EXHIBIT 99.1

Published on February 27, 2018

AMD Adoption of ASC 606 Revenue Recognition Accounting Standard

February 27, 2018

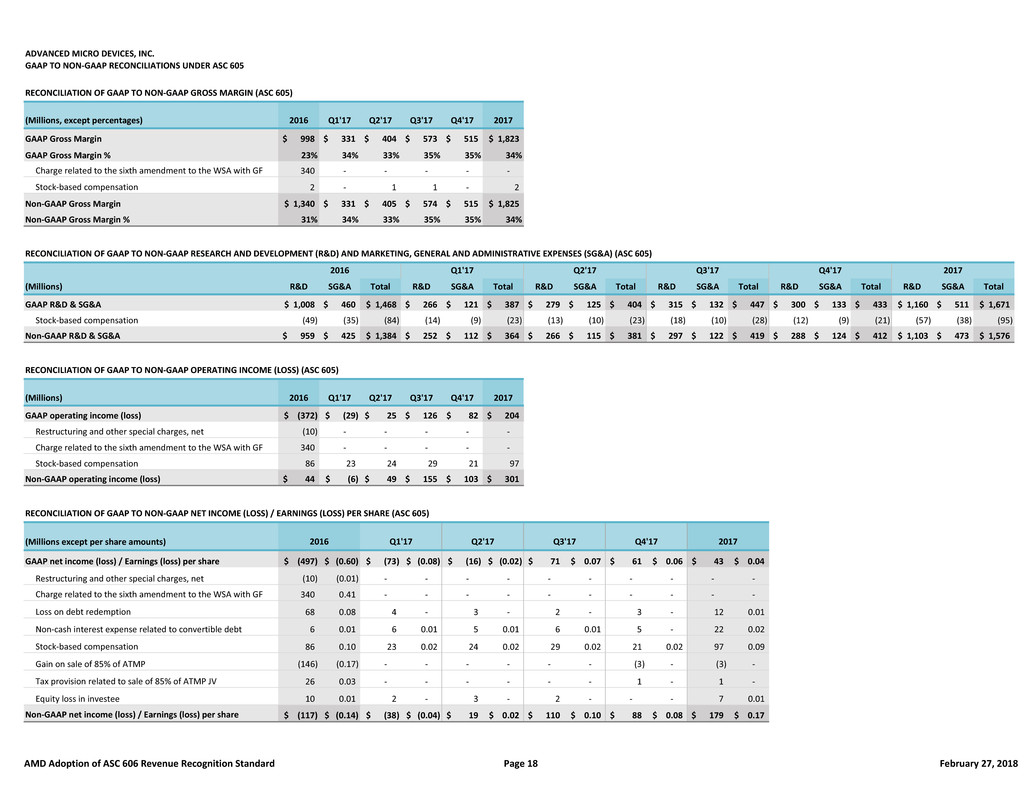

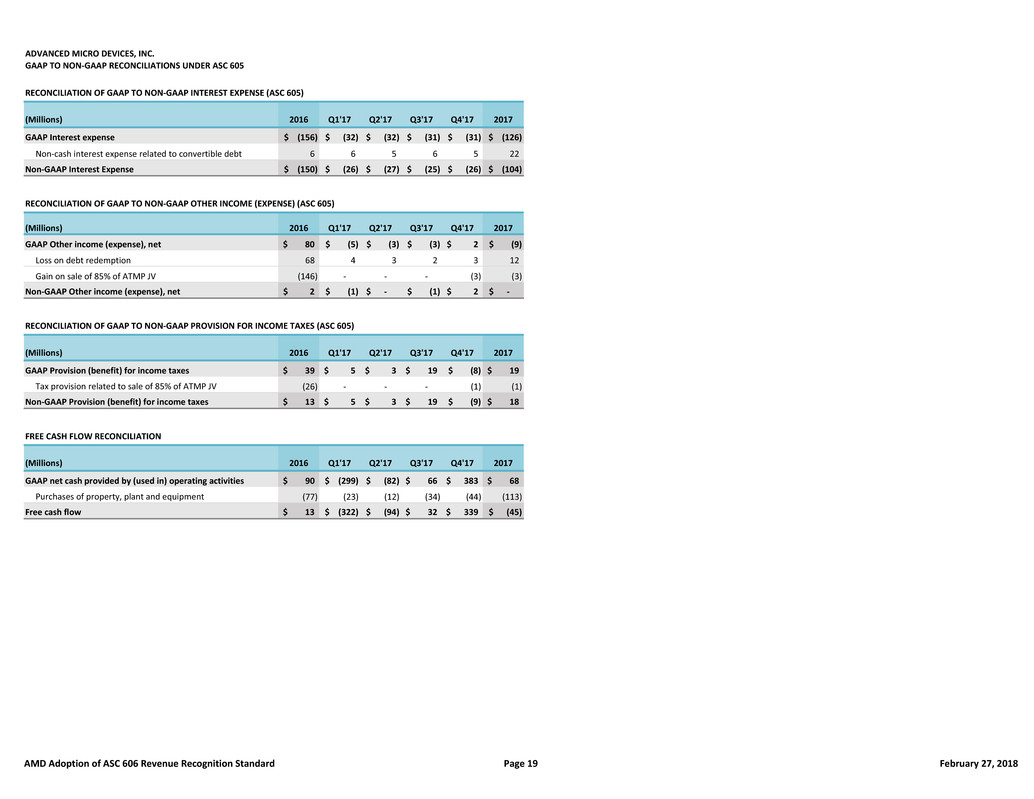

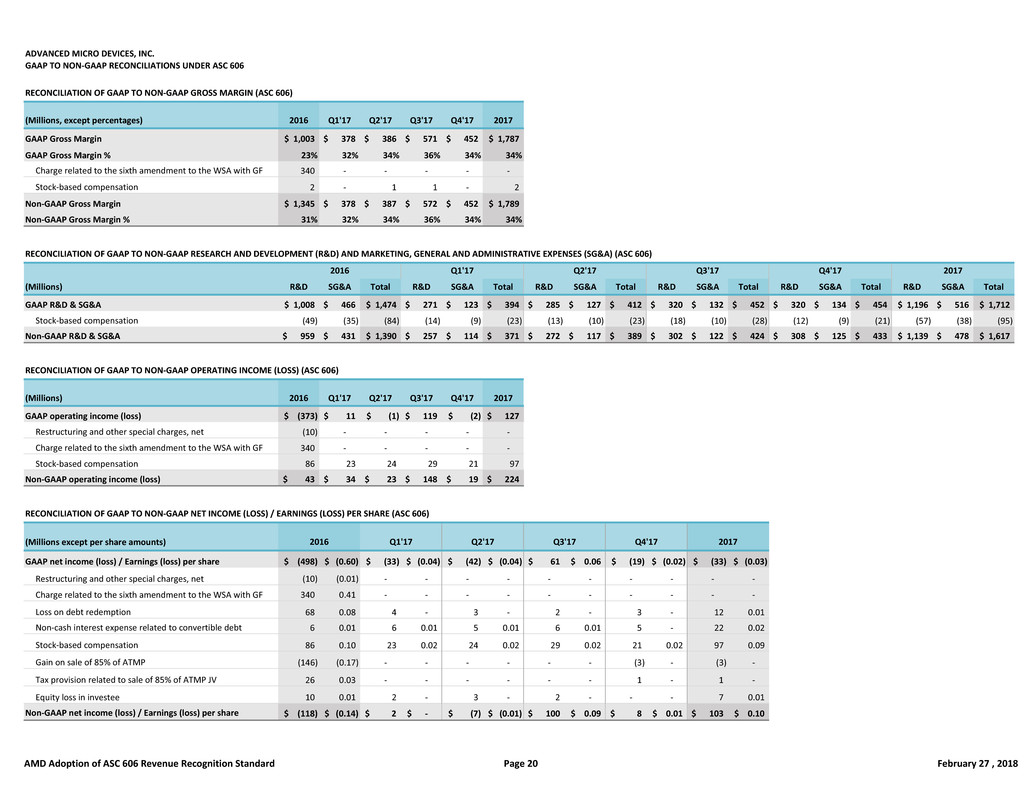

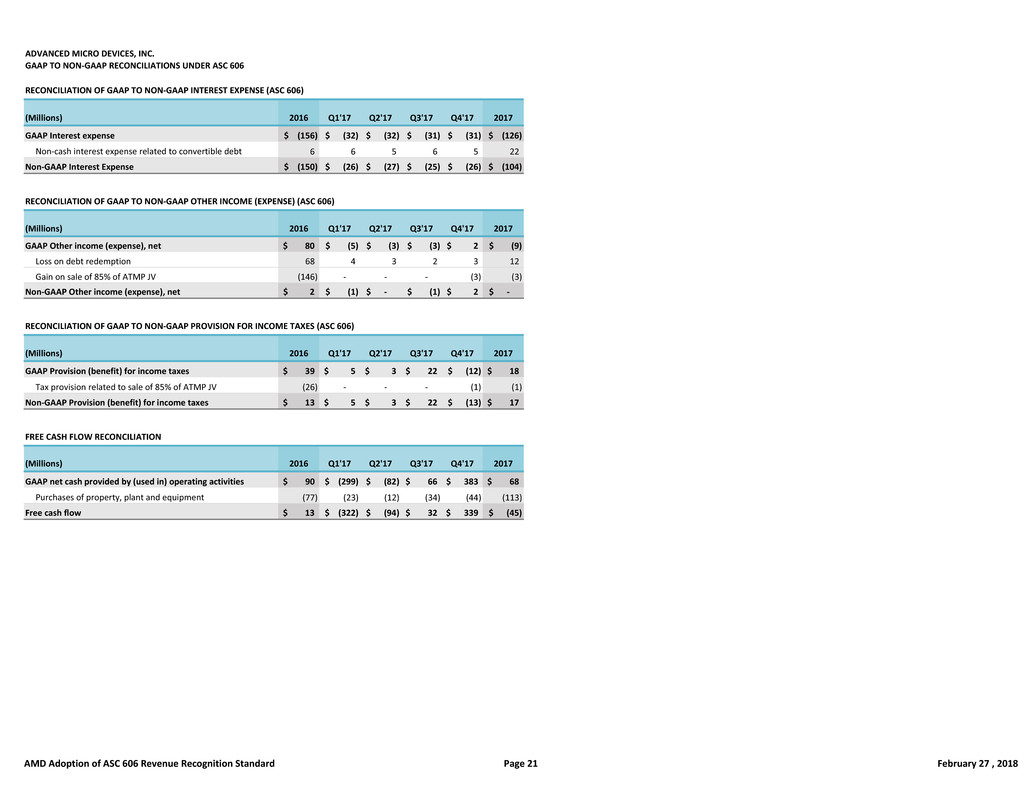

Reconciliation for all non-GAAP financial measures discussed in this document to the most directly comparable GAAP financial measures is included below.

New Revenue Recognition Accounting Standard

AMD adopted the new revenue recognition accounting standard, ASC 606, effective Q1 2018. ASC 606 is effective for all public companies for annual reporting periods beginning after December 15, 2017.

We adopted the new revenue recognition accounting standard under the “full retrospective” method, meaning that adjusted financials for 2016 and 2017 are being provided as though ASC 606 was effective in those prior periods. This method of adoption makes it easier for investors as we provide 2018 guidance, actual results going forward and comparative prior results under one consistent