THE PRESENTATION

Published on October 7, 2008

AMD Investor

Roadshow Dirk Meyer, President and CEO Bob Rivet, Executive Vice President and CFO October 7, 2008 Introducing The Foundry Company and The New Asset Smart AMD Exhibit 99.1 |

| Investor

Roadshow | October 7, 2008 2 Forward Looking Disclaimer This document contains forward-looking statements, which are made pursuant to the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on risks and uncertainties that could cause actual results to differ materially from expectations. These forward-looking statements should not be relied upon as predictions of future events as we cannot assure you that the events or circumstances reflected in these statements will be achieved or will occur. You can identify forward-looking statements by the use of forward-looking terminology including believes, expects, may, will, should, seeks, intends, plans, pro forma, estimates, or anticipates or the negative of these words and phrases or other variations of these words and phrases or comparable terminology. These forward-looking statements relate to, among other things, our asset smart strategy, the impact and effects of our The Foundry Company joint venture, future demand for our products, capital expenditures, potential benefits of our The Foundry Company joint venture and the timing of our The Foundry Company joint venture. The material factors that could cause actual results to differ materially from current expectations include, without limitation, the following: that Intel Corporations pricing, marketing and rebating programs, product bundling, standard setting, new product introductions or other activities targeting the companys business may negatively impact sales plans; any inability to realize all of the anticipated benefits of our proposed The Foundry Company joint venture because, among other things, the revenues, cost savings, improved cash flow, growth prospects and any other benefits expected from the transaction may not be fully realized or may take longer to realize than expected; that The Foundry Company joint venture does not close; a downturn in the semiconductor industry; unexpected variations in market growth and demand for our products and technologies in light of the product mix that we may have available at any particular time or even a decline in demand; our cost reduction efforts are not effective; any inability to improve the efficiency of our supply chain; any inability to transition to advanced manufacturing process technologies in a timely and effective way, consistent with planned capital expenditures; any inability to develop, launch and ramp new products and technologies in the volumes and mix required by the market at mature yields and on a timely basis; any inability to obtain sufficient manufacturing capacity or components to meet demand for our products or the under- utilization of The Foundry Companys manufacturing facilities; the effect of political or economic instability internationally on our sales or production; or that The Foundry Company is less successful than anticipated. We urge investors to review in detail the risks and uncertainties in our Securities and Exchange Commission filings, including but not limited to the Quarterly Report on Form 10-Q for the quarter ended June 28, 2008. |

| Investor

Roadshow | October 7, 2008 3 Introduction Creating a global, leading-edge foundry with world-class, committed partners NOTE: Mubadala and ATIC (Advanced Technology Investment Company) are investment arms of the

Abu Dhabi Government. Unlocking the value of AMDs manufacturing talent and

assets Strengthening AMD balance sheet Reducing AMD capital investment requirements AMD securing guaranteed access to the most advanced, leading-edge capacity Committed future equity funding of a minimum of $3.6B and up to $6.0B from ATIC to The Foundry Company Expanding and strengthening the Foundry Companys IBM partnership Mubadala and ATIC are strategic financial partners for AMD and The Foundry Company, respectively Positioning and financing AMD and The Foundry Company for growth and success |

