive Officer and director of Cadence Design Systems, Inc. (a global electronic design automation company). Mr. Harding also held a variety of senior management positions at Zycad Corporation, and his career also includes positions with TXL and IBM. Mr. Harding has also held leadership roles at Drew University and Indiana University, where he was Vice Chairman of the Board of Trustees and a member of the School of Public and Environmental Affairs Advisory Board, respectively. In addition, Mr. Harding has served as a member of the Steering Committee at the U.S. Council on Competitiveness and was a former National Academies’ Committee member for Software, Growth and Future of the U.S. Economy. In 2012, Mr. Harding was re-elected as the value chain producer director to the board of directors of the Global Semiconductor Alliance. He has been a director of the Global Semiconductor Alliance since 2007. Mr. Harding has served as a member of the board of directors of RF Micro Devices, Inc. since 2006. He has also served on the advisory board of Atrenta, Inc. (a private company) since 2007. Mr. Harding holds a bachelor of arts degree in chemistry and economics from Drew University.

Director Qualifications: Mr. Harding’s experience as President and Chief Executive Officer of eSilicon provides the Board with a deep understanding of the challenges and issues facing semiconductor companies. In addition, Mr. Harding brings to the Board substantial general management and operational experience and expertise in corporate strategy development gained from serving as President and Chief Executive Officer of two technology companies and from his experience as an entrepreneur.

| Joseph A. Householder Director since September 2014 Age: 59 Board Committees: Audit and Finance Committee and Nominating and Corporate Governance Committee

|

Mr. Householder is Executive Vice President and Chief Financial Officer of Sempra Energy (a worldwide provider of energy infrastructure and gas and electric utilities). From 2006 to 2011, Mr. Householder was Senior Vice President, Controller and Chief Accounting Officer of Sempra Energy responsible for financial reporting, accounting and controls and tax functions for all Sempra Energy companies. Prior to this role, he served as Vice President of Corporate Tax and Chief Tax Counsel for Sempra Energy. Prior to joining Sempra Energy in 2001, Mr. Householder was a partner at PricewaterhouseCoopers in the firm’s national tax office. From 1986 to 1999, he served in a number of legal and financial roles at Unocal Corporation, including ultimately as Vice President of Corporate Development and Assistant Chief Financial Officer, where he was responsible for worldwide tax planning, financial reporting and forecasting and mergers and acquisitions. Mr. Householder serves on the board of directors of the Southern California Gas Company and the San Diego Gas & Electric Company, which are wholly-owned subsidiaries of Sempra Energy. He also serves on the board of directors of Infraestructura Energetica Nova (IEnova, a majority-owned subsidiary of Sempra Energy that is publicly traded in Mexico) and the San Diego Regional Economic Development Corporation (a non-profit corporation). In addition, Mr. Householder is a member of the Tax Executives Institute, the American Institute of Certified Public Accountants, the State Bar of California and the American Bar Association. He holds a bachelor of science degree in business administration from the University of Southern California and a juris doctor degree from Loyola Law School.

Director Qualifications: Mr. Householder brings to the Board significant financial and operational expertise as a result of his chief financial officer experience at Sempra Energy, his experience as a partner of PricewaterhouseCoopers and his experience at Unocal Corporation.

11

| Michael J. Inglis Director since March 2014 Age: 55 Board Committees: Audit and Finance Committee, Innovation and Technology Committee and Nominating and Corporate Governance Committee