standard. There is no change to our underlying business guidance under the new standard and we remain focused on growing revenue and increasing profitability in 2018. From Q1 2018 onwards all AMD financial results will be reported under the new revenue recognition accounting standard with prior period financial results adjusted for ASC 606 as provided in this document.

The new revenue accounting standard primarily impacts AMD revenue recognition for:

• |

channel shipments on a sell-in basis (CPUs and GPUs), |

• |

inventory of custom products with a non-cancellable purchase order (semi-custom products), and |

• |

transactions that involve development and licensing agreements. |

AMD Adoption of ASC 606 Revenue Recognition Standard |

Page 1

|

February 27, 2018 |

Under the new standard, revenue from sales to distributors will be recognized as revenue upon the shipment of the product to the distributors (sell-in).

• |

Previously revenue recognition of sales to distributors was upon reported resale of the product by the distributors to their customers (sell-through). |

Semi-custom products under non-cancellable purchases orders will be recognized as revenue based on the value of the inventory and expected margin.

• |

Previously semi-custom product revenue was recognized upon shipment. |

Revenue associated with certain development and intellectual property licensing agreements will be recognized upon transfer of control of the intellectual property license.

• |

Previously the fair value of these agreements was divided into an R&D credit for specific development work as the expenses were incurred and licensing revenue upon completion of the deliverables. |

Revenue recognition related to all other revenue streams remains substantially unchanged under the new standard.

Summary of ASC 606 Impact to 2016 Financials

• |

2016 GAAP and Non-GAAP Results: |

• |

2016 revenue is $47 million higher driven by a net build in channel and semi-custom product inventory.

|

• |

2016 gross margin percentage does not change and gross margin dollars increase by $5 million due to higher revenue.

|

• |

There is no impact to net loss per share.

