ADVANCED MICRO DEVICES, INC.

2485 AUGUSTINE DRIVE

SANTA CLARA, CALIFORNIA 95054

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

You are cordially invited to attend our 2023 annual meeting of stockholders (our “Annual Meeting”) to be held on Thursday, May 18, 2023 at 9:00 a.m. Pacific Time. Our Annual Meeting will be held virtually via the Internet at www.virtualshareholdermeeting.com/AMD2023. You will not be able to attend the Annual Meeting in person.

We are holding our Annual Meeting to:

| • | Elect the nine director nominees named in this proxy statement; |

| • | Approve of the Advanced Micro Devices, Inc. 2023 Equity Incentive Plan; |

| • | Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current fiscal year; |

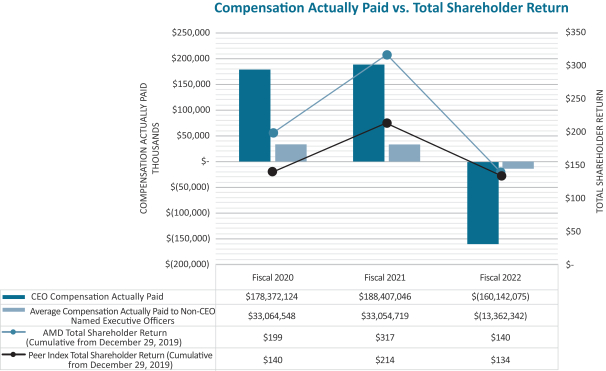

| • | Approve on a non-binding, advisory basis the compensation of our named executive officers (“Say-on-Pay”), as disclosed in this proxy statement pursuant to the compensation disclosure rules of the U.S. Securities and Exchange Commission (the “SEC”); |

| • | Approve on a non-binding, advisory basis the frequency of future Say-on-Pay votes (“Frequency of Say-on-Pay”); and |

| • | Transact any other business that properly comes before our Annual Meeting or any adjournment or postponement thereof. |

We are pleased to provide access to our proxy materials over the Internet under the SEC’s “notice and access” rules. As a result, we are mailing to our stockholders (other than those who previously requested printed or emailed materials on an ongoing basis) a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of printed copies of our proxy materials. The Notice contains instructions on how to access our proxy materials on the Internet, how to vote on the Internet and how you can receive printed or emailed copies of our proxy materials at no charge. We believe that providing our proxy materials over the Internet will lower our Annual Meeting’s cost and environmental impact, while increasing the ability of our stockholders to access the information that they need.

Stockholders of record at the close of business on March 22, 2023 and holders of proxies for those stockholders may attend and vote at our Annual Meeting. To attend our Annual Meeting via the Internet, you must log in to www.virtualshareholdermeeting.com/AMD2023 using the 16-digit control number on the Notice, proxy card or voting instruction form that accompanied the proxy materials.

For additional details on Internet and telephone voting and the virtual meeting, please see pages 1-6 of the Proxy Statement.

Sincerely,

HARRY A. WOLIN

Senior Vice President, General Counsel and Corporate

Secretary

This notice of annual meeting is dated March 31, 2023 and will first be distributed and

made available to the stockholders of Advanced Micro Devices, Inc. on or about March 31, 2023.

YOUR VOTE IS IMPORTANT AND WE ENCOURAGE YOU TO VOTE PROMPTLY

Important notice regarding Internet availability of proxy materials: This proxy statement and our

Annual Report on Form 10-K for the fiscal year ended December 31, 2022 are available at

www.proxyvote.com and on the Investor Relations pages of our website at www.amd.com or ir.amd.com.