| Investor

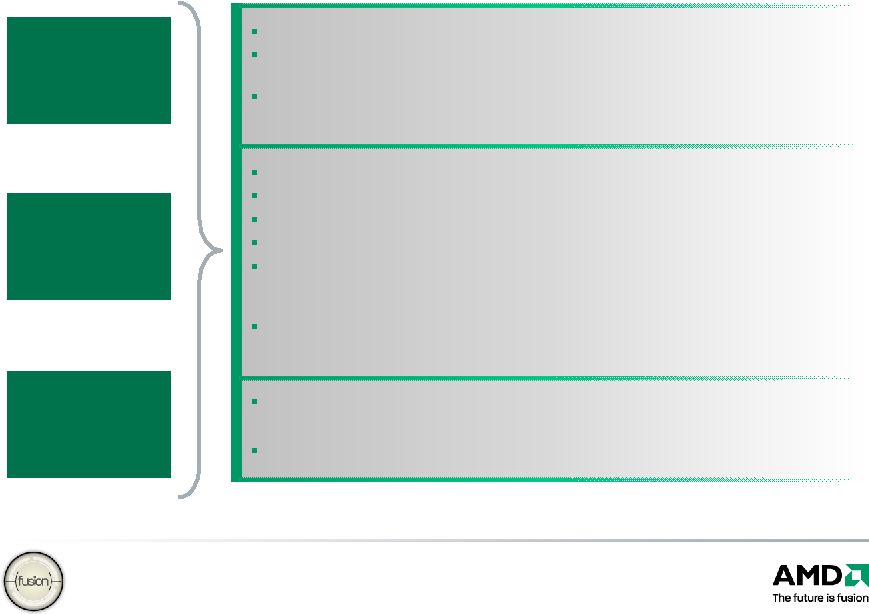

Roadshow | October 7, 2008 4 What We Are Announcing Introducing The Foundry Company ATICs long-term vision and patient capital AMDs manufacturing leadership and global workforce IBMs process technology Capital to meet growing global demand for leading-edge semiconductor manufacturing The Foundry Company plans to build a state-of-the-art manufacturing facility in Upstate New York, USA (creating over 1,400 jobs) - and add an additional world-class facility in Dresden, Germany with completion of Fab 38 AMD goes Asset Smart Strengthens balance sheet Dedicated access to significant leading-edge fab capacity World-class design leadership in processing and graphics Future capital investments in wafer fabs optional AMD and ATIC agreed to form a world-class joint venture to unlock the value of AMDs manufacturing expertise and create an independent, global leading-edge semiconductor manufacturing company With the combination of manufacturing excellence, patient capital, business acumen and global talent to lead the next logical step in the evolution of the semiconductor industry The Foundry Company The Foundry Company |

| Investor

Roadshow | October 7, 2008 5 Overview of ATIC ATIC is investing $1.4B directly into The Foundry Company and paying $0.7B to AMD in exchange for a 55.6% fully diluted stake in The Foundry Company. They are also committing future equity funding of a minimum of $3.6B and up to $6.0B to The Foundry Company for capital investments in Upstate New York and Dresden, Germany ATIC seeks to identify and realize long-term investment opportunities in the highly competitive and capital- intensive advanced technology sector. These advantages include significant and reliable capital, a patient investment philosophy, and a subsequently long-term investment horizon. ATIC was founded in 2008 ATIC will hold and manage the stake in The Foundry Company ATIC will enter into an initial management agreement with Mubadala to help manage The Foundry Company stake while ATIC develops required specialist capabilities ATIC is focused on making significant investments in the advanced technology sector, both locally and internationally. The Advanced Technology Investment Company (ATIC) a technology investment company wholly owned

by the Government of Abu Dhabi |

| Investor

Roadshow | October 7, 2008 6 The Foundry Company is uniquely positioned to win in this new era A Large and Timely Growth Opportunity Global demand is growing for contract semiconductor manufacturing - particularly leading-edge, independent foundry services Global semiconductor sales set to grow from $277B in 2008 to $321B in 2010(1)

Rapidly rising cost and complexity in semiconductor manufacturing Widespread transition to foundries by major IDMs, including TI, Sony, STM, Freescale IBM Alliance is strong and formidable with shared objectives, investments, returns AMD history of manufacturing leadership is ahead of all major independent foundries (1) Source: Semiconductor Industry Association |

| Investor

Roadshow | October 7, 2008 7 Technology Leadership Deep partnership with IBM Aggressive 32/22/15 nm roadmap Bulk and SOI Creating A Global Leader in the Foundry Business Capital Funding Initial funding of $1.4B Minimum committed future equity funding of $3.6B and up to $6.0B in total capital Capacity Roadmap Industry leading capacity roadmap Fab 36, commitment to build out Fab 38, Upstate New York, and more

Leading-edge Volumes Industrys most advanced products in independent foundry Time to market Scale Manufacturing Excellence World class expertise, yields, and cycle times APM technology Best in class fabs built on LEAN principles Global World-class Team Experienced executive team Highly educated workforce The Foundry Company will be a new global enterprise combining talent and resources from around the world to serve a growing global demand for leading-edge foundry services.