|

AMD Adoption of ASC 606 Revenue Recognition Standard |

Page 2

|

February 27, 2018 |

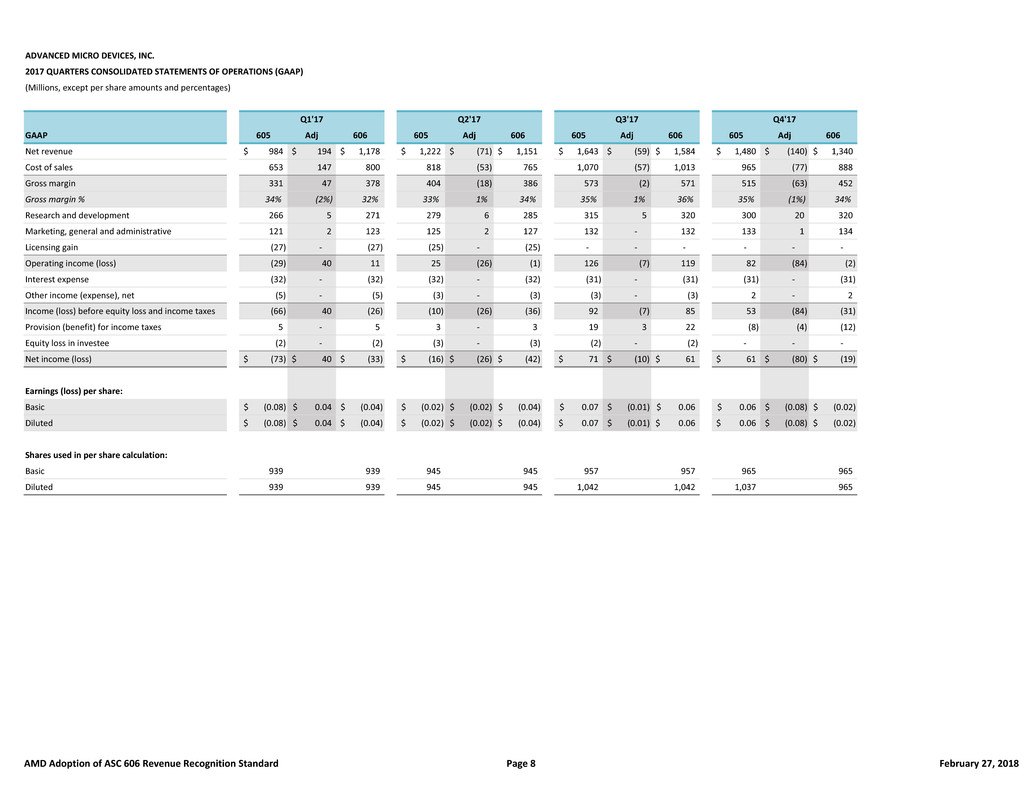

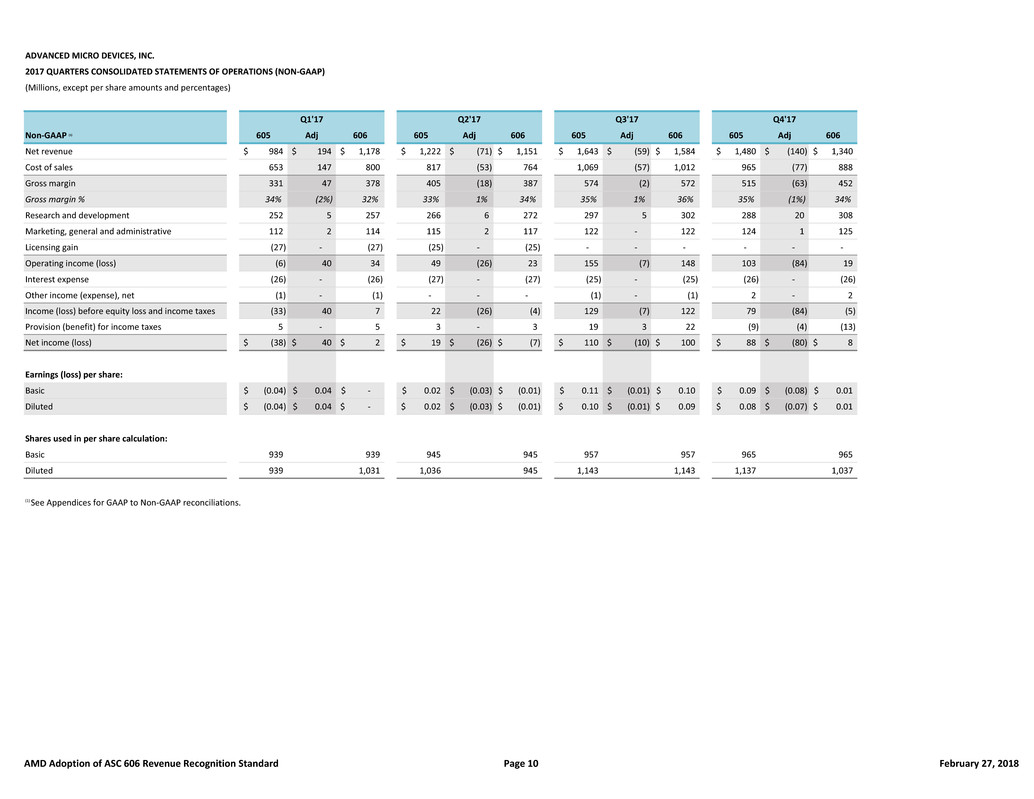

Summary of ASC 606 Impact to 2017 Financials

• |

2017 GAAP and non-GAAP Results: |

• |

2017 revenue is $76 million lower driven by a net drain in channel and semi-custom product inventory.

|

• |

Revenue in each of the quarters in 2017 is adjusted based on whether there is a net drain or net build of channel and semi-custom product inventory. |

• |

2017 gross margin percentage does not change and gross margin dollars decrease by $36 million due primarily to lower channel revenue.

|

• |

Gross margin dollars for each quarter in 2017 are adjusted based on higher or lower channel and semi-custom product revenue.

|

• |

Operating expenses (OPEX) for 2017 are higher by $41 million primarily due to the absence of $36 million of R&D credits related to a development and intellectual property licensing agreement signed in 2017. It is expected that the deliverables for this agreement will be completed in 2018 and revenue will be recognized upon transfer of the license. Marketing, general and administrative expenses increase slightly due to a shift in the timing of recognition of marketing fund expenses.

|

• |

OPEX for each quarter in 2017 increases primarily due to the absence of R&D credits.