|

Mr. Inglis held several senior executive positions between 2002 and 2013 at ARM Holdings plc (a semiconductor intellectual property supplier), including as Executive Vice President, Sales and Marketing, as Executive Vice President, General Manager, Processor Division, and as Chief Commercial Officer. Before joining ARM, Mr. Inglis was a Principal at A.T. Kearney (a global management consulting firm) from 1999 to 2001. Mr. Inglis served as General Manager, Smartcard Division and European Hi-End Microprocessor Operations Manager amongst various roles at Motorola Semiconductor from 1991 to 1998. In addition, Mr. Inglis has held a number of operational and marketing positions at Texas Instruments (a global semiconductor company), BIS Macintosh (an electronics market research firm) and Fairchild Camera and Instrument (a semiconductor company). Mr. Inglis served on the board of directors of ARM from 2002 until his retirement in March 2013. Mr. Inglis was also a member of the board of directors of Pace plc (publicly traded on the London Stock Exchange) from 2008 until April 2013 and was re-appointed as a director to the Pace board of directors in March 2014. Mr. Inglis has a master of business administration degree from Cranfield School of Management and a bachelor of science degree in electronic and electrical engineering from Birmingham University. In addition, Mr. Inglis is a Chartered Engineer and a Member of the Chartered Institute of Marketing.

Director Qualifications: Mr. Inglis brings to the Board senior leadership, management, and sales and marketing expertise, as well as his experience gained from serving as a director on the boards of other public companies. He also provides his broad understanding of the semiconductor industry.

| Dr. Lisa T. Su Director since October 2014 Age: 45

|

Dr. Su is our President and Chief Executive Officer. Dr. Su served as our Chief Operating Officer from July 2014 until October 2014 and as our Senior Vice President and General Manager, Global Business Units since she started with us in January 2012. Prior to joining us, Dr. Su served as Senior Vice President and General Manager, Networking and Multimedia at Freescale Semiconductor, Inc. (an embedded processor manufacturer), where she was responsible for global strategy, marketing, product management and engineering for their embedded communications and applications processor businesses. Dr. Su joined Freescale in 2007 as Chief Technology Officer, leading the company’s technology roadmap and R&D efforts. Prior to her employment with Freescale, Dr. Su spent 13 years with IBM in various engineering and business leadership positions, including Vice President of the Semiconductor Research and Development Center, responsible for the strategic direction of IBM’s silicon technologies, joint development alliances and semiconductor R&D operations. Dr. Su has served on the board of directors of Analog Devices since June 2012. Dr. Su holds bachelor’s, master’s and doctorate degrees in electrical engineering from the Massachusetts Institute of Technology (MIT), has been published in more than 40 technical publications and was named a fellow of the Institute of Electronics and Electrical Engineers (IEEE) in 2009. Dr. Su was also named in MIT Technology Review’s Top 100 Young Innovators in 2002.

Director Qualifications: As our President and Chief Executive Officer, Dr. Su brings to the Board her expertise and proven leadership in the global semiconductor industry as well as valuable insight into our operations, management and culture, providing an essential link between the management and the Board on management’s perspectives.

12

| Ahmed Yahia Director since November 2012 Age: 42 Board Committee: Innovation and Technology Committee

|

Mr. Yahia is CEO of the Technology & Industry global platform of Mubadala, where he oversees Mubadala’s technology, metals, mining and utilities portfolio. He is also a member of Mubadala’s Investment Committee, which is mandated to develop Mubadala’s investment policies, establish investment guidelines and review all proposed projects and investments to ensure they are in line with Mubadala’s business objectives. He also leads a number of corporate efforts across the Mubadala portfolio, including Enterprise Risk Management, Asset Management/Value Creation and Learning & Development. From March 2001 to February 2010, Mr. Yahia was a partner of McKinsey & Company where the central theme of his work was corporate performance transformations, business building and industrial sector development. Mr. Yahia was also the Managing Partner of McKinsey’s Abu Dhabi practice. Mr. Yahia serves on the boards of directors on several private companies, including GLOBALFOUNDRIES Inc., Emirates Global Aluminum PJSC and Mubadala Petroleum LLC. Mr. Yahia also serves as a non-executive director of National Central Cooling Company (Tabreed) (publicly traded in the United Arab Emirates) and served as a director of SMN Power Holding SAOG (publicly traded on the Muscat (Oman) Stock Exchange) from May 2011 until July 2013. Mr. Yahia holds a master of science degree in mechanical engineering/product strategy from the Massachusetts Institute of Technology and a bachelor of science degree in industrial engineering from the Ecole Centrale Paris.