|

| Investor

Roadshow | October 7, 2008 8 Established history of manufacturing excellence under AMD Scale and access to capital to remain on the leading-edge Projected sales to AMD of ~$1.5B, starting 2009 300mm wafer capacity at 65nm/45nm SOI in excess of 28,000 wafers per month SOI technology rooted in IBM alliance Global presence Strong commitment to process technology leadership 3,000 employees, world class IP, experience, dedicated management Doug Grose to become CEO and Hector Ruiz Chairman Introducing The Foundry Company A world-class joint venture with ATIC unlocking the value of AMDs manufacturing expertise and creating an independent, global, leading-edge semiconductor manufacturing company With the combination of manufacturing excellence, patient capital, business acumen and global talent to lead the next logical step in the evolution of the semiconductor industry

|

| Investor

Roadshow | October 7, 2008 9 AMD, the Next Stage, Positioned For Success Strategic commitment from Mubadala The Foundry Company plans multi-billion dollar build-out of leading edge fabs in Dresden and Upstate New York Expanded IBM partnership delivering leading-edge bulk and SOI process technology ~$1.0B new cash investment ~$1.2B(2)

debt reduction assumed by The Foundry Company Future fab capital expenditures optional Reduced process technology R&D costs Improved free cash flow(3)

by the elimination of required fabrication capital expenditures offset somewhat by wafers purchased for cash (foundry model) Leaner and more variable business model, with a lower breakeven point of ~$1.5B The only company with proven track record of innovation in both x86 CPU architecture and graphics technologies Focused on design, development and marketing competencies Asset Smart Manufacturing Strategy Asset Smart Manufacturing Strategy Stronger Financial Structure(1)

Stronger Financial Structure(1)

Leadership Capabilities Leadership Capabilities (1) Excluding The Foundry Company, which will be consolidated for financial reporting purposes

(2) Expected as of close. Debt includes minority interest (non AMD ownership) (3) Defined as cash flow from operations less capital expenditures |

| Investor

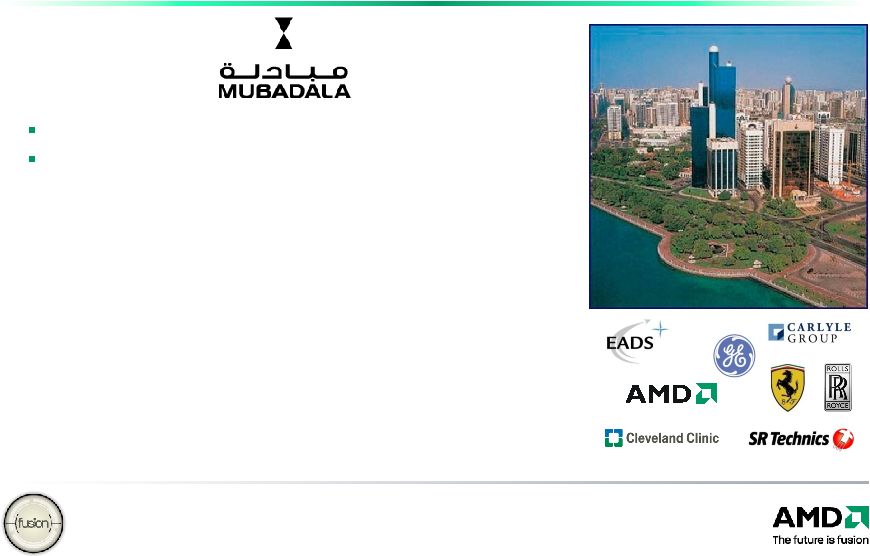

Roadshow | October 7, 2008 10 Mubadala Increasing its Stake in AMD Manages a multi-billion dollar global portfolio Mubadala increases stake in AMD as a sign of confidence in its long-term potential. ATIC funds the creation of the global Joint Venture. Recent deals include: - $8B JV with GE for a financial services business headquartered in Abu Dhabi - Multi faceted transaction including strategic initiatives focused on clean energy, research, training and aviation - 7.5% ownership stake in the Carlyle Group Mubadala Development Company is a development and investment company, owned by the government of Abu Dhabi, with a global focus on commercial activities that achieve economic returns while advancing economic diversification Mubadala is increasing its stake in AMD from 8.1% to 19.3% on a fully diluted basis with $0.3B cash infusion |