|

• |

Provision (benefit) for income taxes adjustment for 2017 relates to the reduction of withholding tax expense associated with the absence of R&D credits.

|

• |

Q3 and Q4 2017 taxes were also impacted by ASC 606 adjustments. |

• |

Earnings (loss) per share for 2017 is lower by $0.07 due to the impact of lower gross margin dollars of approximately $(0.035) as a result of lower revenue and the impact of the absence of $36 million of R&D credits of approximately $(0.035).

|

AMD Adoption of ASC 606 Revenue Recognition Standard |

Page 3

|

February 27, 2018 |

• |

Earnings (loss) per share for each quarter in 2017 is adjusted based primarily on changes to operating income (loss). |

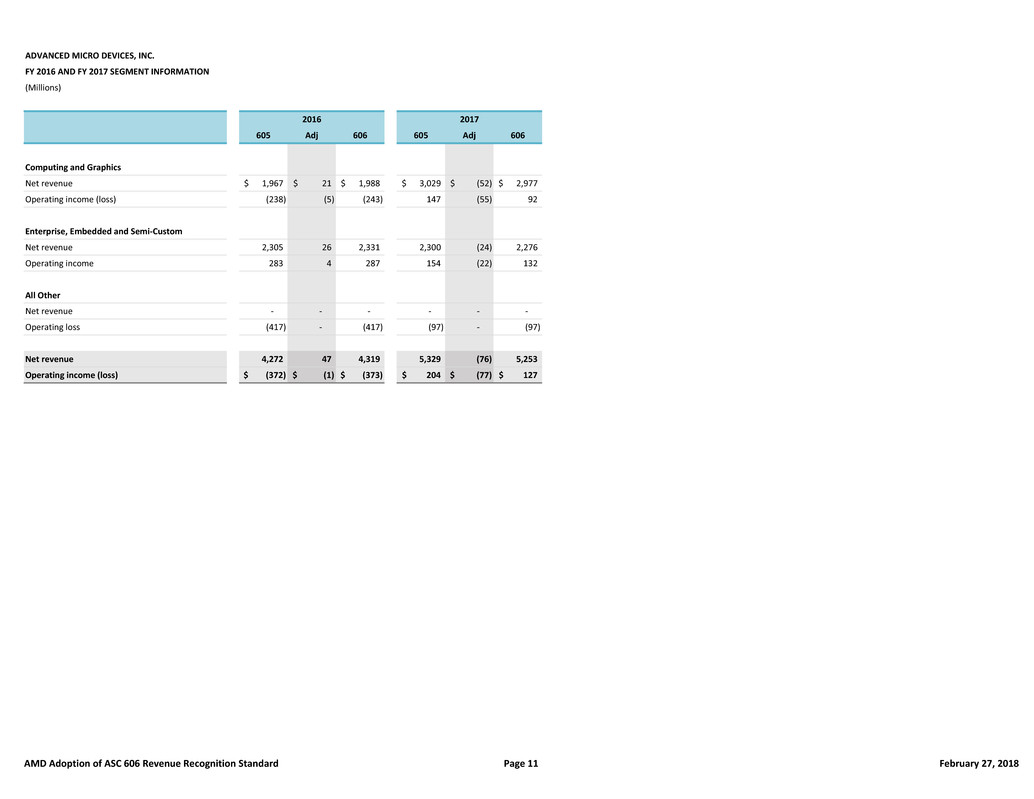

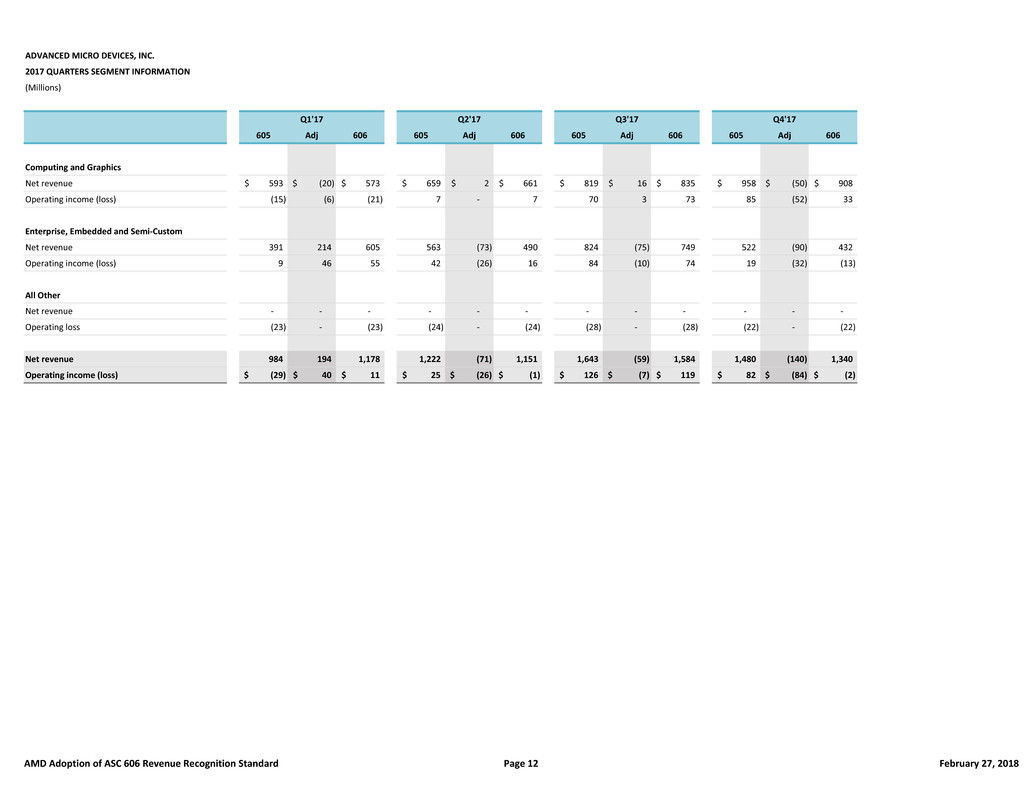

Summary of the impact of ASC 606 on Reportable Segments in 2016 and 2017

Computing and Graphics:

• |

Revenue increases in 2016 by $21 million due to a net build in channel inventory. Revenue is lower in 2017 by $52 million due to a net drain in channel inventory.

|

• |

Revenue in each of the quarters for 2017 is adjusted based on whether there is a net increase or decrease in channel revenue.

|

• |

Operating Income (Loss) decreases $5 million in 2016 primarily due to slightly higher operating expenses. Operating income (loss) decreases $55 million in 2017 primarily due to lower revenue and the absence of R&D credits.

|

• |

Operating income (loss) in each of the quarters for 2017 is adjusted based on the impact of revenue and operating expenses and by the absence of R&D credits.

|

Enterprise, Embedded and Semi-Custom:

• |

Revenue increases $26 million in 2016 due primarily to an increase in semi-custom product revenue and decreases $24 million in 2017 due primarily to a decrease in semi-custom product revenue.

|

• |

Revenue in each of the quarters for 2017 is adjusted based on whether there is a net increase or decrease in semi-custom product revenue.

|

• |

Operating Income (Loss) increases $4 million in 2016 and decreases $22 million in 2017 primarily due to the impact of semi-custom product revenue recognition. In addition, 2017 is impacted by the absence of R&D credits.

|

AMD Adoption of ASC 606 Revenue Recognition Standard |

Page 4

|

February 27, 2018 |

• |

Operating income (loss) in each of the quarters for 2017 is adjusted based on the impact of revenue and the absence of R&D credits.