Director Qualifications: Mr. Yahia’s experience as the CEO of the Technology and Industry global platform of Mubadala and as a former partner of McKinsey & Company provides the Board with expertise in corporate strategy development, corporate performance transformations and operations.

Consideration of Stockholder Nominees for Director

The policy of the Nominating and Corporate Governance Committee is to consider properly submitted stockholder nominations for candidates to serve on the Board. Pursuant to our bylaws, stockholders who wish to nominate persons for election to the Board at our 2016 annual meeting of stockholders must be a stockholder of record, both when they give us notice and at our 2016 annual meeting, must be entitled to vote at our 2016 annual meeting and must comply with the notice provisions in our bylaws. A stockholder’s notice must be delivered to our Secretary not less than 90 nor more than 120 days before the anniversary date of the immediately preceding annual meeting. For our 2016 annual meeting of stockholders, the notice must be delivered between December 31, 2015 and January 30, 2016. However, if our 2016 annual meeting of stockholders is not held within 30 days of April 29, 2016, the stockholder’s notice must be delivered no later than the close of business on the tenth day following the earlier of the day on which the first public announcement of the date of our 2016 annual meeting was made or the day the notice of our 2016 annual meeting is mailed. The public announcement of an adjournment or postponement of our 2016 annual meeting of stockholders will not trigger a new time period (or extend any time period) for the giving of a stockholder notice as described in this proxy statement. Notwithstanding the foregoing, if the number of directors to be elected to the Board at an annual meeting is increased and we do not make a public announcement naming all of the nominees for director or specifying the size of the increased Board at least 100 days prior to the first anniversary of the preceding year’s annual meeting, the stockholder’s notice will be considered timely, but only with respect to nominees for any new positions created by the increase, if it is delivered to our Secretary not later than the close of business on the tenth day following the day on which we first make such public announcement. The stockholder’s notice must be updated and supplemented as set forth in our bylaws. The stockholder’s notice must include the following information for the person making the nomination:

| • | name, age, nationality, business and residence addresses; |

| • | principal occupation and employment; |

13

| • | the class and number of shares owned beneficially or of record; |

| • | any derivative, swap or other transaction which gives economic risk similar to ownership of shares; |

| • | any proxy, agreement, arrangement, understanding or relationship that confers a right to vote any shares; |

| • | any agreement, arrangement, understanding or relationship engaged in to increase or decrease the level of risk related to, or the voting power with respect to, our shares, or that provides the opportunity to profit from a decrease in price or value of shares; |

| • | any performance-related fees that the nominating person is entitled to, based on any increase or decrease in the value of any shares; and |

| • | any other information required by the SEC to be disclosed in a proxy statement. |

The stockholder’s notice must also include the following information for each proposed director nominee:

| • | financial or other material relationships between the nominating person and the nominee during the past three years; |

| • | the same information as for the nominating person (see above); and |

| • | all information required to be disclosed in a proxy statement in connection with election of directors. |

The Chair of our Annual Meeting will determine if the procedures in the bylaws have been followed, and if not, declare that the nomination be disregarded. If the nomination was made in accordance with the procedures in our bylaws, the Nominating and Corporate Governance Committee will apply the same criteria in evaluating the nominee as it would any other Board nominee candidate and will recommend to the Board whether or not the stockholder nominee should be nominated by the Board and included in our proxy statement. These criteria are described below in the description of the Nominating and Corporate Governance Committee in the section entitled “Meetings and Committees of the Board of Directors–Board Committees.” The nominee must be willing to provide a written questionnaire, representation and agreement, if requested by us, and any other information reasonably requested by us in connection with our evaluation of the nominee’s independence.

Communications with the Board or Non-Management Directors

Anyone who wishes to communicate with our Board or with non-management directors may send their communications in writing to One AMD Place, Sunnyvale, California 94088, Attention: Secretary or send an email to Corporate.Secretary@amd.com. Our Secretary will forward all of these communications to our Chairman of the Board.