| Investor

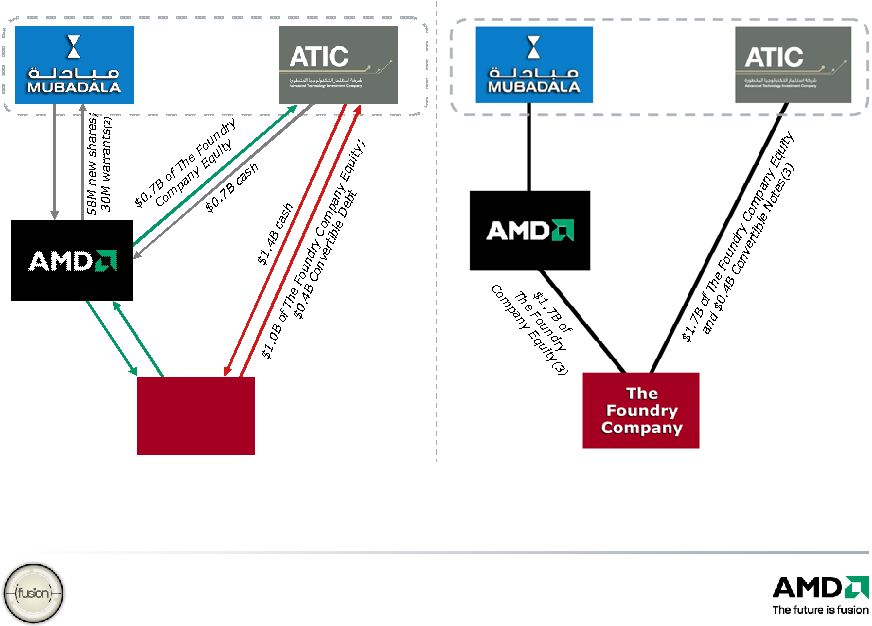

Roadshow | October 7, 2008 11 Summary Transaction Mechanics 107M shares (including 49M from 11/07 investment) and 30M warrants (2) 19.3% (1) $2.4B fab assets and ~$1.2B (5) debt $0.3B cash Transaction Mechanics Pro-Forma Structure ~$1.5B starting cash $2.4B of The Foundry Company Equity(4)

(1) Represents 19.3% of fully diluted basis as of 9/26/08 (2) Includes AMD stock and warrants issued to Mubadala in transaction. Warrants will have an

exercise price of $0.01 (3) AMD and ATIC will each at the closing have equal voting rights. The Foundry Company will be owned on a fully-converted common basis 44.4% by AMD and 55.6% by ATIC. ATICs economic ownership will increase over time based on the differences

in securities held by AMD and ATIC and depending on whether AMD elects to invest at the same level as ATIC in future capital infusions to support The Foundry Companys growth (4) Net $1.7B after sale to ATIC (5) Expected as of close. Debt includes minority interest (non AMD ownership) The Foundry Company The Foundry Company |

| Investor

Roadshow | October 7, 2008 12 Transaction Summary AMD will sell to Mubadala 58M new shares and 30M warrants(1) in exchange

$0.3B which will increase Mubadalas ownership in AMD to 19.3% on a fully diluted basis Mubadala has a right to designate a member of the Board of Directors of AMD (1) Warrants will have an exercise price of $0.01 AMD will transfer people, manufacturing assets, Fab36 debt and some intellectual property ATIC to invest $2.1B in capital: - $1.4B to The Foundry Company - $0.7B to AMD - ATIC will hold convertible notes in The Foundry Company The joint venture will be owned on a fully-converted common basis 44.4% by AMD and 55.6% by

ATIC. - AMD and ATIC will be The Foundry Companys only shareholders. At close each will have

equal voting rights - 80% of ATICs equity in the form of Class B Preferred shares with a preferred 12% return upon

a liquidity event - ATICs economic ownership will increase over time based on the differences in securities held

by AMD and ATIC, and depending on whether AMD elects to invest proportionally with ATIC

in future capital infusions to support The Foundry Companys growth - Have a Board of Directors whose membership is equally divided between representatives of AMD and

ATIC Minimum of $3.6B and up to $6.0B of future funding over five years to The Foundry