|

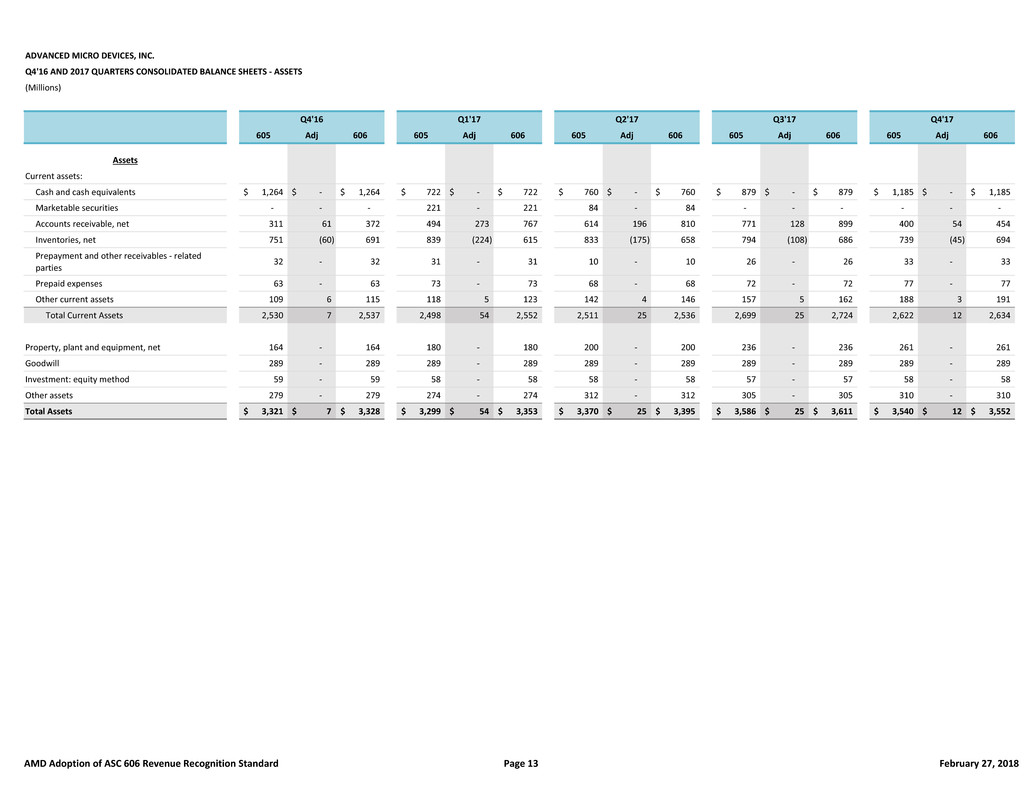

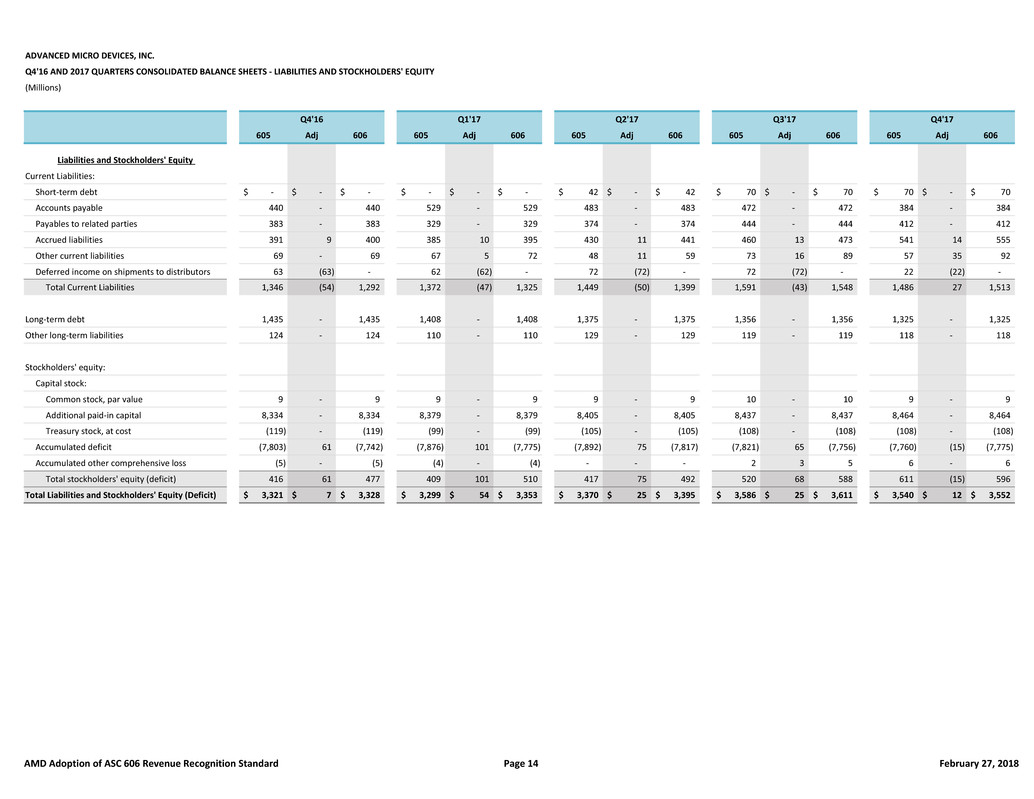

Summary of the key impact on Balance Sheet items under ASC 606 for Annual 2016 & Annual and Quarterly 2017

• |

Accounts receivable increases in all periods primarily due to the acceleration in timing of semi-custom product revenue.

|

• |

Inventory decreases in all periods primarily due to the acceleration in timing of semi-custom product revenue.

|

• |

Other current liabilities increases throughout 2017 due to the reclassification of R&D credits to the balance sheet as deferred revenue. There is no change to 2016.

|

• |

Deferred income on shipments to distributors line item, which represented the deferral of income for shipments to distributors previously recognized as revenue upon reported sale by our distributors (sell-through), goes away under ASC 606 as channel revenue is recognized upon shipment (sell-in) under ASC 606.