At our Annual Meeting, our directors will be elected using a majority vote standard with respect to uncontested elections, such as this election. This standard requires that each director receive the affirmative vote of a majority of the votes cast. A majority of the votes cast means that the number of votes cast “for” a director must exceed the number of votes cast “against” that director. Abstentions and broker non-votes will have no effect on the outcome of these director elections. Each director nominee has submitted a written resignation that will be effective if he or she does not receive a majority of the votes cast for such director and the resignation is accepted by the Nominating and Corporate Governance Committee, another authorized Board committee or the Board.

Recommendation of the Board Directors

The Board of Directors unanimously recommends that you vote FOR each of the director nominees. Unless you indicate otherwise, your proxy will vote FOR the proposed nominees.

14

The Board has adopted the Principles of Corporate Governance to address significant corporate governance issues. The Governance Principles provide a framework for our corporate governance matters and include topics such as Board and Board committee composition and evaluation. The Nominating and Corporate Governance Committee is responsible for reviewing the Governance Principles and recommending any changes to the Governance Principles to the Board.

The Principles of Corporate Governance provide that a substantial majority of the members of the Board must meet the criteria for independence as required by applicable law and the listing rules of The Nasdaq Stock Market (“Nasdaq”). Among other criteria, no director qualifies as independent unless the Board determines that the director has no direct material relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. On an annual basis, the Board undertakes a review of director independence. In determining that Mr. Donofrio is independent, the Board considered our payments to Liberty Mutual Insurance Company, a subsidiary of Liberty Mutual Holding Company Inc., in fiscal 2014. Mr. Donofrio is a member of the board of directors of Liberty Mutual Holding Company Inc.

The Board determined that all directors who served during fiscal 2014, other than Messrs. Edelman, Harding, Read and Yahia and Dr. Su, and all of our director nominees, other than Messrs. Edelman, Harding and Yahia and Dr. Su, are independent in accordance with SEC and Nasdaq rules. The Board also determined that each of the members of the Audit and Finance, Nominating and Corporate Governance and Compensation Committees are independent in accordance with SEC and Nasdaq rules.

Compensation Committee Interlocks and Insider Participation

During fiscal 2014, Messrs. Caldwell and Donofrio and Mses. Denzel and H. Paulett Eberhart served on the Compensation Committee. Ms. Eberhart resigned from the Compensation Committee on May 8, 2014. None of the members of the Compensation Committee is or has been an executive officer or employee of us. In addition, none of our executive officers serves on the board of directors or compensation committee of a company that has an executive officer that serves on the Board or the Compensation Committee.

The Governance Principles permit the roles of Chairman of the Board and Chief Executive Officer to be filled by the same or different individuals, based on our needs, best practices and the interests of our stockholders. This allows the Board flexibility to determine whether the two roles should be combined or separated based upon our needs and the Board’s assessment of its leadership from time to time. The Board has the experience of functioning effectively either way.

Mr. Claflin, who is independent in accordance with SEC and Nasdaq rules, is our Chairman of the Board. The Board first appointed Mr. Claflin as our independent Chairman of the Board in 2009. Mr. Claflin presides at meetings of our stockholders and directors and leads the Board in fulfilling its responsibilities. The Board benefits from Mr. Claflin’s leadership experience as a technology industry veteran, significant public company board experience and intimate familiarity with our history and business. The Board believes that its current leadership structure, with an independent Chairman of the Board, separate from the Chief Executive Officer, is appropriate at this time and allows the Board to fulfill its duties effectively and efficiently based on our current needs. The Board believes that this structure allows Dr. Su, our President and Chief Executive Officer, to focus on our business strategy and market opportunities, as well as on our organizational structure and execution capabilities.