Company, primarily for New York and Dresden facilities - AMD has the option, but not the obligation, to provide additional capital to be invested in The

Foundry Company AMD will have guaranteed access to advanced manufacturing services and

capacity The Foundry Company will have an exclusive supply agreement with limited exceptions to manufacture AMD processors and to manufacture, where competitive, certain percentages of other AMD semiconductor

products. The Foundry Company The Foundry Company |

| Investor

Roadshow | October 7, 2008 13 Positive Impact to AMD (1) (1) AMD Inc financial results projections for fiscal year 2009, without The Foundry Company (2) Expected as of close. Debt includes minority interest (non AMD ownership) (3) Defined as cash flow from operations less capital expenditures Free Cash Flow(3)

Debt Cash Capital Expenditures Reduction in capital expenditure, G&A and process R&D offset by higher COGS Assumption of $1.2B(2)

debt by The Foundry Company ~$1.0B new cash investment Fab capital expenditures optional Operating Profit Net Interest Gross Margin Operating Expenses Higher COGS offset by lower operating expenses Lower interest expense Increased interest income Reflective of asset smart business model Reduction of process R&D Decreased G&A |

| Investor

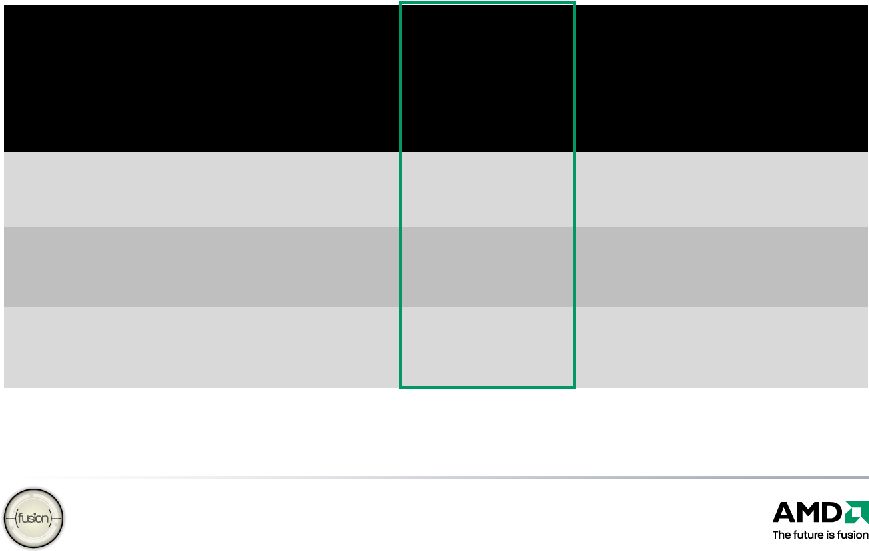

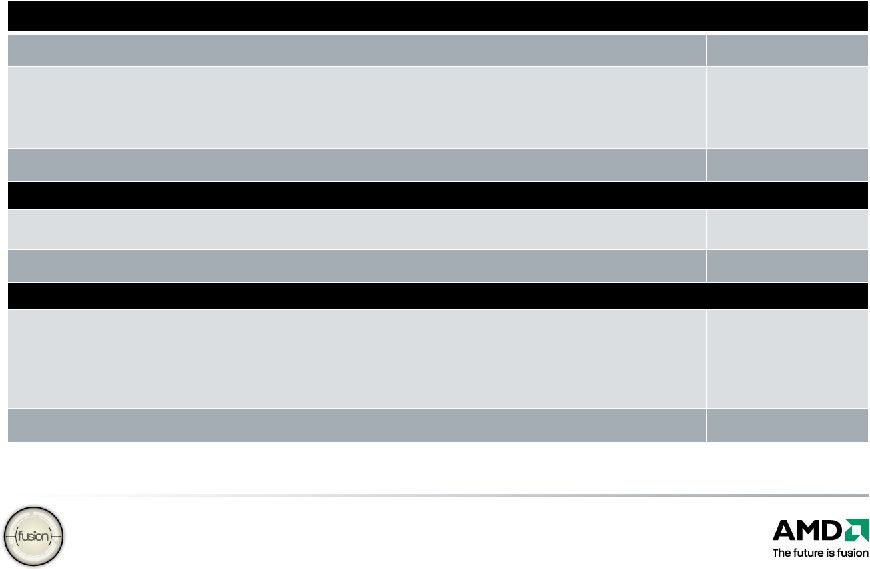

Roadshow | October 7, 2008 14 Improvements in Pro Forma Capitalization 6/28/2008 6/28/2008 6/28/2008 6/28/2008 ($ Billions) AMD As Reported AMD Pro Forma Unconsolidated The Foundry Company Pro Forma AMD Pro Forma Consolidated Total Cash $1.6 $2.5 $1.6 $4.0 Total Debt (1) $5.5 $4.2 $1.7 $7.6 Net Debt $3.9 $1.7 $0.2 $3.6 (1) Includes minority interest: non AMD ownership NOTE: See Appendices A&B for financial reconciliation For financial reporting purposes The Foundry Company will be consolidated with AMD

|

| Investor

Roadshow | October 7, 2008 15 Transaction Close Transaction close expected in the beginning of 2009 and is dependent on: Transfer of previously confirmed New York incentives to The Foundry Company for the creation of a state-of-the-art manufacturing facility in Upstate New York Assumption of Dresden debt by The Foundry Company Continuation of Dresden grants Securing routine merger control clearances in appropriate geographies AMD stockholder approval for issuance of common stock and warrants(1)

to Mubadala Clearance by the Committee on Foreign Investment in the United States (CFIUS) Customary closing conditions (1) Warrants will have an exercise price of $0.01 |