|

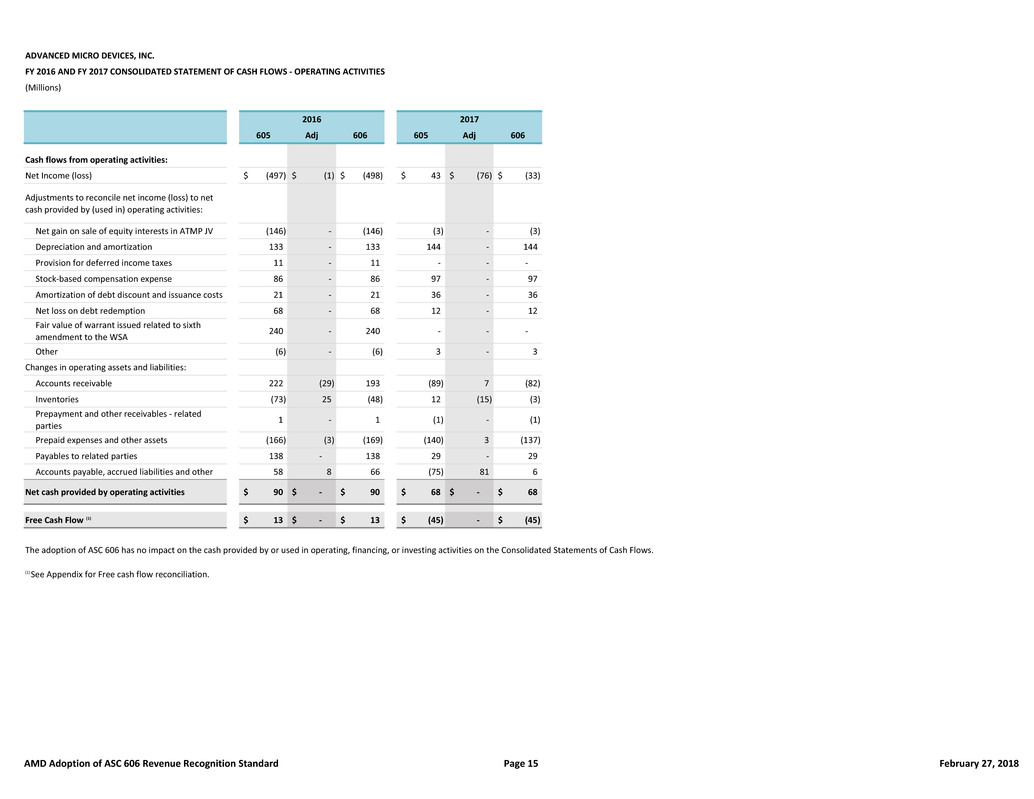

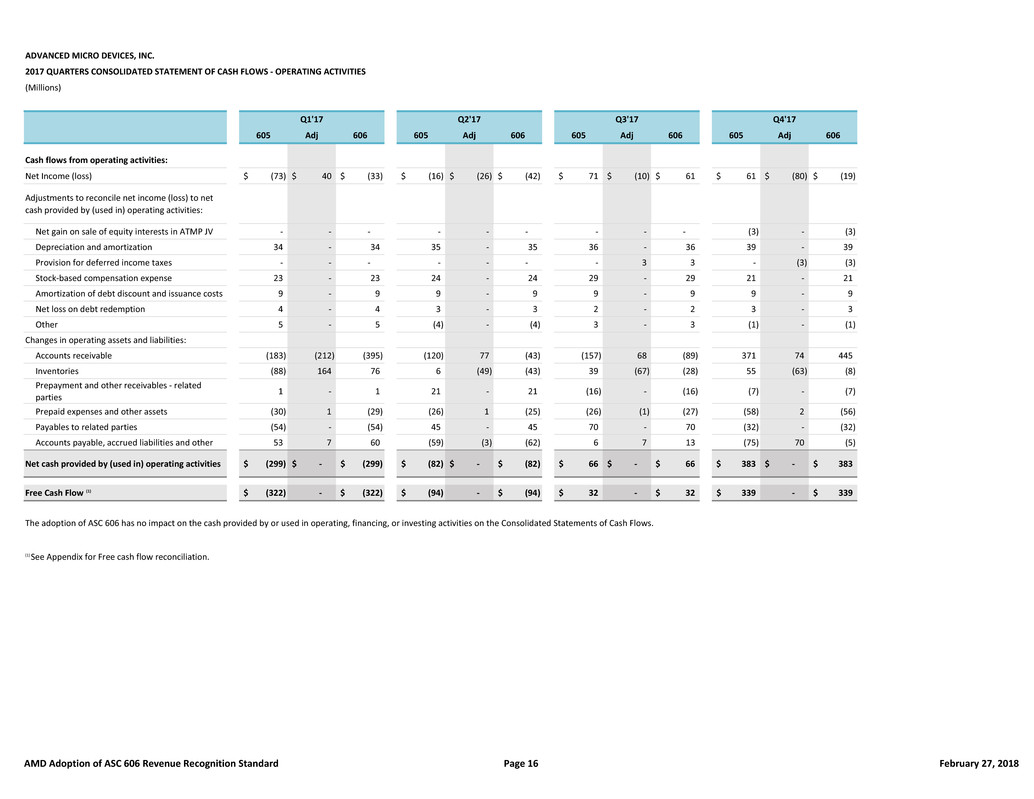

2016 and 2017 Cash Flow Statements

There is no impact on cash flow during any period from the adoption of ASC 606.

In summary the ASC 606 adjusted 2016 and 2017 financial results, provided in this document, reflect the effects of this new revenue recognition accounting standard. There is no change to our underlying business guidance under the new standard and we remain focused on growing revenue and increasing profitability in 2018.

Investor Contacts: |

||||

Ruth Cotter |

Laura Graves |

Alina Ostrovsky |

||

408-749-3887 |

408-749-5467 |

408-749-6688 |

||

ruth.cotter@amd.com |

laura.graves@amd.com

|

alina.ostrovsky@amd.com |

||

AMD Adoption of ASC 606 Revenue Recognition Standard |

Page 5

|

February 27, 2018 |