15

The Board’s role in risk oversight is consistent with our leadership structure, with our Chief Executive Officer and other members of management having responsibility for day-to-day risk management activities and processes, and our Board and its committees being actively involved in overseeing our risk management. The Board and management consider “risk” for these purposes to be the possibility that an undesired event could occur that might adversely affect the achievement of our objectives. Examples of the types of risks faced by us include:

| • | business-specific risks related to our ability to develop new products and services, our strategic position in key existing and new markets, our operational execution and infrastructure, our relationships with our third party manufacturing suppliers and competition in the microprocessor and graphics markets; |

| • | macroeconomic risks, such as adverse global economic conditions; and |

| • | “event” risks, such as natural disasters. |

We engage in activities that seek to take calculated risks that protect the value of our existing assets and create new or future value. Management is responsible for day-to-day risk management activities and processes. Members of senior management participate in identifying risks and risk controls, developing recommendations to determine the appropriate manner in which to control risk and implementing risk mitigation activities. Our Chief Executive Officer has ultimate responsibility for management of our business, including enterprise level risks and the risk management program and processes.

In fulfilling its oversight role, the Board focuses on understanding the nature of our enterprise risks, including reputational risk and risks in our operations, finances and strategic direction, as well as the adequacy of our risk assessment and risk management processes. The Board implements its oversight function primarily through management reports and committees of the Board. At least annually, the Board discusses with management the appropriate level of risk relative to our corporate strategy and objectives and reviews with management our existing risk management processes and their effectiveness. As well, the Board receives periodic management updates on our business operations, financial results and strategy and, as appropriate, discusses and provides feedback with respect to risks related to these topics. In addition, the Board receives full reports from the following Board committee chairs regarding the committee’s considerations and actions related to the specific risk topics over which the committee has oversight:

| • | The Audit and Finance Committee assists the Board in overseeing our enterprise risk management process; reviews our portfolio of risk; discusses with management significant financial, reporting, regulatory and legal compliance risks in conjunction with enterprise risk exposures as well as risks associated with our capital structure; and reviews our policies with respect to risk assessment and risk management and the actions management has taken to limit, monitor or control financial and enterprise risk exposure. The Audit and Finance Committee meets with members of our Internal Audit department to discuss any issues that warrant attention. |

| • | The Compensation Committee oversees risk management as it relates to our compensation policies and practices and has reviewed with management whether our compensation programs may create incentives for our employees to take excessive or inappropriate risks which could have a material adverse effect on us. For additional details, see “Compensation Policies and Practices,” below. |

| • | The Nominating and Corporate Governance Committee considers potential risks related to the effectiveness of the Board, including succession planning for the Board and our overall governance. |

| • | The Innovation and Technology Committee assists the Board in its oversight responsibilities relating to technical and market risks associated with product development and investment as well as risk mitigation policies and procedures relating to products based on new technology or significant innovations to existing technology. |

16

The Board has adopted a code of ethics that applies to all directors and employees entitled “Worldwide Standards of Business Conduct,” which is designed to help directors and employees resolve ethical issues encountered in the business environment. The Worldwide Standards of Business Conduct covers topics such as conflicts of interest, compliance with laws (including anti-corruption laws), fair dealing, protecting our property and confidentiality of our information and encourages the reporting of any behavior not in accordance with the Worldwide Standards of Business Conduct.

The Board has also adopted a Code of Ethics for our executive officers and all other senior finance executives. The Code of Ethics covers topics such as financial reporting, conflicts of interest and compliance with laws, rules, regulations and our policies.

17

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The table below shows the current chairs and membership of the Board and each standing Board committee, the independence status of each Board member and the number of Board and Board committee meetings held during fiscal 2014.