| Investor

Roadshow | October 7, 2008 16 Summary A world-class deal with world-class committed partners Unlocking the value of AMDs manufacturing talent and assets Strengthening AMD balance sheet Reducing AMD capital investment requirements AMD securing guaranteed access to the most advanced, leading-edge capacity Committed future equity funding of a minimum of $3.6B and up to $6.0B from ATIC to The Foundry Company Expanding and strengthening the Foundry Companys IBM partnership Mubadala and ATIC are strategic financial partners for AMD and The Foundry Company, respectively Positioning and financing AMD and The Foundry Company for growth and success |

| Investor

Roadshow | October 7, 2008 17 Trademark Attribution AMD, the AMD Arrow logo and combinations thereof are trademarks of Advanced Micro Devices, Inc. in

the United States and/or other jurisdictions. Other names used in this presentation are

for identification purposes only and may be trademarks of their respective

owners. ©2008 Advanced Micro Devices, Inc. All rights reserved. * * * * * * * * * * * * * * |

| Investor

Roadshow | October 7, 2008 18 Back-up * * * |

| Investor

Roadshow | October 7, 2008 19 AMDs Accounting Post Transaction Close Upon transaction close, AMD will be required to consolidate The Foundry Companys financials under U.S. GAAP accounting rules AMDs consolidated U.S. GAAP EPS will be impacted by three factors: - Inclusion of The Foundry Companys U.S. GAAP financial results - Minority interest allocation to ATIC based on Class A share ownership - Non-cash cumulative dividend from ATICs Class B preferred shares in The Foundry Company to the extent of Class A shares owned by AMD AMD will be transparent as possible by showing consolidated AMD and The Foundry Company financial information and some unconsolidated key financial metrics as we proceed towards transaction close and thereafter. |

| Investor

Roadshow | October 7, 2008 20 ATIC equity investment in The Foundry Company: 20% Class A Preferred shares, 80% Class B Preferred shares, One Class A ordinary share AMD equity investment in The Foundry Company: 100% Class A Preferred shares, One Class A ordinary share The Foundry Company Class A stockholders: 83% AMD, 17% ATIC The Foundry Company Class B stockholders: 100% ATIC Calculation of Class B Dividend Related Adjustments Class B cumulative dividend - A non-cash charge - Only payable upon liquidation event such as IPO or sale of The Foundry Company if return on The Foundry Company Class B Preferred falls below 12% |

