ADVANCED MICRO DEVICES, INC.

2485 AUGUSTINE DRIVE

SANTA CLARA, CALIFORNIA 95054

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

You are cordially invited to attend our 2019 annual meeting of stockholders (our “Annual Meeting”) to be held on Wednesday, May 15, 2019 at 9:00 a.m. Pacific Time at Advanced Micro Devices, Inc., 2485 Augustine Drive, Santa Clara, California 95054. We are holding our Annual Meeting to:

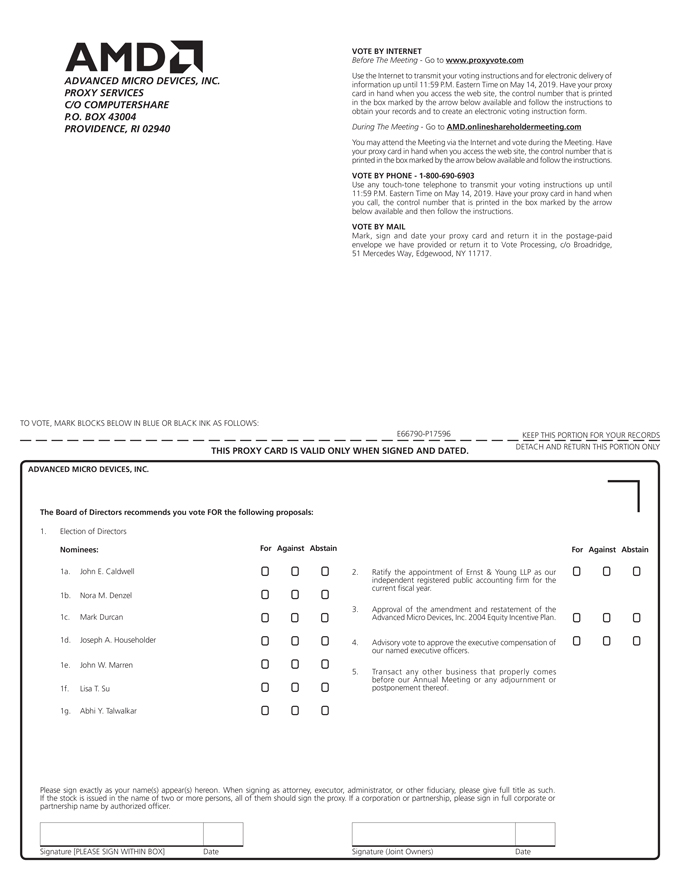

| • | Elect the seven director nominees named in this proxy statement; |

| • | Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current fiscal year; |

| • | Approve the amendment and restatement of the Advanced Micro Devices, Inc. 2004 Equity Incentive Plan (as amended and restated, the “2004 Plan”) to: (i) increase the number of authorized shares that can be awarded to our employees, consultants and directors under the 2004 Plan by 29 million shares and (ii) update the plan for certain tax law changes; |

| • | Approve on a non-binding, advisory basis the compensation of our named executive officers, as disclosed in this proxy statement pursuant to the compensation disclosure rules of the U.S. Securities and Exchange Commission (the “SEC”); and |

| • | Transact any other business that properly comes before our Annual Meeting or any adjournment or postponement thereof. |

We are pleased to provide access to our proxy materials over the Internet under the SEC’s “notice and access” rules. As a result, we are mailing to our stockholders (other than those who previously requested printed or emailed materials on an ongoing basis) a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of printed copies of our proxy materials. The Notice contains instructions on how to access our proxy materials on the Internet, how to vote on the Internet and how you can receive printed or emailed copies of our proxy materials. We believe that providing our proxy materials over the Internet will lower our Annual Meeting’s cost and environmental impact, while increasing the ability of our stockholders to access the information that they need.

Stockholders of record at the close of business on March 18, 2019 and holders of proxies for those stockholders may attend and vote at our Annual Meeting. To attend our Annual Meeting in person, you must present valid photo identification, and, if you hold shares through a broker, bank, trustee or nominee (i.e., in street name), you must also present a letter from your broker or other nominee showing that you were the beneficial owner of the shares on March 18, 2019.

This year, we are also pleased to offer a virtual annual meeting at which our stockholders can view our Annual Meeting at AMD.onlineshareholdermeeting.com. This virtual meeting will be in addition to our physical meeting. Stockholders at the close of business on March 18, 2019 may also ask questions and vote at the virtual meeting via the Internet. We hope this will allow our stockholders who are unable to attend our Annual Meeting in person to participate in the virtual meeting.

Sincerely,

HARRY A. WOLIN

Senior Vice President, General Counsel and Corporate

Secretary

This notice of annual meeting is dated March 21, 2019 and will first be distributed and

made available to the stockholders of Advanced Micro Devices, Inc. on or about March 21, 2019.

YOUR VOTE IS IMPORTANT AND WE ENCOURAGE YOU TO VOTE PROMPTLY

Important notice regarding Internet availability of proxy materials: This proxy statement and our

Annual Report on Form 10-K for the fiscal year ended December 29, 2018 are available at

www.proxyvote.com and on the Investor Relations pages of our website at www.amd.com or ir.amd.com.