| Director | Board of Directors |

Audit and Finance |

Nominating and Corporate Governance Committee |

Compensation Committee |

Innovation and Technology Committee | |||||

|

Bruce L. Claflin |

C | C | ||||||||

|

W. Michael Barnes** |

— | C | — | |||||||

|

John E. Caldwell |

— | — | C | |||||||

|

Henry WK Chow |

— | — | — | |||||||

|

Nora M. Denzel |

— | — | — | |||||||

|

Nicholas M. Donofrio |

— | — | — | C | ||||||

|

Martin L. Edelman* |

— | |||||||||

|

John R. Harding* |

— | — | ||||||||

|

Joseph A. Householder** |

— | — | — | |||||||

|

Michael J. Inglis |

— | — | — | — | ||||||

|

Lisa T. Su* |

— | |||||||||

|

Ahmed Yahia* |

— | — | ||||||||

| Number of 2014 meetings |

8 | 20 | 4 | 12 | 4 |

C Chair — Member * Non-Independent Director ** Financial Expert

The Board held eight meetings during fiscal 2014. During fiscal 2014, all members of the Board attended at least 75 percent of the meetings of the Board and Board committees on which they served. In addition, on at least an annual basis, the Board and management discuss our strategic direction, new business opportunities and product roadmap. Independent and non-management directors also meet regularly in scheduled executive sessions with our Chief Executive Officer and other members of senior management. In addition to these formal meetings, members of our Board informally interact with senior management (including our Chief Executive Officer), industry leaders and customers on a periodic basis. In fiscal 2014, sessions of only our non-employee directors were held six times, and sessions of only our independent directors were held three times.

The Board has four standing committees: an Audit and Finance Committee, a Nominating and Corporate Governance Committee, a Compensation Committee and an Innovation and Technology Committee. The members of the Board committees and their Chairs are nominated by the Nominating and Corporate Governance Committee and appointed by the Board.

Each of the Board committees has adopted a written charter, which has been approved by the Board. You can access our current bylaws, committee charters, the Principles of Corporate Governance, the Worldwide Standards of Business Conduct and the Code of Ethics on the Investor Relations pages of our Web site at www.amd.com or ir.amd.com.

18

Audit and Finance Committee. The Audit and Finance Committee assists the Board with its oversight responsibilities regarding the integrity of our financial statements, our compliance with legal and regulatory requirements, risk assessment, the performance of our internal audit function, our financial affairs and policies and the nature and structure of major financial commitments. The Audit and Finance Committee is also directly responsible for the appointment, independence, compensation, retention and oversight of the work of our independent registered public accounting firm, which reports directly to the Audit and Finance Committee. The Audit and Finance Committee meets alone with our senior management, our financial, legal and internal audit personnel and with our independent registered public accounting firm, which has free access to the Audit and Finance Committee. The Corporate Vice President of our Internal Audit Department reports directly to the Chair of the Audit and Finance Committee and “dotted-line” to our Chief Financial Officer, and serves a staff function for the Audit and Finance Committee. The Audit and Finance Committee currently consists of Dr. Barnes, as Chair, and Messrs. Chow, Householder and Inglis, each determined to be financially literate and “independent” under applicable SEC and Nasdaq rules. The Board also determined that Dr. Barnes and Mr. Householder are each an “audit committee financial expert,” as defined under applicable SEC rules. The Audit and Finance Committee held 20 meetings during fiscal 2014.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee assists the Board in discharging its responsibilities regarding the identification of qualified candidates to become Board members, the selection of nominees for election as directors at the next annual meeting of stockholders (or special meeting of stockholders at which directors are to be elected), the selection of candidates to fill any vacancies on the Board and the development and recommendation to the Board of corporate governance guidelines and principles, including the Governance Principles. In addition, the Nominating and Corporate Governance Committee oversees the Board’s annual review of its performance (including its composition and organization), leads a process for our non-employee directors to evaluate the performance of our Chief Executive Officer and provides input regarding the evaluation of other Section 16 officers. The Nominating and Corporate Governance Committee retains a search firm for the purpose of obtaining information regarding potential candidates for Board membership. The Nominating and Corporate Governance Committee currently consists of Mr. Claflin, as Chair, Dr. Barnes, Messrs. Caldwell, Chow, Donofrio, Householder and Inglis and Ms. Denzel, each determined by the Board to be “independent” under applicable SEC and Nasdaq rules. The Nominating and Corporate Governance Committee held four meetings during fiscal 2014 and one meeting during fiscal 2015 to consider director nominees for our Annual Meeting and other matters.