| Investor

Roadshow | October 7, 2008 21 AMD Net Income (Loss) Plus: The Foundry Company Net Income (Loss) Adjust: Inter-company elimination Consolidated GAAP Net Income (Loss) Less/More: 17% of The Foundry Company Net Income Less: 83% of 12% Class B Preferred Cumulative Dividend AMD Net Income attributable to AMD Common shareholders Divided by: AMD Shares Outstanding EPS attributable to AMD Common shareholders AMDs EPS Post The Foundry Companys Transaction Close Subtraction of minority interest allocated to ATIC (1) Subtraction of cumulative dividend allocated to AMDs share of The Foundry Company Class A (1) (1) 17% and 83% represent ownership percentages of Class A Preferred at transaction close for ATIC and AMD respectively |

| Investor

Roadshow | October 7, 2008 22 Appendix A: Reconciliation of As Reported balances to AMD pro forma unconsolidated, The Foundry Company pro forma standalone and AMD pro forma consolidated Slide 13: Improvements in Pro Forma Capitalization Total Cash ($ Billions)

As Reported (US GAAP) 1.6 Add: Cash received from ATIC for the Foundry Company shares purchased from AMD Add: Cash from issuance of AMD shares and warrants 0.7 0.3 AMD Pro forma Unconsolidated 2.5 The Foundry Company Existing cash and cash contributed by ATIC 1.6 The Foundry Company Pro forma 1.6 AMD Consolidated As Reported balance Add: Cash received directly from ATIC Add: Cash from issuance of AMD shares and warrants Add: Cash contributed by ATIC to The Foundry Company 1.6 0.7 0.3 1.4 AMD Pro forma Consolidated 4.0 |

| Investor

Roadshow | October 7, 2008 23 Appendix B: Reconciliation of As Reported balances to AMD pro forma unconsolidated, The Foundry Company pro forma standalone and AMD pro forma consolidated Slide 13: Improvements in Pro Forma Capitalization Debt ($ Billions)

As Reported (US GAAP) 5.3 Add: Minority Interest 0.2 Total Debt and Minority Interest 5.5 Less: Debt (1.10) and minority interest (0.19) to be assumed by The Foundry Company (1.3) AMD Pro forma Unconsolidated 4.2 The Foundry Company Existing debt and minority interest balance included in As Reported balance above Add: New convertible notes issued by The Foundry Company to ATIC 1.3 0.4 The Foundry Company Pro forma 1.7 AMD Consolidated As Reported balance Add: New convertible notes issued by The Foundry Company Add: New minority interest as a result of this transaction 5.5 0.4 1.7 AMD Pro forma Consolidated 7.6 |

| Investor

Roadshow | October 7, 2008 24 Additional Information and Where You Can Find it AMD will file a proxy statement pursuant to which AMDs board of directors will solicit proxies in connection with seeking AMD stockholder approval of the issuance of AMD shares and warrants pursuant to the Master Transaction Agreement with the Securities and Exchange Commission (the SEC). Investors and security holders are urged to read the proxy statement when it becomes available and other relevant documents filed with the SEC because they will contain important information. Security holders may obtain a free copy of the proxy statement, when AMD files it with the SEC in the coming weeks, and other documents filed by AMD with the SEC at the SECs web site at http://www.sec.gov. The proxy statement and other documents may also be obtained for free by contacting AMD Investor Relations at investor.relations@amd.com or by telephone: (408) 749 4000. AMD and its executive officers and directors may be deemed to be participants in the solicitation of proxies from AMDs stockholders with respect to issuance of AMD shares and warrants pursuant to the Master Transaction Agreement. Information regarding such executive officers and directors is included in AMDs Proxy Statement for its 2008 Annual Meeting of Stockholders filed with the SEC on March 14, 2008, which is available free of charge at the SECs web site at http://www.sec.gov and from AMD Investor Relations which can be contacted at investor.relations@amd.com or by telephone: (408) 749 4000. Certain executive officers and directors of AMD have interests in the transaction that may differ from the interests of AMD stockholders generally. These interests will be described in the proxy statement when AMD files it with the SEC, in the coming weeks. |

| Investor

Roadshow | October 7, 2008 25 Trademark Attribution AMD, the AMD Arrow logo and combinations thereof are trademarks of Advanced Micro Devices, Inc. in

the United States and/or other jurisdictions. Other names used in this presentation are

for identification purposes only and may be trademarks of their respective

owners. ©2008 Advanced Micro Devices, Inc. All rights reserved. * * * * * * * * * * * * * * |